In cryptocurrency trading, history often repeats itself, or at least rhymes. That’s why it can be important to identify historically significant price signals and patterns. According to Egrag Crypto’s latest technical analysis: in the spotlight This pattern for XRP indicates the potential for massive price increases.

This analysis hinges on observing a bullish crossover between the 21-day exponential moving average (21EMA) and the 55-day moving average (55MA) on the two-week chart of XRP/USD. Egrag said, “XRP Rocket: 21 EMA and 55 MA Signal Explosion: Let’s Decipher XRP Trajectory. Would you like me to focus? There are only two significant weekly candles after the crossover between the 21 EMA and the 55MA.”

Will XRP price soar to $7?

Charts provided by Egrag Crypto highlight XRP price movements in two distinct scenarios when this rare bullish signal occurs. The first bullish crossover between the 21-day and 55-day moving averages on the two-week chart occurred in March 2017 (Scenario A). Following this signal, XRP price saw “two prominent two-week candles.” There was an initial surge of about 90%, followed by a shocking 1100% spike,” Egrag said.

For the second time in the history of the XRP price, the signal flashed in late December 2020. This time, XRP rose 100% in the first candle and surged 84% in the second two-week candle. It recorded a 200% rise.

According to cryptocurrency analysts, this scenario is likely to repeat itself. “If you look at the similarities with past bullish trends, my opinion is consistent with the historical data,” Egrag said.

Notably, Egrag’s chart features an upward trend line, a bullish indicator that XRP has tested twice, as indicated by two green circles in mid-2022 and early 2023. These tabs on the trend line are as important as they suggest. Each touch is a test of support where the price finds enough buyers to start a new upward movement.

Analysts speculate that XRP may decline slightly further to tap the rising trend line for the third time, which could foreshadow a significant price rise. A possible third tap of the trend line is considered a buying opportunity ahead of a significant price surge.

Following the third retest of the trendline, Egrag foresees two possible scenarios based on the bullish crossover of the 21 EMA and 55 MA. In Scenario A, the cryptocurrency analyst predicts a sharp rise in the price of

Scenario B suggests a more conservative target of $1.80, which would still result in an impressive gain of 218.82%. The “no return zone” in red at the $1.80 level is set just above the target for Scenario B. This acts as a resistance zone or represents a threshold where we can see strong bullish momentum if the price holds above it.

broader market forces

Cryptocurrency analysts also know that Bitcoin price has traditionally played a significant role in altcoins such as XRP. Therefore, regarding the current market situation, he said, “Eyes are fixed on BTC as most expect a peak in the $48,000-$50,000 range and potentially a downtrend, triggering a broad alt season. But what’s interesting? “This is the scenario where BTC surges to ATH, falls back, and unleashes a truly wild alt season.”

The analyst’s view is tilted towards an initial surge between $7 and $10, followed by a significant retracement, followed by an even bigger rise to the $20 to $30 level. When asked about the expected retracement range in the $7-$10 range, Egrag Crypto responded with an “aggressive $1.3-$1.5” decline.

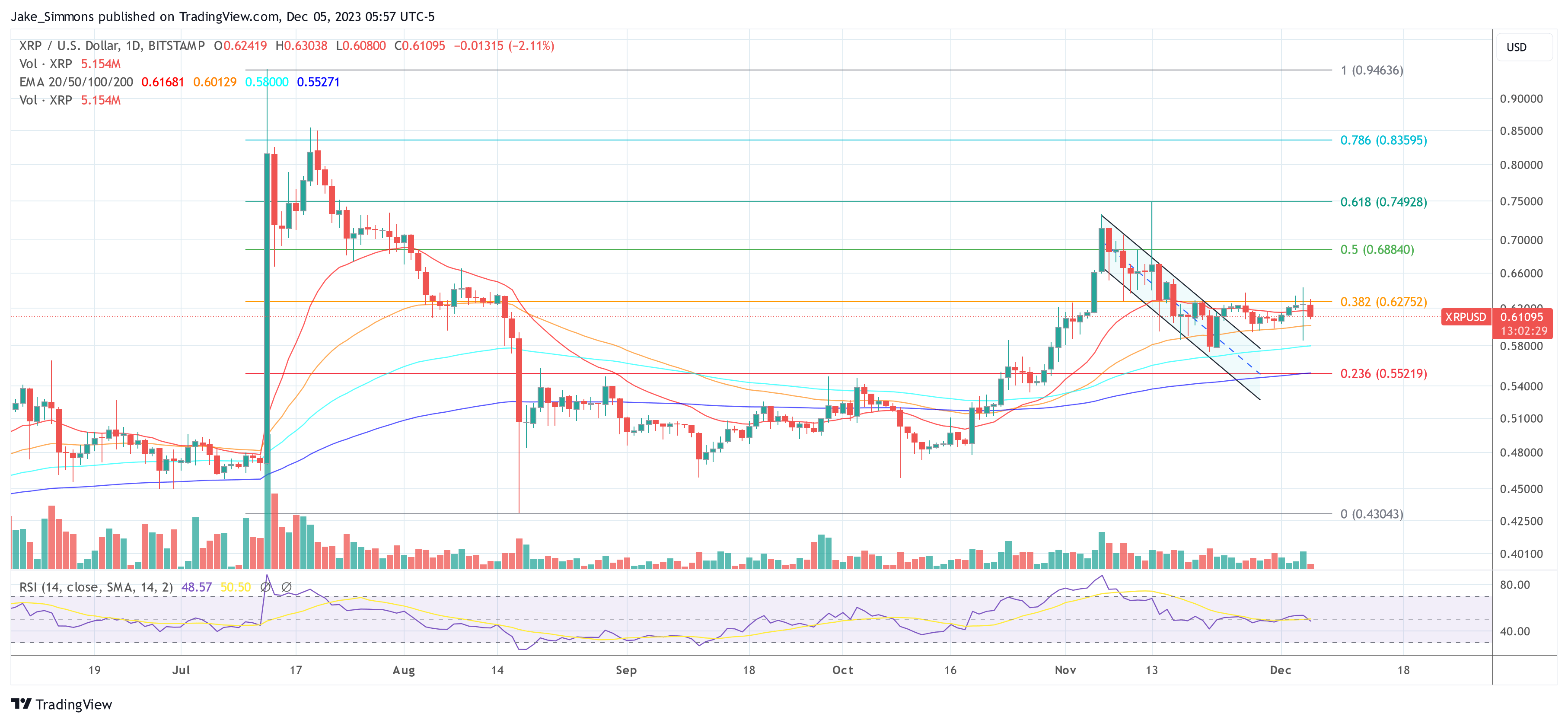

At press time, XRP was trading at $0.61095.

Featured image from Medium, chart from TradingView.com