On-chain data shows that many older coins have recently moved out of the XRP network, a sign that turned out to be bearish for the coin last time.

XRP tenure consumption metrics recorded a significant surge.

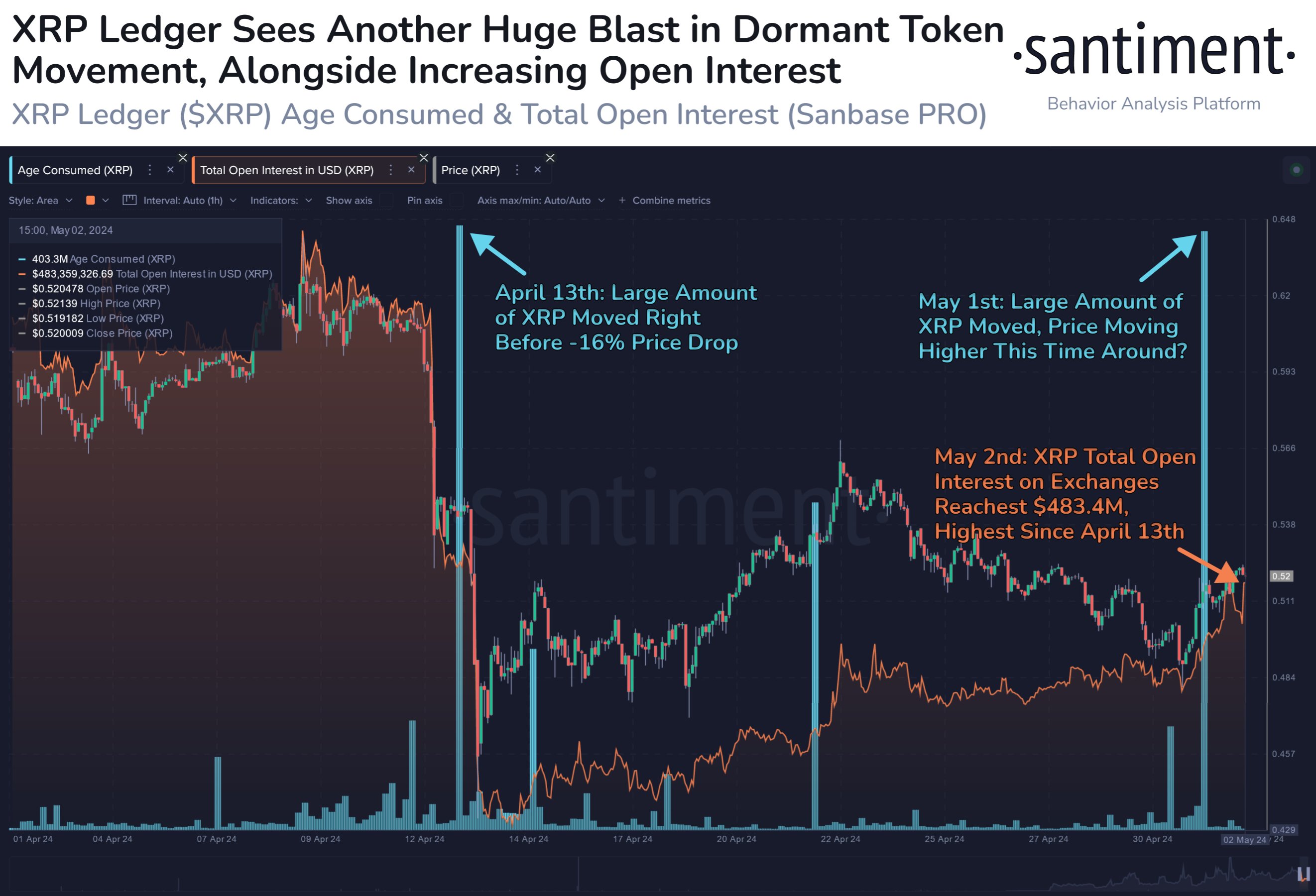

According to data from on-chain analytics firm st tlyXRP has just observed a large-scale movement of dormant coins, similar to what the asset witnessed last month.

The metric of interest here is “age period,” which, as defined by Santiment, represents “the amount of tokens changing addresses on a given day multiplied by the time since they last moved.”

A high value of this indicator means that a large number of previously dormant coins have finally been moved to the blockchain. Older coins are generally less likely to be involved in sales because they belong to more assertive hands in the market. Therefore, big movements in these coins are worth noting because they are not events that occur too often.

The chart below shows the trend of this indicator for XRP over the past month.

The value of the metric seems to have been quite high in recent days | Source: Santiment on X

If you look at the graph, you can see that XRP Age Consumed recorded a sharp surge earlier this month, which means that some seniors have decided to break their silence.

This latest surge is quite large in scale and reminiscent of another surge seen last month. Interestingly, the previous surge occurred right before the cryptocurrency’s price plunged 16%.

So the previous spike would have coincided with some HODLers moving to sell their coins. The latest massive dormant coin movement could also bring a downside to XRP as it is likely created for a similar purpose.

But Santiment points out that this may not be the case after all, saying:

There are claims that these older coin movements are related to potential #buythedip interest from key stakeholders, and prices have been rising slightly since the surge occurred this May.

While these dormant coin movements may turn out to be bullish this time, there is another signal brewing for the asset to keep an eye on.

As highlighted in the same chart, XRP’s total open interest, which tracks the number of derivatives positions currently open across all exchanges associated with the asset, has been increasing recently.

This metric is currently at a three-week high of $483.4 million, meaning there is a significant amount of speculation in the market right now. Historically, this has led to price volatility.

In theory, this volatility could take the asset in either direction, but it is worth noting that last month’s collapse occurred after open interest reached extreme levels. But so far the indicators have not yet reached the same high point.

XRP price

XRP’s price has yet to make a significant recovery from last month’s crash, as it is still trading around $0.52.

Looks like the price of the asset has been overall moving sideways since the plunge | Source: XRPUSD on TradingView

Kanchanara from Unsplash.com, featured image from Santiment.net, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.

Source: NewsBTC.com