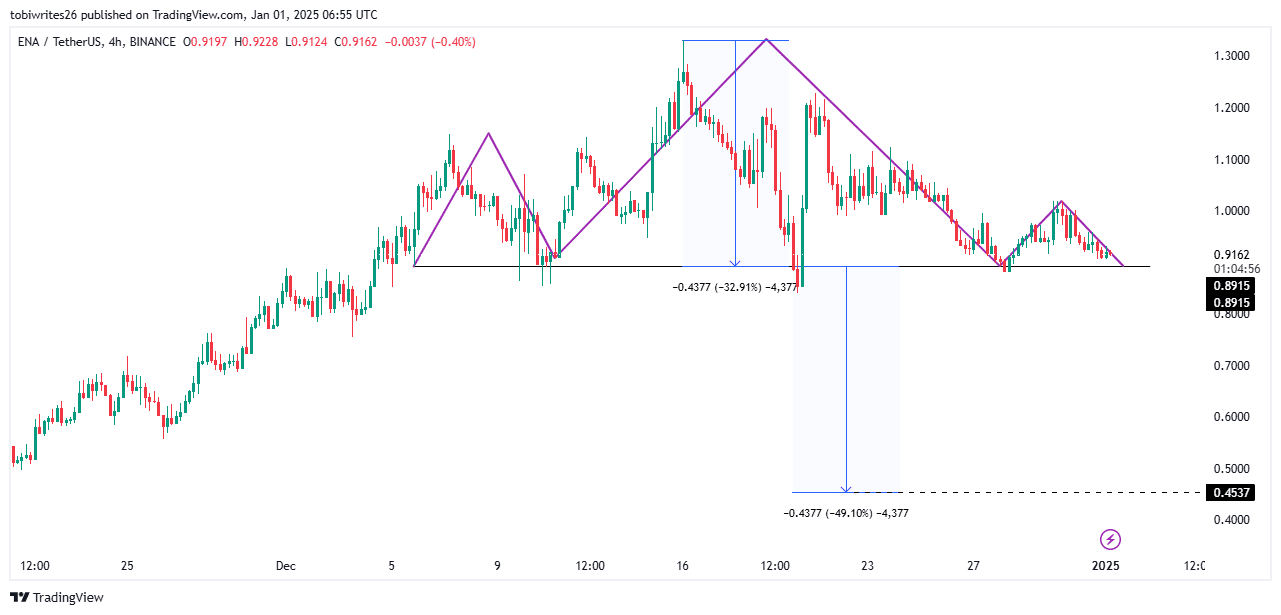

- ENA formed a head and shoulders pattern on the price chart, highlighting increased selling activity.

- The upcoming ENA token unlocking is expected to amplify this pressure, potentially driving the asset value down even further.

Over the past week, Ethena (ENA) has already lost 11.89% of its market value, with losses widening over the past 24 hours as the token fell another 2.01%.

Given the current market structure and prevailing bearish trend, ENA is likely to face further downside as its price hits new lows.

Head and Shoulders Pattern on ENA Chart

On the 4-hour chart, ENA is seen forming a head and shoulders pattern, which is a bearish technical signal. It is possible that the pattern is almost complete and there is only one candle left in the confirmation phase.

If the pattern is fully formed, ENA could enter another bearish phase. If it falls below the support level, commonly called the neckline, the price is likely to fall significantly.

The chart indicates that ENA could fall to $0.454, a 49.10% plunge from its current price of $0.92. Without strong support to absorb selling pressure at these levels, the token may face deeper losses.

Source: TradingView

Market activity further contributed to the bearish outlook as traders continued to intensify selling pressure.

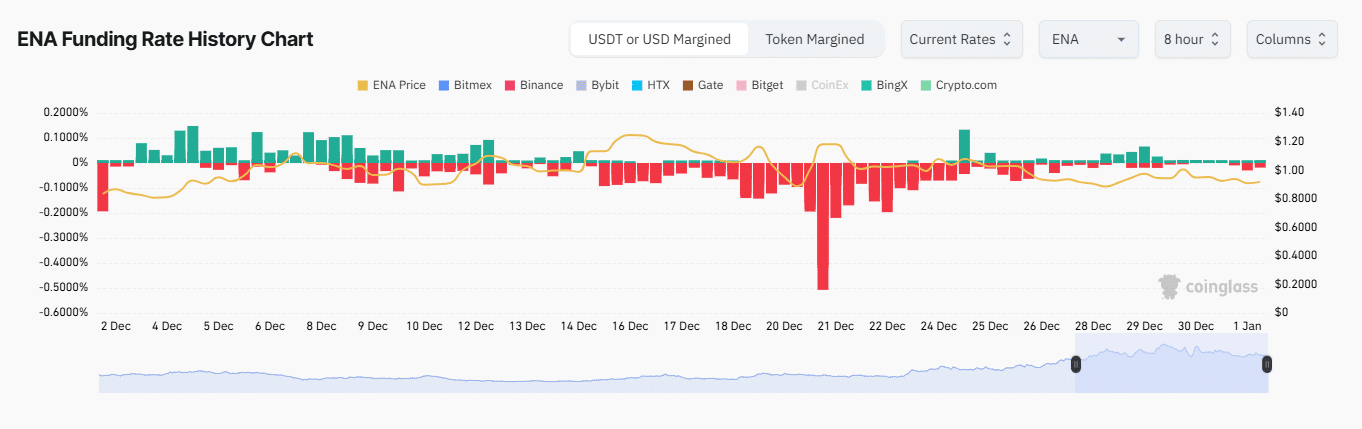

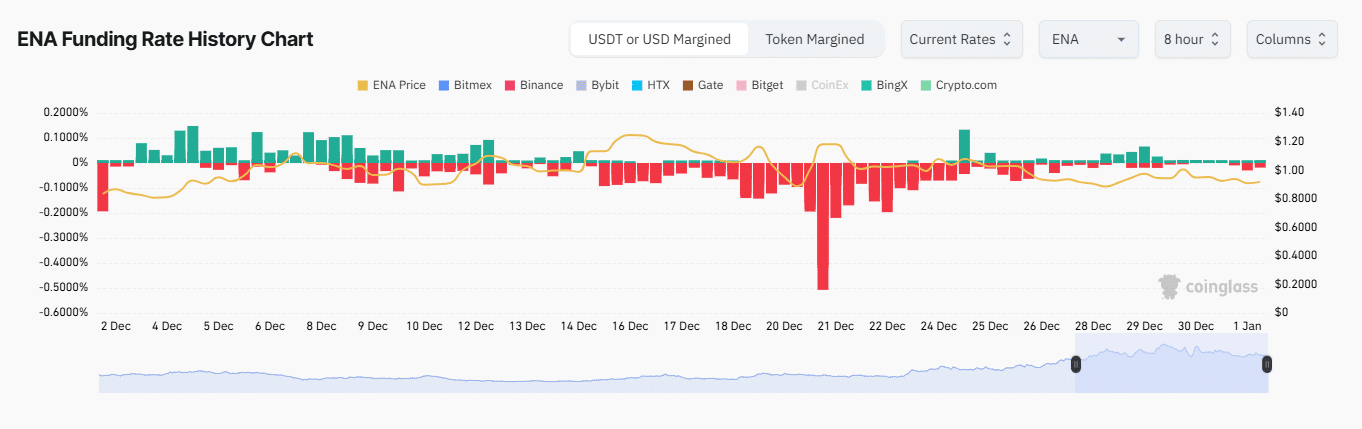

Intensifying selling pressure in the derivatives market

Derivatives markets were under high selling pressure with sellers dominating trading activity.

As of press time, the funding rate is -0.0019%, which is clearly in negative territory.

A negative funding ratio means short traders are paying a premium to hold their positions, reflecting bearish sentiment in the market.

Source: Coinglass

If the funding rate falls further, the price of ENA is likely to face further downward pressure and could potentially reach $4.5 as shown in the chart.

ENA’s open interest also decreased by 2.43% over the last 24 hours to $558.53 million. This means that active positions decrease as market participants close trades amidst increasing selling pressure.

This behavior is often a sign of an effort to avoid liquidation and limit further losses, which is a key sign of diminishing confidence in the market.

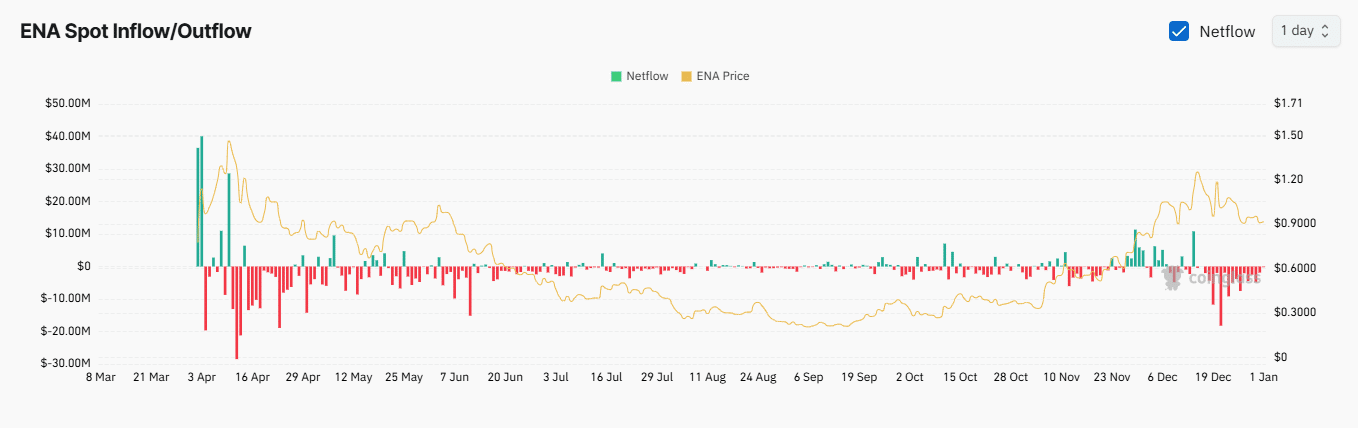

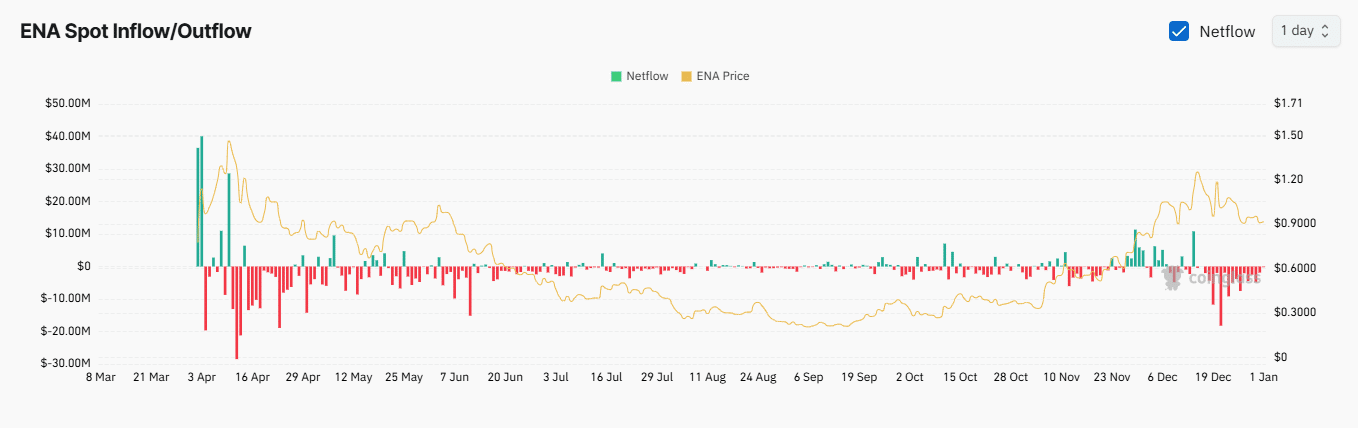

Exchange NetFlow data supports this bearish outlook. There has been a noticeable decrease in the amount of ENA tokens leaving exchanges over the past four days.

Source: Coinglass

The continued decline in external token flows means more ENA tokens remain on exchanges, increasing available supply. This surplus can add to selling pressure and push asset prices down further.

ENA supply expected to increase

According to Layergg, 12 million ENA tokens will be unlocked and hit the market on January 1st. This will significantly increase the circulating supply of ENA.

Read Ethena (ENA) price forecast for 2025-2026

If there is not enough demand to stabilize the market, additional supply combined with prevailing bearish sentiment could accelerate price declines.

Given current market conditions, this scenario appears increasingly likely for ENA.