- The XRP has increased the risk of breaking important support areas in the face of strengthening sales pressure.

- Is Ripple losing its appeal to high rewards?

In the last 48 hours, RIPPLE (XRP) has experienced significant sales pressure, and 1.11 billion tokens have been off -loaded off, allowing the price to 1.95 -$ 2 support.

Historically, this level provided strong support and served as a major accumulation area for buyers. But can history be repeated if the sales pressure is still high and the market conditions are not clear?

Are you trying to split the floor of XRP?

So far, XRP has tested $ 1.95 -$ 2 support for $ 2.80 since the December rally, and every time the buyer comes in every time.

But this time, the momentum of the entire market, especially the 80K of BTC (Bitcoin), is not as strong as before.

Why is this important? Whale selling is taking place as Bitcoin records the lowest at the lowest score for four consecutive days due to uncertainty about Trump’s ‘mutual’ tariff on April 2.

In the previous recovery, Ripple closely followed Bitcoin’s $ 77K. As long as BTC has more than $ 80K, $ 2 support for XRP can be strong. But when the BTC is shaken, the XRP can face more disadvantages.

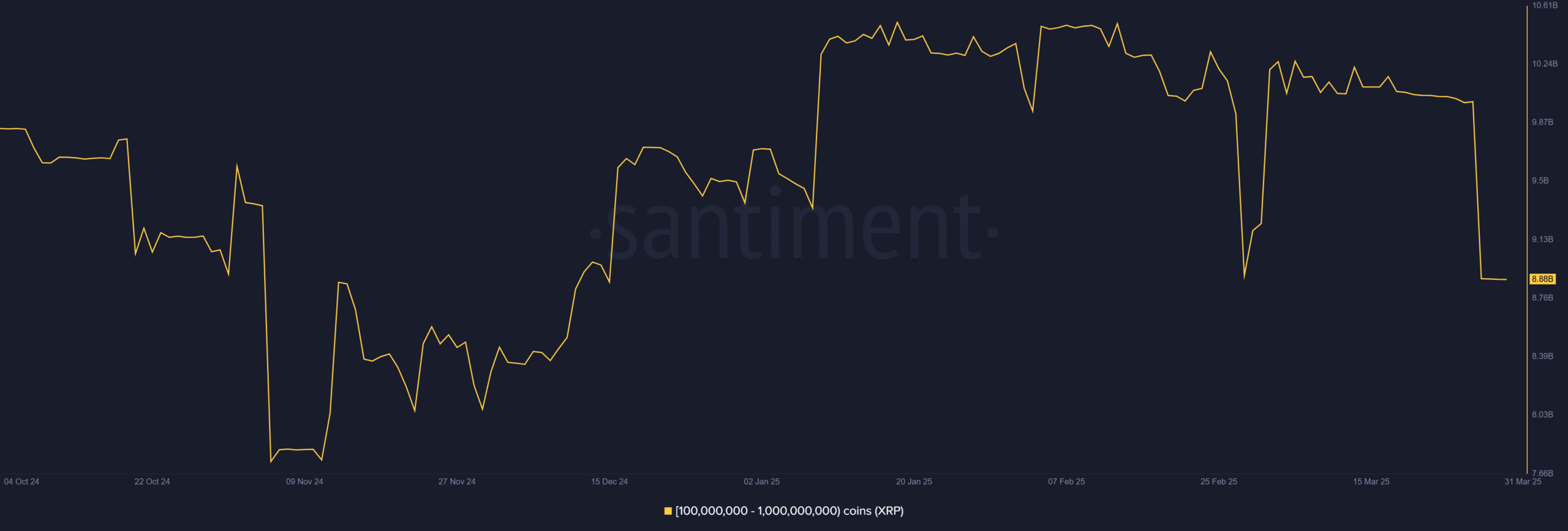

The main whale cohort with 100m – 1B XRP played an important role in the past rebound. In the late February, I injected $ 4 billion into XRP to recover to $ 2.50.

Now two days, this whale has abandoned more than 2 billion XRP.

Source: Santiment

If the whale does not come back soon, the $ 2 support for XRP can be a problem. In particular, problems may arise as the pressure of both market trends and internal factors increases.

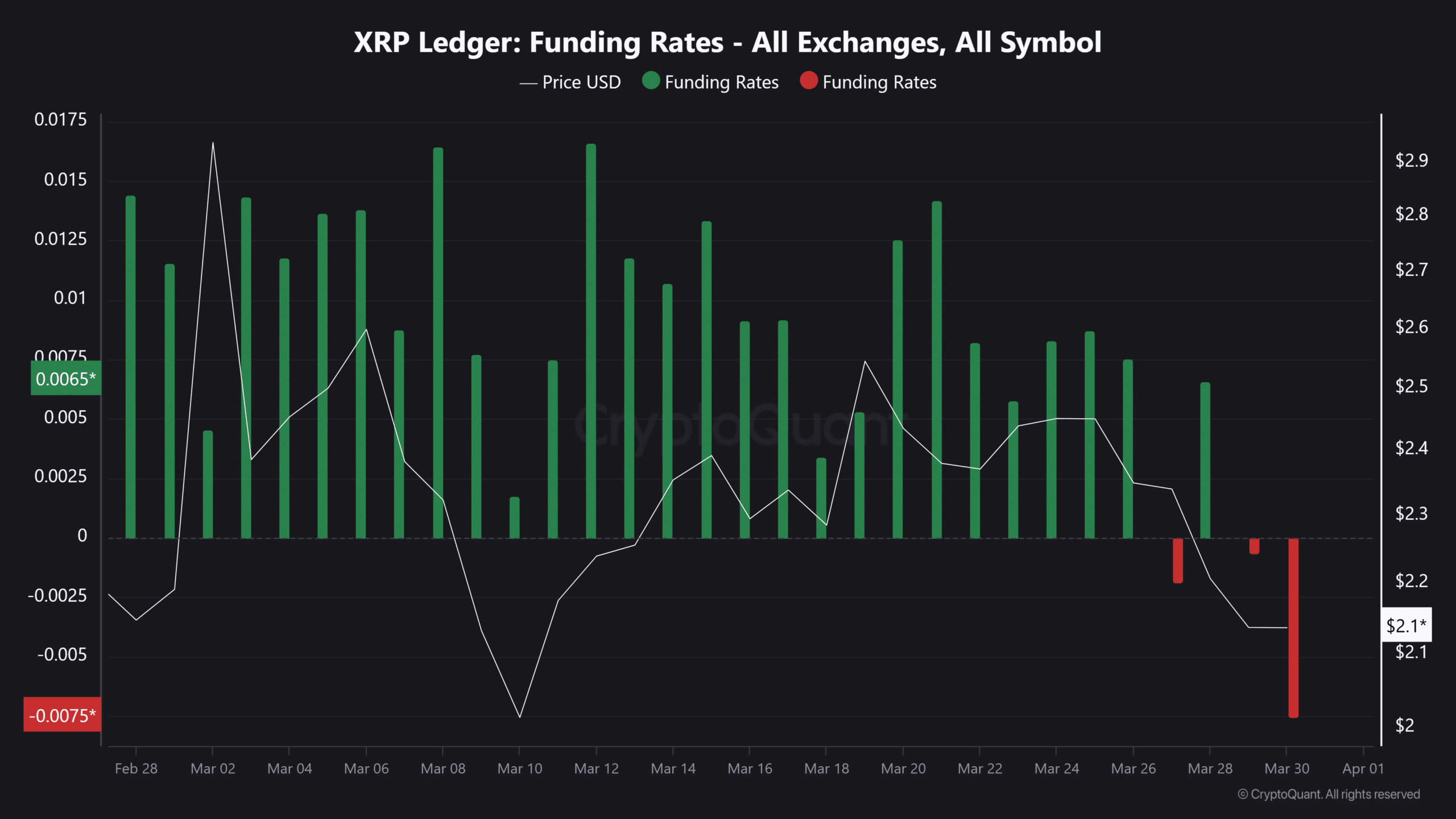

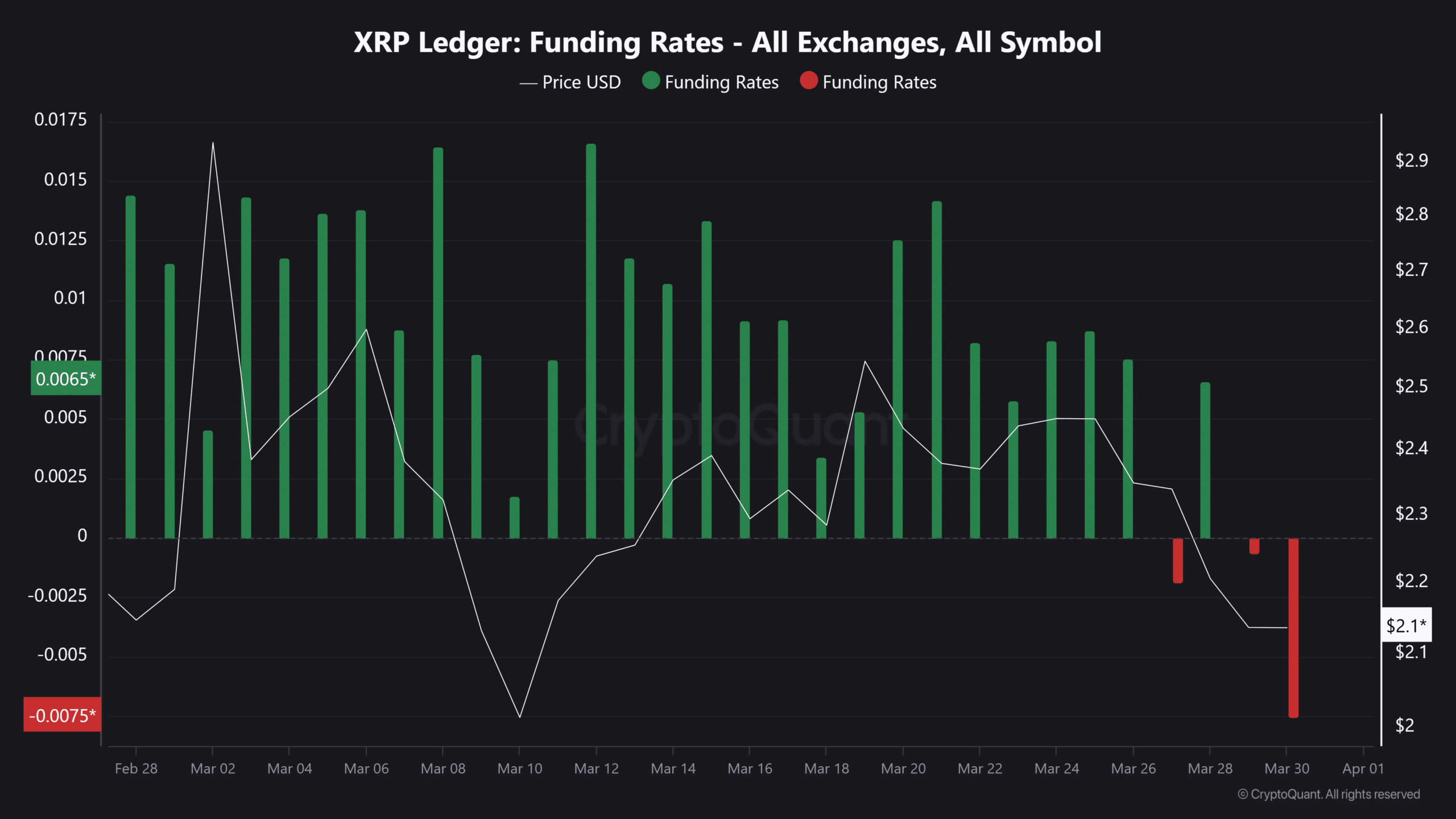

Short sellers use uncertainty

Risks are shocking as market volatility increases.

The ELR (Extrated Leverage Ratio) is close to the lowest level in March and high risk, and sales orders continue to rise, adding to the supply of XRP in the futures market.

Can supply shock happen? maybe. XRP surpassed 77 million orders in the branch market, with 86 million people flowing from Binance. However, it is not enough to offset the pressure from the future and the big player.

According to concerns, short sellers show that short prejudice increases in permanent contracts by using negative negative market sentiment for the first time this month.

Source: cryptoquant

If this trend continues, long pressure can push XRP to less than $ 1.95.

If Longs does not see the main accumulation of derivatives so far, the main support of Ripple is in danger. Especially if Bitcoin is lost after tariff news.