- The price of XRP may drop to $0.48 after numerous holders sell their tokens.

- Volatility is surging and network activity is sluggish, showing signs of recovery.

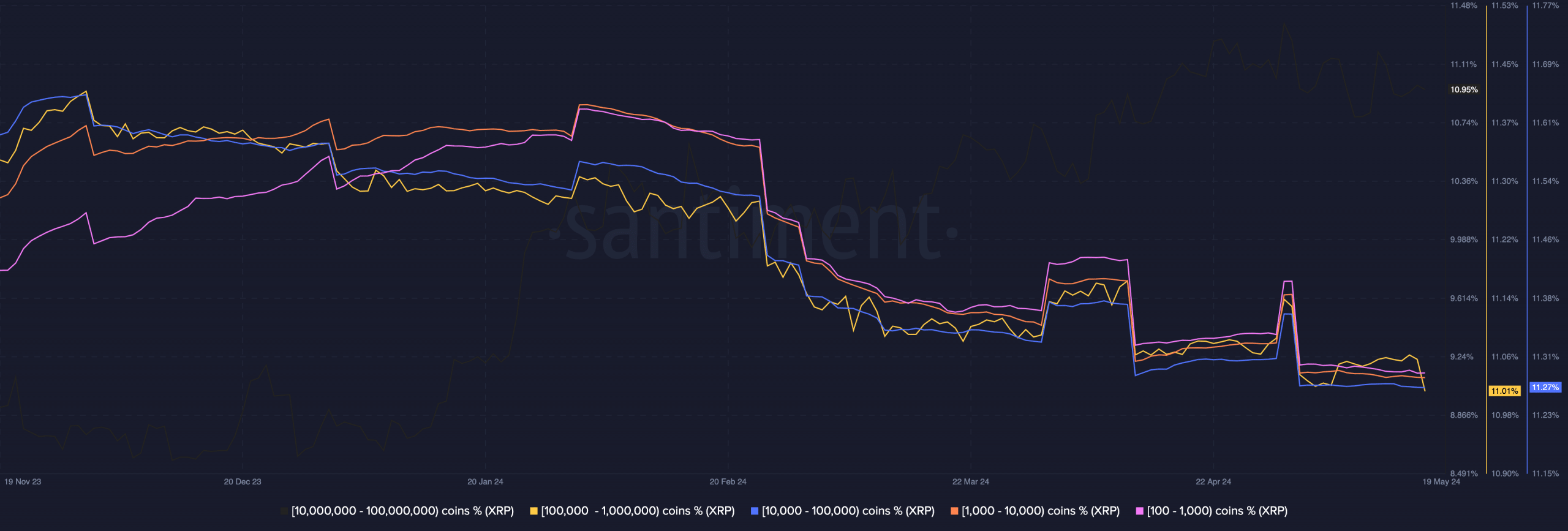

After analyzing data from Santiment, AMBCrypto determined that addresses with between 100,000 and 1 million XRP are shredding the number of tokens held in their wallets.

At press time, on-chain data showed that a group of 100,000 to 1 million people currently holds 11.01% of the total XRP circulating supply. It was also found that the 10,000 to 100,000 group accounted for 11.27% of the decrease in address balance.

XRP begins its downward path

Last week, the price of XRP was able to rise from $0.48 to $0.52 within a few days. However, the token erased some of these gains.

As balances decrease, the token price may fall below $0.50. At press time, the token was worth $0.51, indicating that the effects are already underway.

Source: Santiment

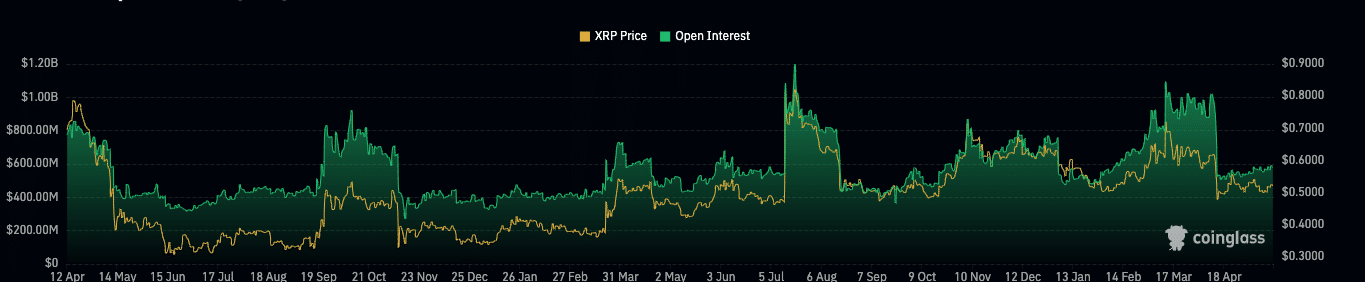

However, this indicator alone cannot determine whether XRP will continue to fall. AMBCrypto therefore considered public interest (OI) assessments.

OI represents the value of all open positions in a contract. An increase in OI means more liquidity is flowing into the market. When this happens, it means the buyer is being aggressive.

A decrease in OI means an increase in the number of net positions liquidated. In this case, it means the seller is being aggressive.

At press time, XRP’s open interest was $577.63 million. This was a net decline over the past 24 hours. If this number continues to drop, the token price could avoid another pump.

Source: Coinglass

The market is no longer volatile

Moreover, bulls targeting higher prices may need to temper their optimism. From the looks of it, the value of XRP could fall to the $0.50 support level.

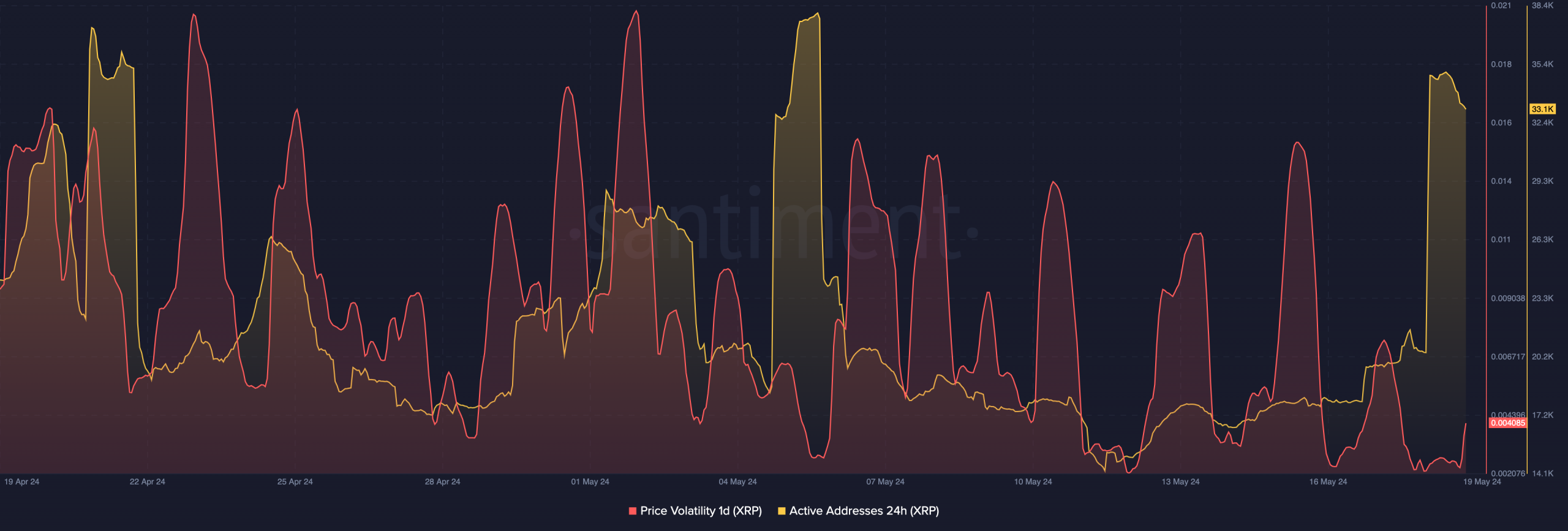

However, if selling pressure intensifies, the XRP Ledger’s native token is likely to fall back to $0.48. In addition to this, AMBCrypto looked at daily volatility.

Volatility shows how quickly and often significant price changes occur. Increased volatility due to increased buying pressure could result in price spikes.

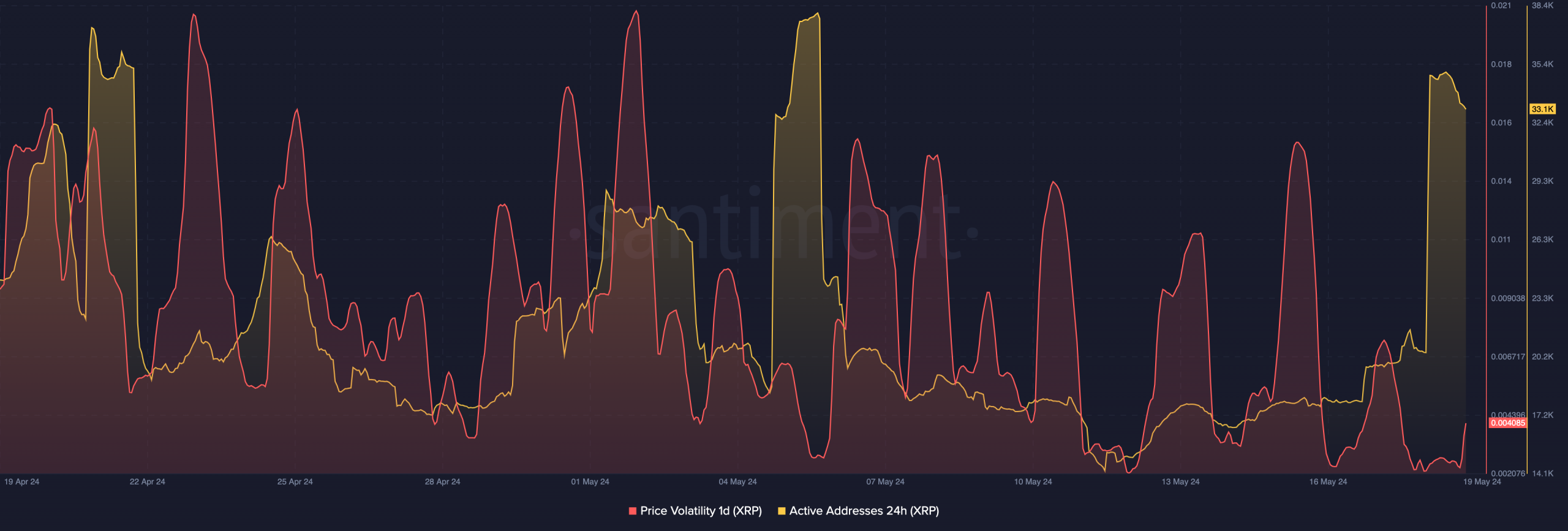

At press time, XRP’s daily volatility has surged after recent declines. However, this surge does not appear to favor the uptrend. Instead, the indicator may be reinforcing a downward trend.

Additionally, on-chain data shows that 24-hour active addresses increased to 35,000 on May 18. However, as of this writing, the metric has decreased to 33,100.

Source: Santiment

Is your portfolio green? Check out our XRP Profit Calculator

Active Addresses shows the number of unique addresses that have participated in the transfer of that asset on a specific date. Historically, as the number of active addresses increases, the price of XRP increases.

Therefore, the recent decline suggests that XRP may not make any moves that will push its price higher. In the short term, XRP is likely to decline significantly.