- XRP’s support is suffering due to poor price trends.

- Currently, over 1 billion XRP holders have lost their profits.

Although XRP has faced challenges recently, it has successfully managed to stay above critical thresholds. How is total supply doing in terms of profits and what factors could help sustain the current price range?

XRP relies heavily on support

At the end of last week, the price of These moves signaled positive momentum.

However, a 2.46% drop earlier this week erased those gains and brought the price down to around $0.52.

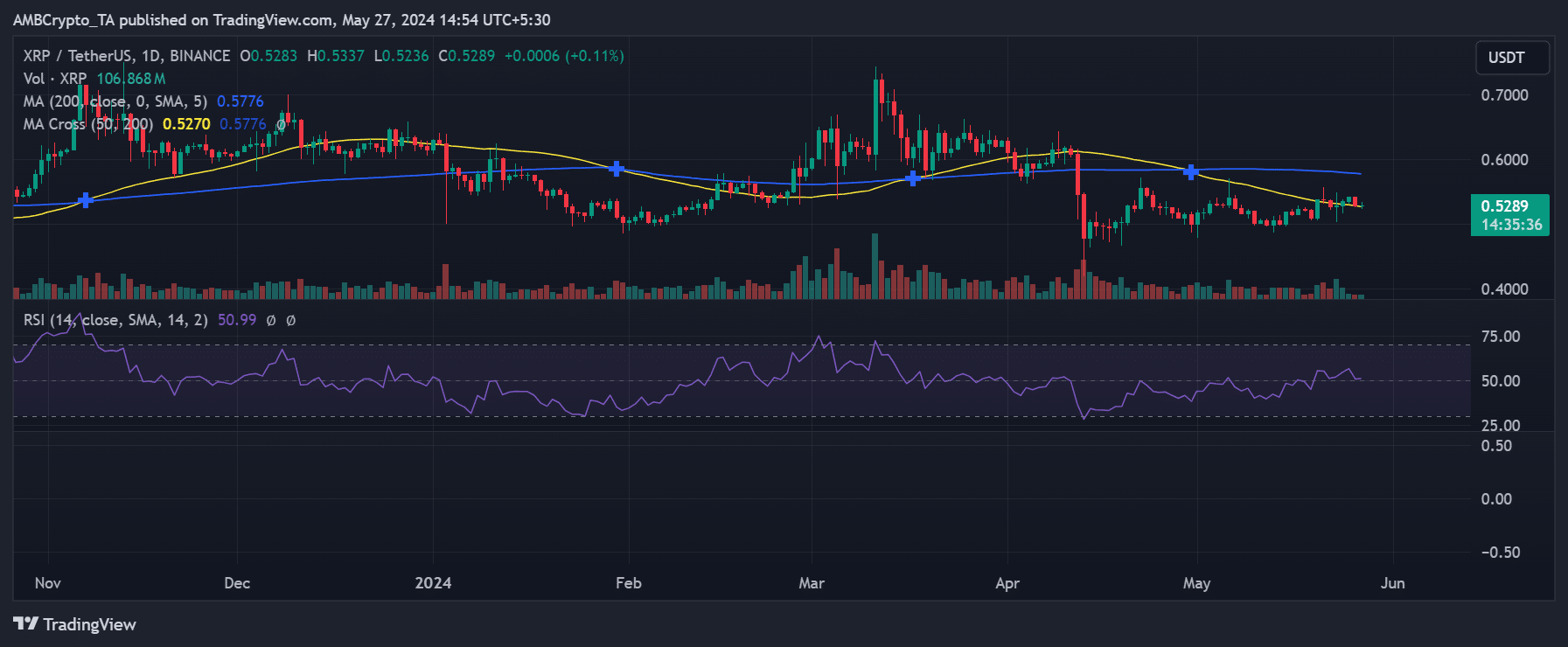

At press time, the price was trading around $0.52, with the yellow line currently acting as immediate support.

Source: TradingView

The long-term moving average (blue line) held a resistance level around $0.58. Additionally, the Relative Strength Index (RSI) indicates that XRP is experiencing a mild bullish trend.

RSI is currently at the neutral line and could fall below the neutral line if prices decline significantly.

XRP demand remains constant

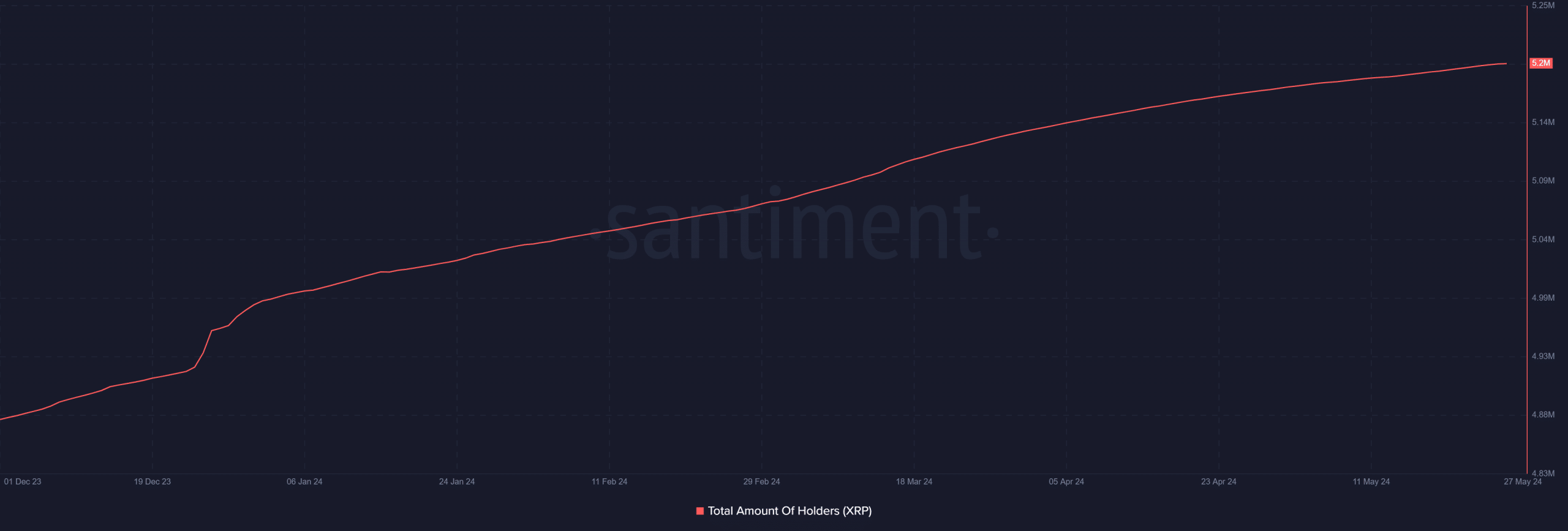

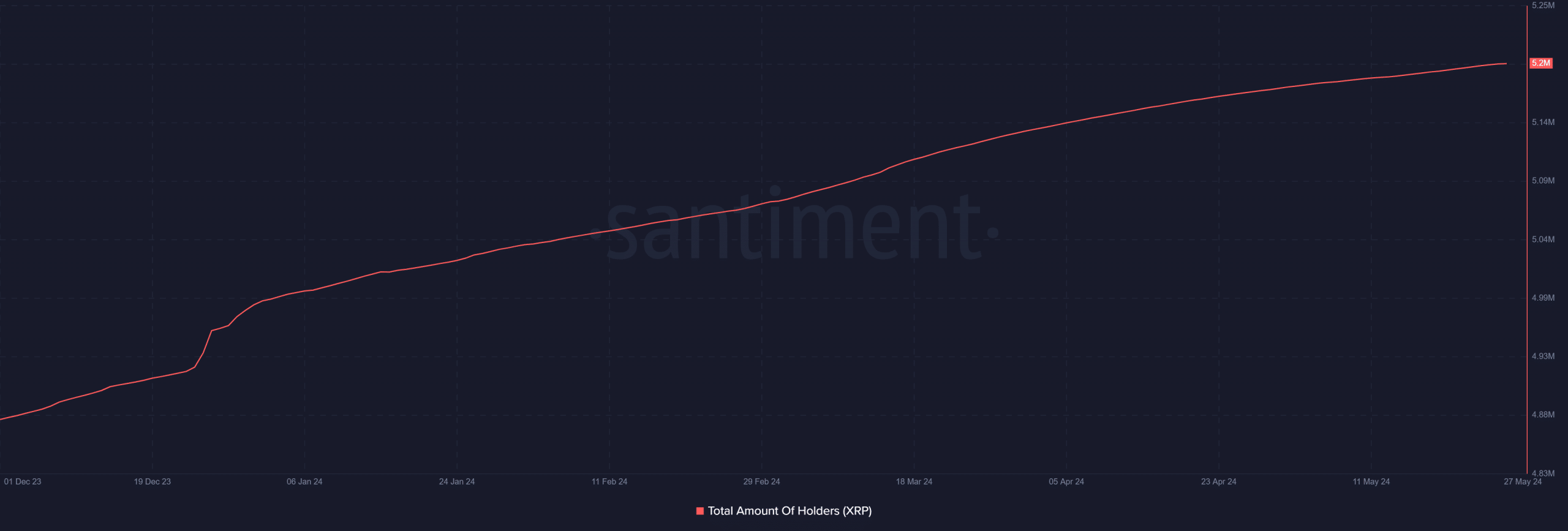

AMBCrypto’s analysis of the total number of XRP holders shows that demand has been relatively flat in recent days, with approximately 5.2 million holders at the time of writing.

This figure has remained unchanged over the past three days, indicating that there is no rush to accumulate assets despite the price trend.

Source: Santiment

There hasn’t been much activity recently, with trading volume hovering around $793 million.

Given these low activity levels, the current support may have difficulty maintaining, potentially leading to a price decline soon.

reduced profit supply

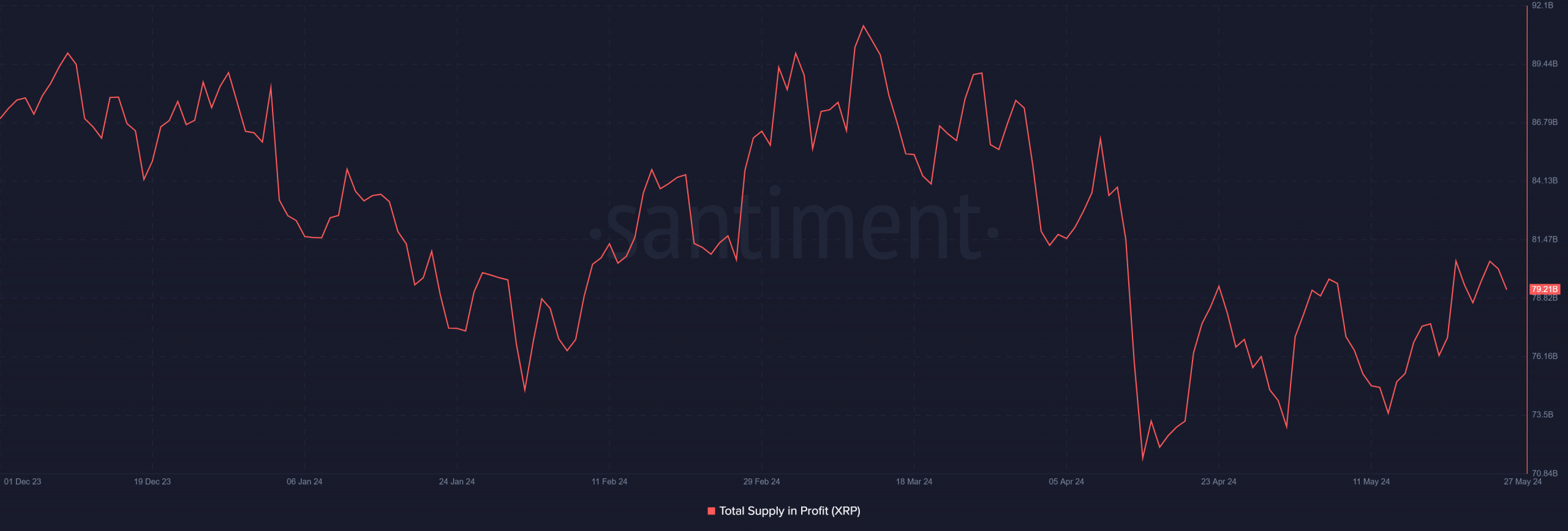

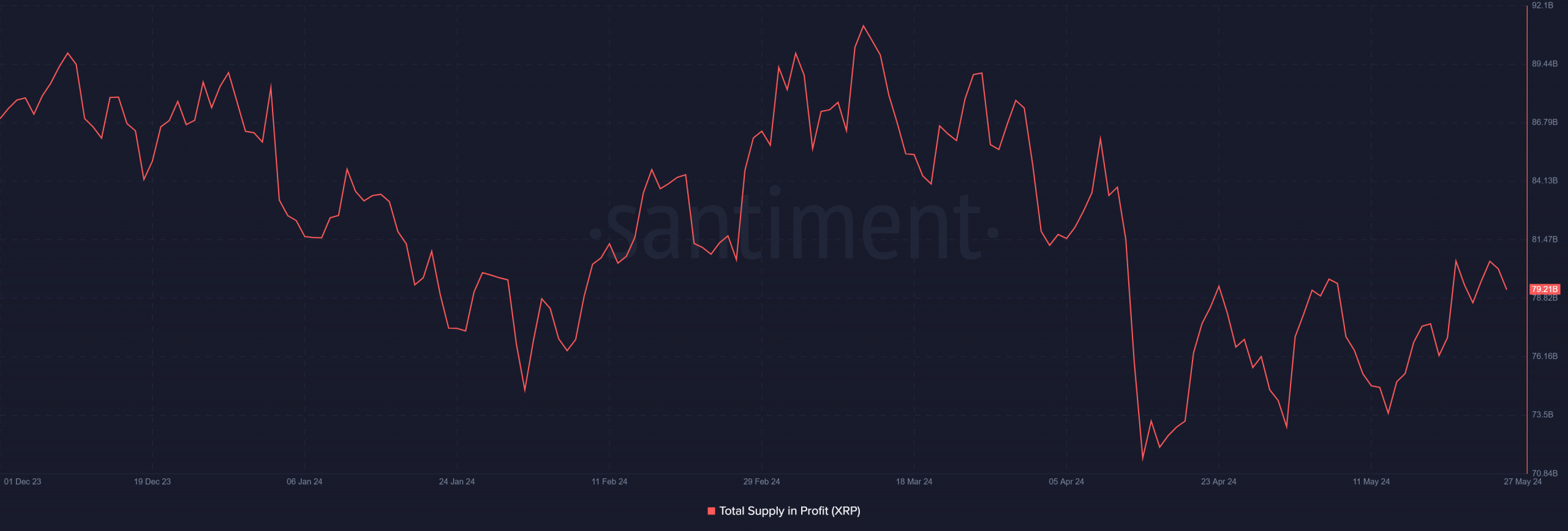

AMBCrypto’s investigation of the total supply of

A study of Santiment charts showed that approximately 1 billion XRP had shifted from profitable positions to losses between May 25 and press time.

Source: Santiment

Realistic or not, the market cap of XRP in BTC terms is:

On May 25, revenue exceeded 80 billion XRP, but at the time of writing it has decreased to approximately 79 billion XRP.

These changes have reduced the supply-to-profit ratio from over 80% to around 79% at the time of this writing.