- At the time of writing, ETH is stuck in a 4-hour symmetrical triangle, showing no clear directional trend.

- On-chain data suggests a potential rally is coming.

Ethereum (ETH) market activity is muted, with the price up slightly by around 2.45% and currently trading at around $2,600.

This type of price action is commonly seen when an asset is trading within a symmetrical triangle, a pattern characterized by converging diagonal upper and lower lines.

Previous instances of similar trading patterns often resulted in large price increases or decreases.

Analyst Predictions for ETH

at Recent TweetsCryptocurrency analyst Karl Runefeld emphasized that ETH is at a crossroads, facing a decision that could trigger a drop to new lows.

This could cause the bullish momentum to fade and ETH could hit a new monthly high.

Runefelt shared a 4-hour chart outlining potential price targets based on ETH’s direction.

“Potential bullish target: $2,800

Potential downside target: $2,350.”

At such a critical juncture, it is important to identify additional confluence points. To this end, AMBCrypto undertook further analysis.

Traders with ‘money’ can push ETH higher.

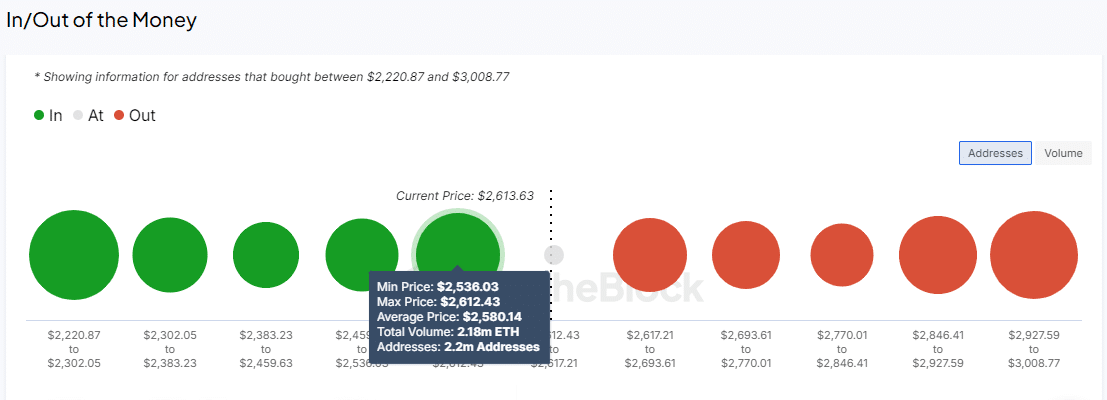

AMBCrypto used the In and Out of Money Around Price (IOMAP) indicator to analyze whether profitable traders (In the Money) or losing traders (Out of the Money) can influence the price direction of Ethereum.

“In the Money” indicates that the trade is currently profitable and acts as a support zone, while “Out of the Money” indicates that the trade is unprofitable and acts as a resistance zone.

According to IntoTheBlockETH bounced off the $2,597.37 support level, with transactions involving 2.39 million addresses and $8 billion worth of ETH.

Source: IntoTheBlock

This level is potentially essential to push the price higher. However, significant resistance is expected from traders who lost money at $2,677.33, $2,760.00, and $2,831.77.

While these resistance levels pose challenges, the bullish momentum at the time of writing, which outweighs selling pressure, suggests that ETH could trend towards or even surpass $2,800.

Buyers are interested in ETH

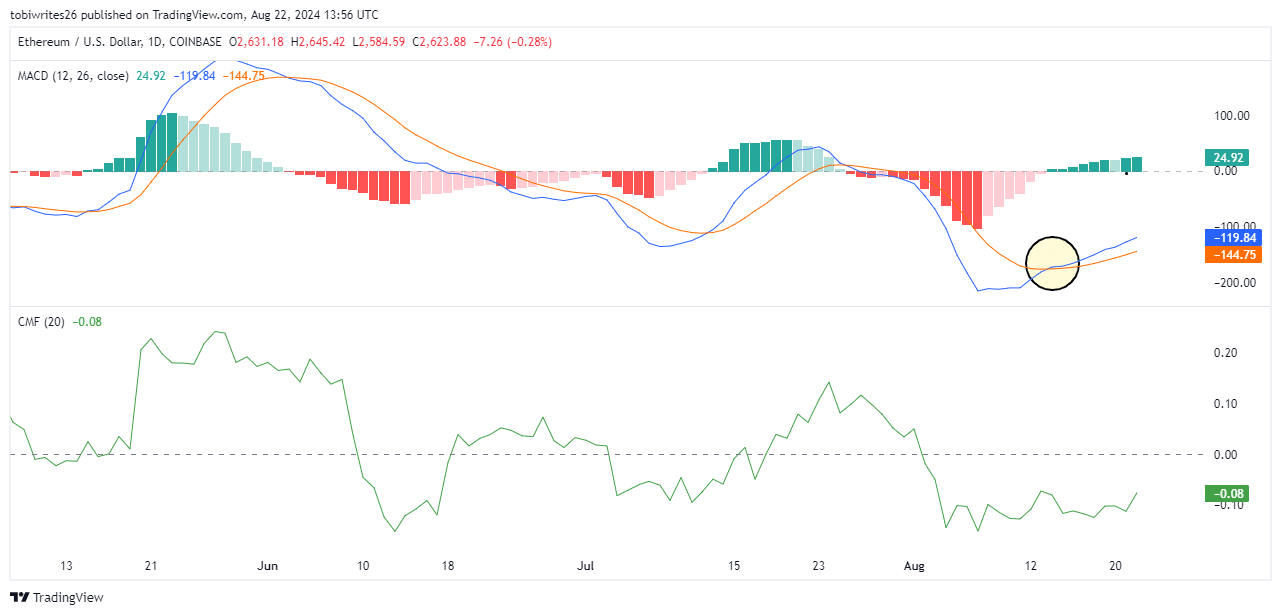

Ethereum traders are seeing increasing momentum, as evidenced by the Moving Average Convergence Divergence (MACD) indicator.

This tool tracks the relationship between two moving averages of the ETH price to help identify changes in momentum and direction.

Recently, the MACD showed a bullish crossover signal, which suggests that buyers are actively entering the market and are likely to continue to push the price higher.

Additionally, Ethereum’s momentum is rising and the MACD is trending in the positive zone, which suggests that the price is likely to continue to rise.

Source: TradingView

Is your portfolio green? Check out our ETH yield calculator

Chaikin Money Flow (CMF) also supports this bullish outlook. It has been rising since August 18, indicating increasing buying pressure.

If this trend continues, the ETH price could rise further towards the $2,800 target.