- SEI prices have fallen 74% since March, and outstanding commitments and development activity continue to decline.

- The token is facing significant resistance at $0.30, a break of which could trigger a potential rally.

The Sei (SEI) token, which once hit a high of $1.14 in March, has seen a significant decline in recent months. At the time of writing, SEI is trading at $0.2648, down 74% from its March high.

This decline is an extension of the overall downtrend that has continued throughout the past week, during which the token’s value has fallen by around 10%.

With the SEI price dropping 3.3% in the last 24 hours alone, concerns are growing about the token’s future prospects.

Is there room for a rebound?

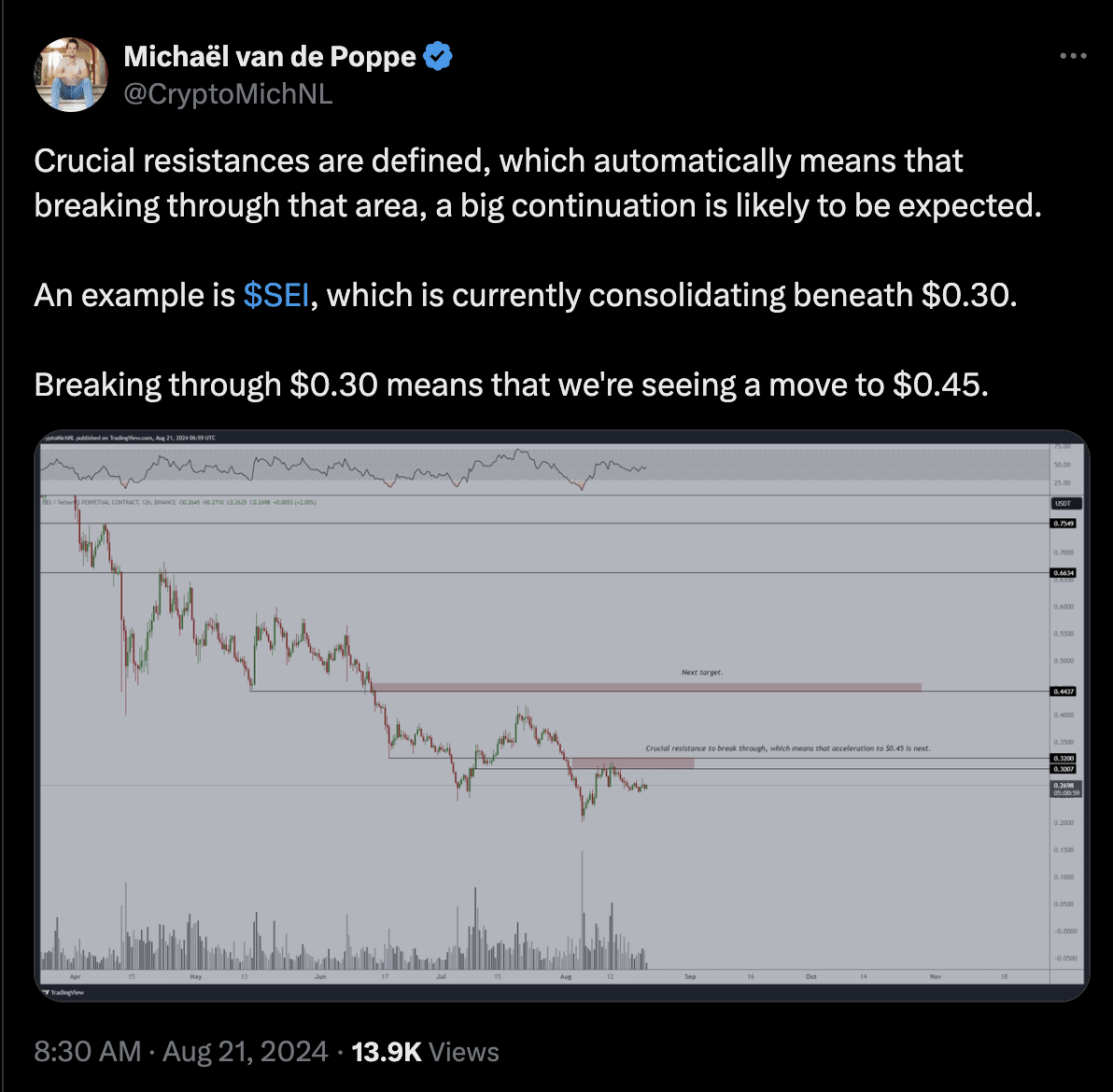

Amid this bear market, renowned crypto analyst Micheal Van De Pooppe shared his views on SEI, suggesting that the token may be at a pivotal point.

Van de Poupé highlighted that SEI is consolidating below the $0.30 level, which he identified as a “significant resistance” point.

He noted that breaking through this resistance could open the way to: Significant upward movementThen, there is a possibility that the token price will go up to $0.45.

However, to understand whether SEI is ready for such a breakthrough, it is essential to examine the fundamentals that can influence price movements.

Source: Michael Van De Poppe/X

Basic outlook for SEI

While there is a possibility of a bullish breakout, the fundamentals for SEI paint a more complex picture.

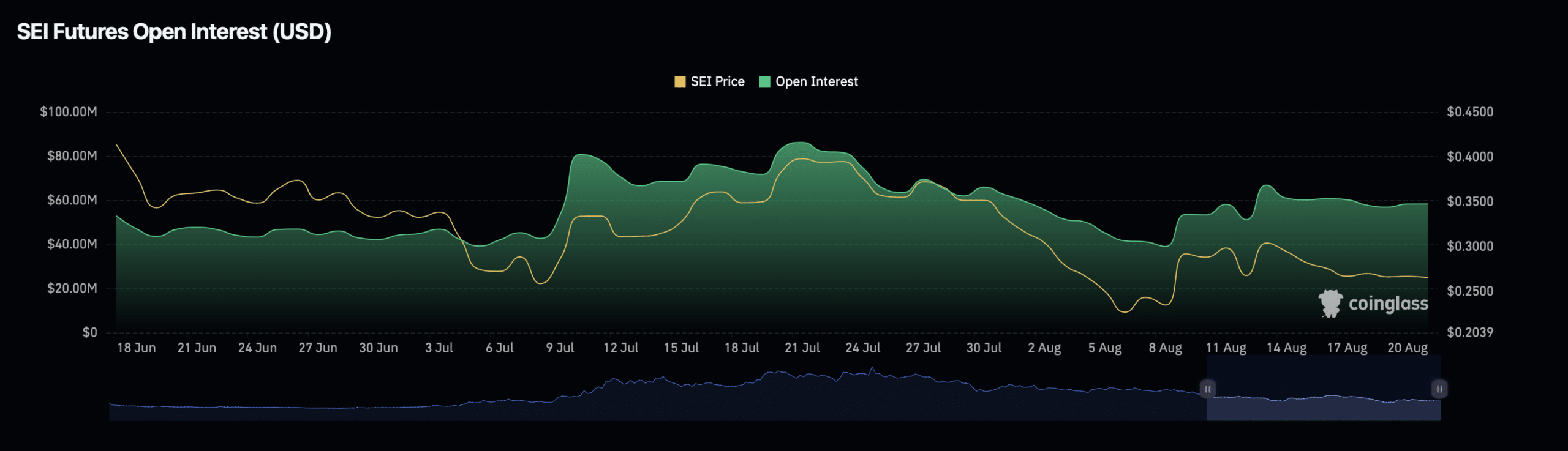

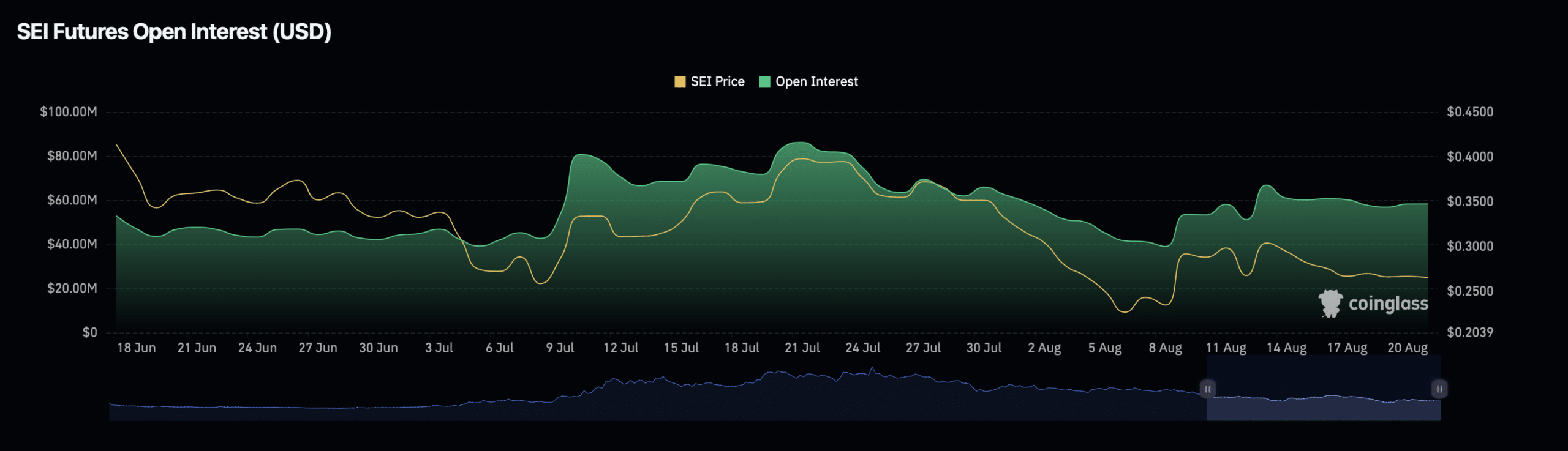

data According to data from Coinglass, SEI’s open interest is trending down, reflecting price action, indicating weakening investor confidence.

Over the last 24 hours, SEI’s outstanding interest has decreased by approximately 5.40%, and at press time, its valuation stands at $58.6 million.

Similarly, the outstanding volume decreased by 23.72% and currently stands at $70.5 million.

Source: Coinglass

The decline in open interest and volume suggests that traders are becoming more cautious due to the ongoing price slump.

Open interest, which represents the total number of open contracts in a futures market, is often linked to market sentiment.

Especially during a downtrend, a decrease in open interest may indicate that fewer traders are willing to hold or open new positions, potentially reducing liquidity and causing prices to fall further.

For SEI to reverse its current trend, it would likely need to see a resurgence in open interest, which would signal renewed interest and confidence from traders.

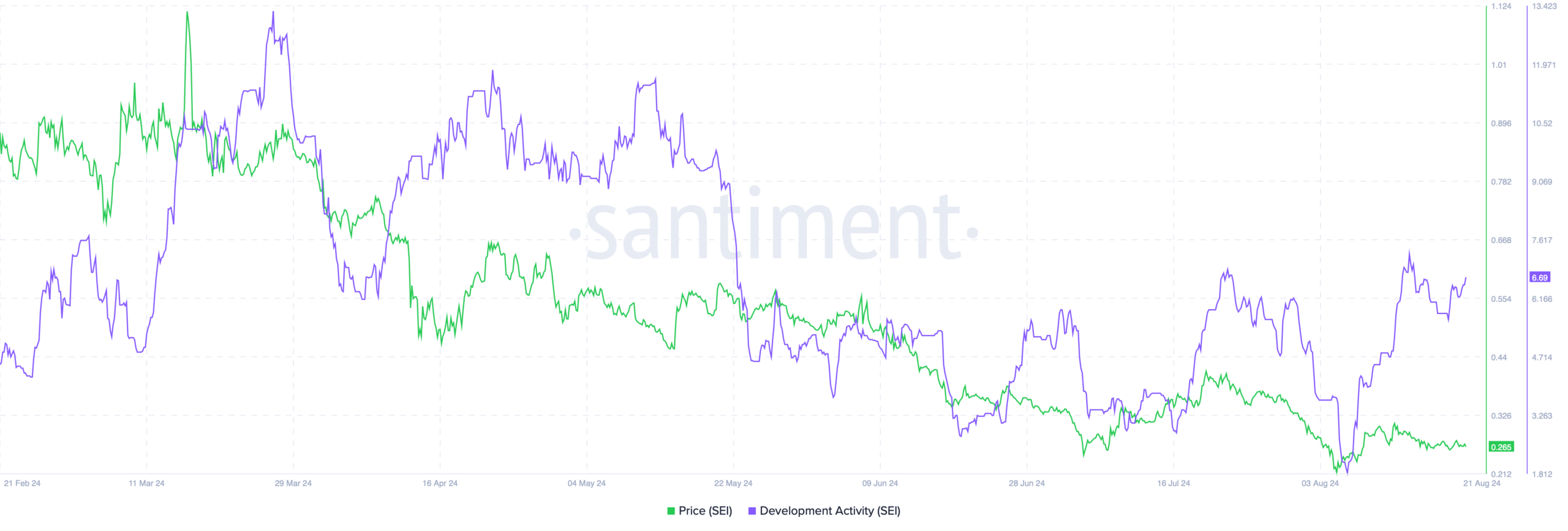

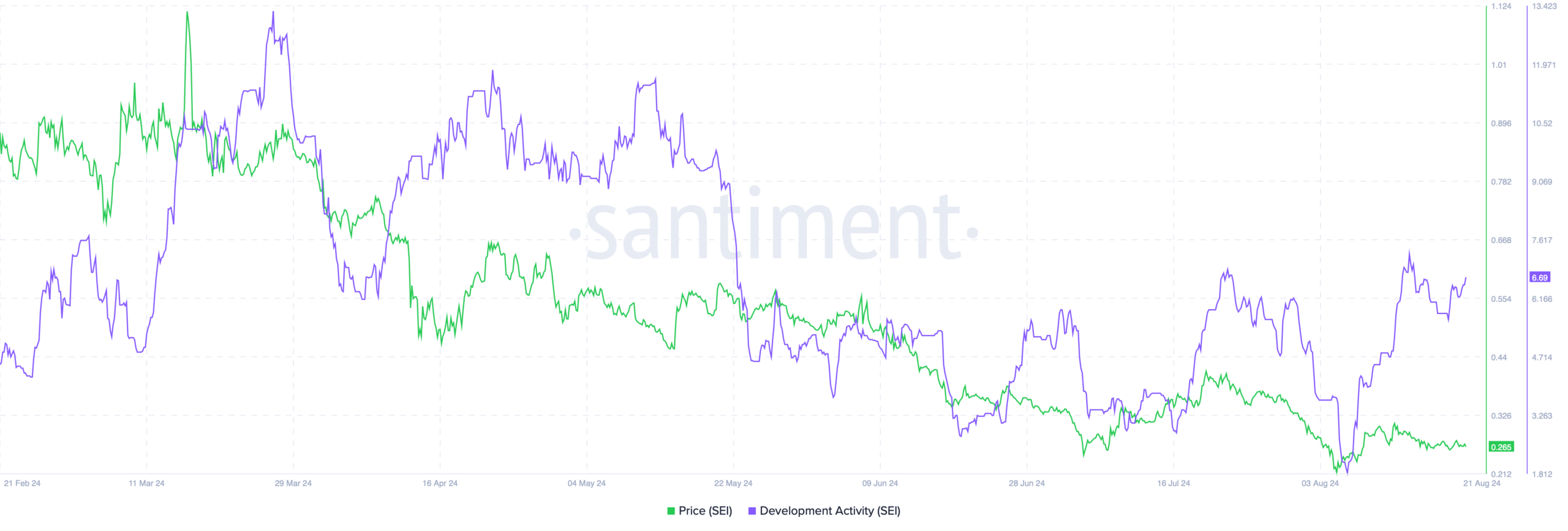

In addition to the decline in outstanding transactions, SEI’s network development activity is also on a downward trend.

According to data In Santiment, SEI development activity has fallen sharply from more than 13 in March to less than 2 as of this writing.

Source: Santiment

Read Sei(SEI) Price Forecast 2024-2025

Development activity is a key metric that tracks the progress of the project’s codebase and overall ecosystem development.

A decline in this indicator could be a red flag indicating a decline in innovation and project updates, which could impact investor sentiment and long-term confidence in the asset.