- The surge in XRP price could be attributed to increased accumulation by whales, who currently hold 85% of the total supply.

- Outstanding contracts hit a three-month high, suggesting speculative activity is picking up.

Ripple (XRP) has been one of the biggest gainers in the past few days after its price hit $0.60. This price increase represents a 36.45% increase over the past seven days.

While this was surprising, AMBCrypto was able to find out why. According to on-chain data provider Santiment, addresses holding more than 100,000 XRP have increased their holdings significantly.

Go big or go home

This group of investors, known as whales and sharks, have a huge impact on the price. Simply put, if the assets held by this group fall, the price of the token is likely to crash.

Therefore, the increase in accumulation created buying pressure on XRP, causing its price to rise.

The rise also showed that these sharks and whales now own 85% of the total supply, the highest point in 11 months.

Source: Santiment

If a scenario emerges where whale holdings continue to increase, the token value could rise back to $0.63 and possibly even trade higher.

Another reason the token could reach this price is because the cryptocurrency’s reference price and real-time index will be launched soon on July 29th.

However, it is important to note that these indices are not tradable futures products. Instead, they provide clear price data on the asset in question.

XRP, the stagnant coin, is now starting to move.

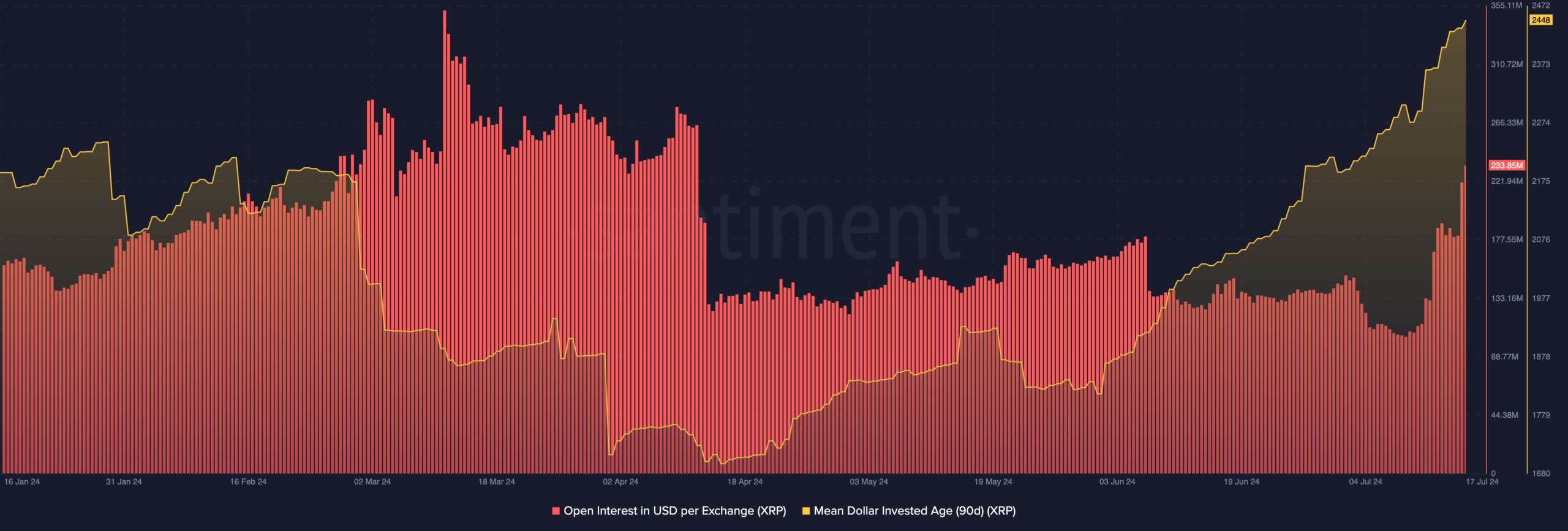

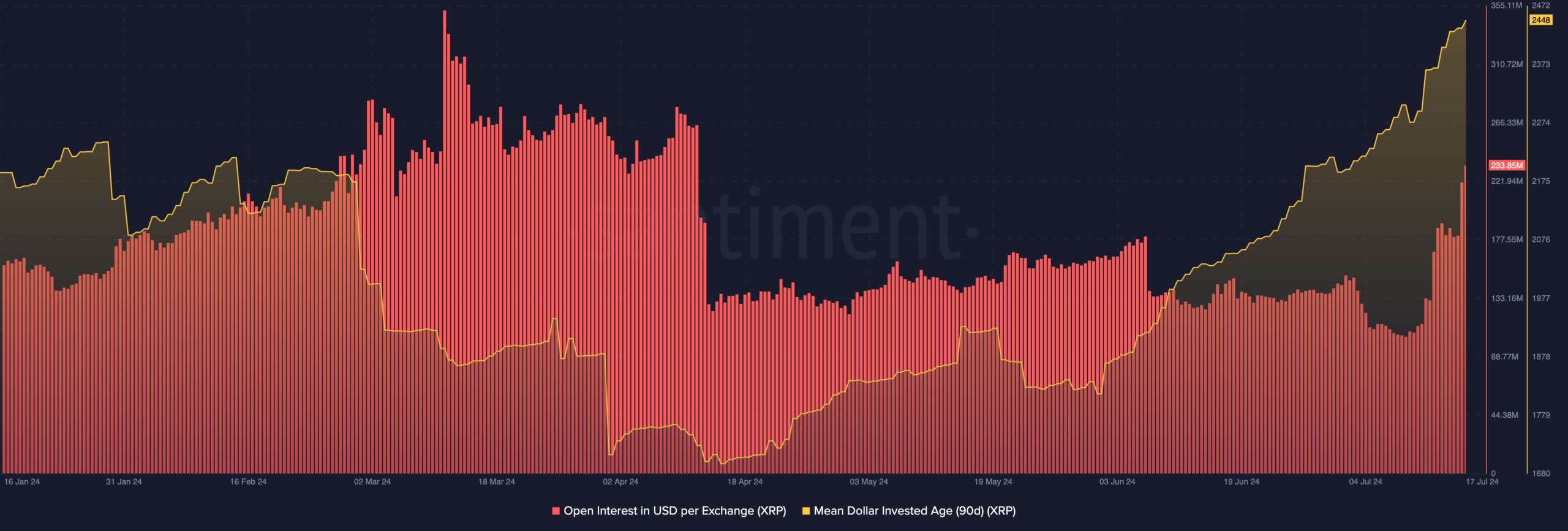

Meanwhile, in the cryptocurrency derivatives market, XRP’s open interest (OI) reached $233.85 million, the highest OI value since April 12.

OI is the total value of contracts open to the market. When it increases, it means there has been a surge in speculative activity around the token and the liquidity allocated to the contract is increasing.

But if it decreases, it means something else. From a price perspective, if the OI continues to rise, it could further support the price of XRP. If this is true, as mentioned earlier, the cryptocurrency could reach $0.63.

In addition, there was a notable spike in the 90-day MDIA, which stands for Mean Dollar Invested Age.

As the name suggests, this indicator refers to the average dollar invested in a cryptocurrency market cap.

Source: Santiment

In previous bull markets, the rising MDIA line means that whales are moving their idle coins back into circulation. If this continues, the price of XRP is likely to go higher.

Read our Ripple(XRP) Price Prediction 2024-2025

Based on this analysis, it is likely that the token’s value will continue to rise, as mentioned in a previous article by AMBCrypto.

However, beyond the possibility of a rally to $0.63, there is a possibility that XRP could try to re-approach $0.72, a level it last reached in March.