- XRP could fall to medium levels, another ~8% decline.

- Buyers have lost control over the past week.

Ripple (XRP) showed resistance at the 7-month high of $0.71. This move and subsequent rejection occurred in much the same way as was noted in the AMBCrypto analysis a week ago.

A look at on-chain indicators from earlier this week shows that accumulation is underway and investors are confident. However, the $0.7 level is still expected to loom large on the price chart.

Market structure maintains a bullish bias.

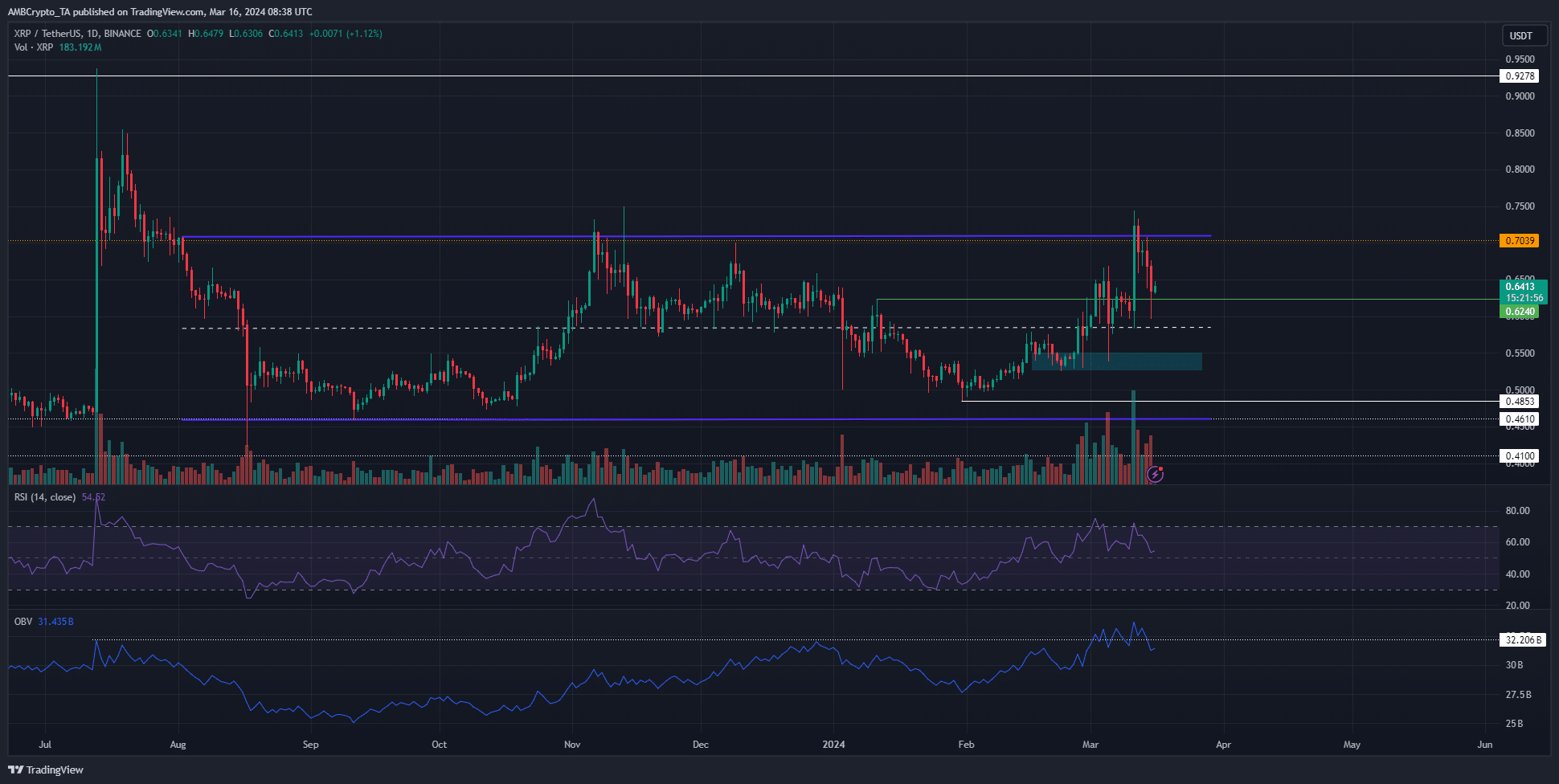

Source: XRP/USDT on TradingView

According to XRP’s daily chart, market structure remains strong despite a drop of nearly 15% over the past five days. To change this we need to move below $0.525.

RSI also remained above neutral 50, but momentum appeared to be neutral at 54.

OBV was unable to defend the resistance level that appeared to have turned into support last week. This increased selling pressure and caused the indicator to fall. Together, the indicators indicate that the bulls are struggling.

$0.624 is a lower term support level that may not hold. The mid-level of $0.585 and the $0.52-$0.54 region were the two key demand areas where XRP could see a bullish response.

Selling pressure continues to increase in the short term

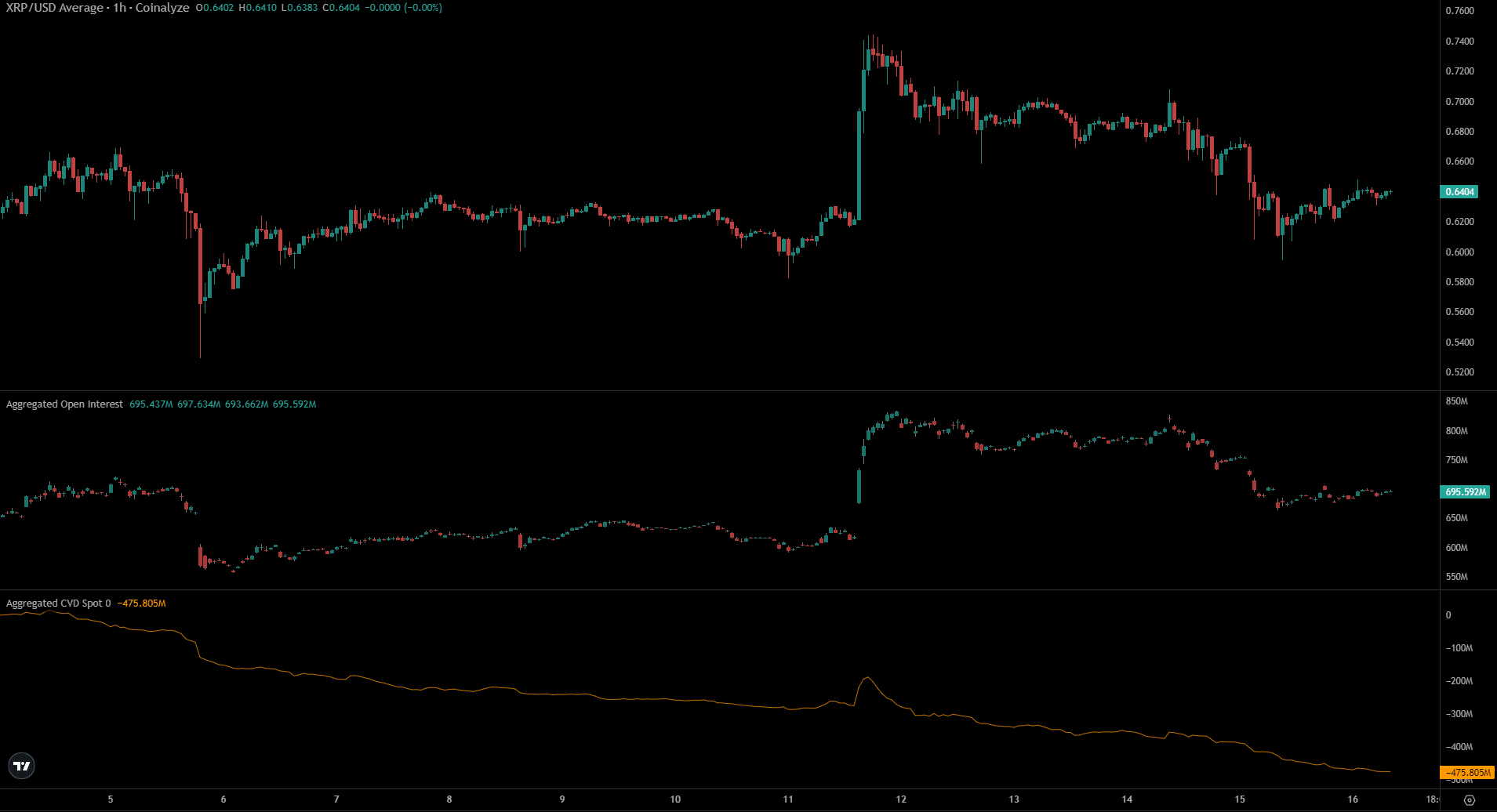

Source: Coin Analysis

XRP’s open interest has been steadily decreasing since March 14th. The inference was that bearish sentiment began with falling prices. Speculators were not ready to bet on a reversal of XRP’s short-term decline.

How much is 1, 10 or 100 XRP worth today?

Meanwhile, the CVD point has been heading south since March 5. The lack of demand in the spot market has been a concern for long-term holders.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.