- Worldcoin had strong near-term bullish expectations.

- After a bearish divergence, the price may fall towards $3.3.

Worldcoin (WLD) flipped the $2.5 resistance area to support and target the next $4.5 level. There was a bearish differential in WLD, but both daily and weekly market structures were bullish.

This could see prices fall over the next few days. The $3.26 level has also reversed for support and a deeper retracement appears unlikely due to strong capital inflows.

Moving average crossover captures Worldcoin bullishness.

Source: WLD/USDT on TradingView

On the daily chart, WLD saw a sharp decline from March to September, followed by a month of consolidation. Since its September lows, WLD has soared 198% as of press time. Much of this rise has occurred over the past 10 days following a breakout of the $2.5 resistance zone.

The $2.5-$2.9 zone has since been retested as a demand zone. Buyers successfully defended this, pushing Worldcoin above the $3.26 resistance level, a lower high than in July.

The weekly market structure turned bullish after breaking $3.26. The daily structure has been strengthening since the second week of November, after a decline in late October brought the price down to $1.589.

The 20-day moving average and the 50-day moving average have formed a bullish crossover, which is likely to act as support during a retest. The Money Flow Index (MFI) is at 81, forming a bearish divergence that could result in lower highs compared to December 1st.

The bulls’ next target is the $4.5 area, which was the main support zone from April to June. Therefore, it may take some time for a rally above this level to materialize, and a consolidation below the resistance line is expected.

Short-term sentiment remains firmly bullish.

Source: Coinglass

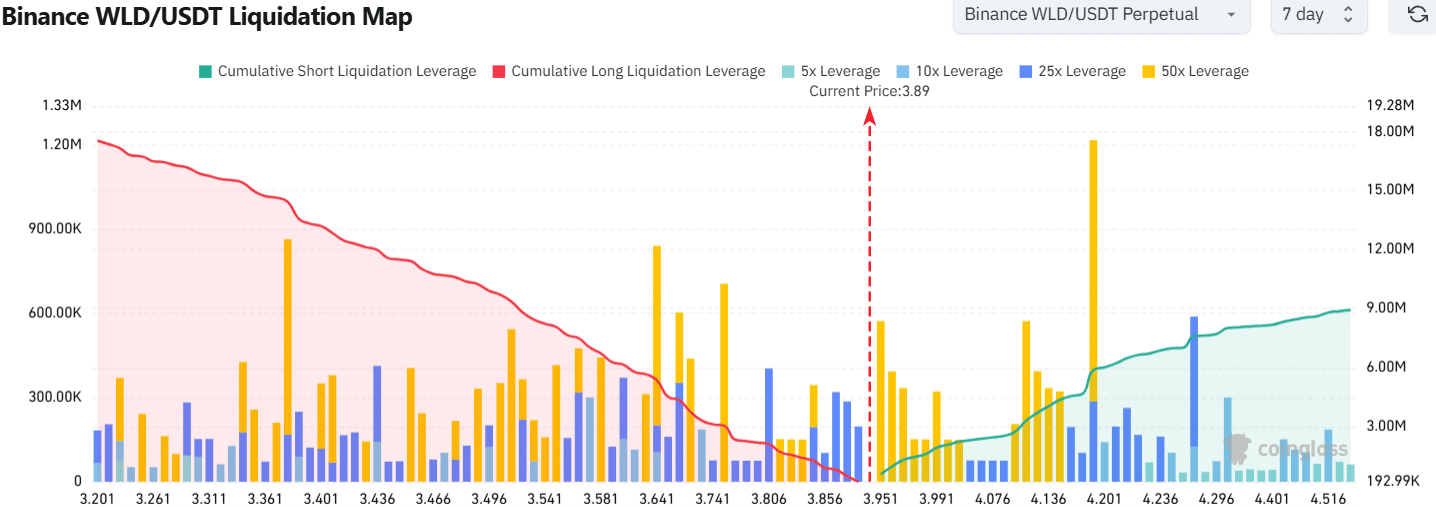

The bearish divergence warned of a decline, but the clearing map showed a possible push northward. A large amount of short-term liquidations were accumulated at around $4 and $4.15.

Realistic or not, the market cap of WLD in BTC terms is:

High cumulative leverage around $4.13 meant WLD was likely to move higher to sweep this area before a pullback. At press time, it’s unclear whether buyers have the power to push the price above $4.

Traders should watch out for a break above $4 as the market could become overextended.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.