- XRP has been witnessing some range accumulation over the past month.

- Short-term speculative sentiment was bearish, but a near-term rise to $2.4 is expected.

Ripple (XRP) has a bullish long-term outlook. The rally to $2.9 led to the formation of a steadily accumulating range from the bulls.

Experienced commodities trader and classic chart analyst Peter Brandt recently called for a market capitalization of $500 billion for XRP.

XRP Range Formation and Next Buying Opportunity

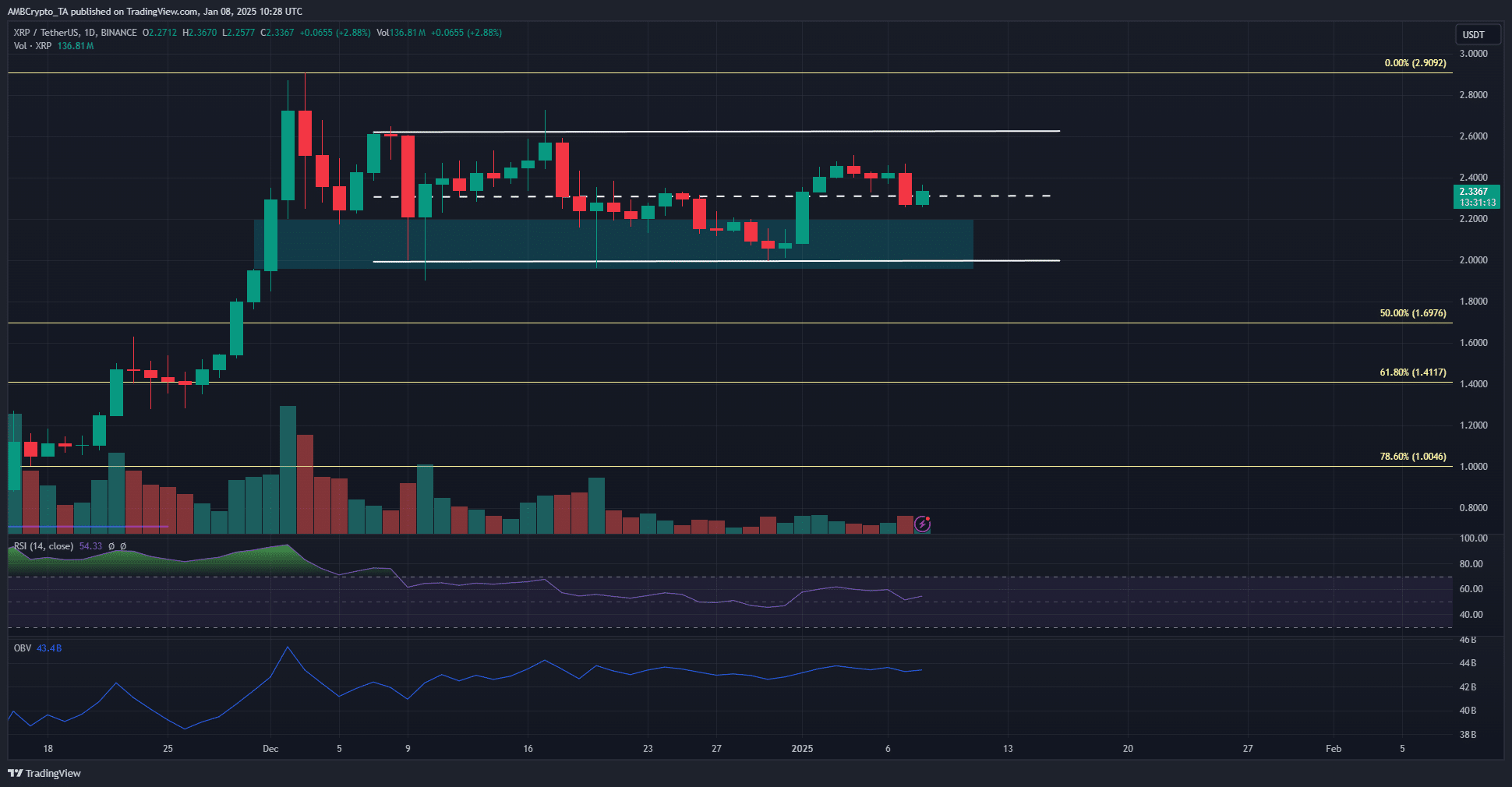

Source: XRP/USDT on TradingView

During the month, XRP traded in an extended range from $2 to $2.62. The intermediate level of $2.31 has acted as both support and resistance over the past month and was at press time.

In the south, the fair value gap in late November was the next demand zone where XRP could see a bullish response. Despite the range formation, OBV has been rising slowly over the past month.

This was an encouraging sight and showed that selling pressure was weak. RSI on the daily chart also remained above neutral 50, indicating that bullish momentum prevails.

Revisiting the lows or the $1.9 level would be a long-term buying opportunity.

Short liquidation is fraught with overhead.

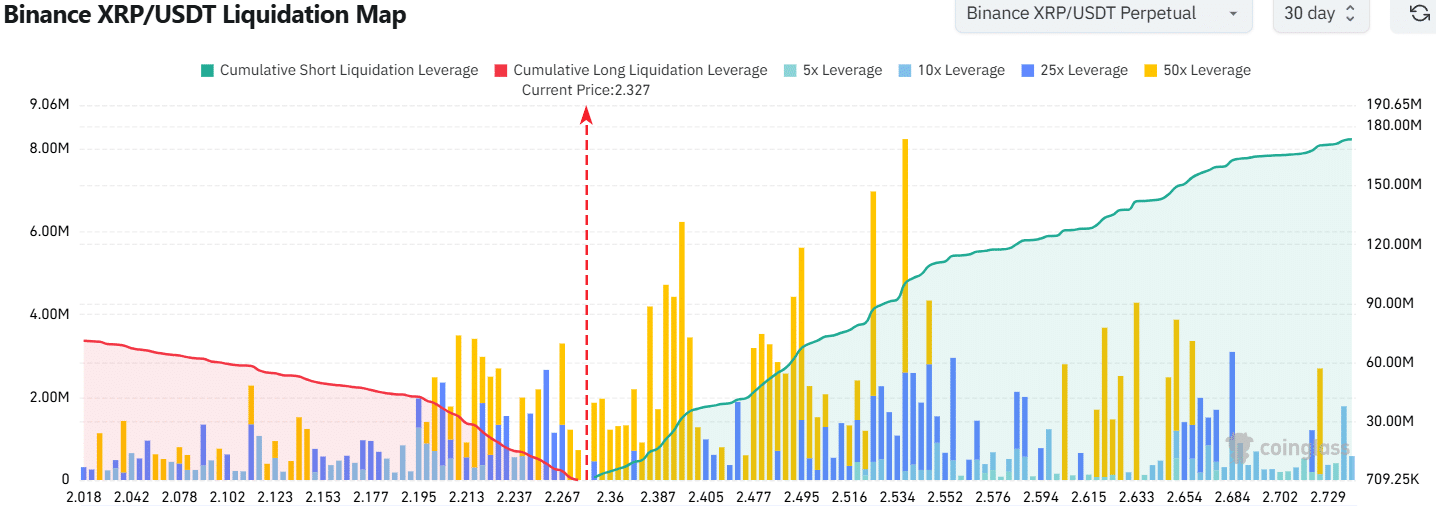

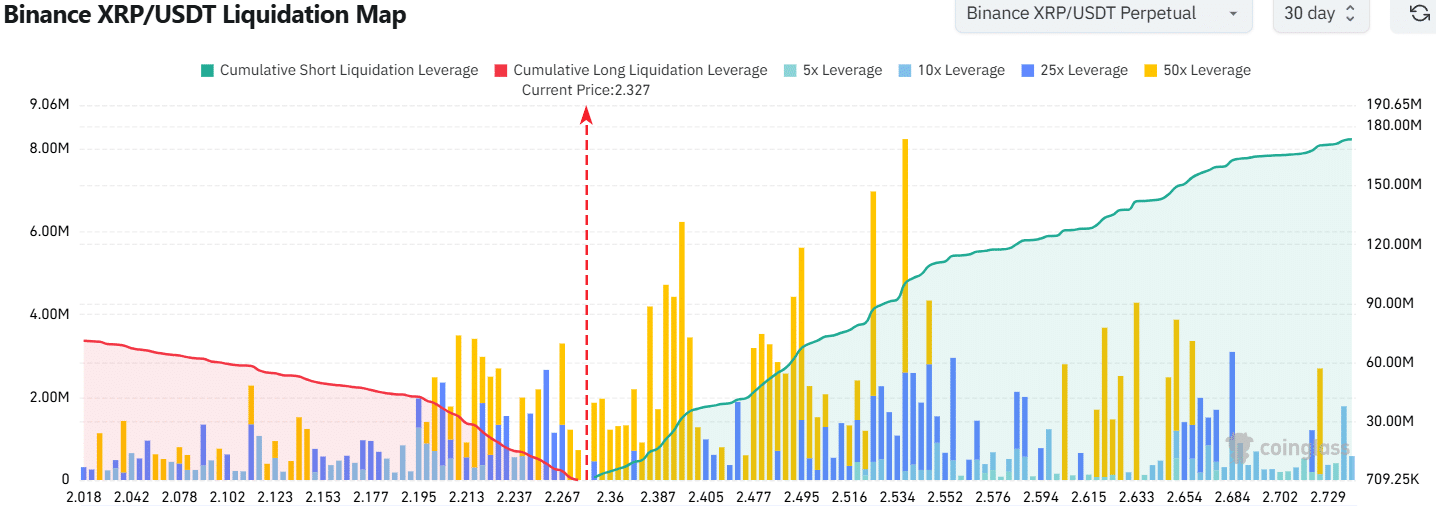

Source: Coinglass

Last month’s liquidation map showed a significant cluster of highly leveraged liquidation levels between $2.33 and $2.4. The cumulative liquidation leverage was $2.4, which was greater than $2.21.

This meant that moving north would result in more liquidation.

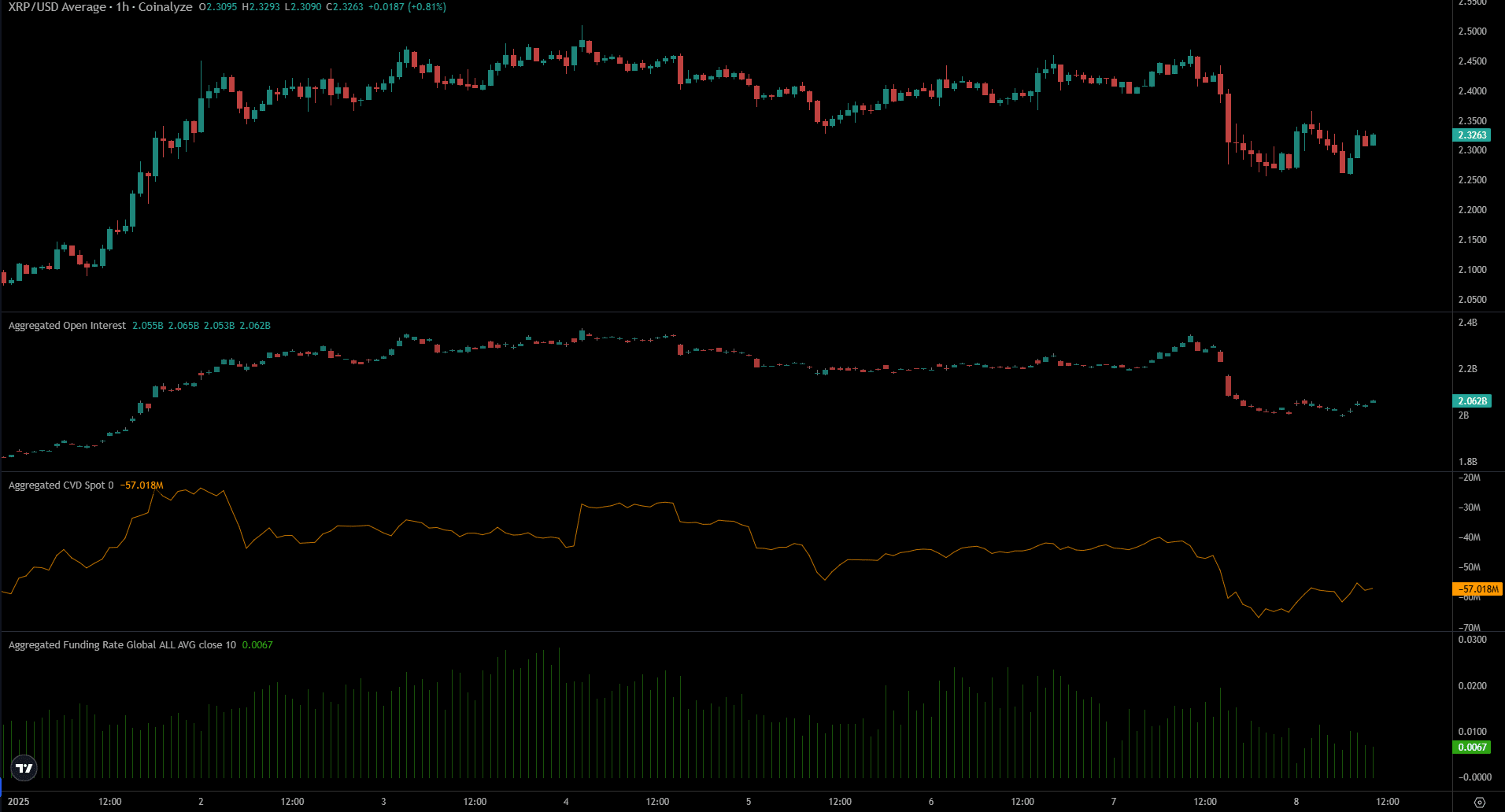

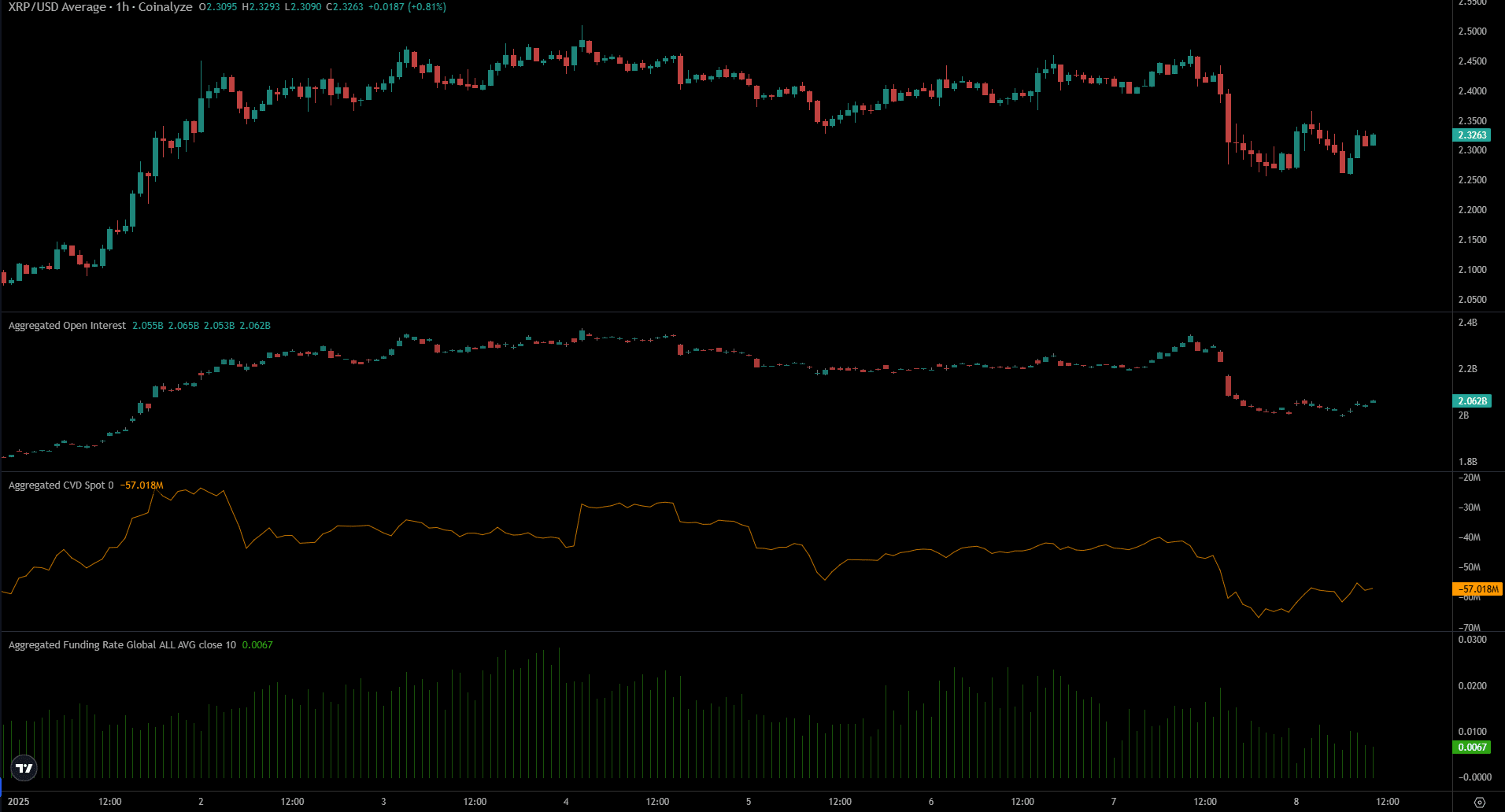

Source: Coin Analysis

Both open interest and spot CVD have fallen over the past 24 hours. This was the result of market-wide selling pressure caused by the decline in Bitcoin (BTC). The funding rate also decreased.

Short-term data suggests a bearish sentiment.

Realistic or not, the market cap of XRP in BTC terms is:

The clearing map hinted that a move near the highs is more likely in the coming days. It was unclear whether a range break would follow.

Swing traders should be ready to take profits during this move and could repurchase $2.35-$2.4 for support during a retest.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.