- XRP is approaching the important resistance level at $0.6533 and bullish indicators suggest strong upside potential.

- The increase in active addresses and transactions reinforced positive sentiments about the breakout.

Ripple (XRP) At press time, it is rapidly approaching the important resistance level of $0.6533, sparking renewed optimism among traders and investors.

XRP, trading at $0.5849 with a gain of 6.06%, appears ready to challenge this barrier.

Could a successful breakout take the cryptocurrency to its next target of $0.7463, potentially opening a new phase of bullish momentum?

Is XRP ready for a breakout?

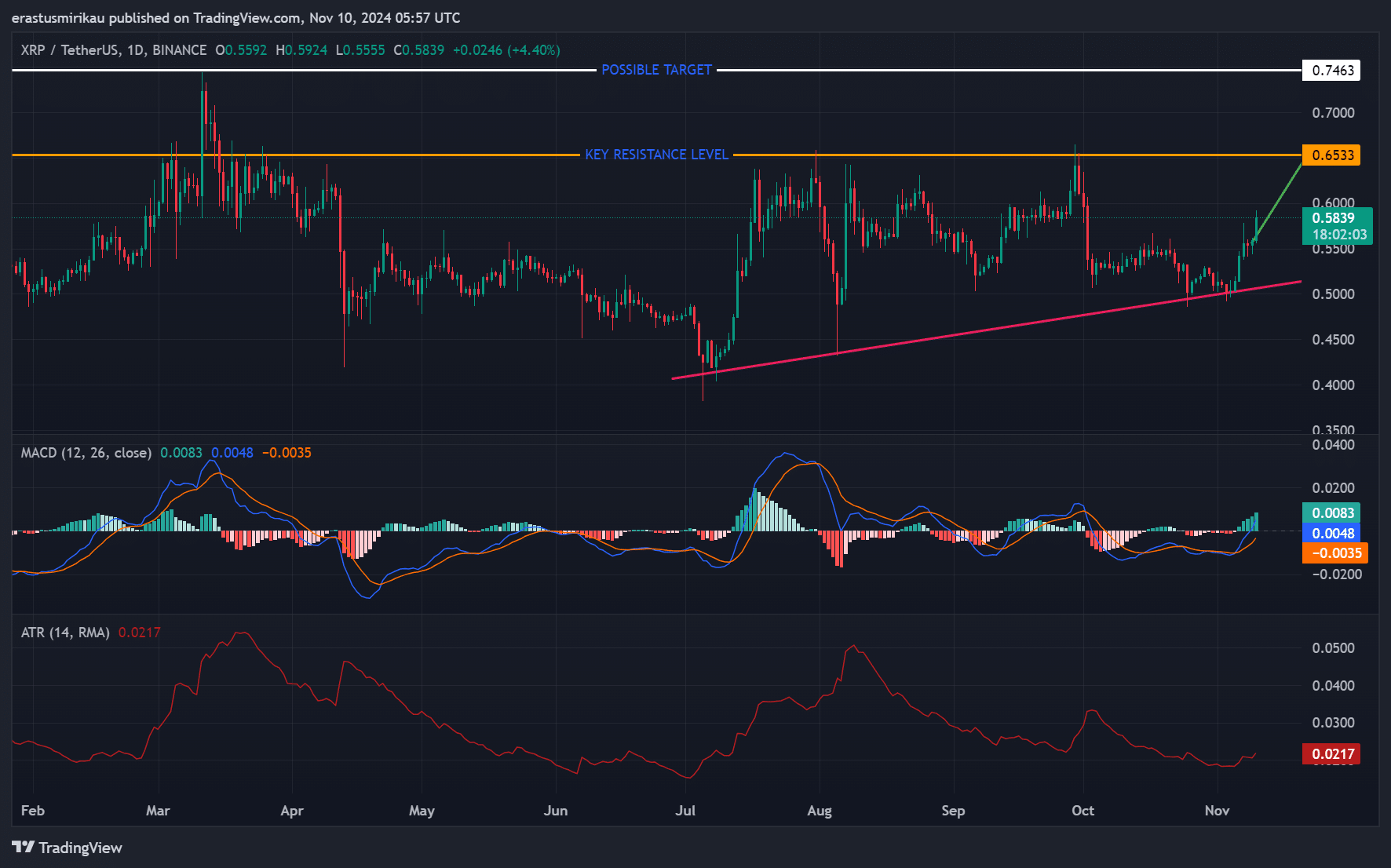

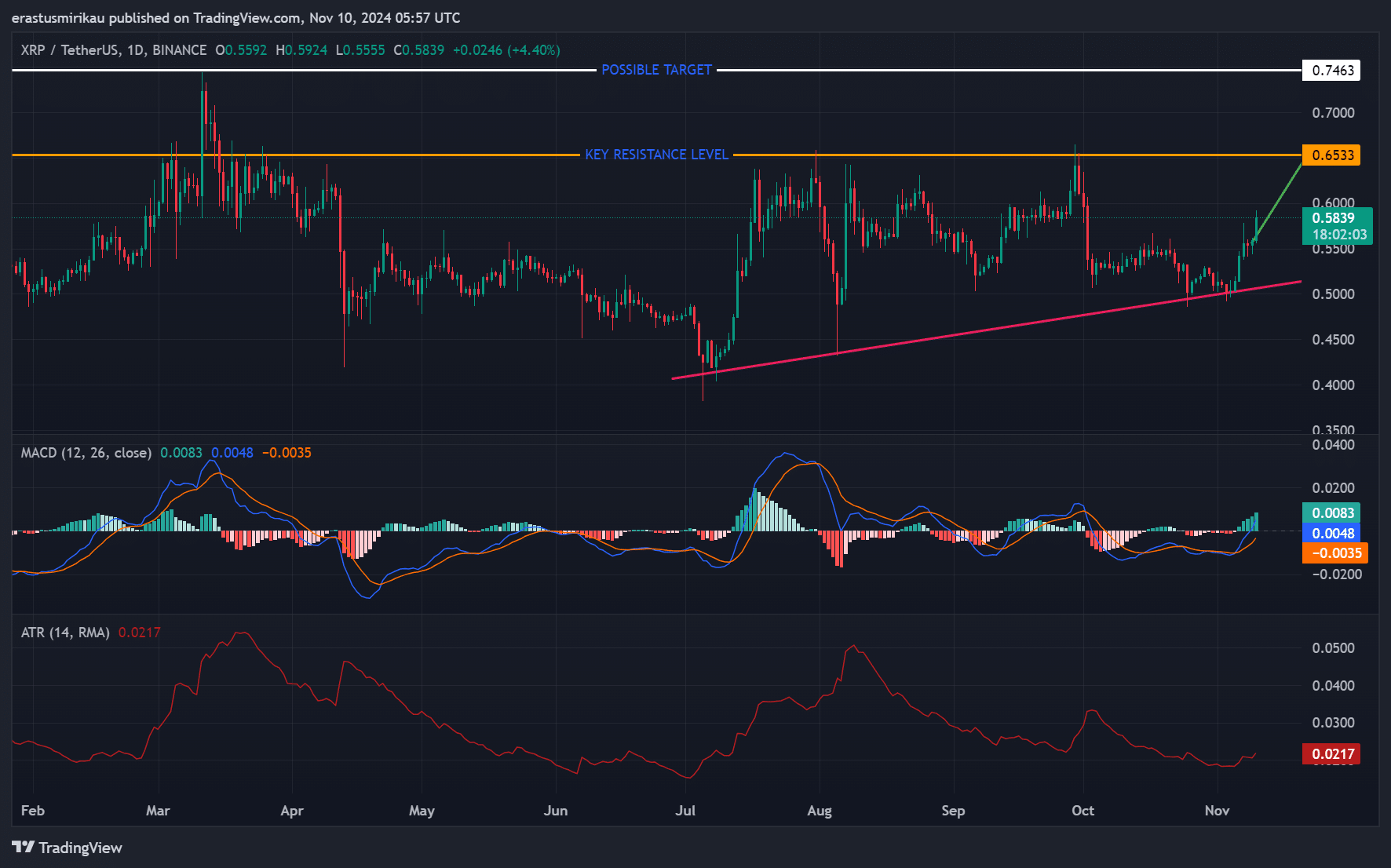

The price of XRP is on an upward trajectory and is close to significant resistance at $0.6533.

Previous attempts to break this level caused the price to fall, but the recent rally and increased trading volume means that XRP now has the power to surpass this level.

A breach of this level could open the path to the next target at $0.7463.

Key technical indicators further support the optimistic outlook. The Average True Range (ATR), which measures market volatility, rose to 0.0217, indicating growing trading interest and the potential for a big move.

Additionally, Moving Average Convergence Divergence (MACD) showed a bullish crossover at the MACD line at 0.0083 and the signal line at 0.0048.

Positive histogram bars further strengthen the case for upward momentum, suggesting that the bullish trend could continue if XRP successfully breaks through resistance.

Source: TradingView

On-chain signals indicate growth.

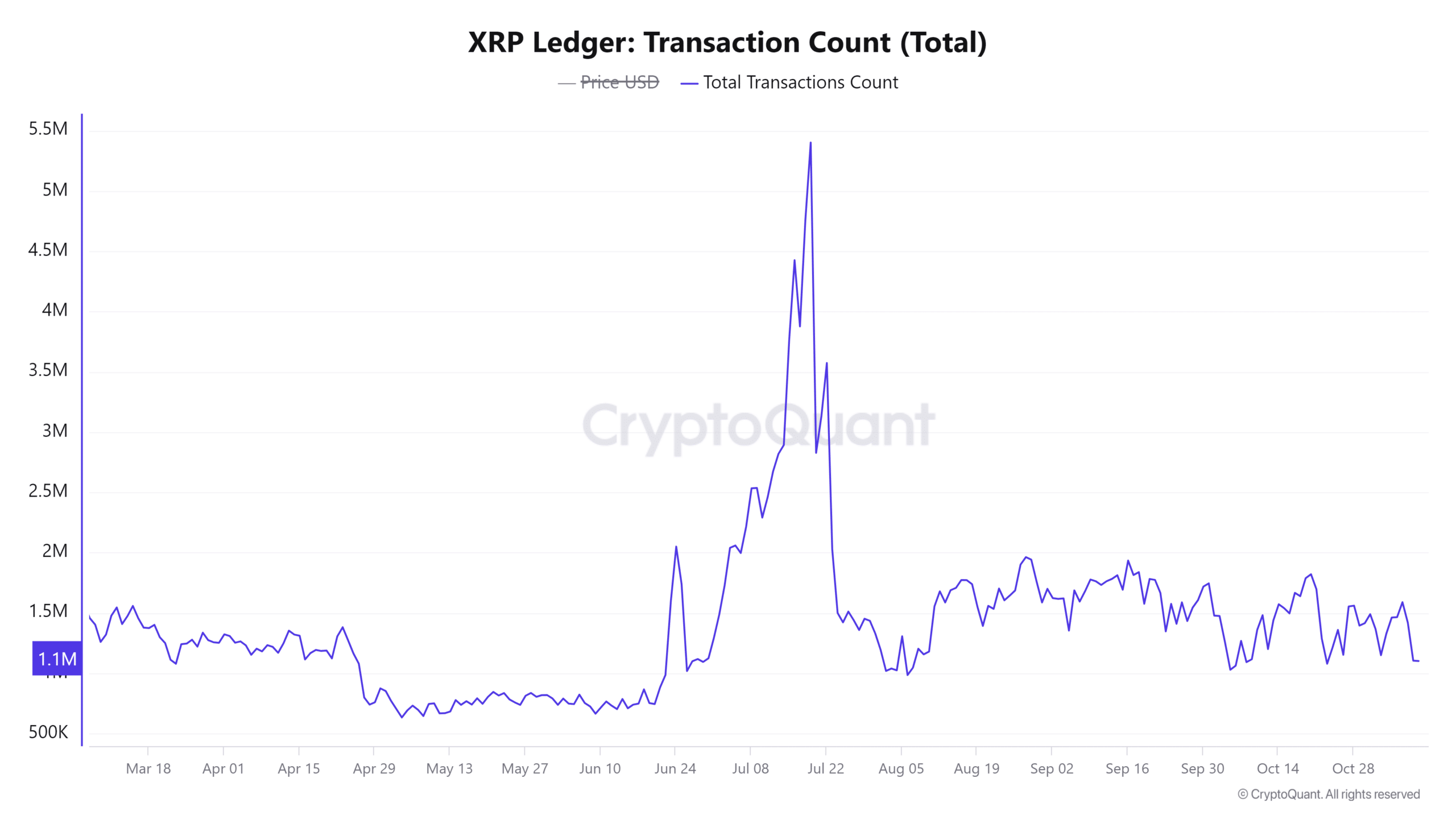

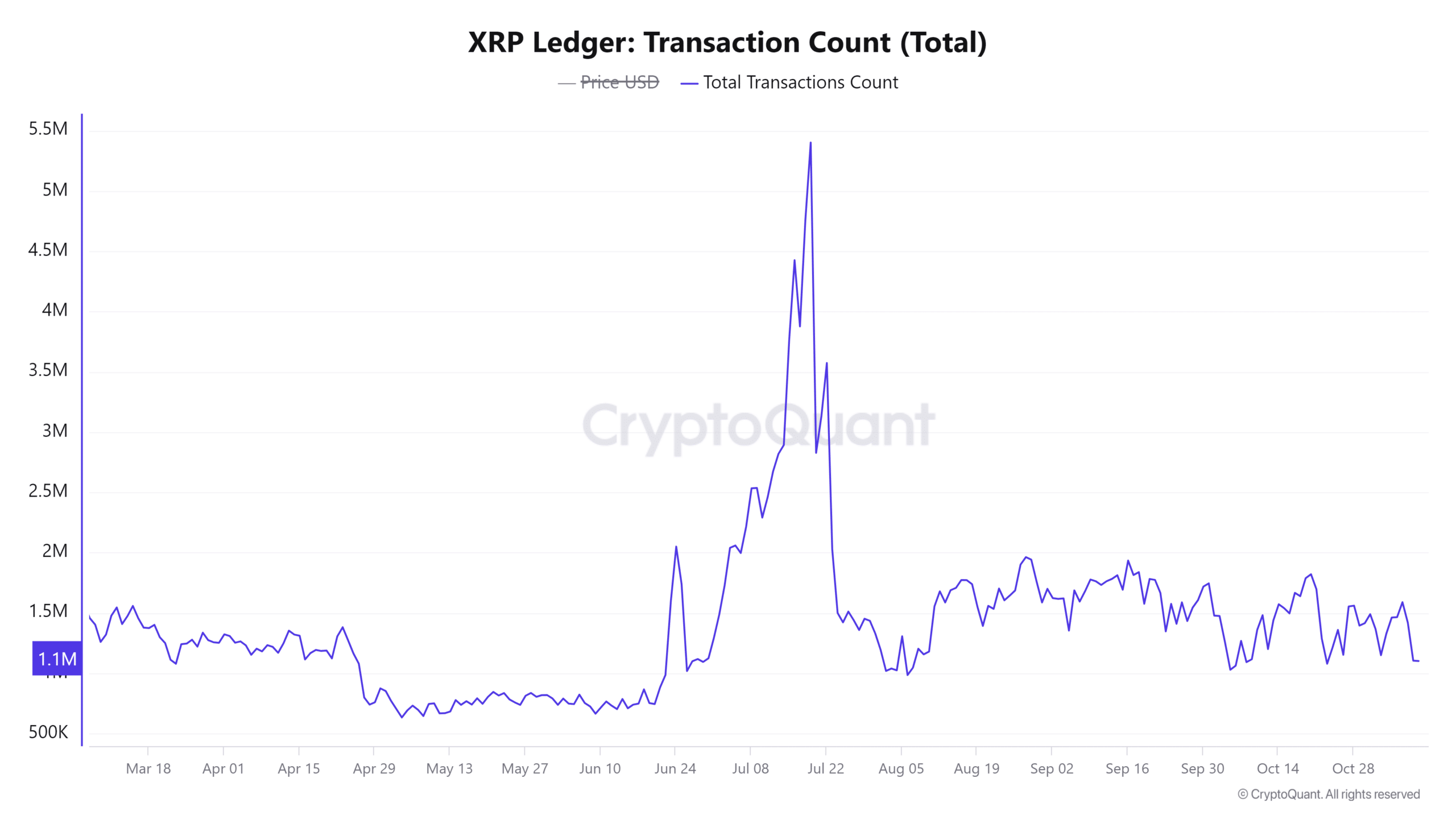

On-chain indicators were also consistent with the bullish sentiment. According to sentiment analysisDaily active addresses recently reached 21,327, indicating increased network engagement at press time.

Typically, an increase in active addresses is a sign of growing interest, which can spur price movements.

Additionally, the total number of transactions increased by 1.02% over the last 24 hours to 1.144 million. This continued activity and demand strengthens the case for a potential breakthrough.

Source: CryptoQuant

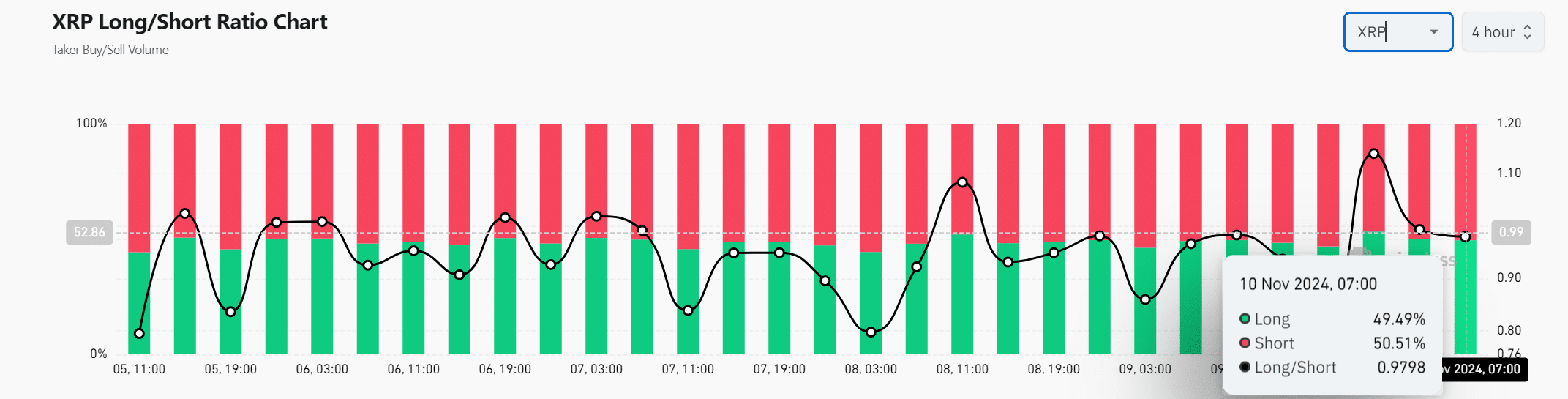

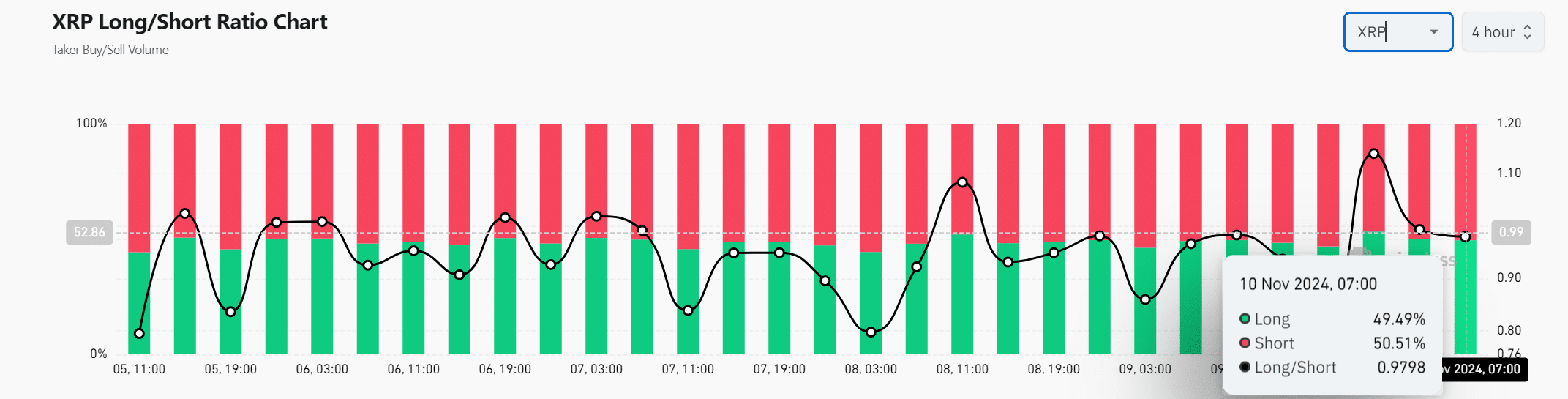

Market Sentiment: Balanced Long/Short Ratio

Market sentiment was cautious but tilted towards the bullish with the long/short ratio remaining nearly balanced at press time. In particular, long positions accounted for 49.49% and short positions accounted for 50.51% of all positions.

This nearly equal split indicates that traders are waiting for a clear signal. However, a successful breakout can amplify bullish momentum by tilting this ratio in favor of long positions.

Source: Coinglass

read Ripple (XRP) Price Prediction 2024-25

Is XRP ready for a new rally?

Strong technical indicators, increasing on-chain activity, and balanced but tilted bullish sentiment have the potential for XRP to break above the $0.6533 resistance.

If this level is broken, XRP could actually target the $0.7463 target, signaling the start of a strong bullish phase. The next few days will be critical in confirming this potential move.