- The Toncoin trading volume indicator crashed, but the upper time frame trend is still bearish.

- Recent momentum and market sentiment suggest further losses are possible.

Toncoin (TON) has been trending down over multiple time frames. Recent reports indicate that the bearish momentum is strengthening, but futures market data has provided some hope.

However, Bitcoin (BTC) faced bearish pressure as hopes for a strong September were dashed. The sentiment across the market caused TON to fall below the range it had formed in early June.

Prices are heading below $6.

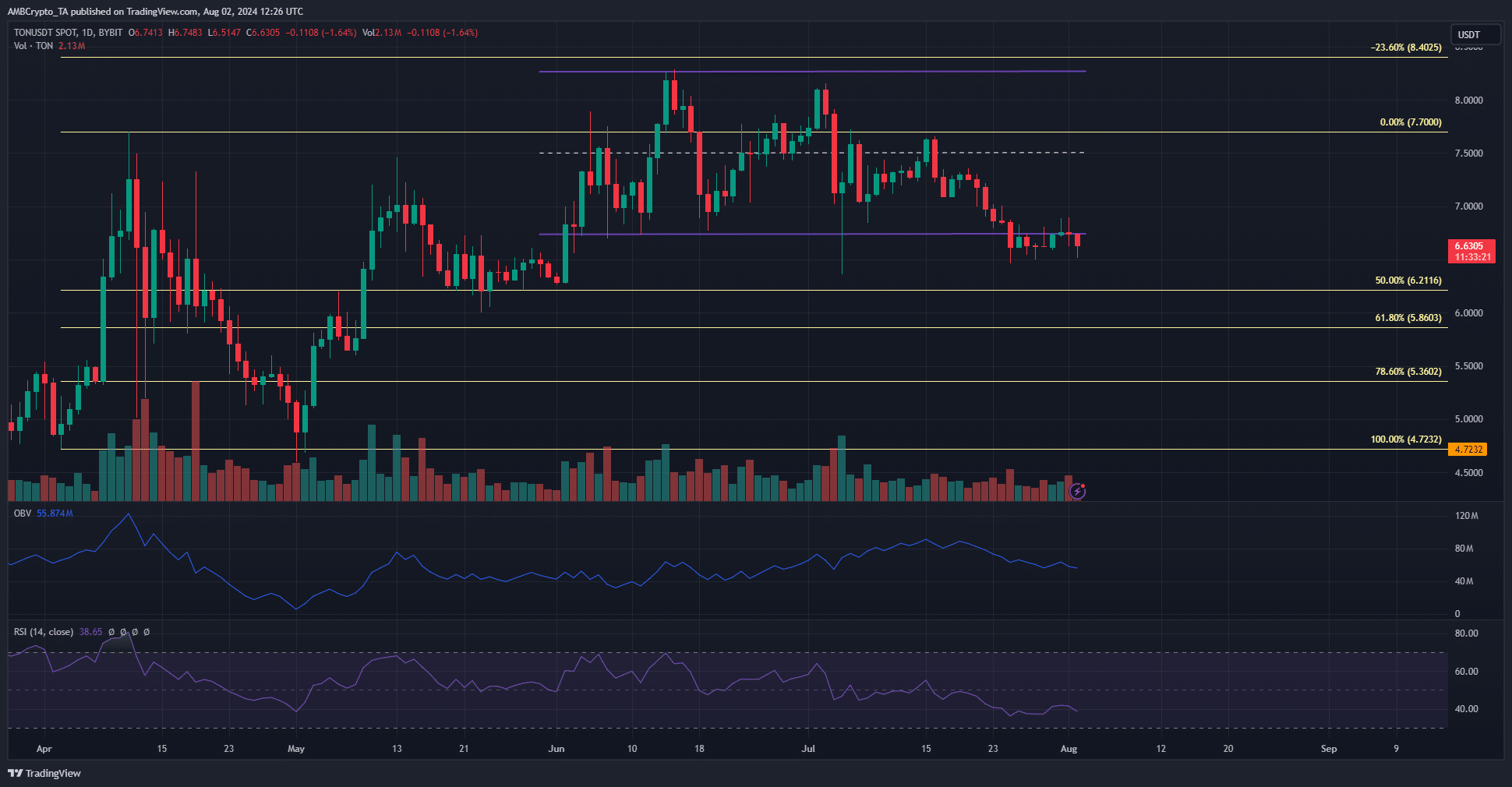

Source: TON/USDT on TradingView

Since early June, Toncoin has been trading in a range of $6.74 to $8.27. Last week, the low of this range was broken and turned into a resistance zone.

Following this development, OBV continued to trend lower, which was a strong signal that this was not a breakout but a continuation of the downtrend from last month.

The daily RSI was also down. The Fibonacci correction levels outlined the next support levels at $6.21, $5.86, and $5.36. Failure to defend the range lows meant that a move below $6 was likely in August.

What could reverse TON’s downtrend?

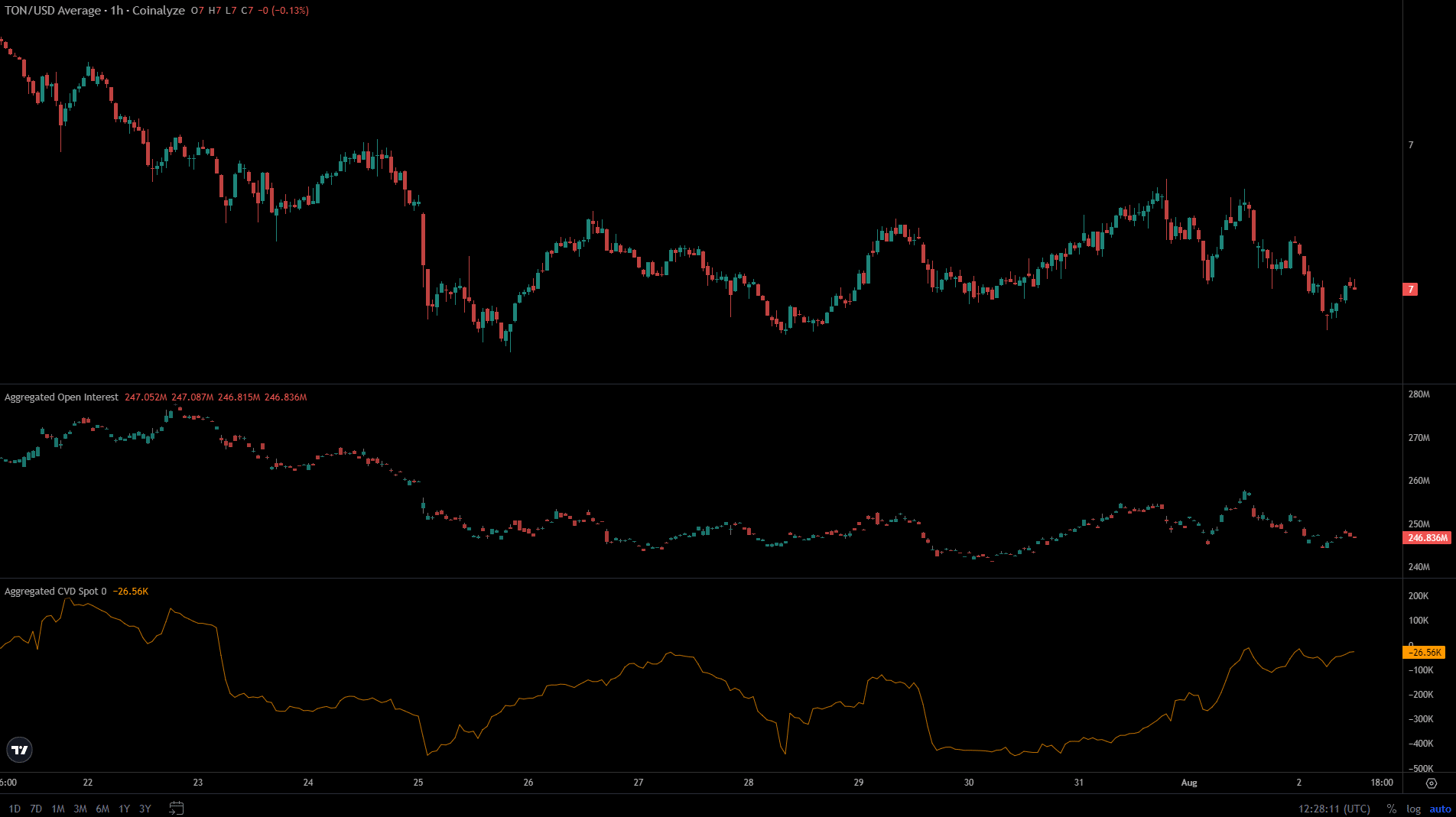

Source: Coinalyze

Open interest has fallen from $257 million to $246 million over the past two days. This came as Toncoin was rejected at the short-term resistance level of $6.84, which has been acting as resistance since July 26.

Is your portfolio green? Check out the TON profit calculator

All factors so far were pointing to a downtrend for TON. However, spot CVD was rising at an astonishing rate.

The results are contrary to the OBV results. The increased buying pressure over the past few days may not be enough to start a price recovery, but it could lead to a move towards the $6.8 area in the short term.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.