- As Ether Lee’s risk appetite falls, he pays attention to the market and shows a slowdown in future growth.

- BYBIT HACK had a relatively gentle impact due to a wider market change.

Ether Lee’s elasticity is being tested as a recent event, including the rumors of bybit hack and shift market sentiments.

Surprisingly, the sale of potential security violations had less impact than the market downturn on February 3, which had a greater impact despite the unclear cause.

There is a deeper concern under these short -term fluctuations. Ether Lee’s risk appetite has been steadily decreasing since March 2024.

If the risk decreases decrease, the liquidation can be reduced and the accumulation can be promoted, but the market appears slow. The problem is whether ETH can be located or if it is possible to face long -term uncertainty while crossing the key level.

BYbit Hack: A small event in the larger picture?

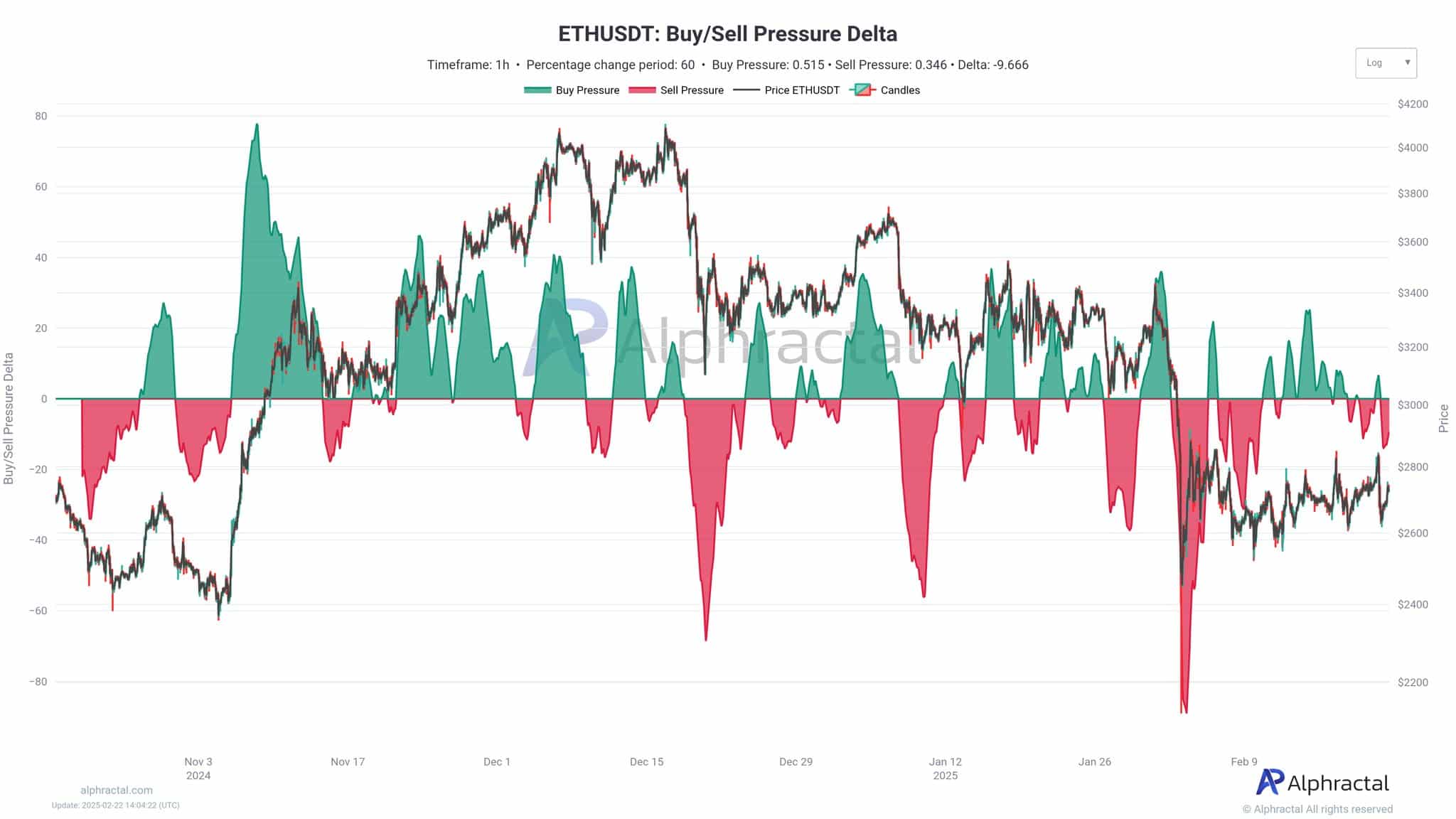

Despite concerns about the potential for Bybit Hack, data suggests that the most rapid decrease in ETH is not an isolated event in recent months, but rather a wider risk -off movement.

Source: Alphractal

At the end of January and early February, there was a decline in prices, but the price dropped before the hacking news appeared.

Sells on February 3, more severe than hacking, represents deeper fluidity and changing feelings.

As dangerous appetite has decreased since March 2024, Ether Lee has reduced the participation of leverage traders. This reduces liquidation, but ETH’s sluggish recovery signal continues to signal market uncertainty.

Ether Leeum: Is the risk of decrease a cause of concern?

Ether Leeum’s risk appetite has steadily decreased since March 2024, reflecting a wider change in emotions. The NRM chart shows a clear decline. Investors are avoiding more risks.

Historically, higher risk appetite led to speculative surge, but the market is now more cautious.

Source: Alphractal

Regulatory uncertainty and reduced leverage participation contributed to this trend.

Low risk indicators reduce volatility and create a more stable environment, but weaken the possibility of explosive price fluctuations.

Unless dangerous appetite recovers, Ether Leeum can continue to be traded in a more controlled and less speculative manner.

Risk compensation paradox

As Ether Lee’s risk appetite decreases, the market decreases volatility and reduces liquidation.

This stability can encourage long -term accumulation, but priced appreciation can lead to congestion as the speed slows without reasoning momentum.

Source: Alphractal

Historically, the low Sharpe ratio is consistent with the movement to the side, requiring the patience of investors.

If Ether Lee’s risk adjustment revenue is conquered, the market can face the extended accumulation stage instead of imminent escape.

Ether Leeum: Battle of demand and demand

The price of Ether Lee is increasingly affected by institutional inflow, retail feelings and regulations.

Blackrock’s recent $ 3.6 billion investment signals institutional signals, potentially stabilizes prices and promotes adoption.

Meanwhile, retail feelings are still divided, and some are accumulated in deep and other deep dip due to market uncertainty.

The possibility of approval of Etherum Stay King ETF in 2025 can reinforce retail profits, but improving the US regulatory clarity can reduce investor uncertainty.

Ultimately, Ether Leeum’s future depends on the balance of institutional support with continuous retail participation and favorable regulatory conditions.