This article is also available in Spanish.

Ethereum is unchanged at press time, moving within a narrow $400 range with a lower limit of $2,300 and an upper limit of $2,800. Investors are optimistic, expecting prices to surge in the next session, but uncertainty continues to sweep the markets.

Ethereum finds support at $2,300: over 52 million ETH purchased.

The world’s second most valuable coin is weak, down more than 50% from its July high and unable to break local resistance at $3,500. With traders closely monitoring how the price action plays out, one analyst has picked up an interesting development in the market data.

Related Reading

The analyst cited IntoTheBlock data as of October 11. observe More than 52 million ETH were acquired by traders at around $2,300 levels. Considering the amount of coins in traders’ hands at this price, this zone provides immediate support.

So if buyers gain the upper hand and push the price up from this point, this level will lock in the upward trend. If sellers double down, as has been the case over the past few trading months, the odds of ETH falling below the Q3 2024 low increase.

As seen in the CoinMarketCap poll, the current sentiment is bearish. Over 65% of ETH holders and traders expect the price to struggle in the near term.

Therefore, how the price reacts at local support levels determines short-term and medium-term formations. A surge that would push ETH above $2,800 would be crucial in boosting demand and provide a much-needed tailwind for bullish traders.

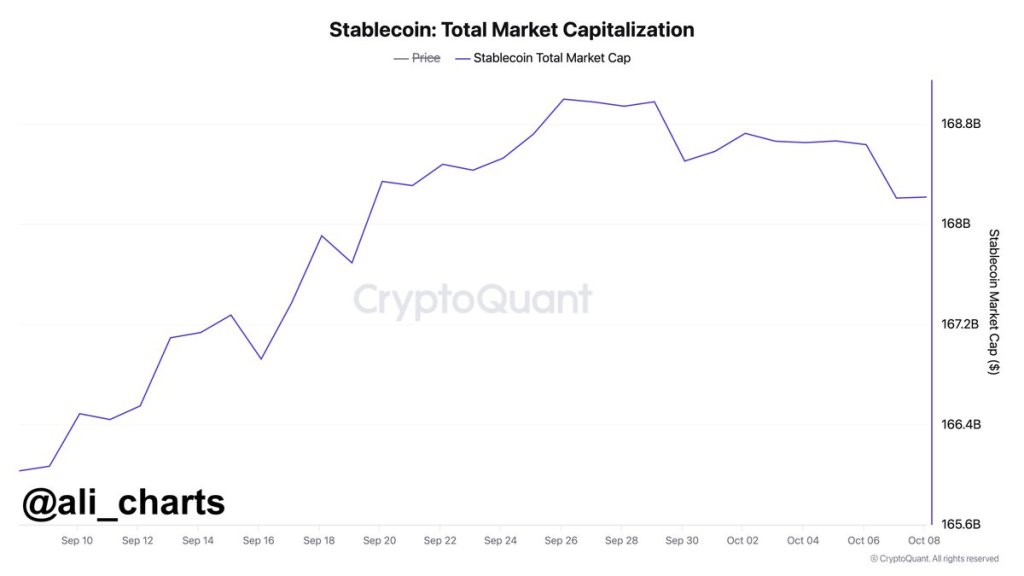

USDT, USDC and Stablecoin Market Cap Fall: Is Purchasing Power Declining?

Although optimism is high, other relevant market data points to weakness. Over the past few weeks, the market capitalization of stablecoins such as USDT and USDC has been declining. As of October 10, analysts memo It fell by $780 million from its recent high, suggesting a possible decline in purchasing power.

Typically, whenever USDC, USDT, or even DAI move to centralized exchanges, more users want to buy cryptocurrency assets, including ETH and BTC. However, if a leak occurs or the market capitalization decreases, it could mean that more users are carefully monitoring the event before committing.

In general, more coins, including stablecoins, tend to head to centralized exchanges when there are concerns about market prospects. These inflows tend to precede market-wide corrections.

Related Reading

ETH inflows to centralized exchanges are not an option at this time. But what is happening now is that more holders are staking. As of mid-week, market data showed that over 34 million ETH remained locked, earning holders 3.3% APY.

Featured image by DALLE, chart by TradingView