- Cardano is likely to drop to $0.30 in the short term to secure liquidity.

- A decline in the MDIA could be a strong signal that bulls are ready to re-enter.

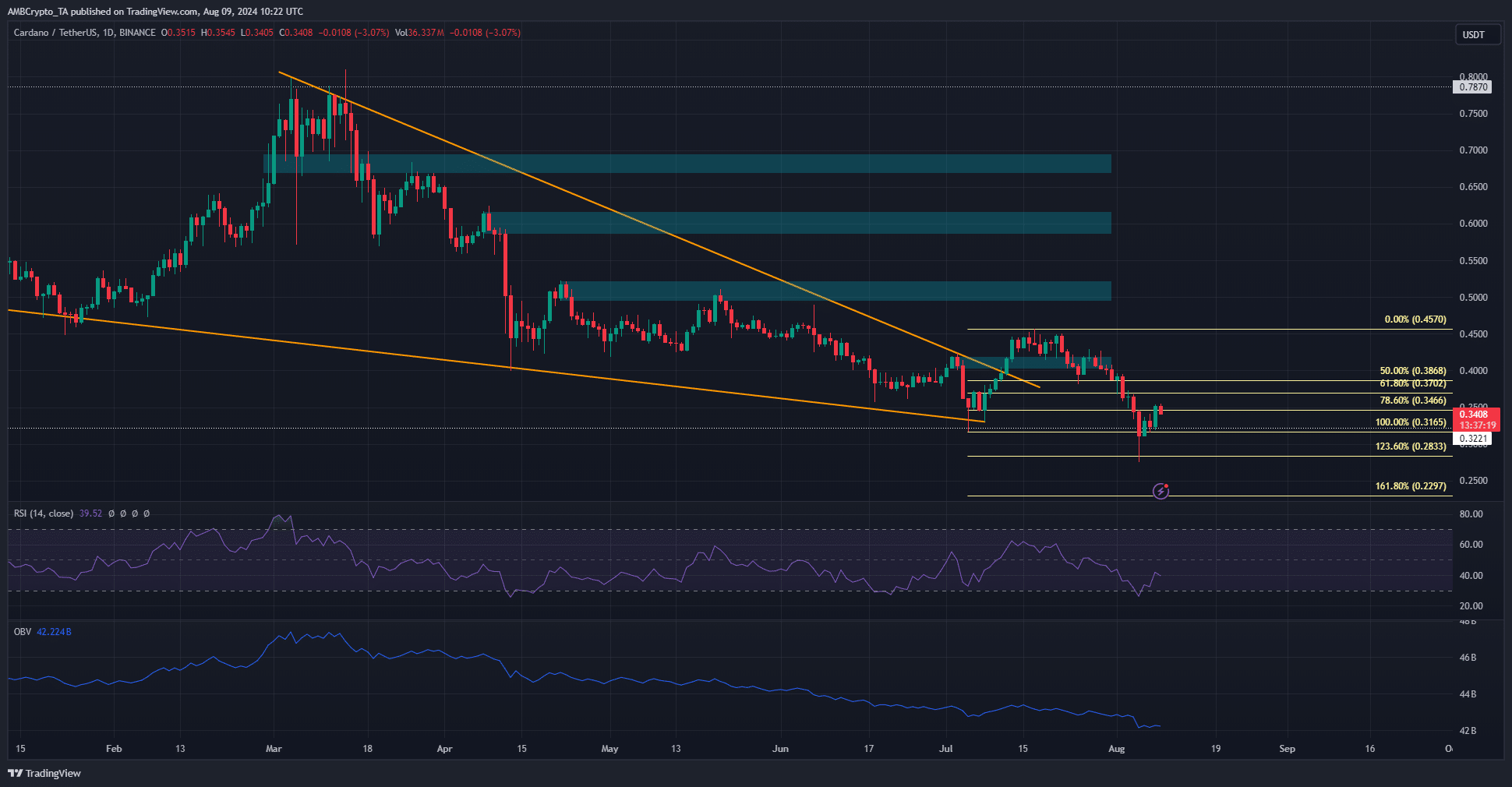

Cardano (ADA) broke out of a descending wedge formation in mid-July, but the uptrend stalled before it could really get going.

If that wasn’t disappointing enough, the Bitcoin (BTC) selloff and market-wide panic earlier this week caused ADA to crash to $0.275.

Source: ADA/USDT on TradingView

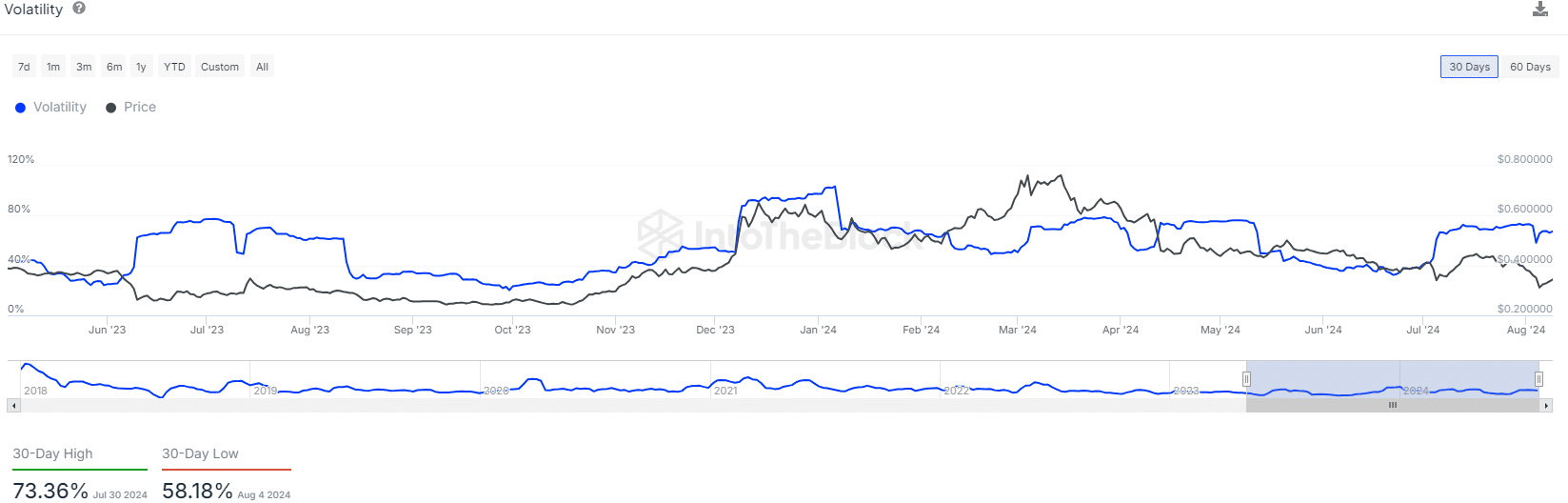

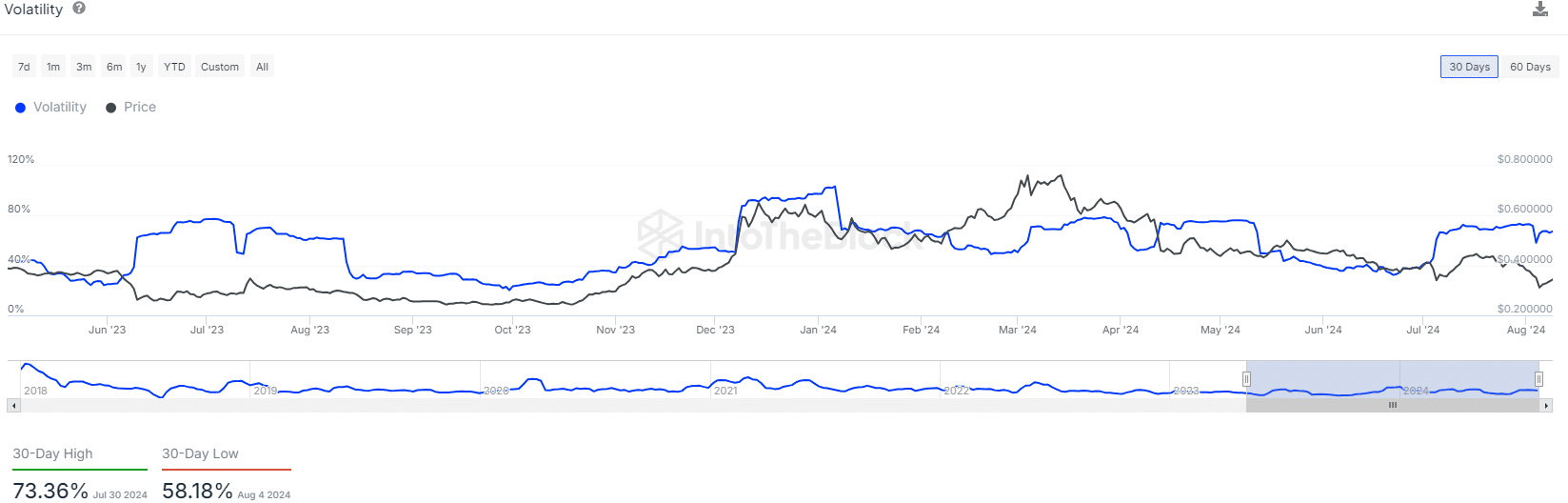

Data shows that the asset has been quite volatile in recent weeks. Other indicators have been mixed, but more bearish than bullish. Despite the price drop, social media sentiment remains bullish.

Is ADA a good investment?

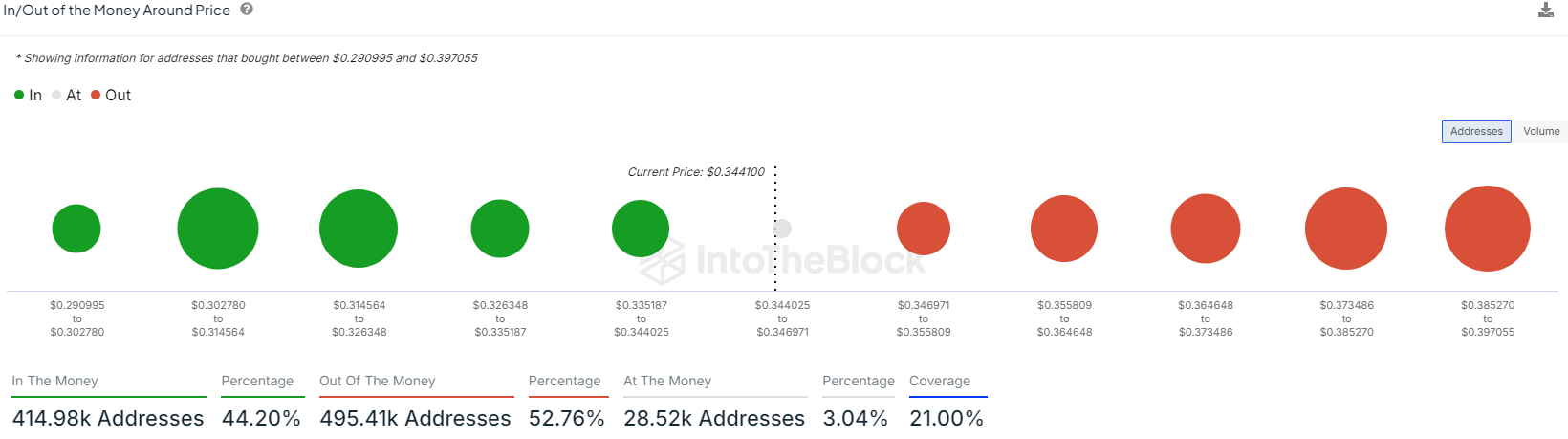

Source: IntoTheBlock

The 30-day volatility of Cardano saw high price fluctuations in July. In the first week of August, the indicator fell to a low of 58.18% due to the continuous price decline.

Ideally, long-term investors want to see low volatility over long periods of time to indicate steady and sustained accumulation.

AMBCrypto looked at another indicator, the beta coefficient, and compared Cardano’s volatility to Bitcoin. At the time of writing, it had a value of 0.86, meaning that price movements are less volatile.

Additionally, ADA appears more likely to be preferred by conservative investors.

More aggressive investors are likely to target higher returns and will be willing to tolerate higher volatility in their chosen asset compared to BTC.

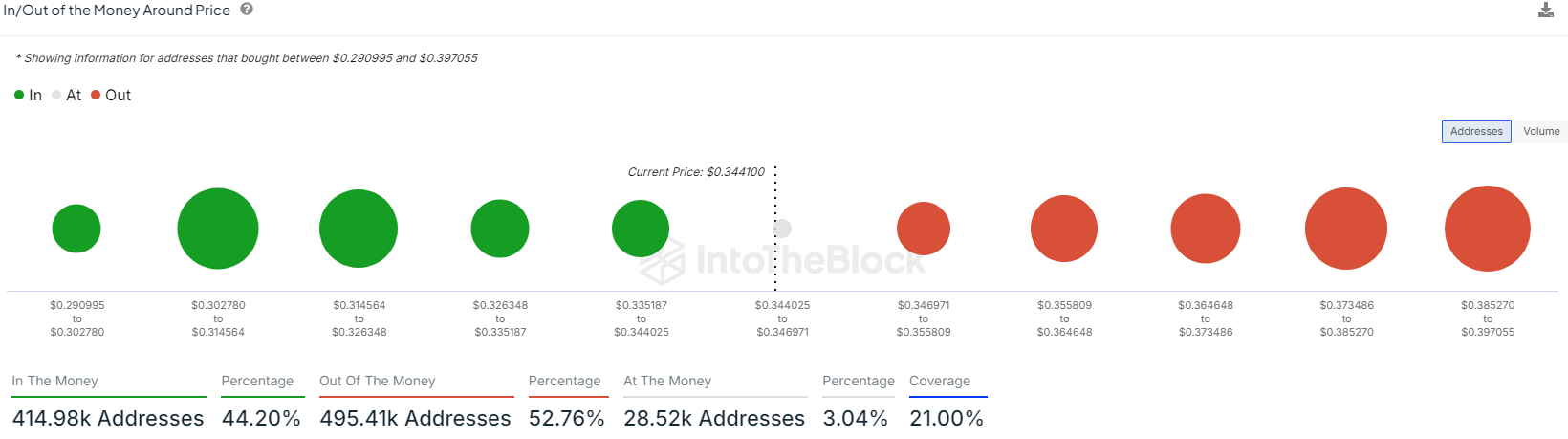

Source: IntoTheBlock

$0.3-$0.326 was highlighted as the biggest support area around the price. This area was joined by the July lows but was broken on Monday.

Gather more clues about the next price trend

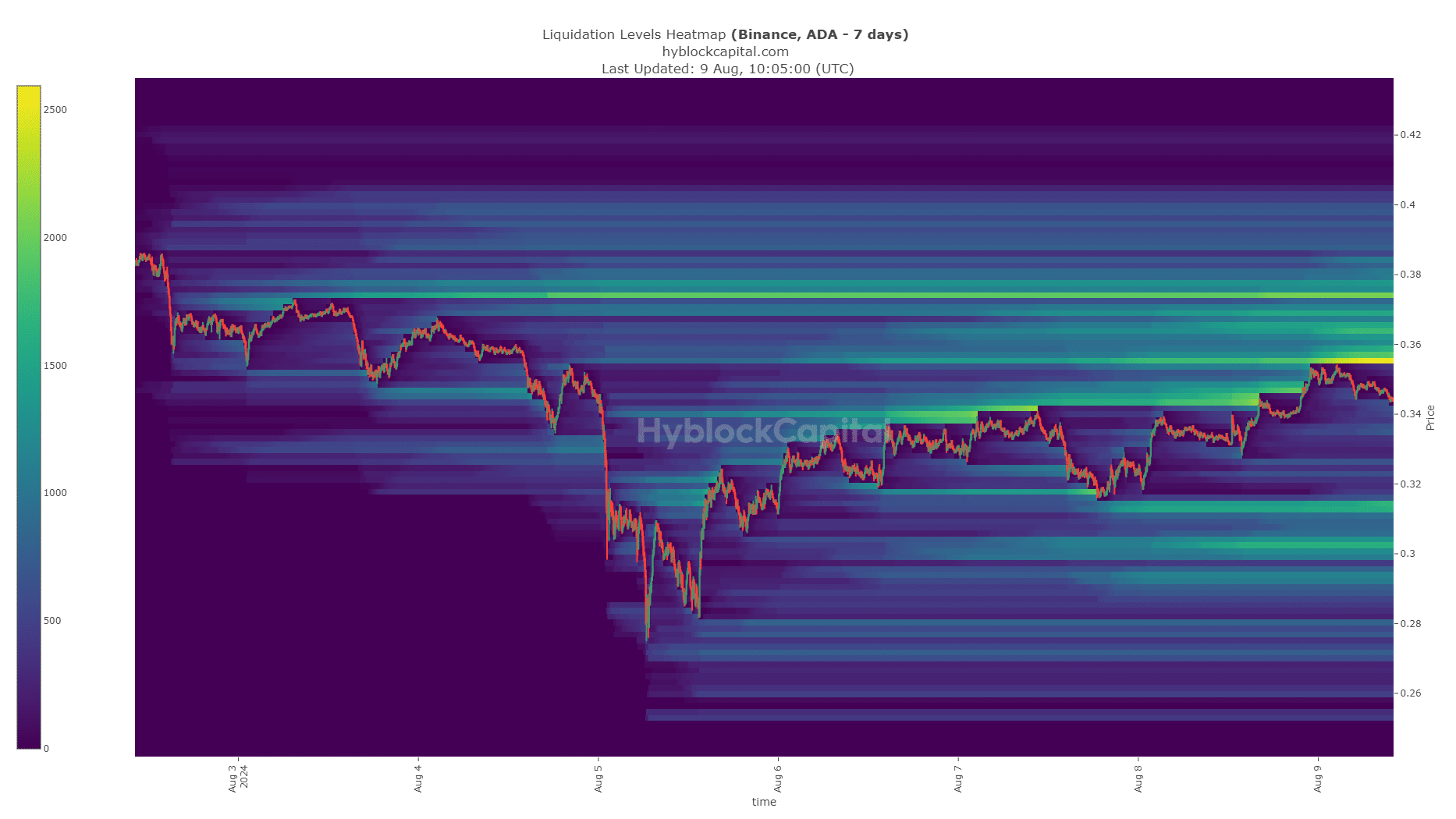

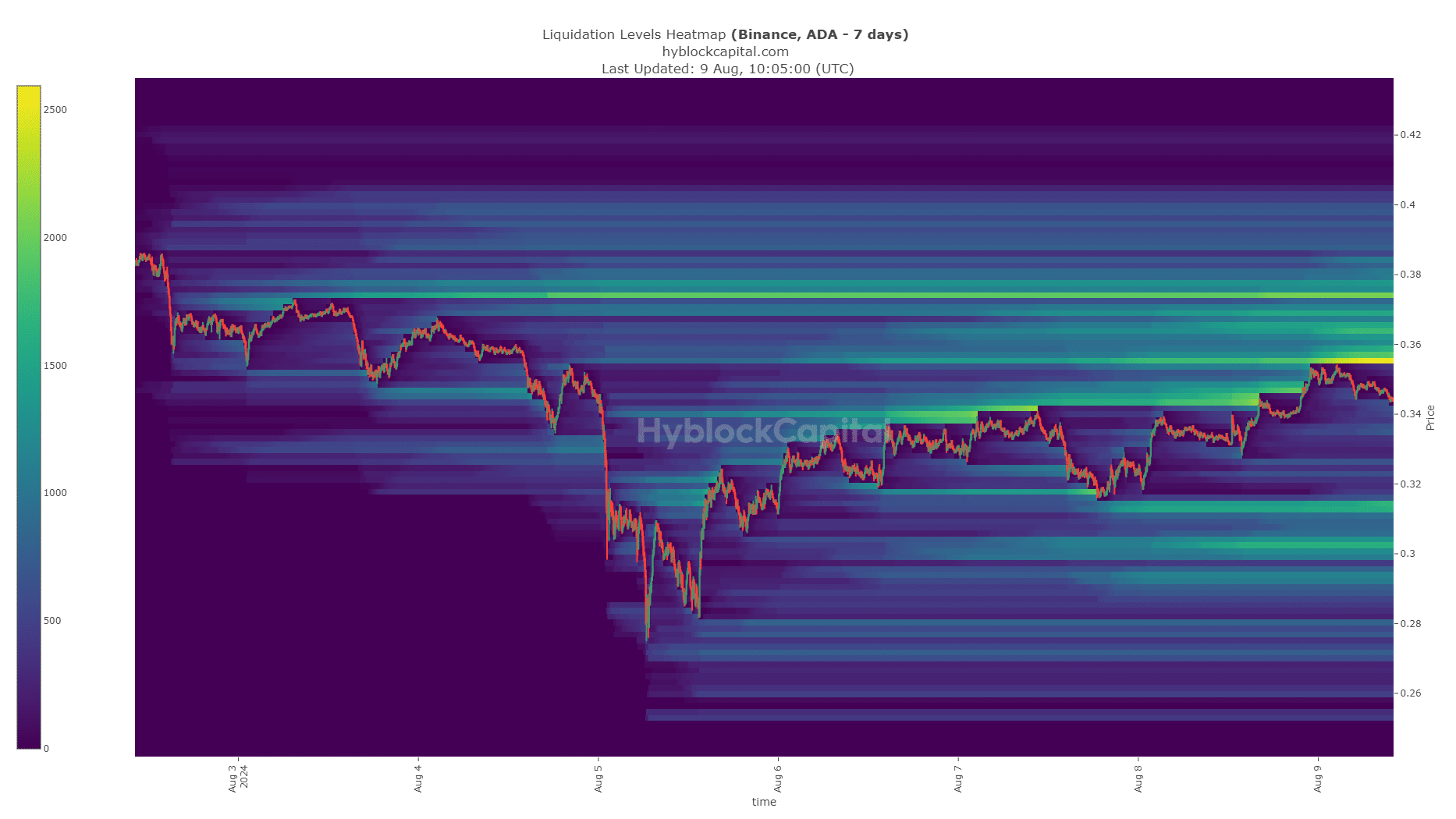

Source: Highblock

A 7-day lookback period showed that the $0.3-$0.314 range was concentrated with liquidation levels that could have influenced a reversal.

However, given the recent sell-off, there hasn’t been enough time to build up significant liquidity, so it would naturally be a target for a higher time frame.

This is supported by technical results and fund deposit/withdrawal data.

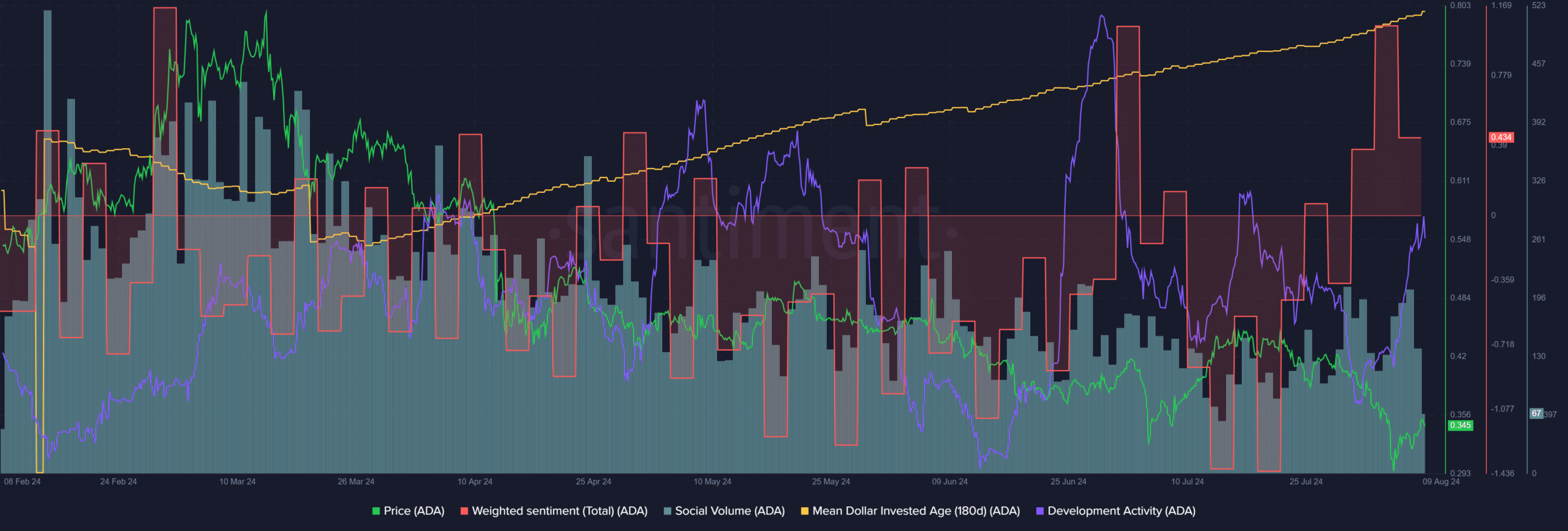

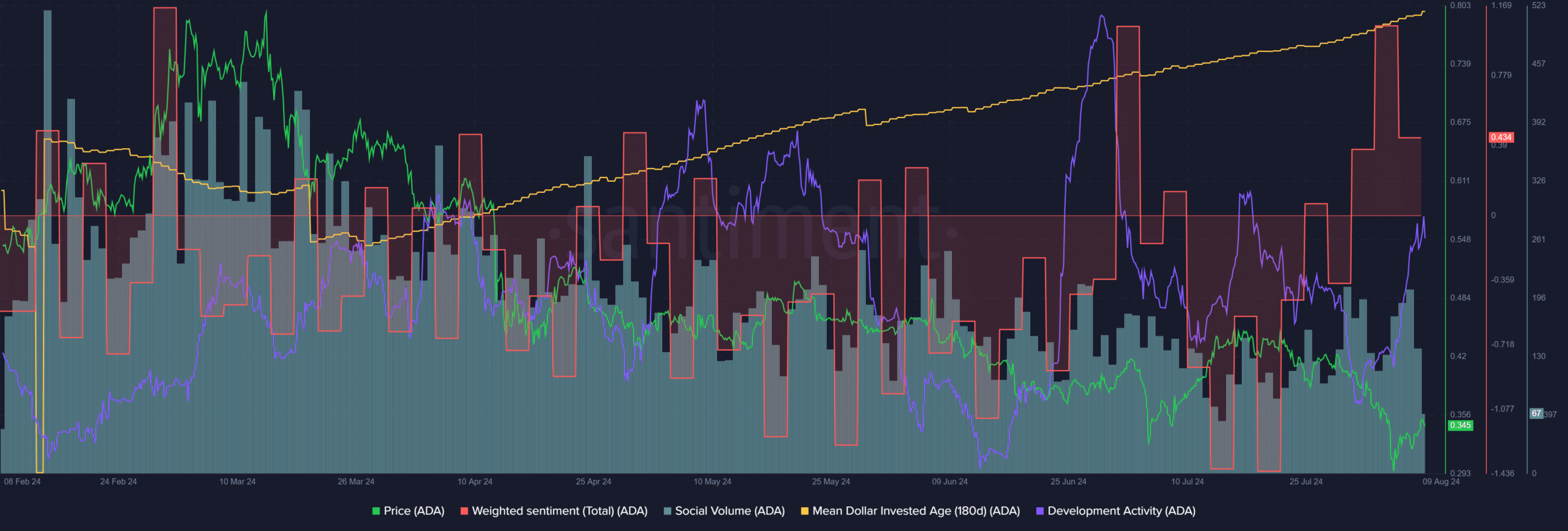

Source: Santiment

The weighted sentiment was positive, a surprising development after the price plunged below $0.30, suggesting that panic had not gripped investors.

Development activity was at similar levels to the past few months, another encouraging sight for long-term holders.

Read our Cardano (ADA) Price Prediction 2024-25

However, the average dollar investment age continues to trend upward. The 180-day MDIA has been rising since March, almost reaching the October 2023 level, indicating a slowdown and lack of new capital inflows.

If this indicator shows a downward trend, it will be a strong signal that ADA is ready for a sustained uptrend.