- ONDO is down 9.55% in the last 24 hours.

- Due to strong bearish sentiment, analysts expect a drop to $1.05.

Since hitting a local high of $2.1 a week ago, Ondo Finance (ONDO) has struggled to maintain upward momentum.

During this period, the altcoin fell to $1.47. In fact, at the time of writing, ONDO was trading at $1.51. This represents a 9.55% decline over the last 24 hours. Likewise, the altcoin fell 19.70% on the weekly chart.

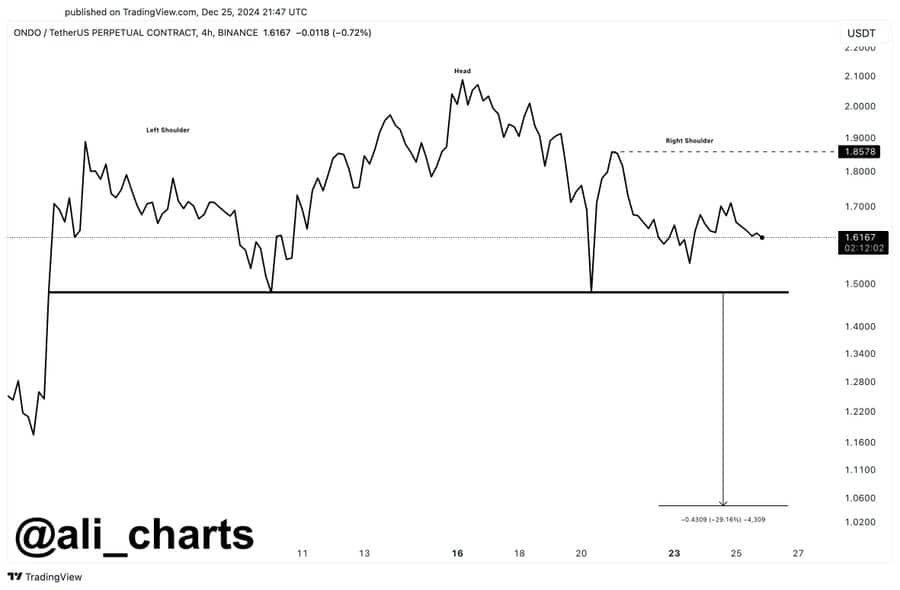

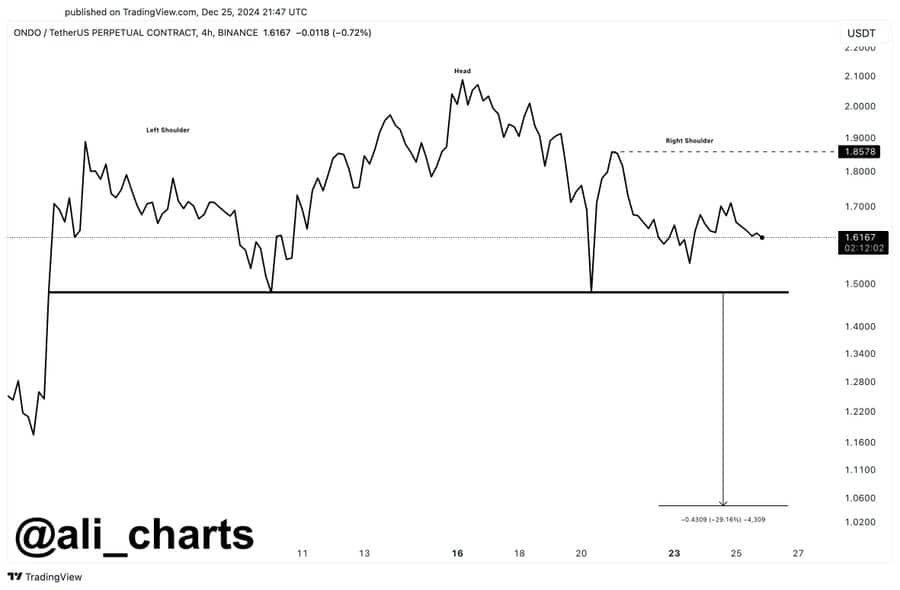

Recent market conditions have the cryptocurrency community predicting further declines. Accordingly, renowned cryptocurrency analyst Ali Martinez suggested that a decline to $1.05 is likely, citing a head and shoulders pattern.

market psychology

In his analysis, Martinez assumed that ONDO was forming a head and shoulders pattern at press time. So, if the altcoin closes below $1.48, the price could see a 30% correction to around $1.05.

Source: X

For context, the Head and Shoulders pattern is a bearish reversal pattern that indicates a possible price decline following an uptrend.

A drop in price below the neckline shows that it is likely to drop by the height from the neckline to the head.

Therefore, ONDO should claim $1.86 as support to nullify the bearish outlook. Failure to do so will result in altcoins continuing to decline.

ONDO: Explore the charts

Although the analysis provided above provides a bearish outlook, it is important to determine what other market indicators imply.

According to AMBCrypto’s analysis, ONDO was in a correction phase with strong bearish sentiment at press time.

Source: Santiment

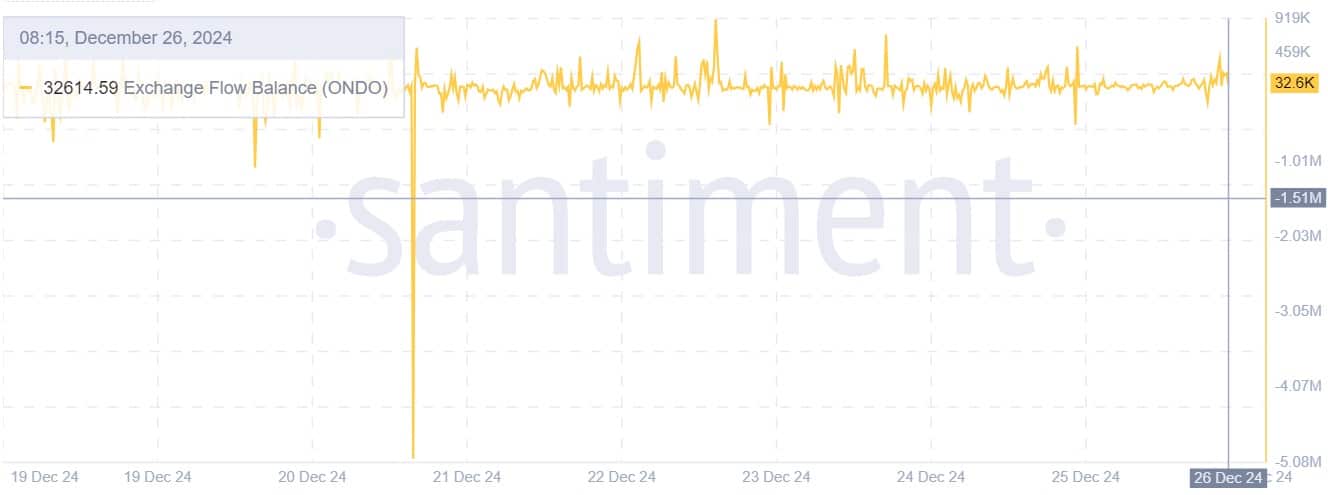

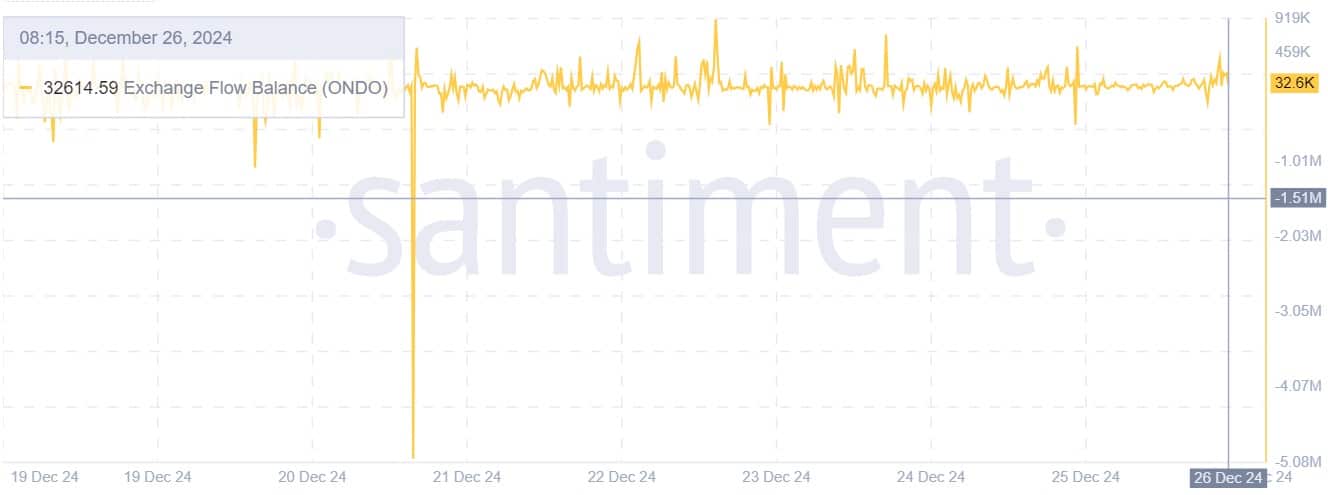

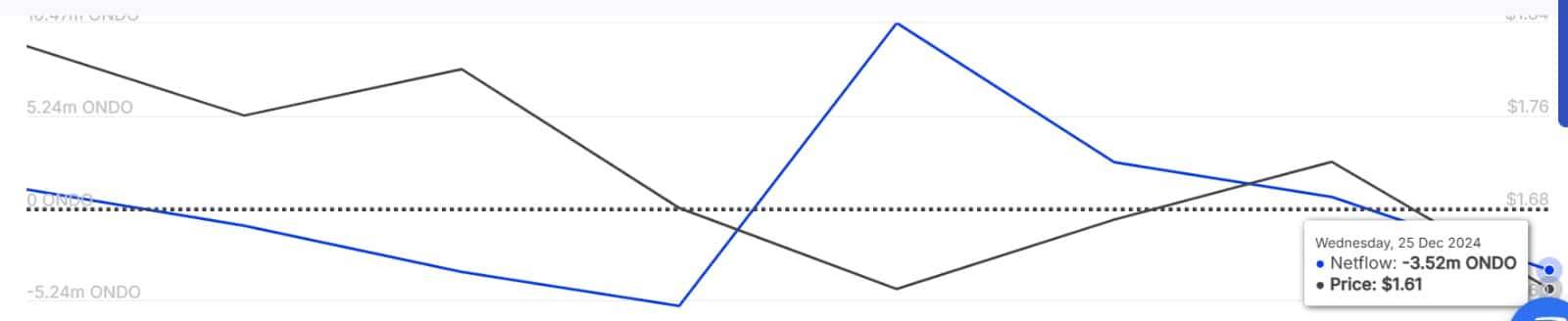

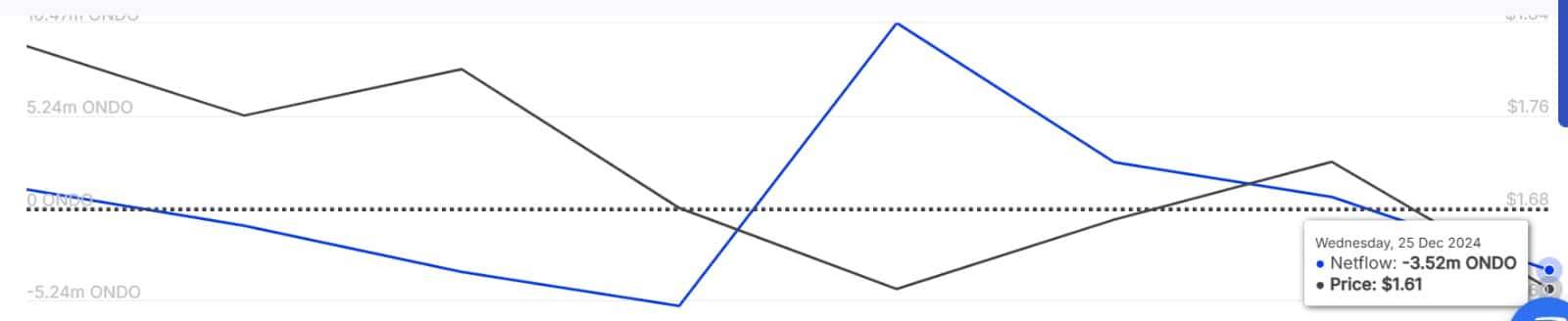

The weakness of ONDO is evidenced by the rise in exchange-flow balance. This means that more traders are transferring more assets to exchanges in preparation for selling or selling.

Source: IntoTheBlock

These exchange flows are much more prevalent among large holders. According to IntoTheBlock, the net flow of large holders decreased to -3.52 million over the past week.

This shows that there is more outflow from whales compared to inflow.

Source: Santiment

Additionally, ONDO’s NVT to trading volume ratio has surged over the past few days, raising concerns about overvaluation.

This indicates low network participation due to low transactions, active addresses, and overall network usage.

Source: Santiment

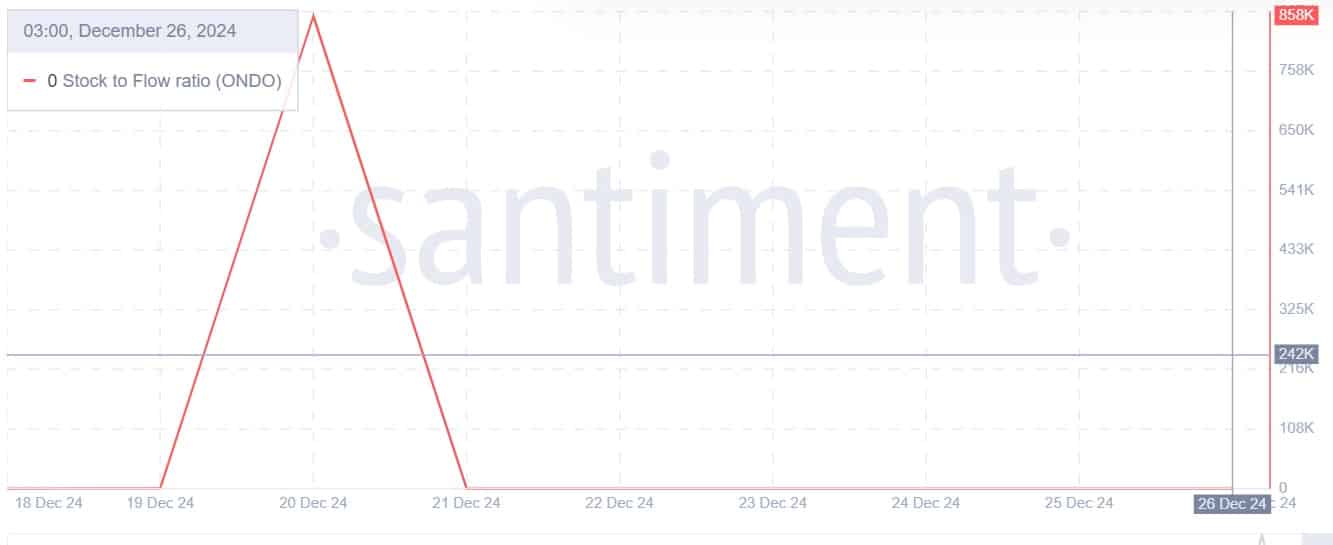

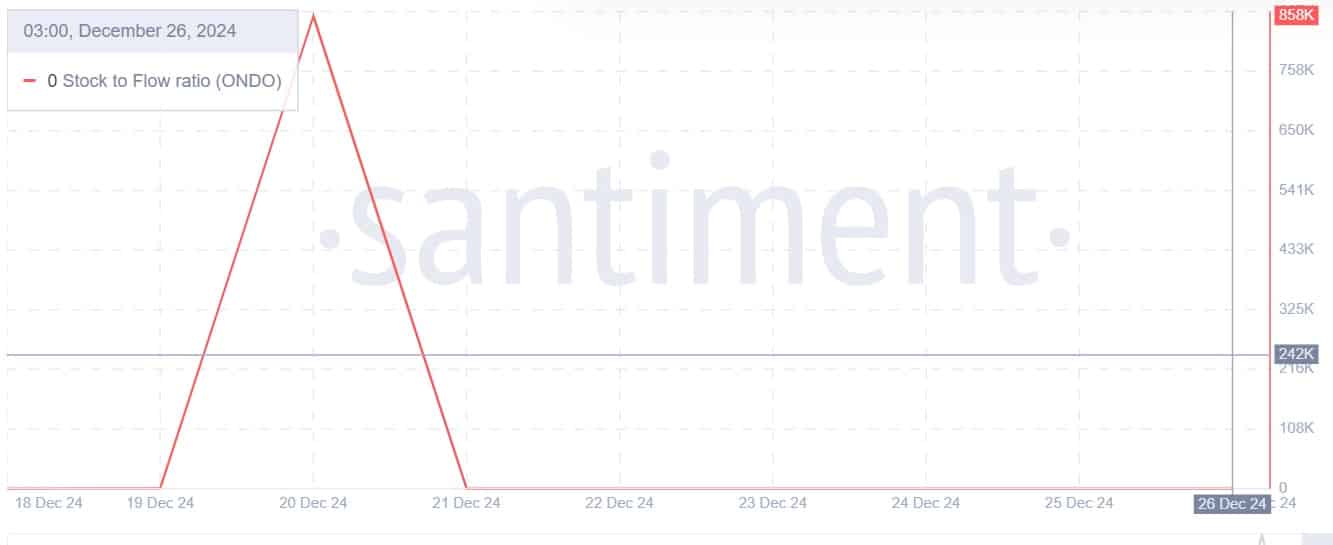

Lastly, the stock-to-flow ratio of altcoins indicated oversupply, further supporting earlier observations of increased inflows to exchanges.

Read Ondo Finance (ONDO) price forecast for 2025-2026

Oversupply of ONDO could create selling pressure, creating further downside risk.

If current market conditions continue, ONDO will find support around $1.04. However, if the trend reverses, the altcoin will regain $1.7 in the short term.