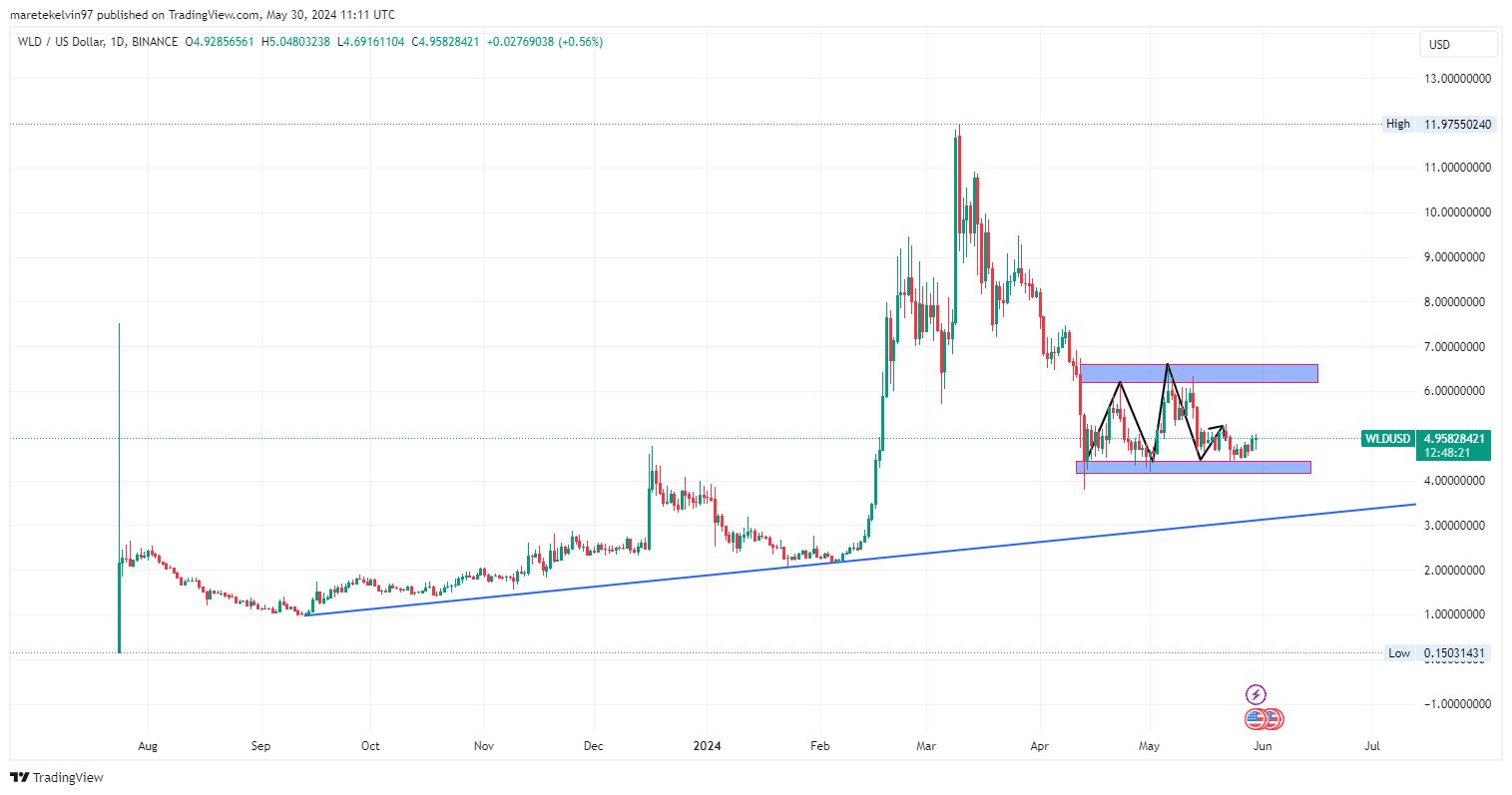

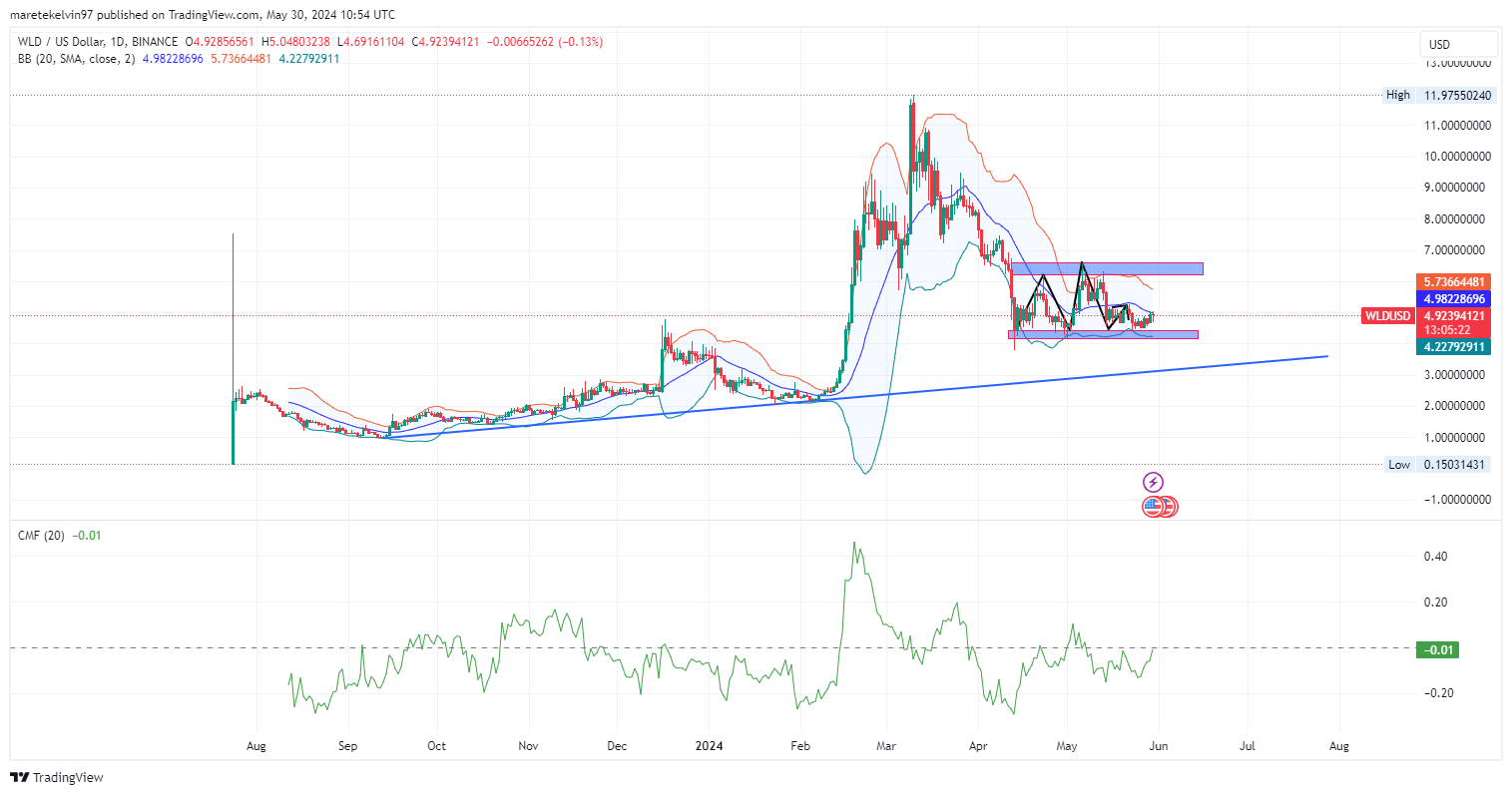

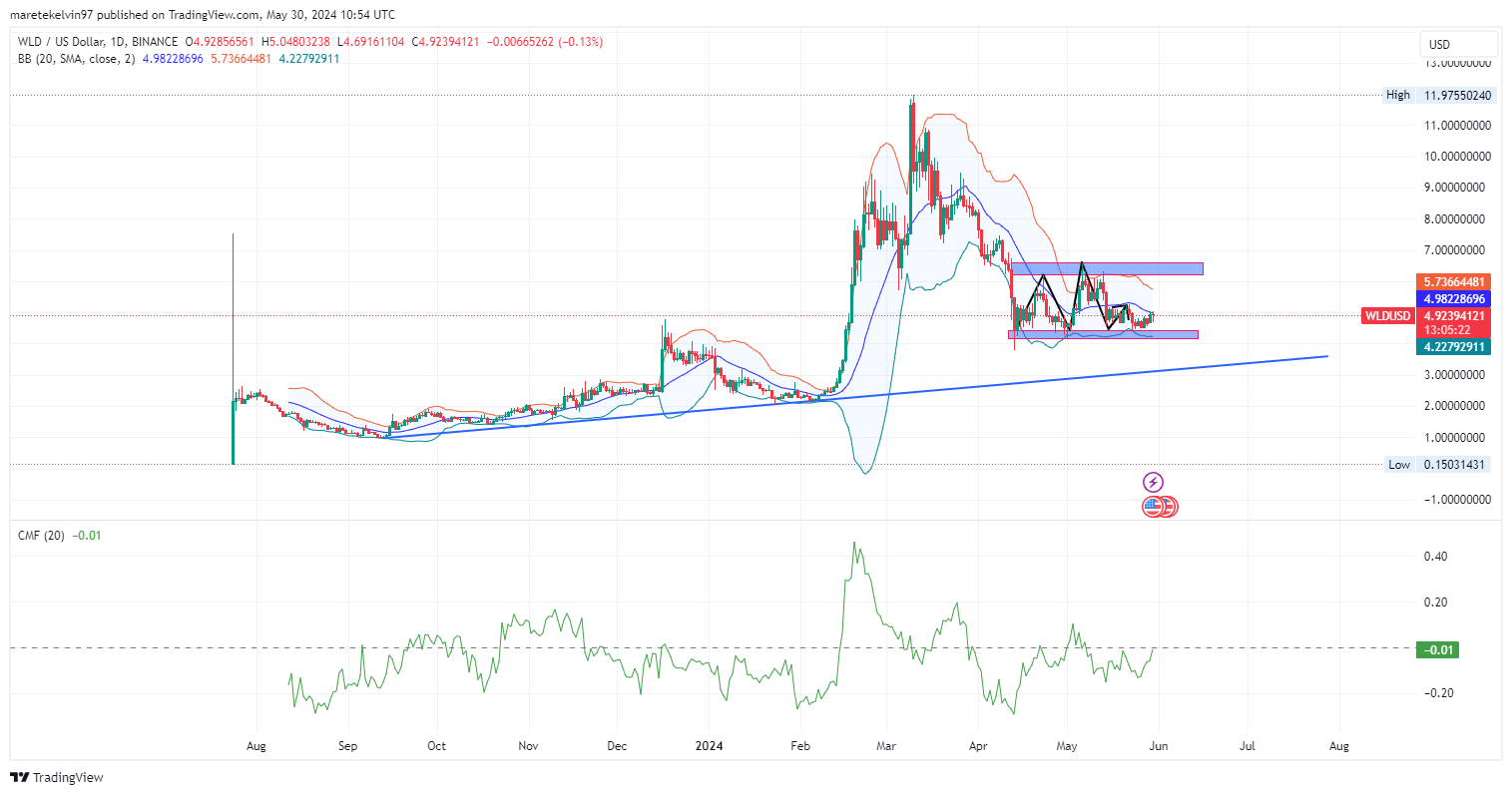

- Worldcoin price is consolidating in a range pattern between $4.3 and $6.2 key levels.

- The indicator indicates bullish momentum and profit potential for holders.

Worldcoin (WLD) has been consolidating in a range pattern between $4.3 and $6.2 over the past two months. The $4.3 support level has been tested multiple times, indicating strong buying interest.

The $6.2 resistance level has also been tested three times, indicating strong interest levels. Currently, WLD is showing strength with a price target of $6.2 resistance level.

A break above $6.2 could lead to a new upward trend. However, if bearish pressure breaks the $4.3 support line, a head and shoulders could form, signaling a further decline in the price to retest the existing uptrend line support just below the support level.

Source: TradingView

According to the time of this writing: CoinMarketCapThe price of Worldcoin is $4.83, up 0.01% over the last 24 hours and down 1.28% over the past 7 days.

The market capitalization reaches $1.1 billion. Trading volume over the last 24 hours was $507.61 million, an increase of 50.52%.

Worldcoin holders can see the light

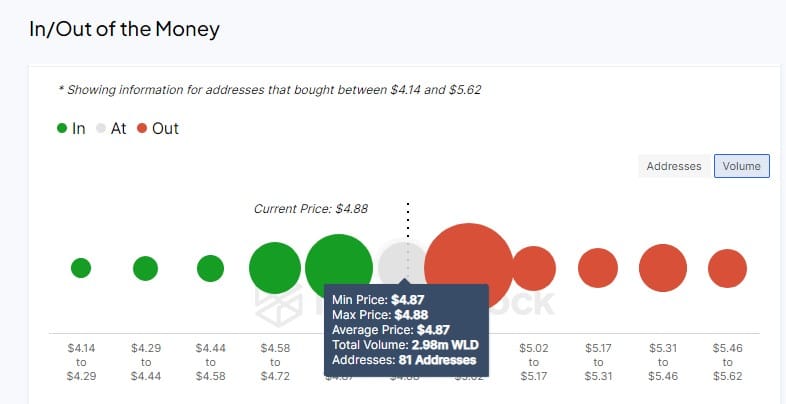

AMBCrypto analyzed IntoTheBlock’s global fund deposit/withdrawal indicators, showing that 2.98 million WLD are on the verge of taking profits.

$241.38 million worth of supply was purchased between the $4.87 and $4.88 supply zones. Bearing in mind that the current price is $4.84, the moment of profit for holders is approaching.

Source: IntoTheBlock

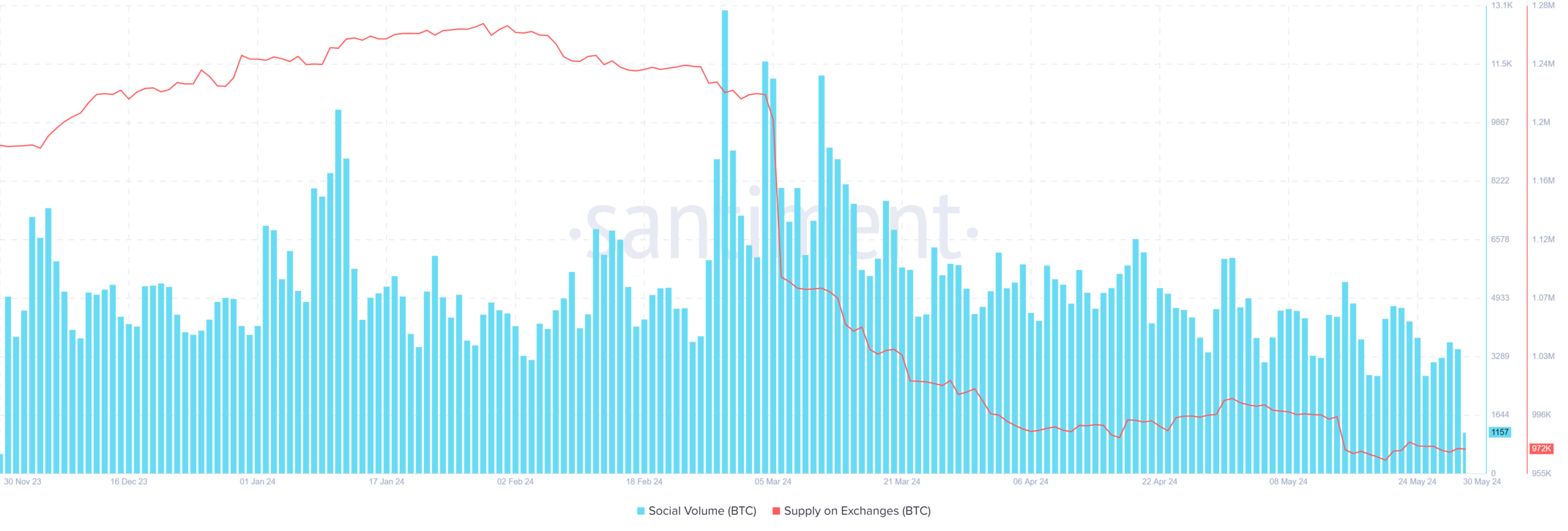

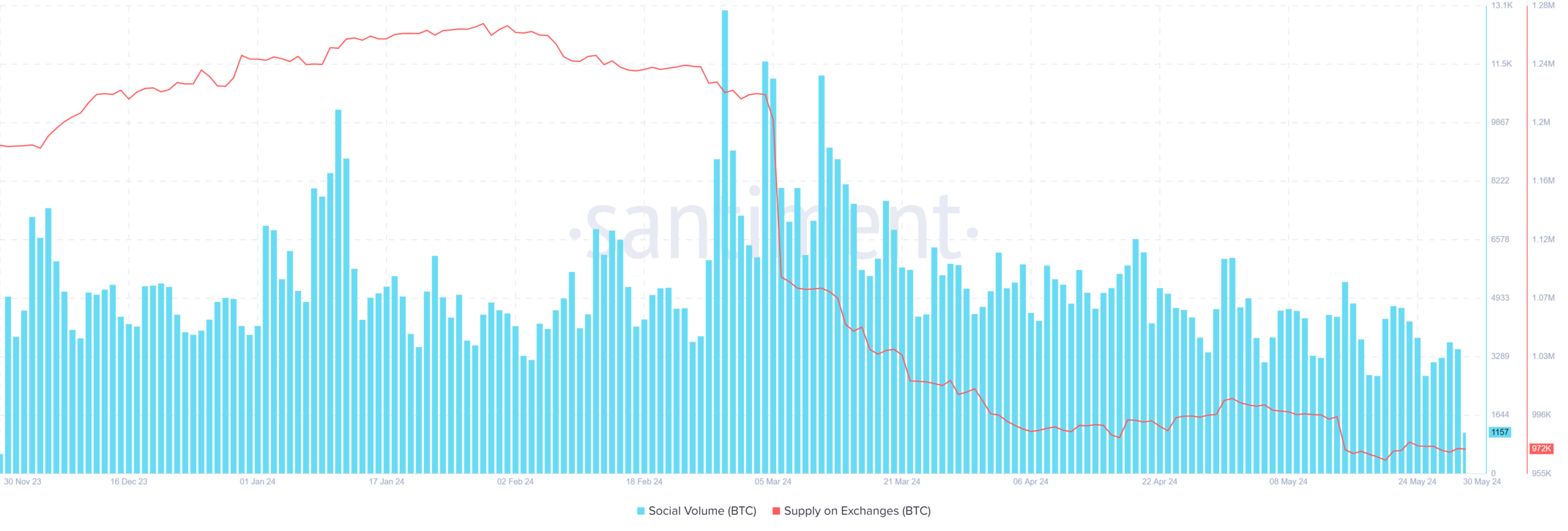

AMBCrypto further analyzed Santiment’s data on WLD’s exchange supply and social volume from November 2023 to May 2024. There were several spikes in social volume, indicating strong market interest.

Exchange supply has shown a steadily decreasing curve, confirming the bullish mood as investors move WLD off exchanges. This is consistent with Worldcoin’s current strength of $6.2.

Source: Santiment

Is your portfolio green? Check out the WLD Profit Calculator

According to the Tradingview indicator chart, the current WLD price is located between the lower and middle Bollinger Bands, indicating less volatility and recovery from oversold conditions.

A surge in price can indicate a bullish trend. Chaikin Money Flow (CMF) is -0.01, indicating that traders are indecisive and waiting to observe the market direction.

Source: TradingView