BlackRock and Citadel Securities invested in the group with the goal of disrupting U.S. stock exchange markets.

Texas Stock Exchange Chairman and CEO James H. Lee has raised $120 million in funding from more than two dozen investors to potentially launch an exchange that could compete with the NYSE and Nasdaq. is being secured. The investor consortium includes BlackRock, the world’s largest asset manager, and Citadel Securities, a huge market maker.

Are BlackRock and Citadel planning a blockchain move in the stock market?

According to The Wall Street Journal, TXSE sees itself as a challenge to the hegemony maintained by traditional and outdated exchanges. The group also wants to address rising compliance fees and listing costs.

Neither BlackRock nor Citadel have proposed a cryptocurrency-related strategy for investing in TXSE, but blockchain technology could be an effective solution to the agenda presented by the Lee Group.

Blockchain networks are known to run an energy-efficient model compared to the traditional financial sector. Naysayers and disbelievers have been scrutinizing Bitcoin’s (BTC) proof-of-work (PoW) structure for years as being energy-intensive, but the data disagrees.

Bitcoin consumes less than 50% of the energy used by the banking system, according to a 2021 Galaxy Digital report cited by Nasdaq. Considering that top altcoin blockchains such as Ethereum (ETH) and Solana (SOL) use energy-optimized structures through Proof-of-Stake (PoS), decentralized chains can reduce operating costs for TXSE. there is.

Introducing on-chain mechanisms to the world’s largest capital market will enable 24/7 trading access and instant settlements. The stock market operates only five days a week. As long as the chain’s uptime remains uninterrupted, anyone in the world can buy BTC, ETH or SOL whenever they want.

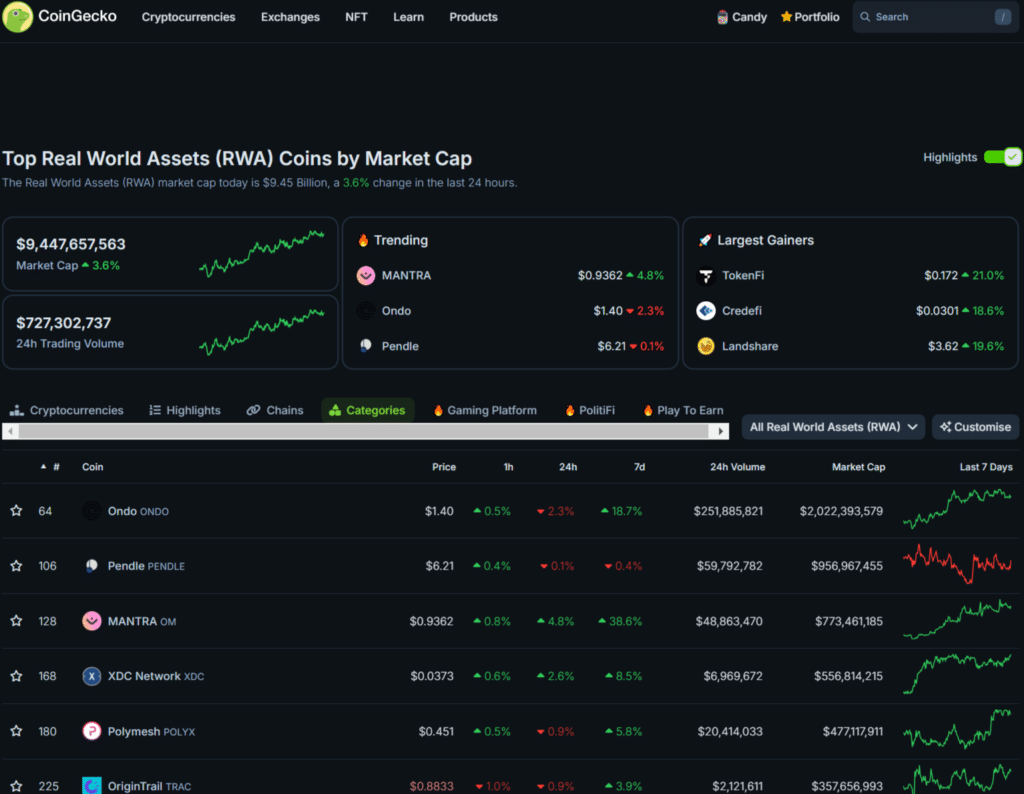

Bitcoin, in particular, has not experienced any downtime in over a decade, and Ethereum is the most trusted DeFi blockchain, with over $66 billion in total value locked per DefiLlama. Tokenization of real-world assets, such as bonds and stocks, is also growing, surging to a $9.4 billion market in recent years, indicating that it is possible to bring in stocks and other securities.