- In the last few months, SOL has decreased 35.5%.

- Solana’s daily active address and warm chain decrease, indicating downward pressure.

After three weeks ago, Solana (SOL) experienced a strong weakness. During this period, Solana did not record the lowest level of three months.

Why do Solana decline through such a strong decline? According to the analysis, Solana has a low heat chain and is fundamentally difficult.

Solana’s warm chain is reduced

Solana’s chain activities have been steadily decreasing over the last few months. As a result, the number of daily active addresses of the network was 3.5 million, not the three -month low.

Source: Artemis

If the number of active users decreases, market interest will be greatly reduced and adoption is reduced. Often, the lower the active user, the less chain activity, which may lead to depreciation.

Historically, fewer users are generally associated with price drops as demand falls.

Source: Artemis

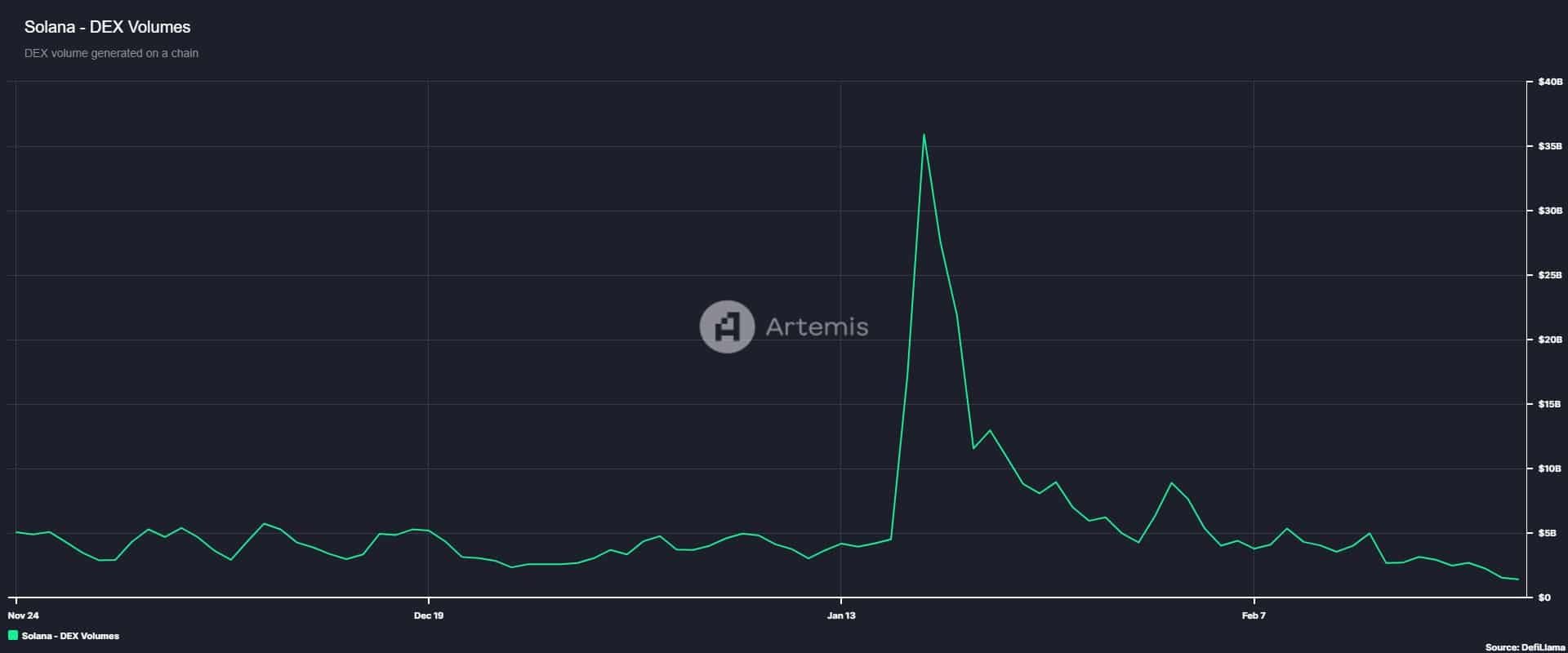

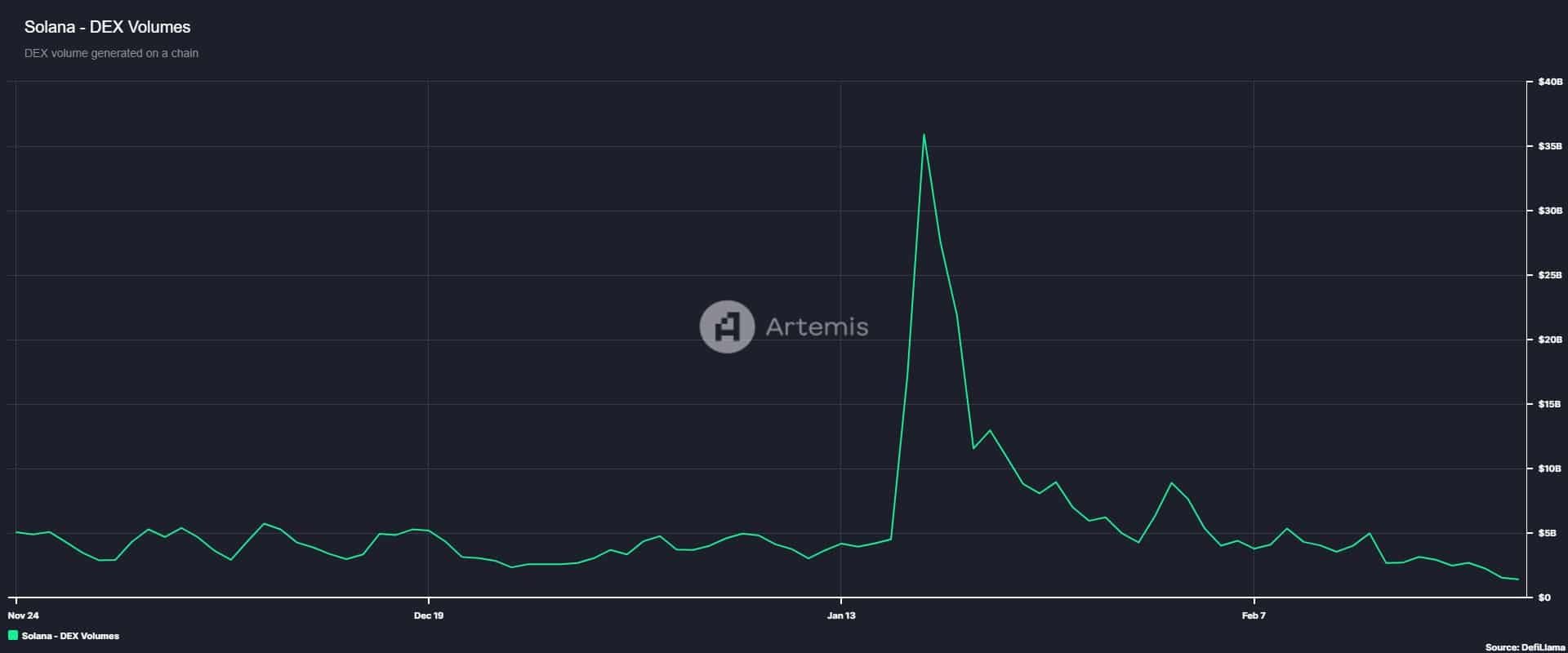

This reduced hot chain activity in Solana is further demonstrated by the decrease in distributed exchange (DEX) trading volume. According to ARTEMIS data, this recorded a four -month low of $ 1.5 billion.

This reduction reduces trust in the network because investors prefer centralized exchanges (CEX) over security issues.

Source: Artemis

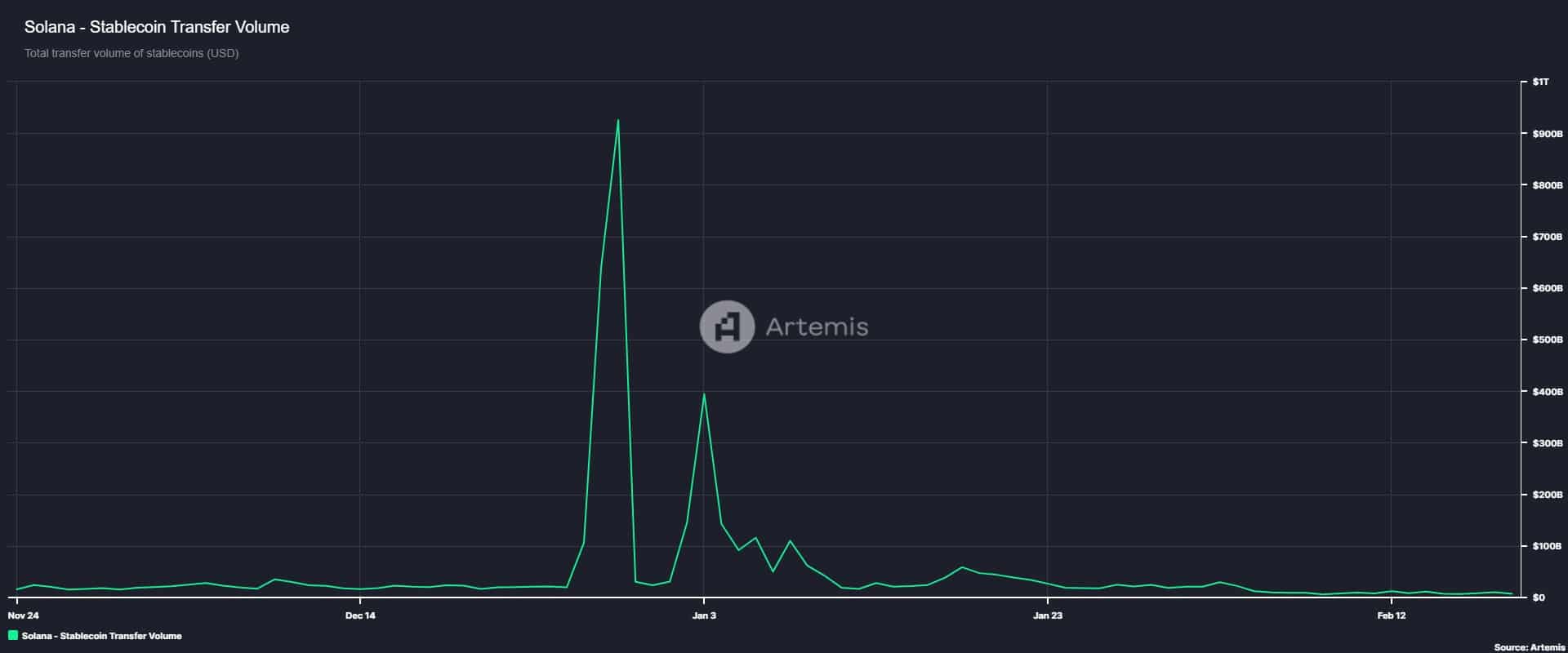

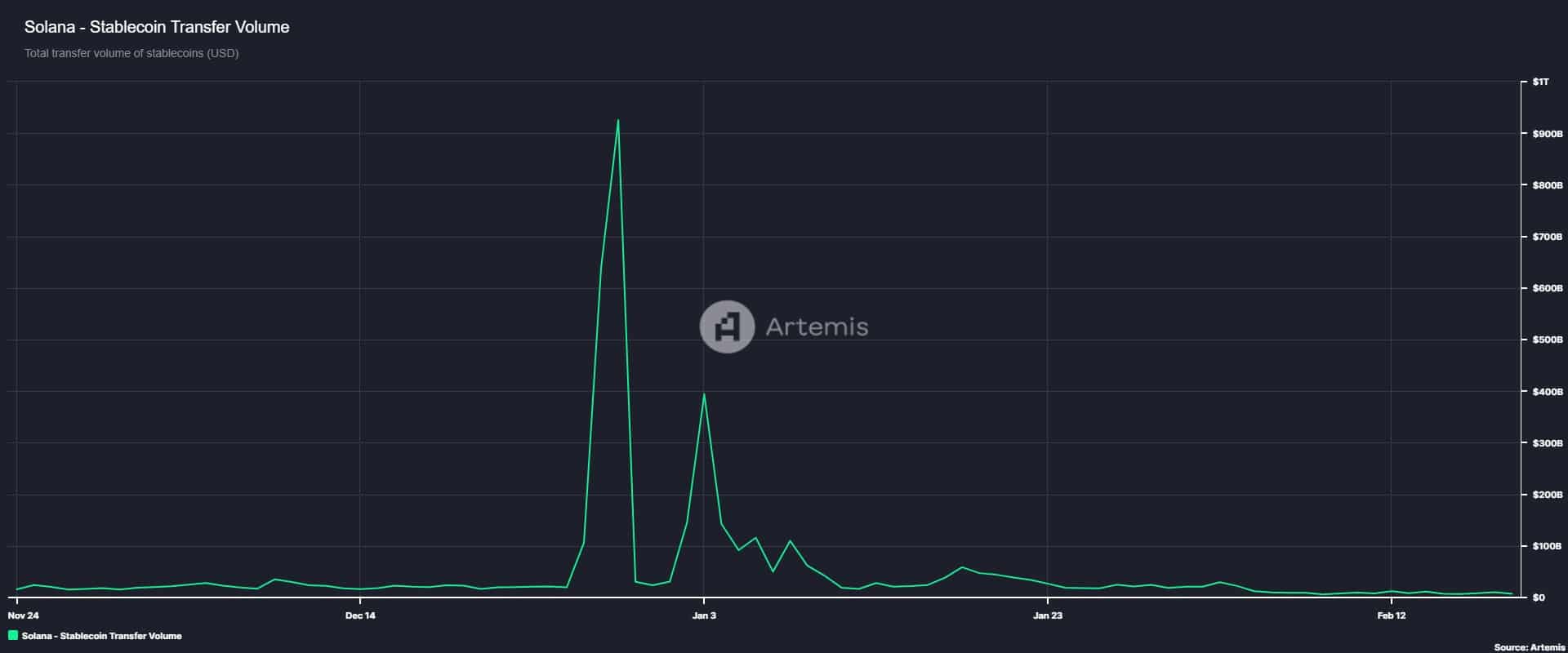

In addition, Solana’s transfer of Stablecoin has decreased to $ 7.1 billion. This means continuous decrease in $ 334 billion a month ago.

This important decline suggests that investors, especially large people, are considering other chains, such as Ett.

This also reflects the risk feelings between SOL investors.

Effect on SOL?

As expected, the decrease in hot chains had a negative impact on the price movement of SOL. This affected the demand side of SOL. In general, the demand is low, so the purchase pressure decreases, leaving the market to the seller and falling the price pressure.

At the time of writing, Solana was traded at $ 158 at $ 3 months. This is a 7.09% decrease in the daily chart. Solana has decreased 35.52% over last month.

If the strong downward pressure and low demand are low, the SOL can decrease.

If the current trend persists, the SOL risk will drop to $ 154. However, if the buyer takes this opportunity to buy a deep, the SOL can recover to $ 175.