- The curve is formed at the upper time frame.

- Why are big holders selling ahead of the upcoming alt season?

Curve (CRV) recently broke out on the 2-day time frame, signaling a possible price increase. Using the Lux Algo indicator, CRV successfully retested the breakout level and is now targeting a new high.

After completing the 5th wave bottom, CRV established support at $0.30 and resistance was found at $0.42. However, it is uncertain whether CRV will reach the short-term high of $0.50.

Source: TradingView

CRV has also broken out of consolidation at the time of writing, and price action suggests a possible retest of the $0.30 or $0.33 levels.

These levels may present buying opportunities, but aggressive buying may be psychologically challenging for some investors.

Source: TradingView

Will Alt Season Increase CRV?

The broader altcoin market is also showing signs of strength. Altcoins are attempting to break out of the 9-month falling wedge on the weekly timeframe, a move that could further push CRV’s price higher.

The current total market cap of altcoins is at levels not seen since 2023, suggesting that a similar surge could be imminent. This could potentially spur bullish momentum and push CRV higher.

Source: el_crypto_prof/X

Liquidation level and market capitalization

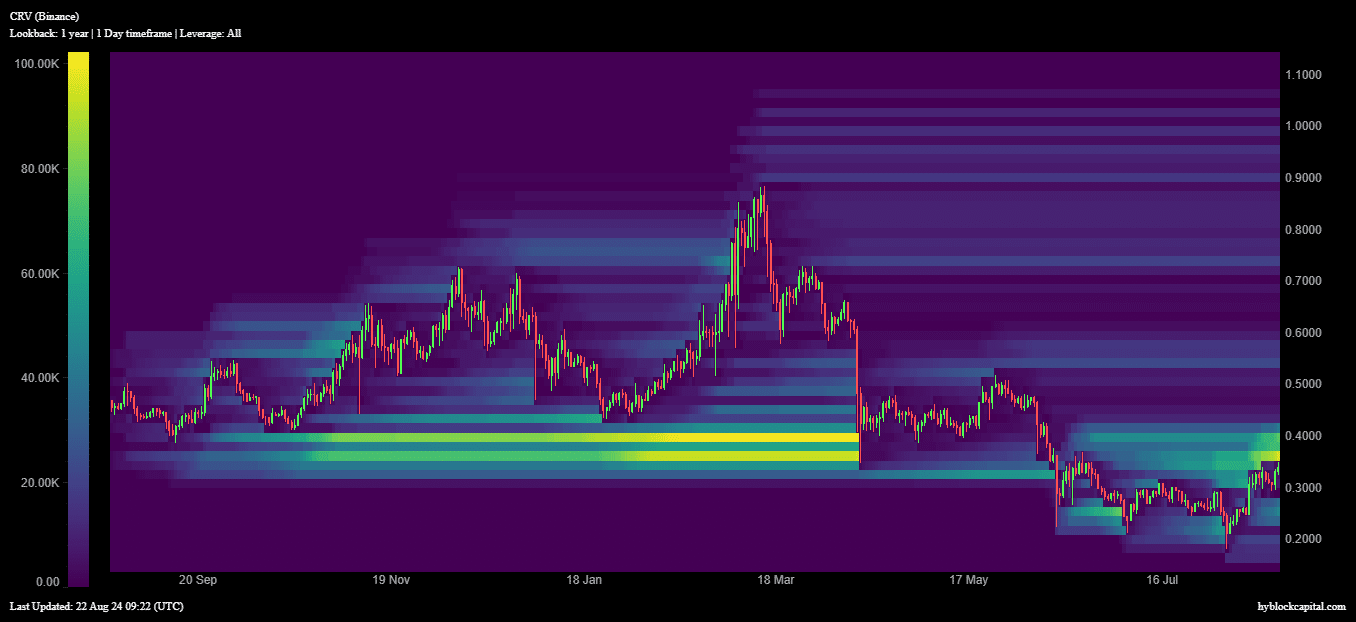

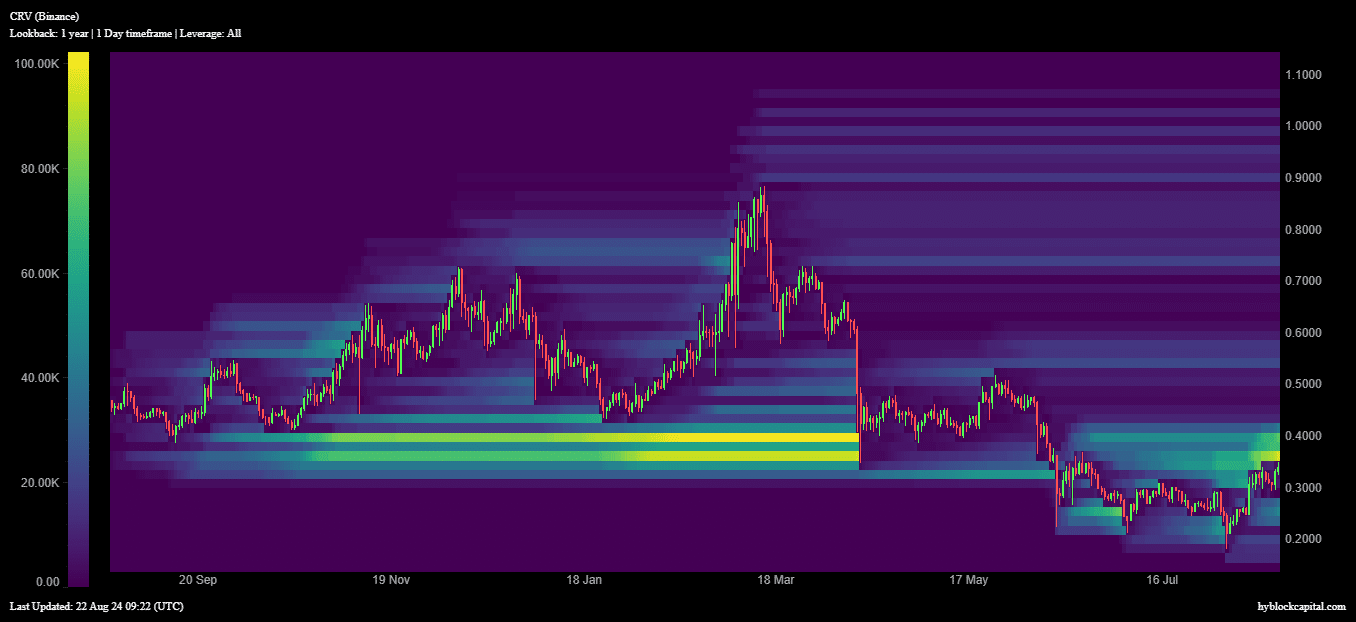

CRV is slowly recovering along with other cryptocurrencies, with liquidity hovering around $22.36K at the time of writing, which is around the $0.50 price level. With CRV orders continuing to fill, it seems likely that it will reach this level in the near future.

Source: Hyblock Capital

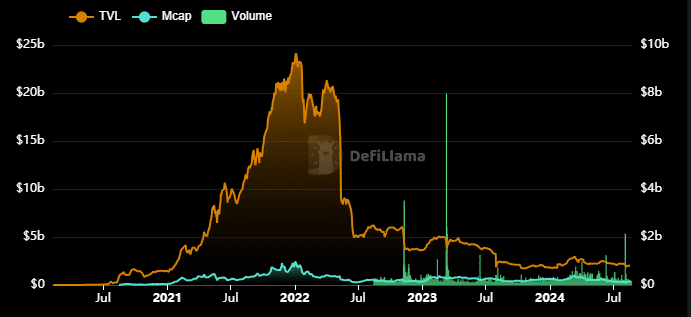

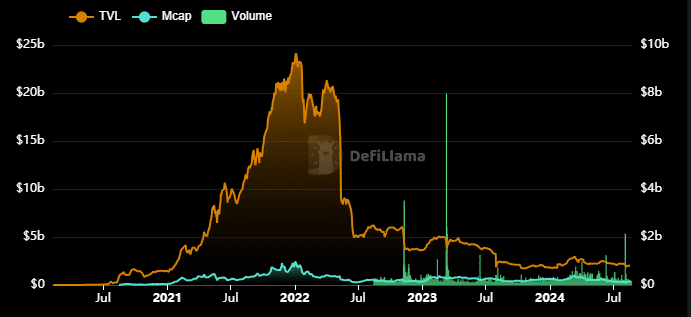

CRV had a market cap of $385 million at the time of press time, with a trading volume of $157 million. This gives it a volume-to-market cap ratio of 42.22%, indicating a stable market with high liquidity and low volatility.

Despite these positive aspects, the total value locked into CRV remains low.

Source: DefiLlama

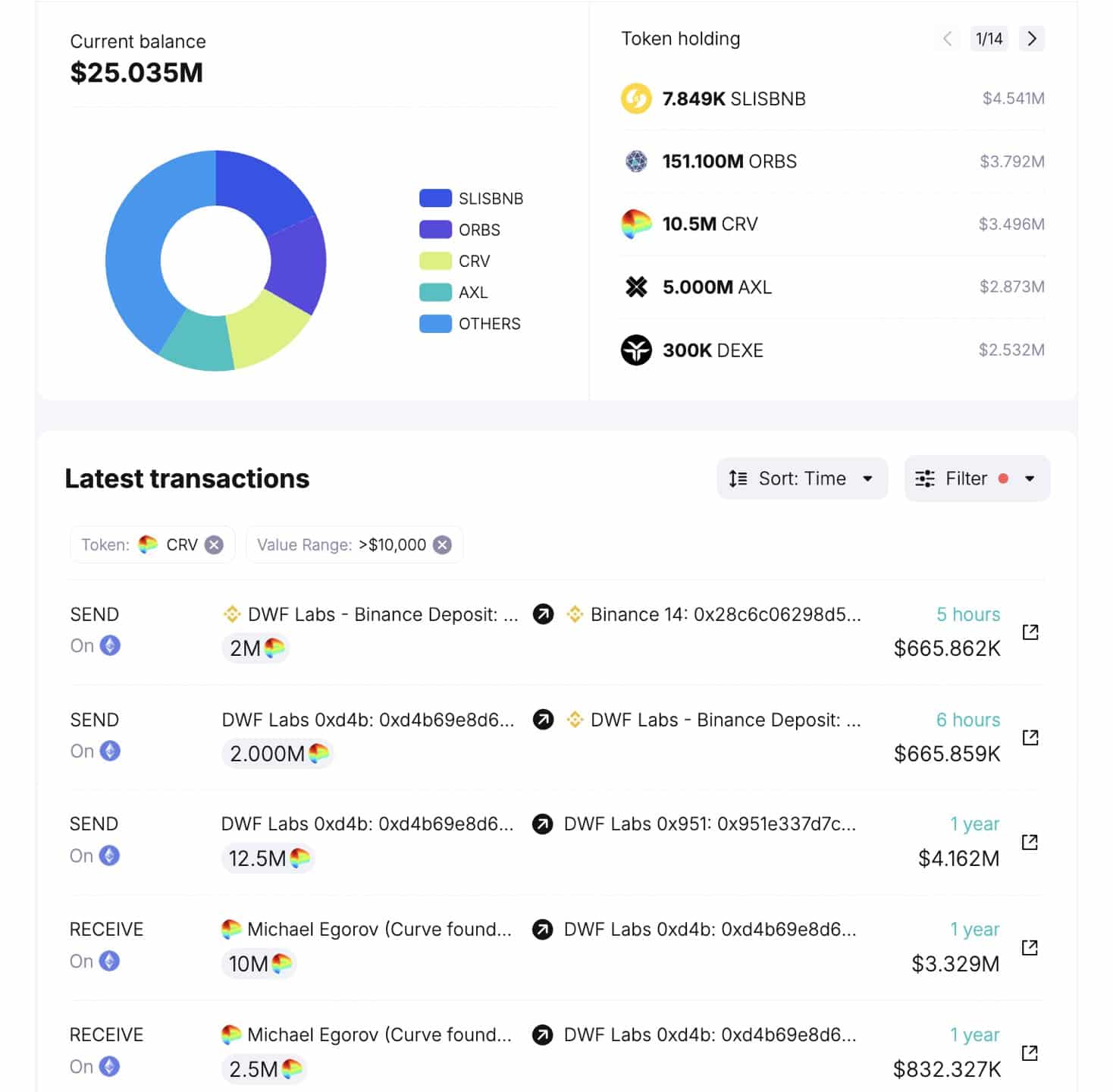

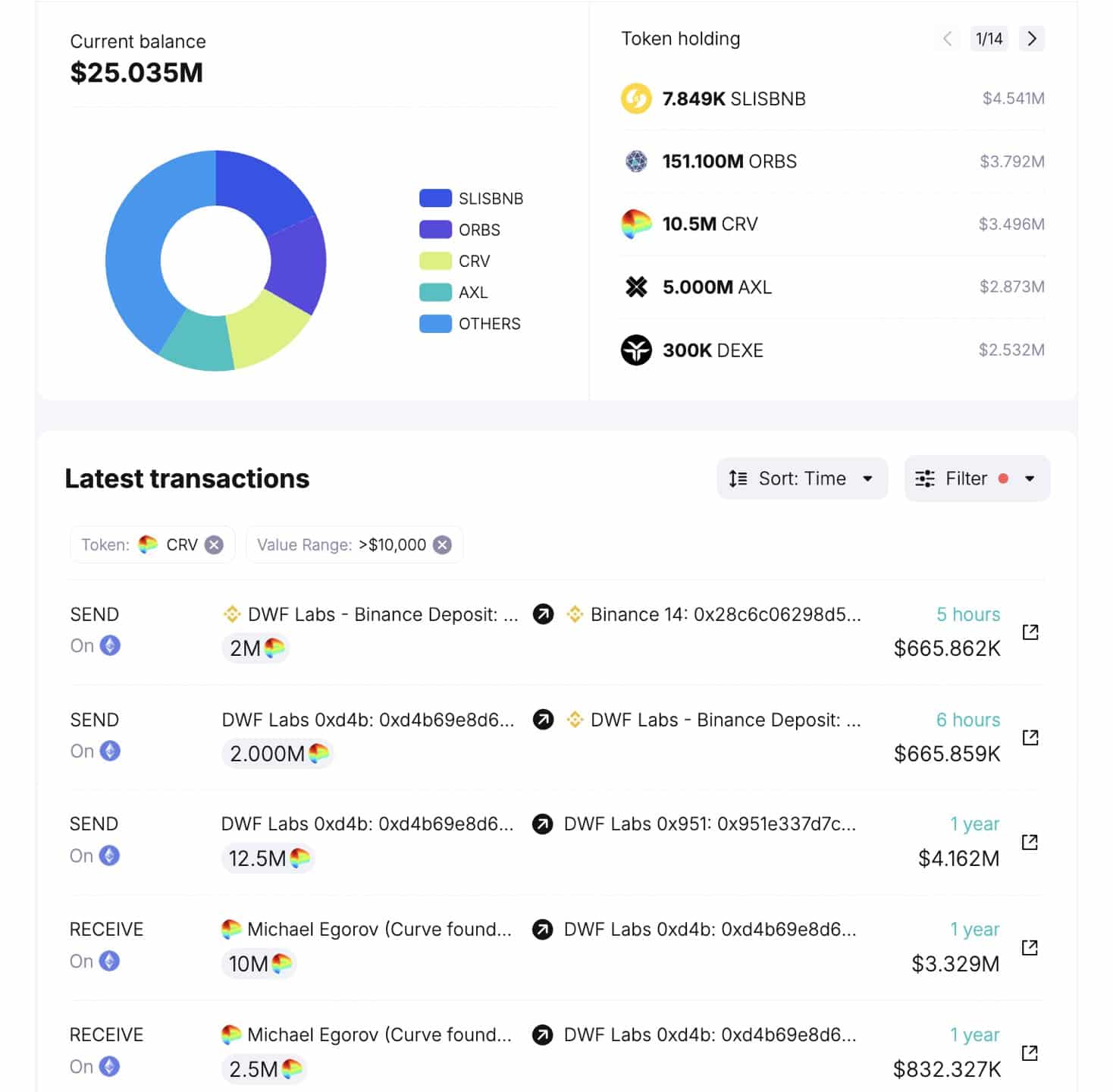

Is DWF Labs going to offload CRV?

DWF Labs, a major CRV holder, recently deposited 2 million CRV ($683,000) to Binance.

For those who don’t know, DWF Labs previously bought 12.5 million CRV from Curve founder Michael Egorov during the liquidation crisis and still holds 10.5 million CRV.

They are currently facing a total loss of $824,000 (-16.5%) at the time of writing. It is not yet known what impact DWF Labs’ actions will have on the price of CRV, but the potential sale of CRV could have an impact on market sentiment.

Source: SpotOnChain

Read Curve DAO (CRV) Price Prediction 2024-2025

CRV shows promise, especially with the potential for a breakout in the broader altcoin market, but investors should closely monitor key support and resistance levels.

CRV’s next steps will likely depend on broader market movements and the actions of major holders like DWF Labs.