- Interest in XRP disclosure increased 41%, showing strong speculative trust in Ripple’s breakout and trend reversal.

- According to neutral funding rate and absorption of sales pressure, the bull can be quietly constructed for continuous rally.

Ripple (XRP) It showed signs of a new strength, supported by the rapid increase in leverage location and strong technology structure.

According to the Binance Future Data, aggressive sales pressure steadily absorbed, suggesting a quiet accumulation under the surface.

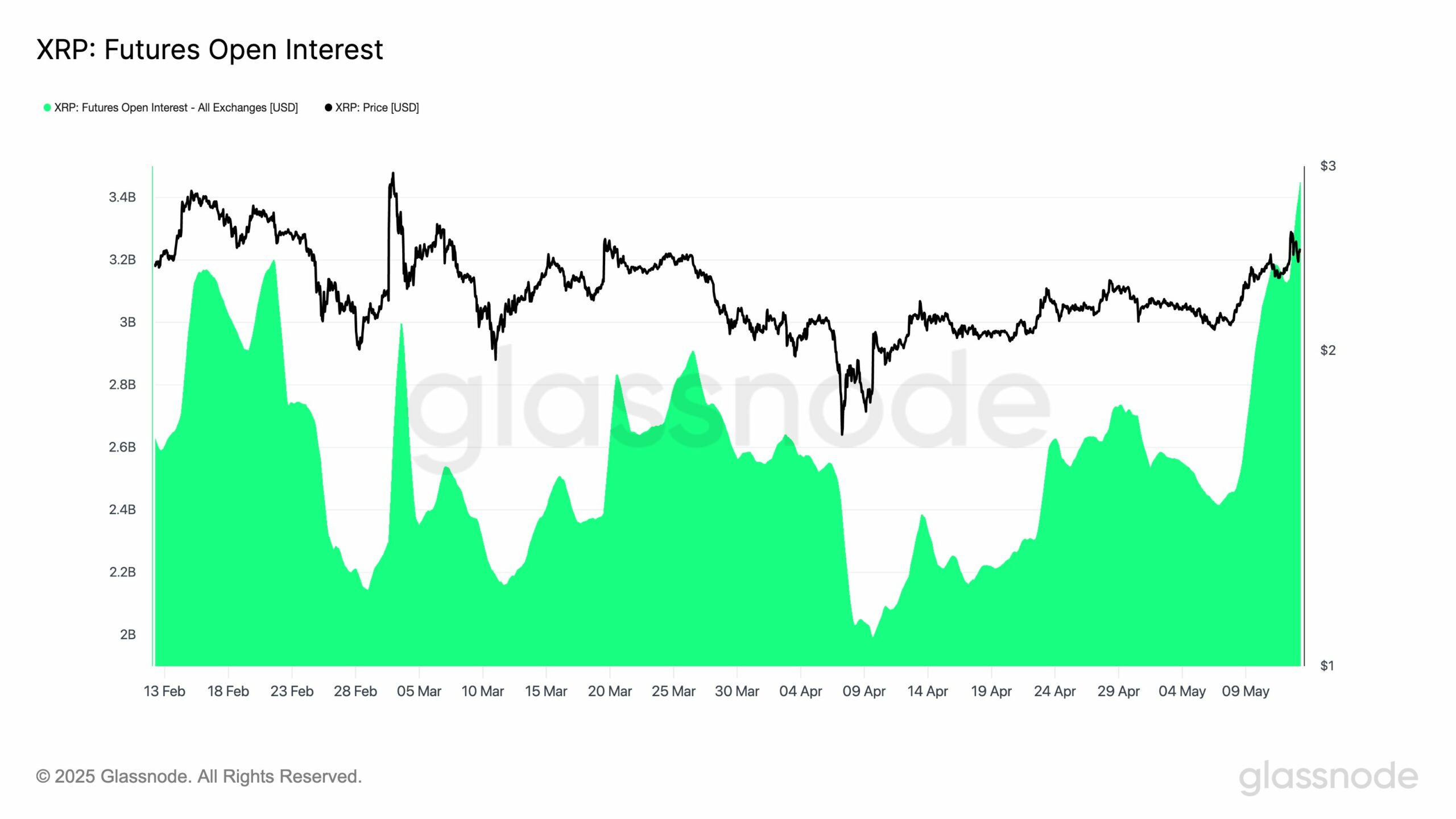

On the other hand, the XRP disclosure interest (OI) has rebounded rapidly, and the financing rate (FR) remains neutral, showing a balanced sentiment despite the growing speculation.

The union sets the potential continuous rally if the main support level is maintained.

The XRP Open Interest rises rapidly as the conviction is returned.

XRP’s futures OIs surged to more than $ 1 billion last week, up from $ 24.2 billion to $ 34.2 billion, up 41.6%.

This aggressive spike coincides with the price rebound from $ 2.14 to $ 2.48, reflecting a new direction belief.

Naturally, this reflects the increasing direction of the direction of direction. However, if the OI rises without the spike of the FR, the risk of overcrowded time increases.

Nevertheless, at this stage, merchants appear to be in a position for constant backwards.

Source: Glass Node

The brake out has been confirmed, but can the bull maintain the amount of exercise?

XRP has come out of the channel of lowering price measures since March.

Altcoin was previously resisted and raised its important $ 2.38 level to act as a support.

FIBONACCI Projections identify $ 2.82, $ 3.01 and $ 3.38 as the next goal when Bulls maintains control. However, probability -based RSI is currently emerging with more than 98 and suggests overdue conditions. Therefore, if the amount of exercise is interrupted, it can occur by returning short -term.

Despite these risks, if there is no major resistance cluster, an open path is provided. As long as XRP remains more than $ 2.38, the structure is still optimistic.

If you do not maintain this level, you can invite new sales pressure and invalidate evacuation. Therefore, the trader should carefully watch the price behavior around the area, especially in relation to leverage activities.

Source: TradingView

The rate of funding shows uncertainty under the surface

Despite the leverage surges, XRP’s OI weighted FR stood at +0.0128%. Its neutrality does not yet mean one -sided position.

Therefore, the market remains a delicate balance that can still face pressure when emotions are overturned.

Neutral funding, on the other hand, allows space for healthy sustainability because there is no excessively long prejudice.

Source: COINGLASS

Will XRP hold $ 2.38 and raise it higher?

Ripple’s technical brake out and the rapid rise in OI reflect the growing merchants’ conviction and strong momentum. More than $ 2.38 movements indicate important changes in the market structure, and maintaining this level is the key to rally.

But the probability -free RSI remained in an over -zone, FR is still neutral and indicates a potential tug of war between the bull and the bear.

If the buyer continues to absorb sales pressure and maintains the control over the support, the promotion of $ 3.00 will increase.