- ADA is down 13% in the last 24 hours.

- Technical indicators pointed to further price decline.

Cardano (ADA) It’s in the news today after releasing March development highlights. But that’s not the only reason it made headlines. In fact, it did so for all the wrong reasons after ADA was in the red on the charts and fell 13% due to the market crash.

Cardano is doing well in development.

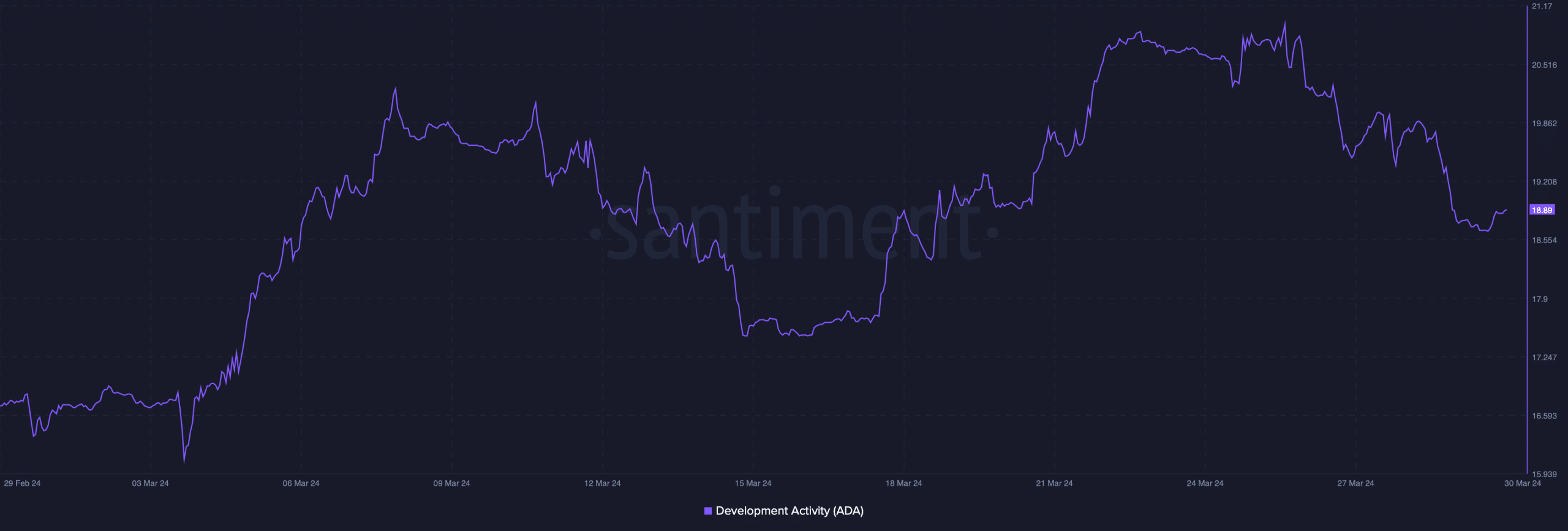

AMBCrypto’s assessment of Santiment’s data shows that Cardano-related development activity remains high. This is evidenced in the development activity charts, which remained consistently high in March.

Source: Santiment

Cardano developers posted an X on Input Output. line dividing Efforts of developers in the last month of the first quarter. Likewise, the team released Cardano node v.8.9.0, which introduced Genesis Lite bootstrap peers, recertified bugs and improved overall performance.

To increase scalability, the Mithril team has also released Mithril release 2408.0, which includes improvements to stake distribution and more. In addition to this, the report also noted that the total number of ADA transactions increased by 2.3 million during the month. March also saw the launch of three new projects on the Cardano blockchain.

Cardano is facing the wrath of the bears

Cardano ended March with a slight decline in price compared to the beginning of the month, with the price falling to $0.64. April did not bring good news for investors either, as the token price fell by almost 13% in 24 hours.

According to CoinMarketCap, at the time of this writing, ADA is trading at $0.5071, with a market capitalization of over $18 billion, making it the 10th largest cryptocurrency. A further decline in ADA price seemed likely in April as most indicators showed bearish signals.

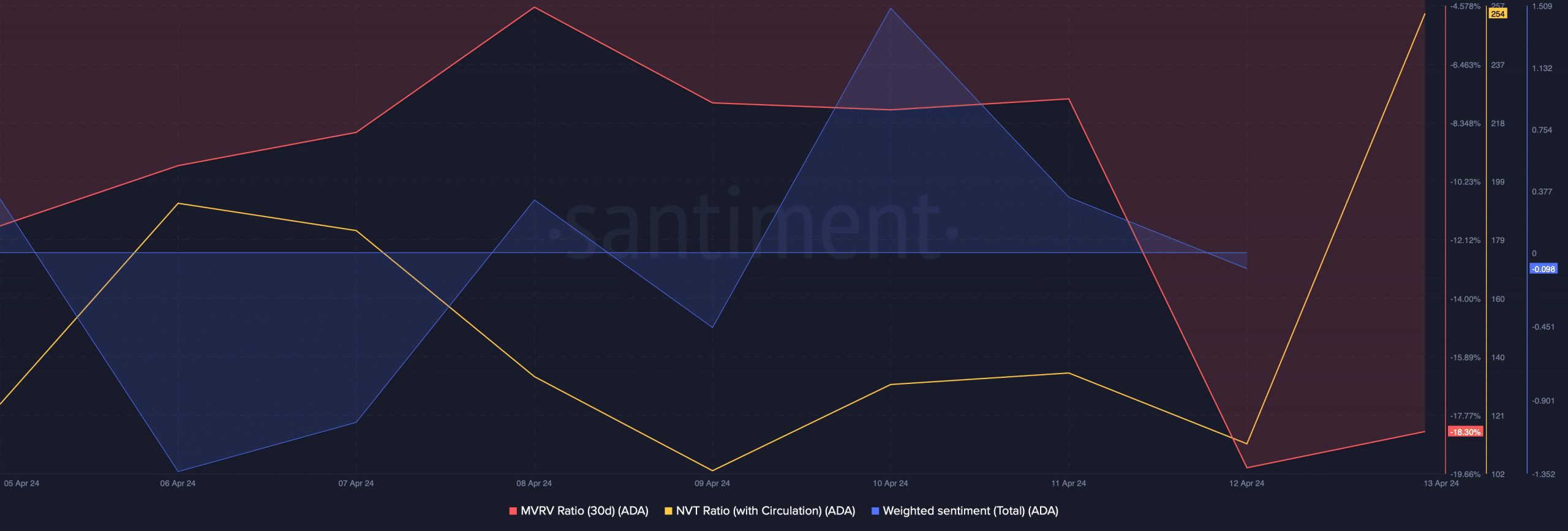

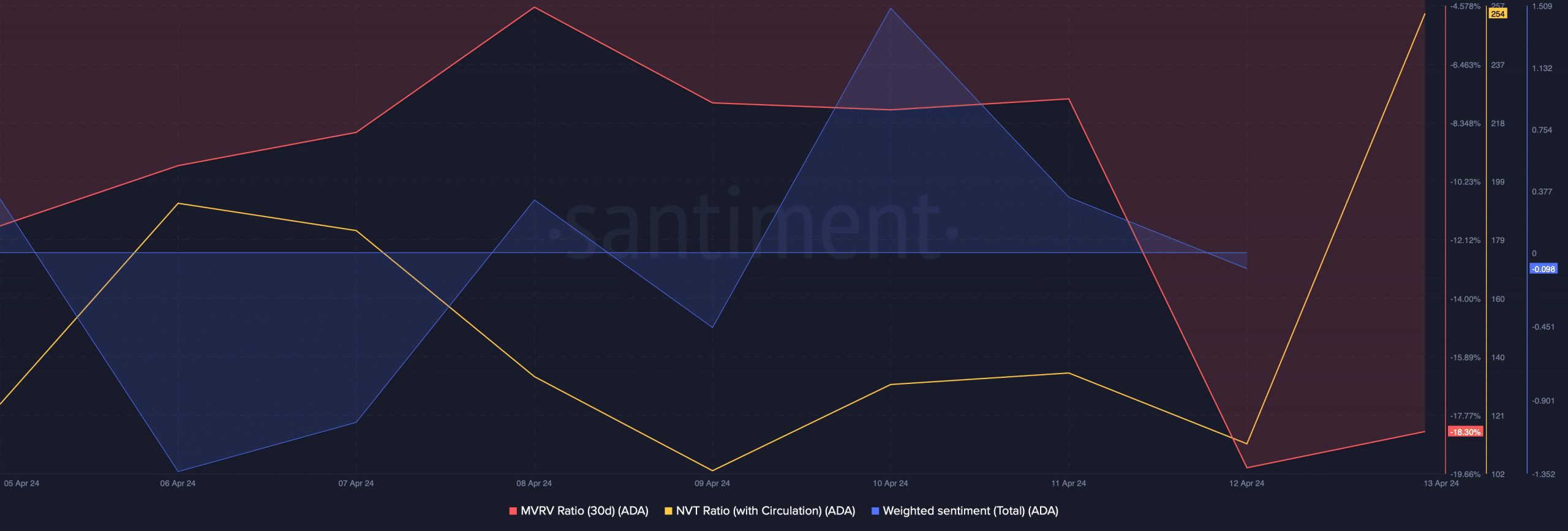

Analysis of Santiment’s data shows that Cardano’s MVRV ratio has fallen sharply. At press time, it was worth -18%. Sentiment toward the ADA has also turned bearish, as evidenced by the decline in weighted sentiment on April 12th. Moreover, the token’s NVT ratio also surged. A rise in the metric means the asset is overvalued and suggests further price declines in the future.

Source: Santiment

read Cardano (ADA) Price Prediction 2024-25

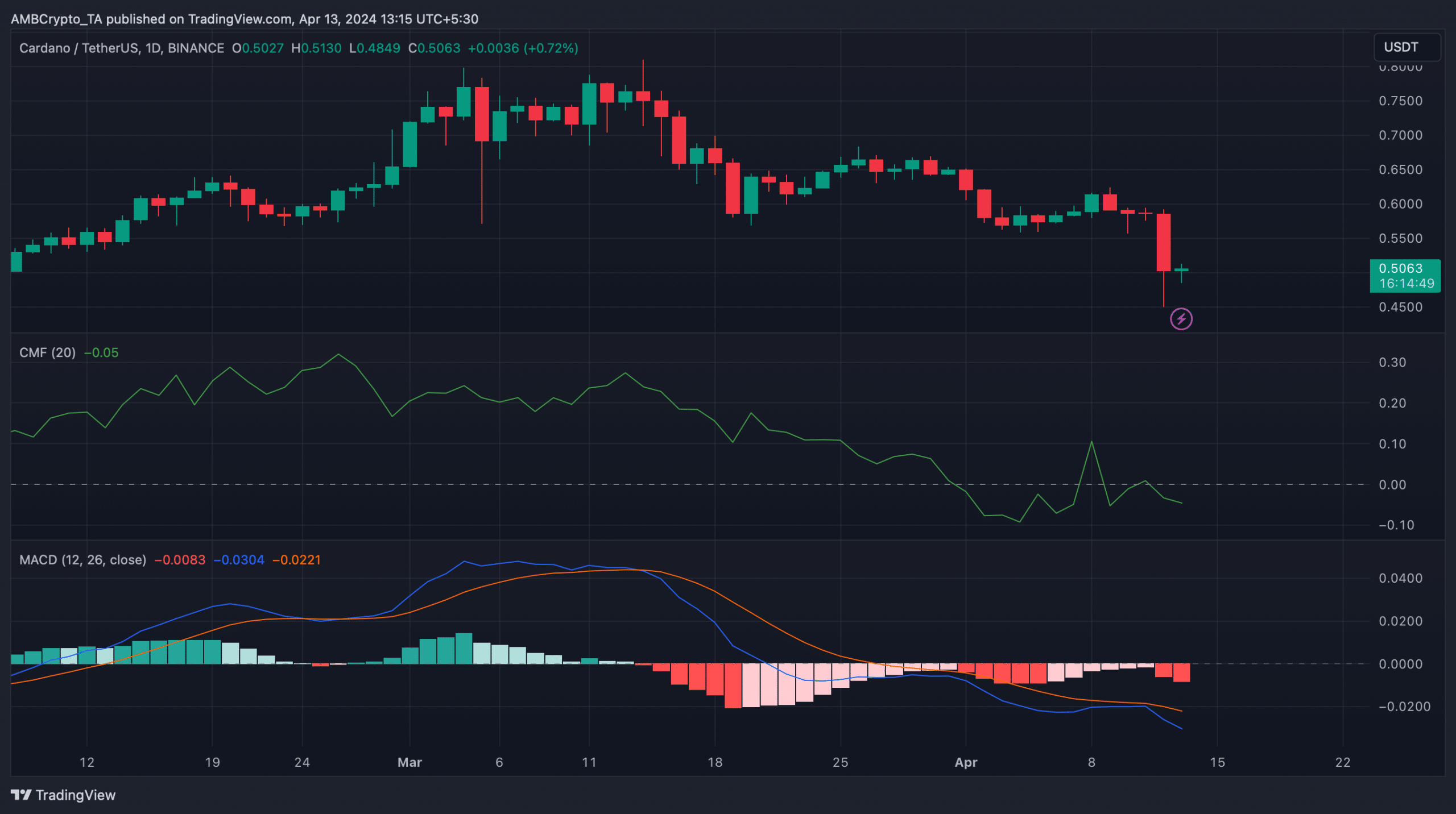

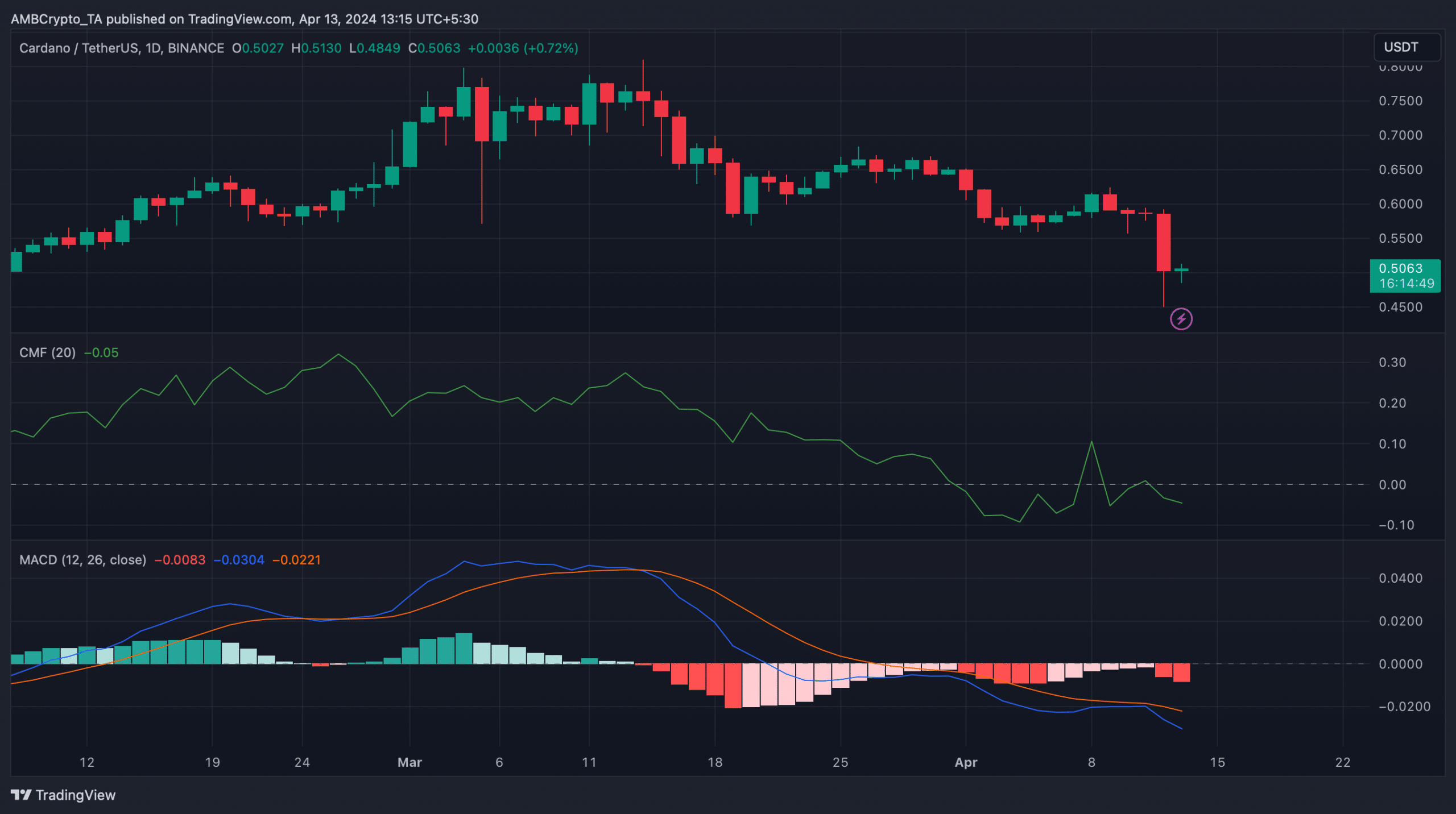

We then analyzed Cardano’s daily charts to see if the indicators hinted at further price declines. ADA’s MACD had a clear bearish edge on the market.

Additionally, Chaikin Money Flow (CMF) recorded a sharp decline on April 12th. Both of these technical indicators supported the sellers and indicate that investors may witness a decline in the value of ADA in the coming days.

Source: TradingView