- Open interest in SAND is up 5.6% in the last 24 hours following a bullish breakout.

- Key liquidation levels were $0.255 and $0.27, with traders using excessive leverage at these levels.

The overall cryptocurrency market is showing a notable recovery.

Meanwhile, virtual gaming platform The Sandbox (SAND) broke away from a strong bullish pattern and shifted sentiment from a downtrend to an uptrend.

SAND Technical Analysis and Key Levels

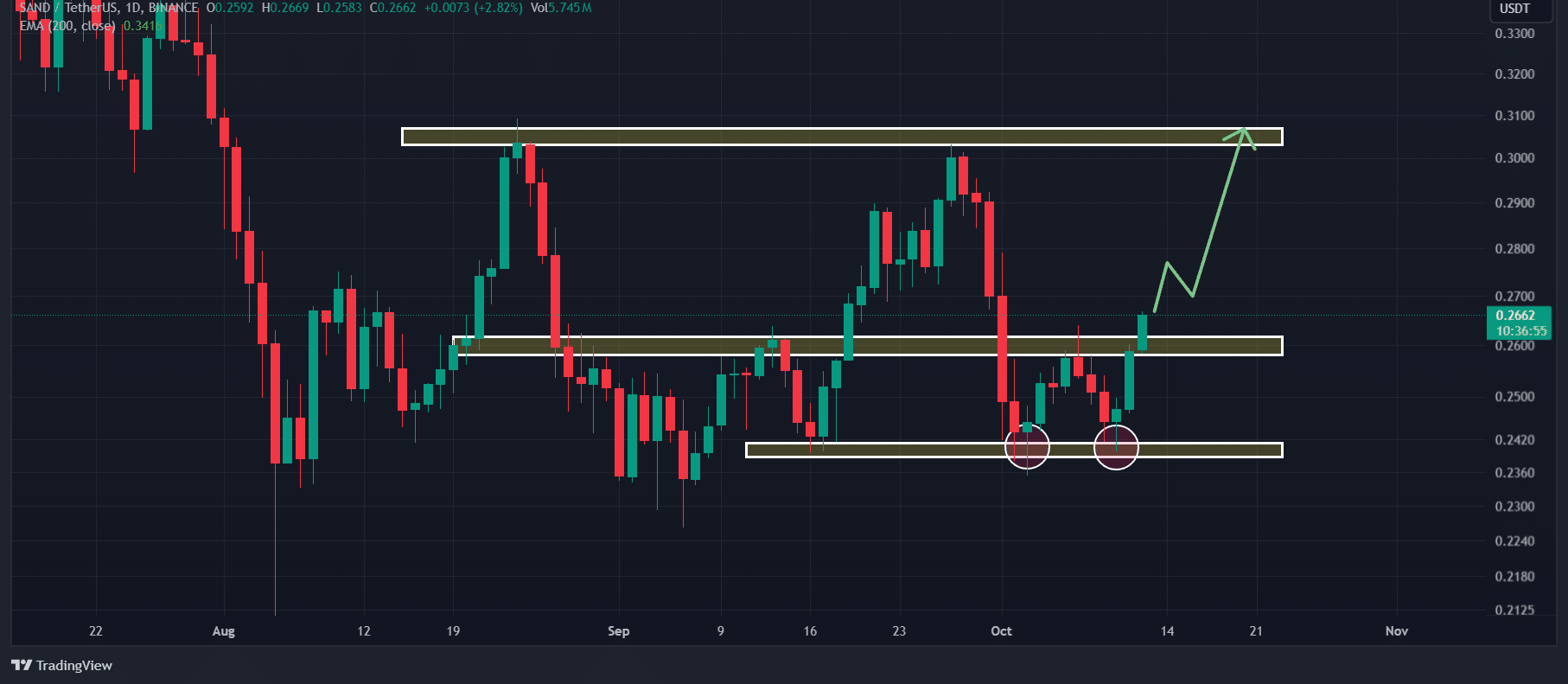

According to AMBCrypto’s technical analysis, SAND was strengthening as it broke out of a double bottom price action pattern at press time. This breakout was confirmed when the daily candle closed above the neckline.

Source: TradingView

Based on recent price performance, if SAND closes the daily candle above $0.264, it is likely to surge 15% to reach the $0.305 level in the next few days.

Additionally, SAND’s Relative Strength Index (RSI) stands at 52.30 at press time, suggesting an upside potential ahead.

Despite SAND’s optimistic outlook, the 200 exponential moving average (EMA) showed a downward trend. When an asset is trading below the 200 EMA, traders and investors typically consider the asset to be in a downtrend and vice versa.

Bullish on-chain indicators for SAND

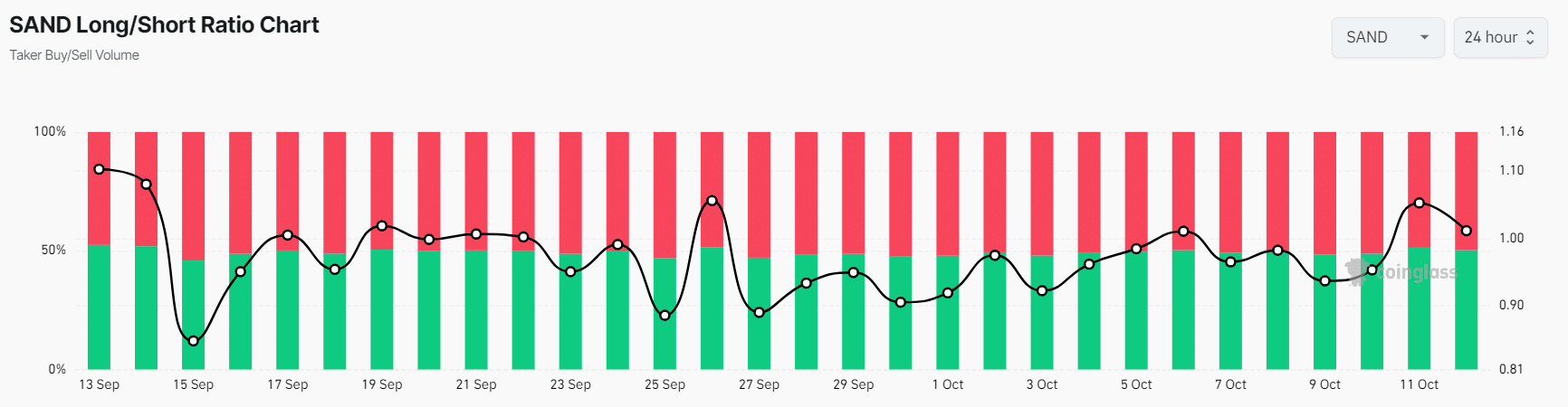

SAND’s optimistic outlook is further supported by on-chain indicators. According to on-chain analytics firm Coinglass, at press time, SAND’s long/short ratio was 1.03, indicating a bullish market mood.

Source: Coinglass

Additionally, futures open interest is up 5.6% in the last 24 hours and up 3.91% in the last 4 hours.

This means that trader interest in the SAND token is growing after the double bottom price action pattern emerged.

Key Liquidation Levels

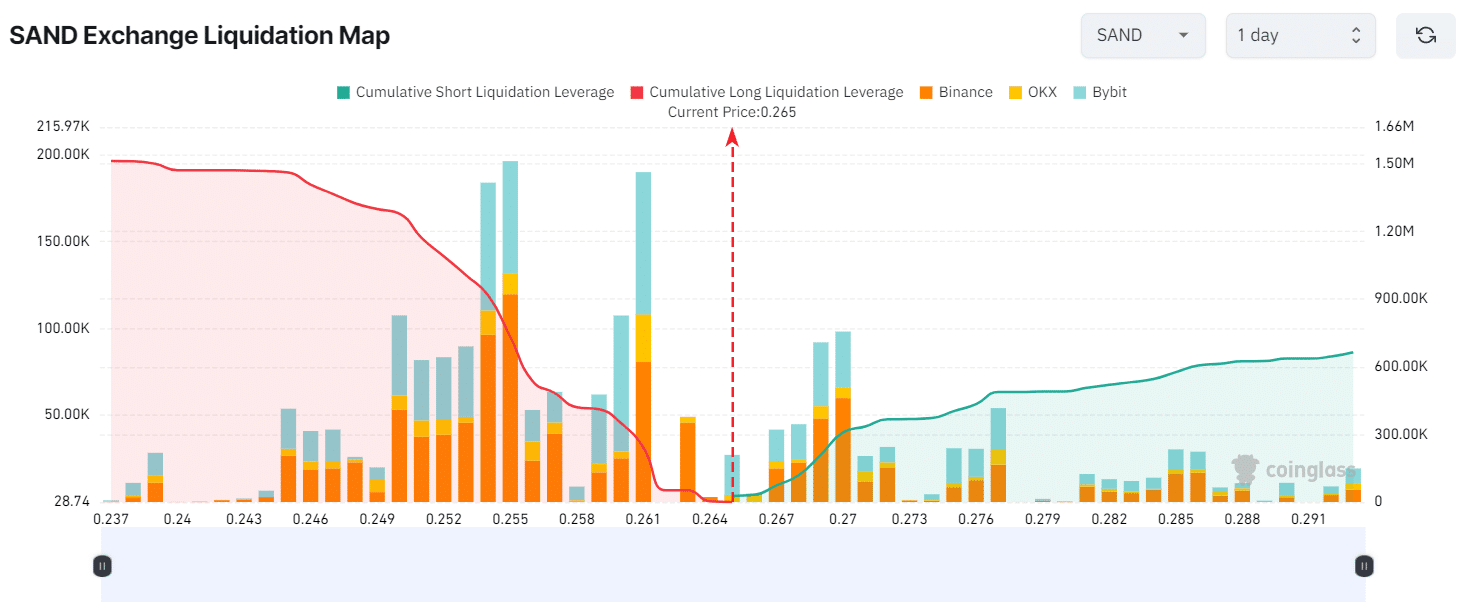

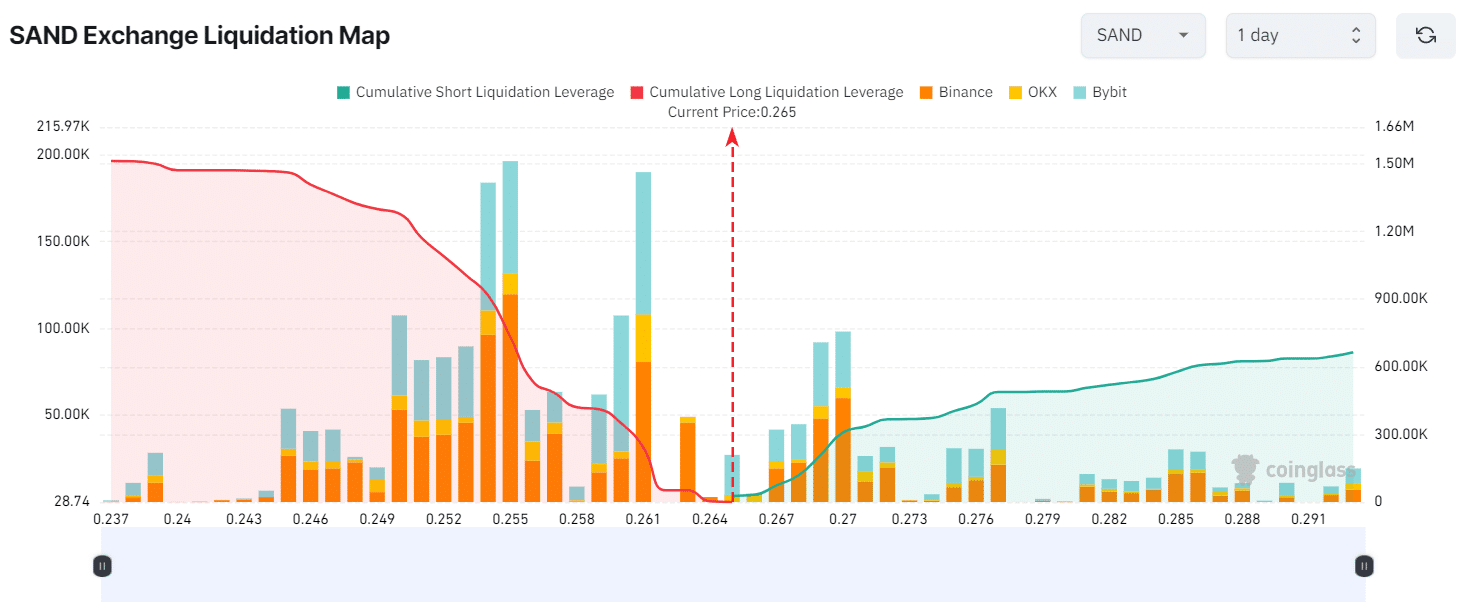

According to Coinglass, the current key liquidation levels are $0.255 at the bottom and $0.27 at the top, with traders using excessive leverage at these levels.

Source: Coinglass

If market sentiment does not change and the price rises to the $0.27 level, approximately $308,620 worth of short positions will be liquidated.

Conversely, if sentiment changes and the price falls to the $0.255 level, approximately $732,960 worth of long positions will be liquidated.

This liquidation data shows that bulls’ long positions are more than twice the bears’ short positions.

Combining all of these on-chain indicators and technical analysis, it appears that bulls are currently dominating the asset and have the potential to support SAND in a future rally.

Read The Sandbox (SAND) price forecast for 2024-2025

Current price momentum

At press time, SAND is trading near $0.266 and has experienced a price surge of over 5.2% in the past 24 hours.

During the same period, trading volume decreased by 6%, reducing the participation of traders and investors.