- Worldcoin bulls seem to be finally gaining ground after a months-long hiatus.

- These bounces may be caused by price declines due to short selling and may be temporary.

WorldCoin (WLD) is finally experiencing a recovery in demand after a sustained downtrend that lasted approximately five months.

At first glance, this may seem like the start of another massive rally, but further evaluation suggests a potentially different outcome.

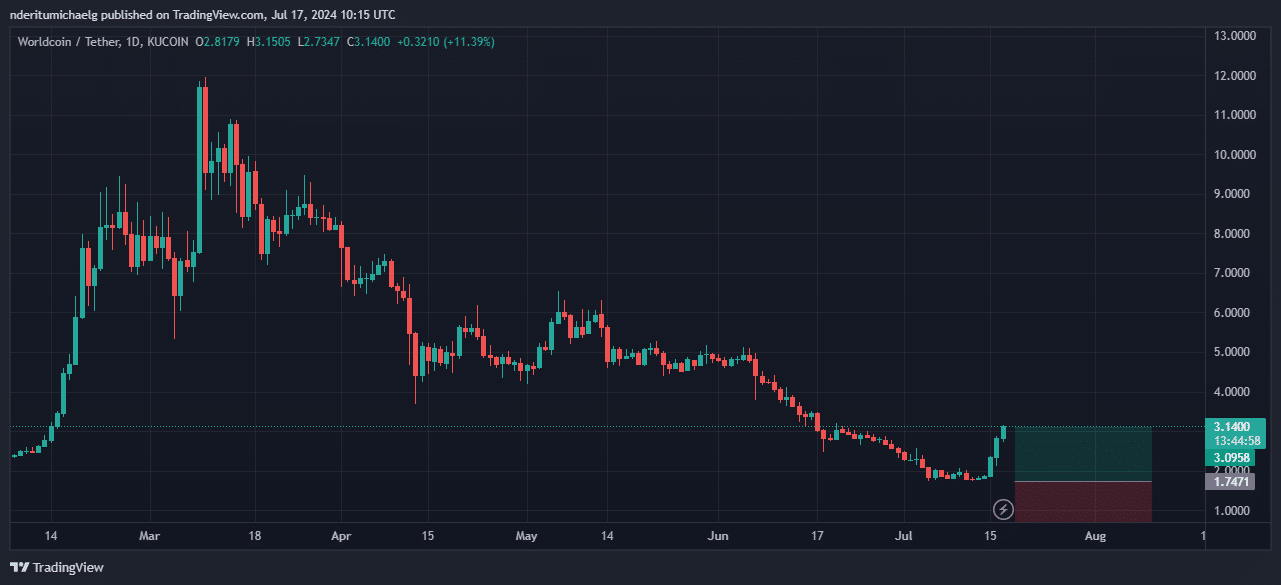

The price action of WLD has been parabolic over the past few days after bottoming in the $1.72-$1.77 range, which is consistent with the overall market sentiment, reflecting the bullish recovery we have observed among the top coins.

WorldCoin was trading at $3.12 at the time of writing, up 77.2% from its current monthly low.

Source: TradingView

WLD’s recent rally isn’t the first bullish attempt since the massive decline that began in March.

Another attempt was made in May, but failed amid a downtrend that resulted in an overall decline of 89% from the one-year high in March 2024.

This is not your typical Worldcoin rally

At first glance, the prolonged downtrend and the drop below the pre-February low suggested that the stock was on the verge of a sell-off that would prompt buying.

With the recent announcements and the subsequent downtrend expanding, this observation may have triggered a massive short-term sell-off.

The Worldcoin Foundation announced earlier this month that it has extended the WLD grant reservation timeline. The extended timeline means that people will be able to reserve tokens for another year.

Additionally, the Worldcoin Foundation announced that token unlocking for early contributors, team members, and investors will begin on July 17. Additionally, the unlocking timeline has been extended from 3 years to 5 years.

Following the announcement of the token unlock, the number of short positions on WLD has skyrocketed, suggesting that many traders may be expecting the Worldcoin price to be suppressed due to higher supply.

Unfortunately, short term investors fell right into the short squeeze trap as the price rose due to continued demand for WLD.

Will WLD extend the rally?

Liquidating the aforementioned short positions further extended WLD’s uptrend, which explains why it is outperforming most other major coins.

The current WorldCoin rally is eerily similar to the surge seen in April 2024, but the circumstances may not be exactly the same.

First, the imminent release of the lock-in could dampen investor sentiment and reduce demand.

On the other hand, the level of unlocking over the next few weeks may not result in a significant surge in token supply.

Is your portfolio green? Check out the WLD profit calculator

Both scenarios could play out, so we will be watching Worldcoin closely to see how things unfold.

Meanwhile, if WLD continues to rise, resistance is expected around the $4.75 price level based on past performance.