- XRP may find it difficult to compete with the performance of other altcoins.

- Although both metrics supported churn, the data showed that churn can be short-lived.

The price of XRP has taken a huge hit over the past 30 days, losing 11.71% of its value. Needless to say, other altcoins also made it onto the charts. However, the case of XRP looks different. Especially considering that XRP has been one of the worst cryptocurrencies this year.

This disappointing show raises questions such as: Should I sell my XRP? Here, AMBCrypto will look at several metrics and developments that can give us an idea of the token’s future performance.

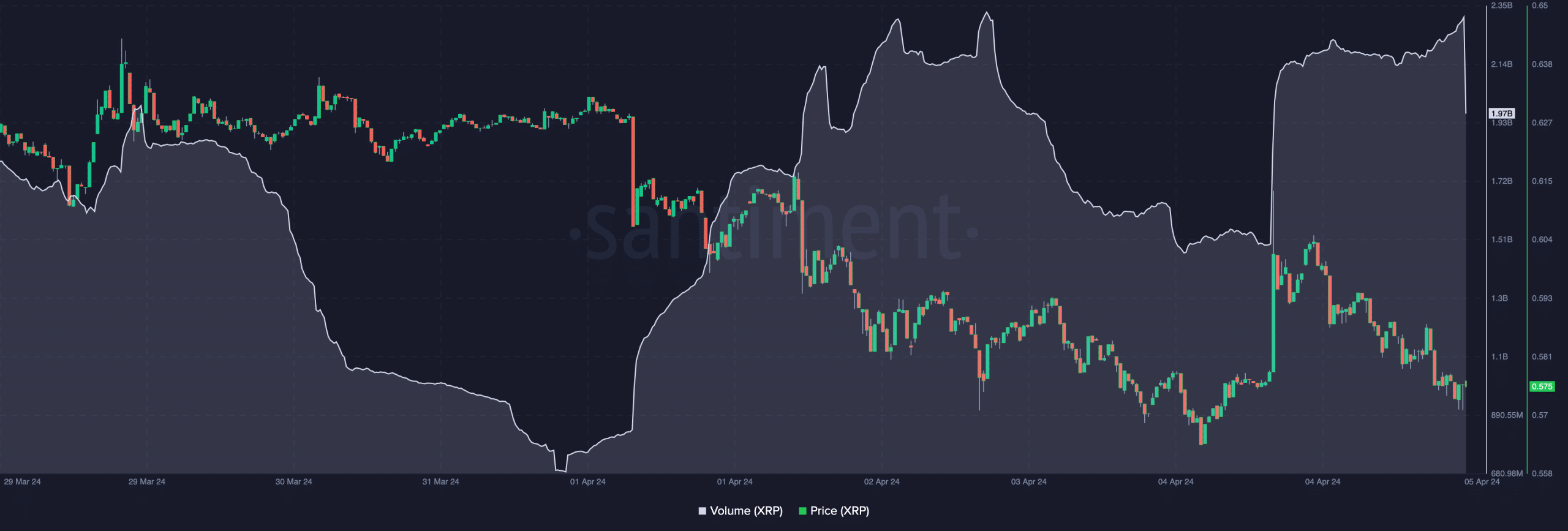

First, let’s look at trading volume. On April 5, XRP’s trading volume exceeded $2 billion. Interestingly enough, the price dropped to $0.57 during this period.

Source: Santiment

Store your tokens

Increasing volume and falling prices do not bode well for traders who are optimistic about price action. Instead, trends suggest that the value of the token may continue to decline. However, AMBCrypto found that Ripple’s announcement of introducing a stablecoin was one of the reasons for the increase in trading volume. Nonetheless, is this really bullish news for XRP?

It could be argued otherwise. This is because the Ripple network’s stablecoin could make XRP less competitive compared to other altcoins.

Additionally, the cryptocurrency may no longer achieve the “global reserve token” goal the company had in mind. If XRP succumbs to the above statement, it may be stripped of its liquidity. Therefore, prices may not perform well in a bull market.

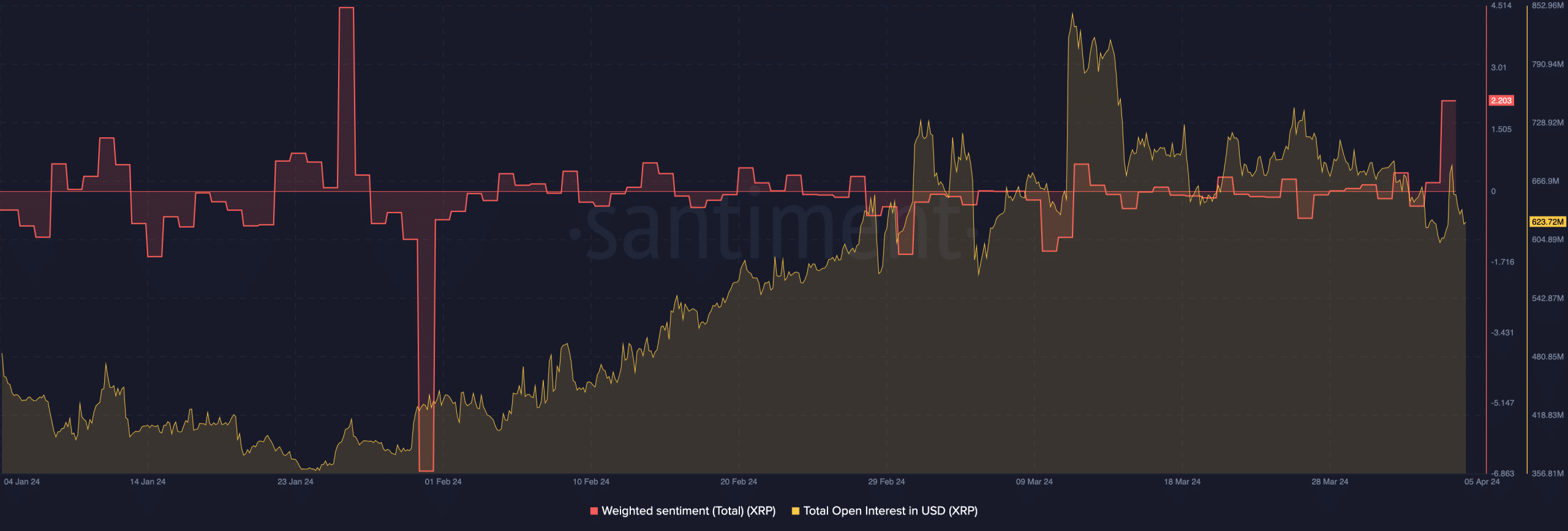

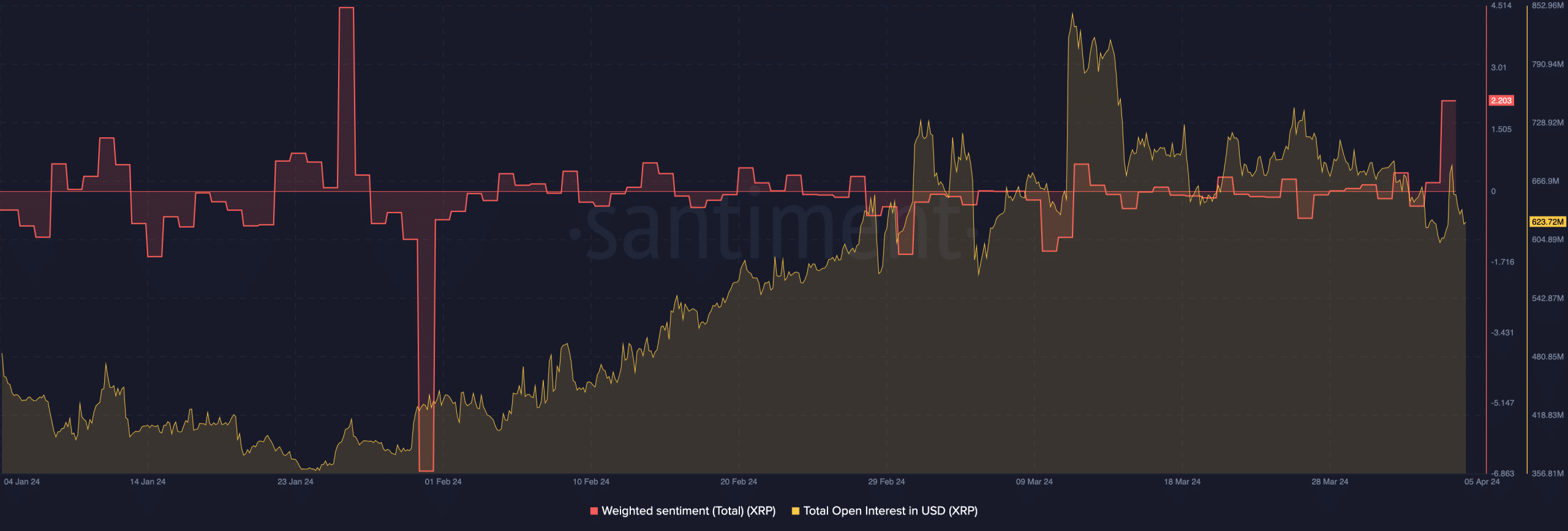

Another indicator worth looking at is Weighted Sentiment. According to AMBCrypto’s on-chain analysis, XRP’s Weighted Sentiment rose to its highest level since January 26.

Potential upside may be temporary

The increase suggested that market participants may be optimistic about price movements. However, it is also important to look at how prices changed in January.

At the time, when sentiment soared, the price of XRP was $0.54. A few days later the token’s value dropped to $0.49. If history repeats itself, XRP could rise to $0.59.

Source: Santiment

However, the potential increase may be short-lived, and a 9.25% decline may occur in the short term.

In addition to Weighted Sentiment, AMBCrypto also evaluated Open Interest (OI). At press time, XRP’s OI was falling, indicating that traders were increasingly closing out their net positions. A reasonable inference from the decline is that sellers are becoming more aggressive.

If the downtrend continues to decrease as much as the price, there could be a bounce next. However, as historical data suggests, the potential rebound may not last.

Read Ripple (XRP) Price Forecast 2024-2025

From a long-term perspective, XRP may be one of the worst-performing assets this cycle. If you’re someone who expects parabolic returns, the token may not deliver that.