The Telegram-based project Toncoin (TON) has emerged as one of the blockchains that has made a breakthrough in this cycle. This success has been achieved not only by the price performance of the token, but also by the significant level of adoption it has achieved.

However, despite Toncoin’s many achievements, the blockchain faces challenges that could impact its price.

A Double-Edged Sword Appears in Toncoin

One area where the project excels is in active wallets. According to TON Stats, the number of monthly active wallets has exceeded 4 million, with over 500,000 new accounts joining the network since the beginning of August.

The 30-day active wallets metric tracks the number of wallets that have been involved in at least one successful transaction. For Toncoin, this growth is largely due to active participation in the chain’s tap-to-earn platform.

For example, projects like Tapswap and Hamster Kombat continue to see good levels of user adoption. Alternatives including Catizen and Blum have also played a significant role in helping Toncoin achieve this milestone.

Read more: What is Telegram Bot Coin?

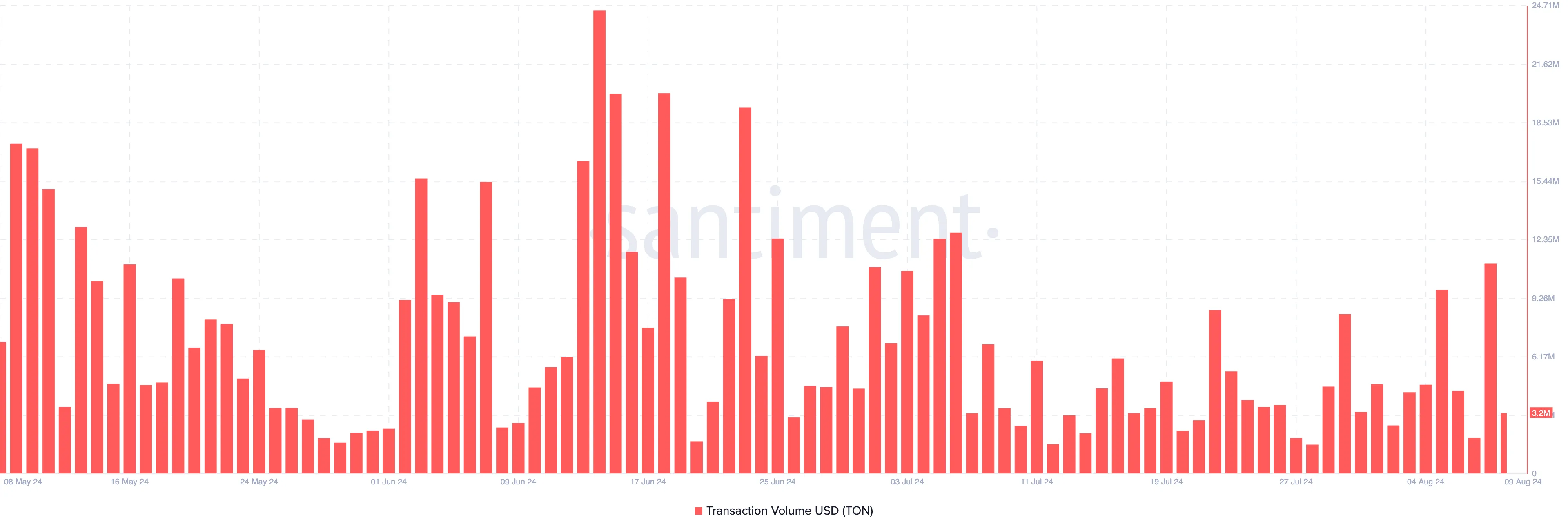

Despite the surge in traction, TON has struggled to maintain a strong number of daily transactions. Typically, an increase in transaction value increases the network’s fees and revenue share.

Moreover, higher trading volumes can support a token recovery, especially if a significant portion of the tokens are purchased in native tokens. On August 8, TON’s total trading volume reached $11 million. However, at the time of writing, this figure has nearly tripled to $3.2 million.

This decline suggests that interest in cryptocurrencies is declining. If this trend continues or worsens, the price of TON could be similarly affected.

TON Price Prediction: $6 is the Key

Toncoin is trading at $6.44, a level reached after Binance listed the cryptocurrency. According to the daily chart, TON is on the verge of reversing the losses incurred between August 1 and 5.

However, the Aroon indicator suggests that this uptrend may soon come to a halt. The Aroon indicator, which measures the strength of a trend, consists of two lines: Aroon Up (orange) and Aroon Down (blue).

At the time of writing, the Aroon Down line is higher than the Aroon Up line, indicating that the TON uptrend may soon be neutralized. Also, the Moving Average Convergence Divergence (MACD), which measures momentum, is currently negative.

The MACD position suggests that the momentum surrounding the token is generally bearish. If this trend continues, it could lead to a price decline.

Read more: 6 Best Toncoin (TON) Wallets in 2024

If so, the price of TON may drop to $6.04. However, continued buying pressure from bulls may push the price higher, potentially reaching $6.91.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions may change without prior notice. Always do your own research and consult with a professional before making any financial decisions. We inform you that our Terms of Use, Privacy Policy, and Disclaimer have been updated.