- The price of XRP has fallen by more than 11% in the last 24 hours.

- Several market indicators suggested that the bearish trend may be changing.

After the market crash, Ripple (XRP) Prices are witnessing a correction and are yet to show any signs of recovery.

The worst is yet to come as the token fails to test its long-term bullish pattern, implying further price declines.

XRP has hurdles to cross

According to CoinMarketCap, the token price has fallen by more than 18% over the past 7 days. In the last 24 hours alone, registered tokens have seen double-digit declines, plummeting 11%.

At the time of this writing, XRP was trading at $0.4844, with a market capitalization of over $26.7 billion.

Meanwhile, XRP failed to test its six-year symmetrical triangle pattern as its value fell below $0.5.

Since the token was unable to test the pattern, investors may see its value decline further in the future.

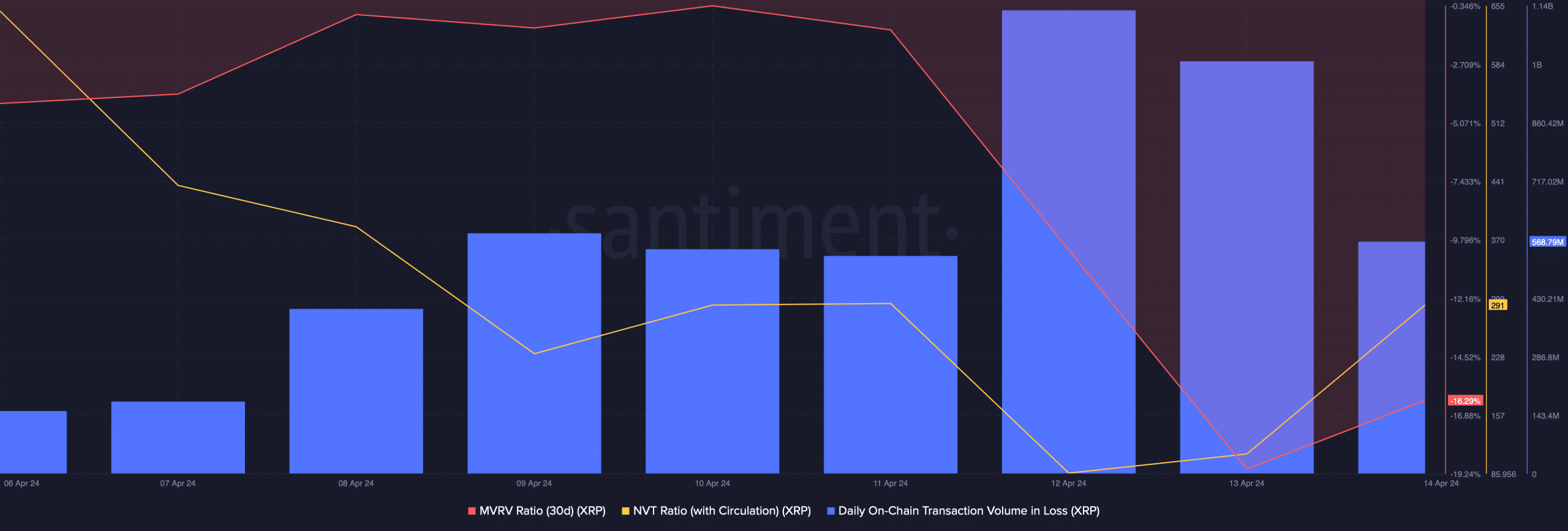

AMBCrypto’s analysis of Santiment’s data pointed out quite a few bearish indicators. For example, the token’s MVRV ratio has declined sharply in the past week.

After the decline, the NVT rate also gained upward momentum, suggesting that XRP is overvalued.

Additionally, the token’s daily on-chain trading volume losses have increased dramatically over the past few days, which may be due to the market crash.

Source: Santiment

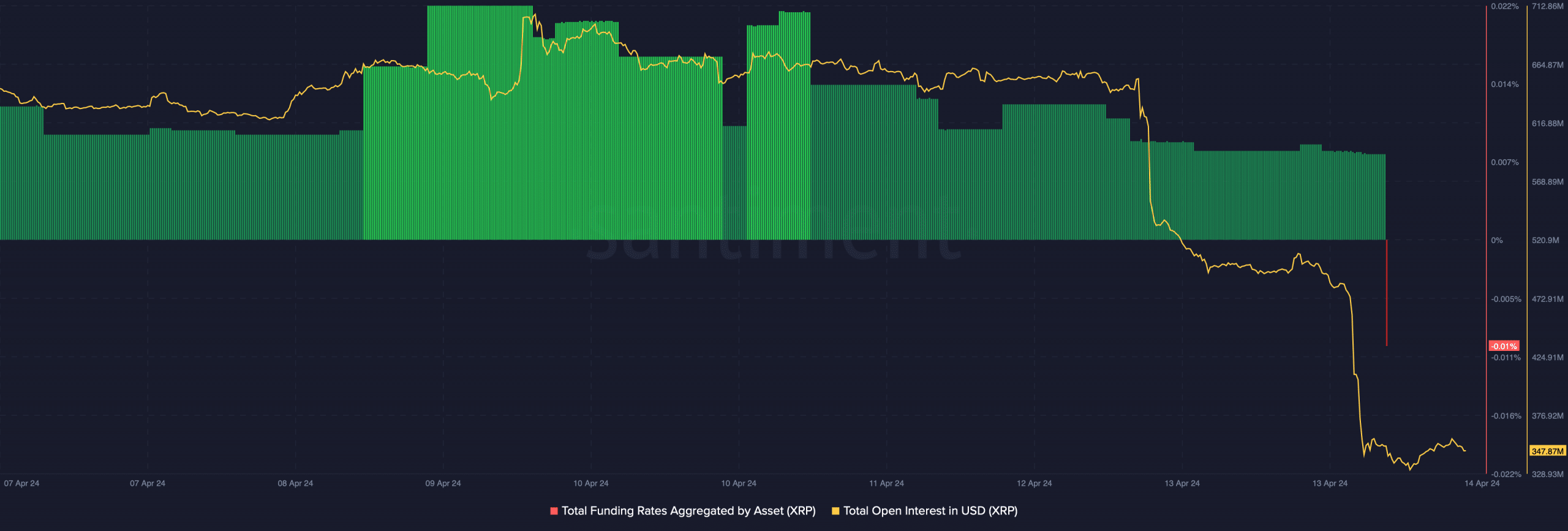

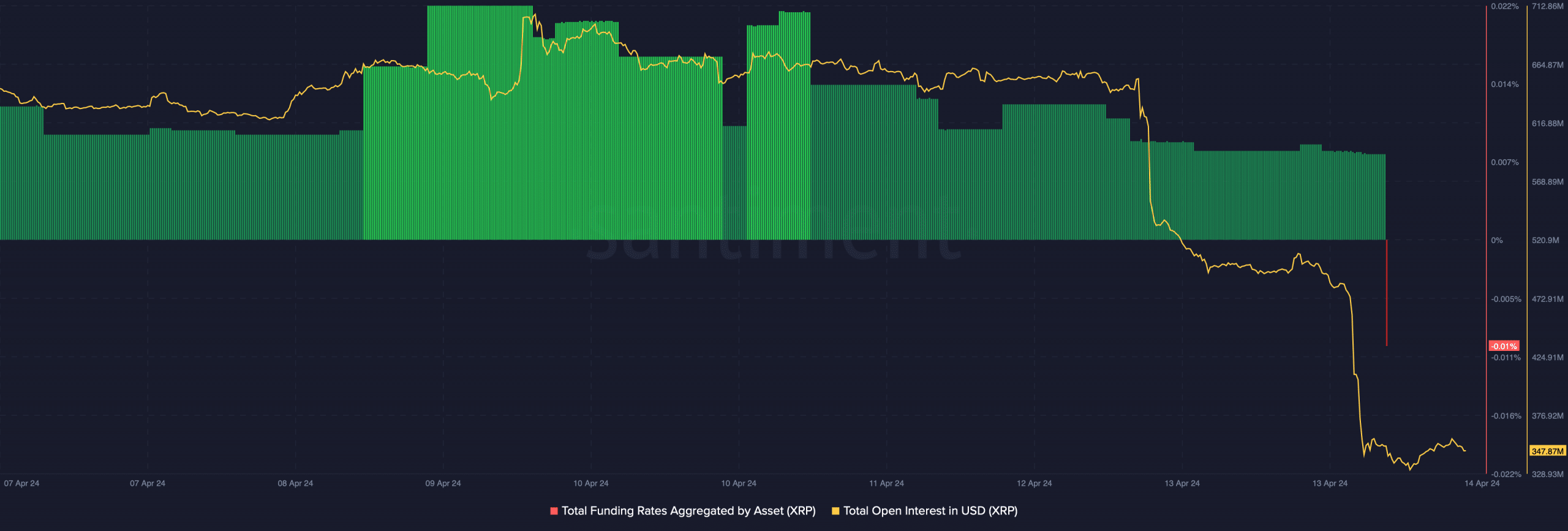

However, XRP’s derivatives indicators looked optimistic. Open interest has decreased dramatically. This sets the stage for a possible trend reversal that could occur soon, allowing the token to recover its recent losses.

The funding rate also dropped. In general, prices tend to move in the opposite direction of the funding rate, which suggests that prices may rise in the future.

Source: Santiment

Is a further downtrend coming?

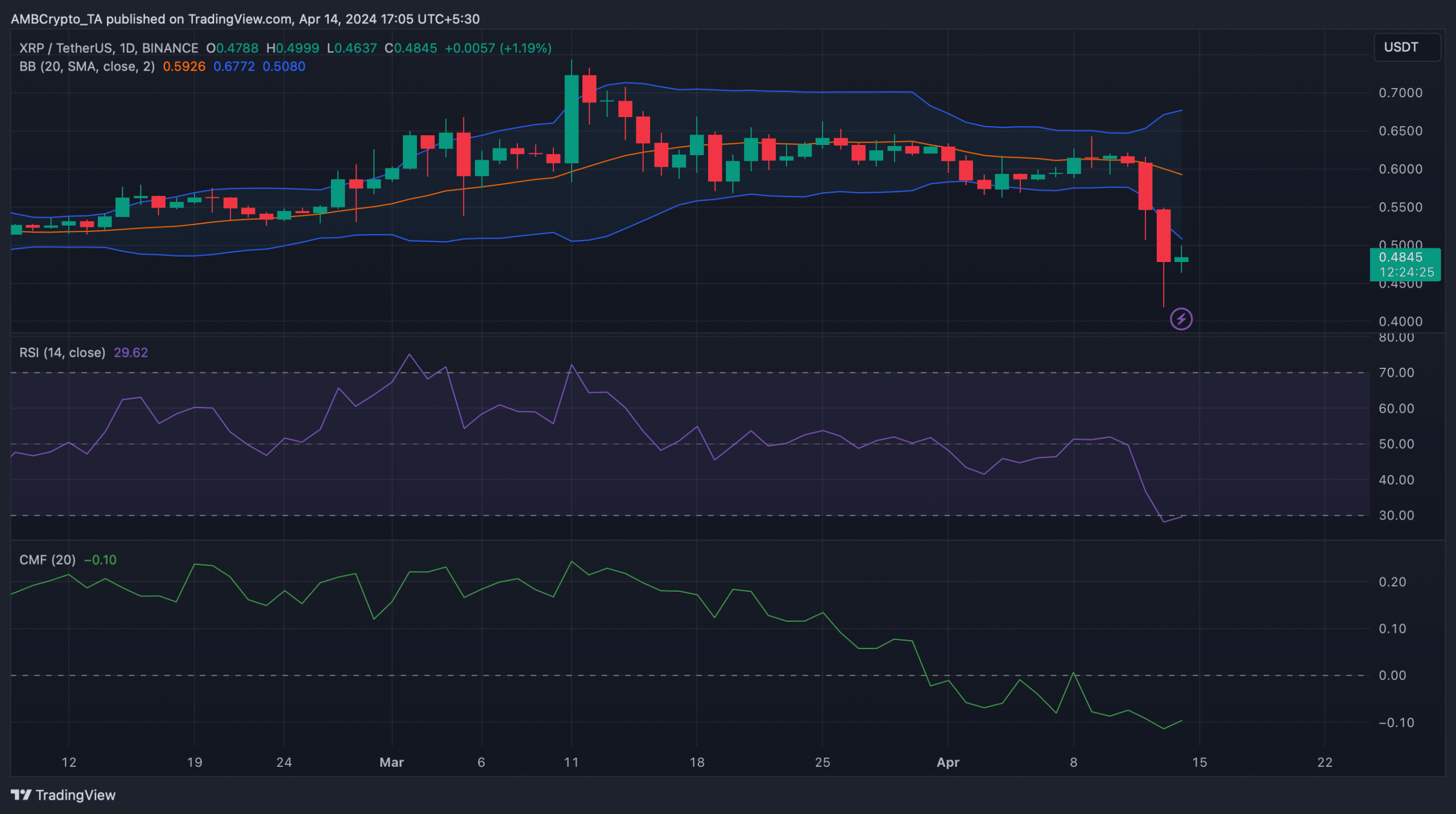

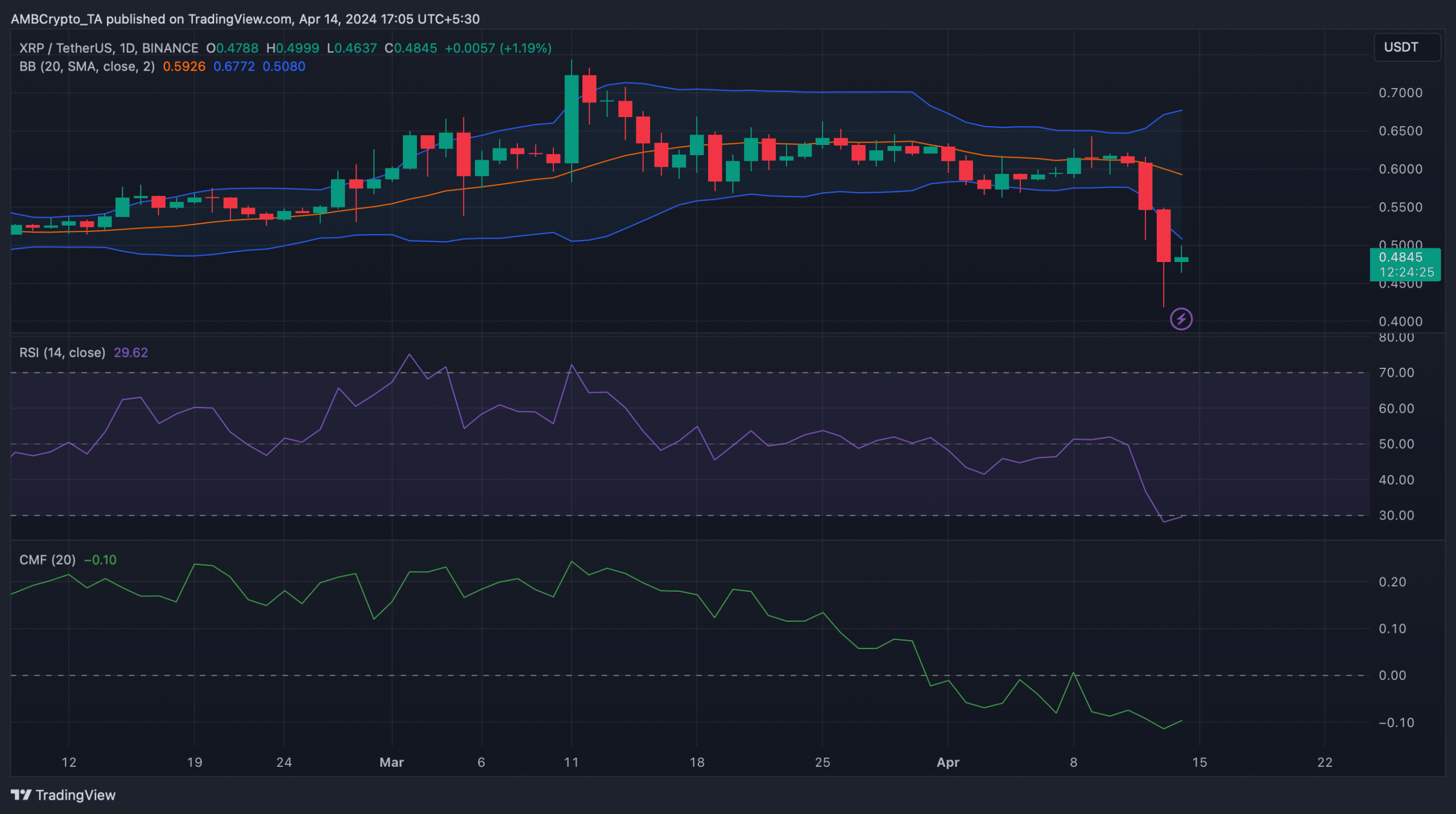

AMBCrypto then analyzed XRP’s daily charts to better understand which direction XRP is heading. The price of XRP has touched the lower limit of Bollinger Bands.

The token’s Relative Strength Index (RSI) has entered oversold territory, suggesting that buying pressure may increase for the token. Chaikin Money Flow (CMF) also rose slightly, indicating a price increase.

Source: TradingView

However, as the global geopolitical scenario becomes unstable, nothing can be said with certainty.

The ongoing conflict in the Middle East may have a negative impact on the price of the top cryptocurrency and may remain weak in the coming weeks.

read Ripple (XRP) Price Prediction 2024-25

AMBCrypto looked at data from Hyblock Capital to find support levels where XRP could plummet if the downtrend continues. We found that the token is supported near $0.46.

If the token tests this support, an upward rally can be expected. However, if things play out differently, the price of XRP could fall to $0.42.

Source: Hiblock Capital