- XRP has seen selling pressure dissipate over the past few days.

- The possibility of another price drop still remains.

Ripple (XRP) made some gains last week but has yet to show an upward trend. Trading volume rose on Monday, May 6, the day of the court briefing.

Technical indicators and price action did not favor a bullish bias.

According to the AMBCrypto report, Weighted Sentiment was on the decline. Another report highlighted that one indicator indicates a potential price decline is imminent due to age consumption indicators.

Resistance in the mid-range again turned off buyers.

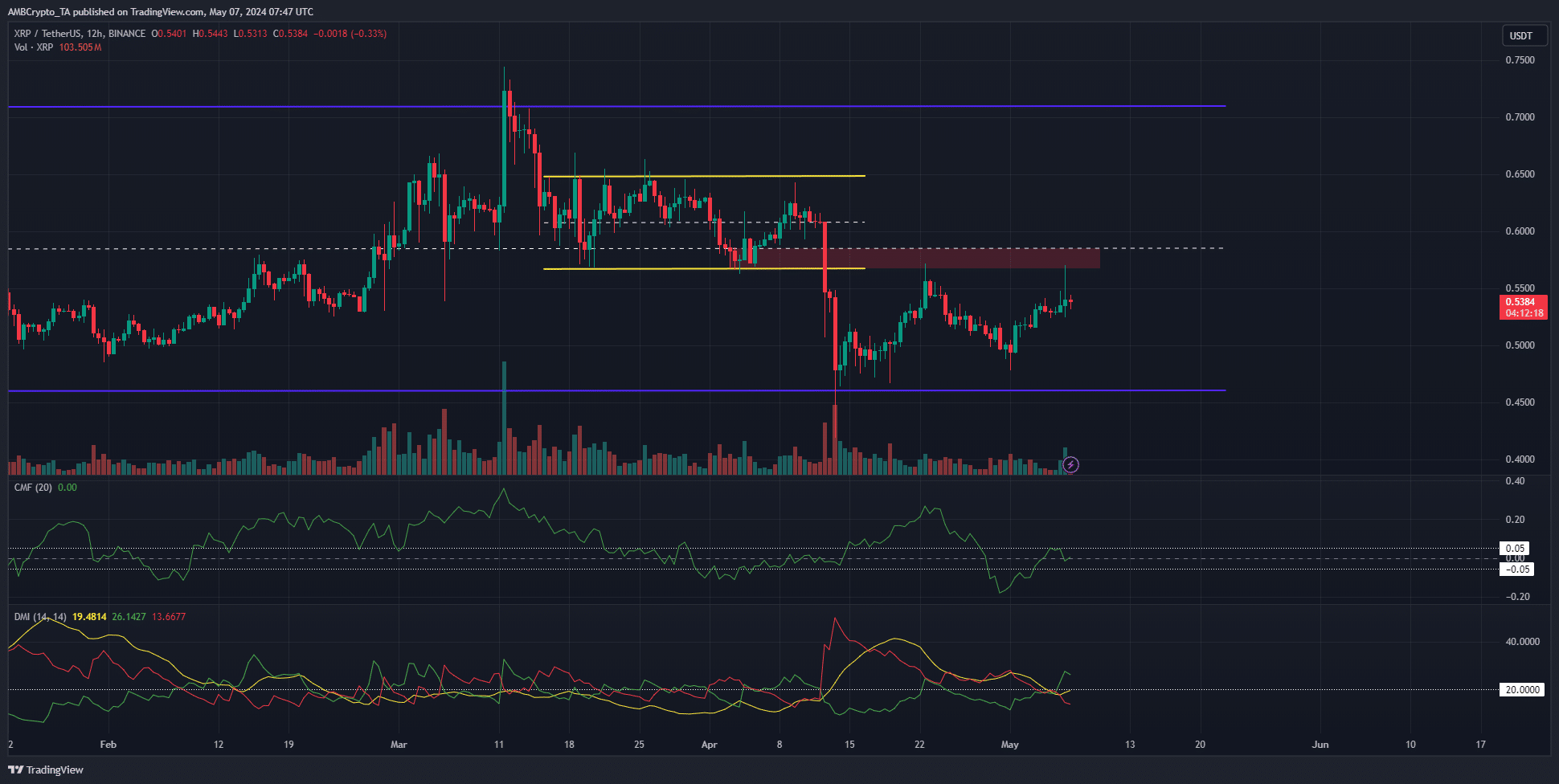

Source: XRP/USDT on TradingView

The 9-month XRP range (purple) extended from $0.46 to $0.71. The intermediate price range of $0.585 has been acting as resistance since mid-March.

Resistance areas (red boxes) are also bearish blocking blocks, meaning stronger resistance.

Chaikin Money Flow is 0, indicating a lack of significant capital flow into the market. Looking at the Directional Movement Index, +DI (green) is above 26 and ADX (yellow) is close to 20.

This shows that a strong upward trend is almost achieved. Whether this will allow XRP to break above the $0.585 resistance remains to be seen.

So, there could be a 5% rise to $0.585 followed by a 15% decline to the $0.48 support area.

Has XRP reached a stability point?

Source: Coin Analysis

XRP’s open interest has been slowly trending upward over the past week. However, it was not a meaningful rally.

The price rose more than 10% in the same period, but given the resistance overhead, speculators were nervous about buying XRP.

Despite the bearish sentiment on the OI chart, one encouraging factor was spot CVD. A bottom was formed over the past three days, meaning the previous steady downward trend has come to a halt.

This will be the first step to recovery. This indicates that buying and selling pressures are balanced in the spot market.

Read Ripple (XRP) Price Prediction for 2024-25

If CVD begins to trend upward, this signals accumulation and strengthens the possibility of an upward trend.

As things stand, the possibility of XRP plummeting to $0.48 is a good thing considering its age-related metrics.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.