- XRP emerged as a surprise winner of the “Trump pump,” making HODLing a smart move.

- The cryptocurrency space is constantly evolving, and the fight for dominance is not over yet.

If there is a coin that properly utilizes the “Trump Pump”, it is Ripple (XRP). Long-term HODLers, who have endured three years of stagnation and inactivity, are finally seeing their patience pay off.

Despite expected sell-side pressure as stakeholders staked out profits, bulls showed impressive resilience, fending off two declines within 10 trading days and keeping XRP stable around $2.50.

Now that things are changing, XRP is setting its sights on its next big target: 2025. But the journey ahead is not without its challenges. Especially since Bitcoin (BTC) holds the position of “Mastercard” in the cryptocurrency industry.

So, while XRP may have had the spotlight this cycle, questions still remain. Could this be the dawn of a new era for Ripple, or will Bitcoin’s gravity bring it back on track?

Assessing the long-term potential of XRP compared to Bitcoin

The daily chart shows interesting changes. As Bitcoin consolidated, investors converted their funds to XRP, pushing daily gains to nearly 20% and close to $3. But the overheated situation made modifications inevitable.

Just three days ago, XRP fell 15%, wiping out much of its election cycle gains and hitting a daily low of $2. Still, the rebound was fast critical.

Two main takeaways stand out. FOMO is reinforcing bets for a $3 breakout, and those who were once in the quagmire are now making decent profits, increasing the likelihood of a near-term decline.

But there is a silver lining. Such fluctuations are common in cryptocurrency markets, where rapid entry and exit are common.

So what’s more important? The growing appeal of XRP as a “solid alternative” and “safe haven” to Bitcoin’s high-risk volatility suggests potential changes that require deeper exploration.

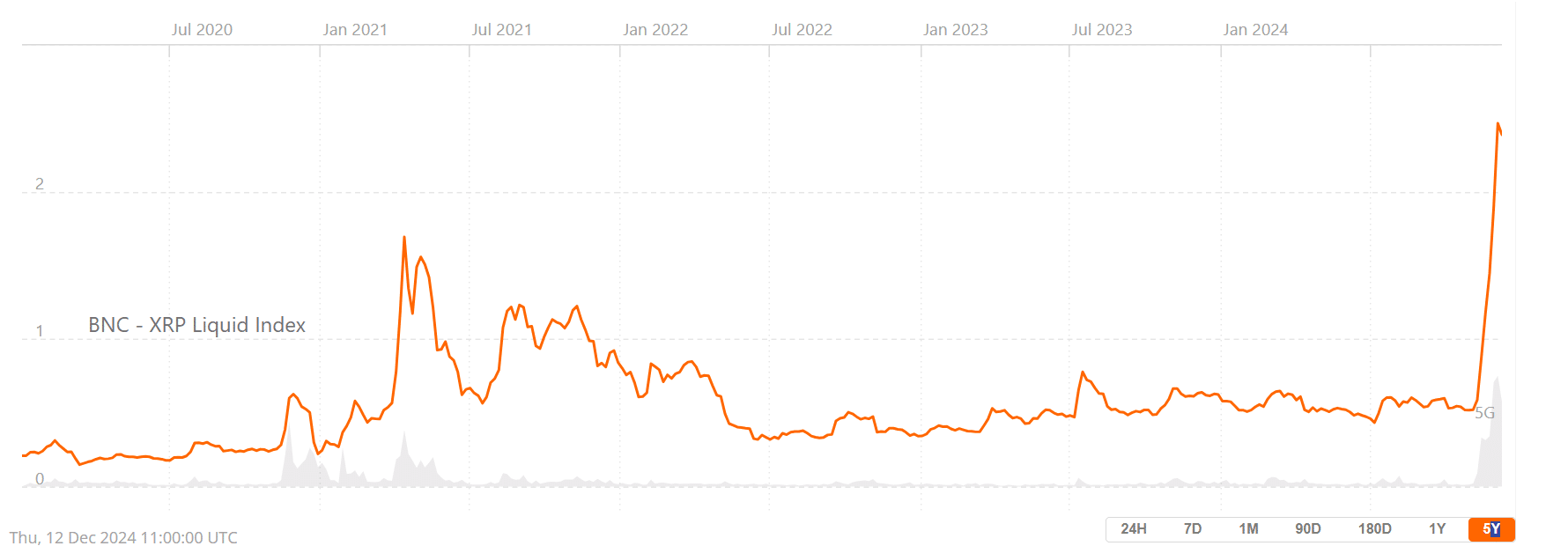

Source: BraveNewCoin

In a healthy market, high demand drives liquidity, and XRP is proof of this. The liquidity index soared to its highest level in five years, signaling a surge in demand for the token. This makes HODLing an increasingly logical choice for investors.

As more investors get involved, we could see more capital flowing into XRP in 2025, especially as Bitcoin’s status as a “risky investment” increases.

With market makers predicting Bitcoin’s all-time high of $200,000, XRP could benefit from increased interest as investors look for stable alternatives.

Simply put, 2025 could be a game changer. This year could see a surge in capital allocation and diversification, testing Bitcoin’s dominance and opening up new opportunities in the altcoin market for both retail and institutional investors.

But what are the odds that Ripple will take the lead?

XRP’s breakout of the $2 resistance line could not have come at a better time and sets the stage for investors to confidently invest in XRP’s future potential.

The psychology behind it is clear. XRP’s impressive 300% surge in just one month has garnered attention, establishing XRP as a strong competitor in the cryptocurrency market.

With this powerful rally, it is no surprise that both retail and institutional investors are putting XRP at the forefront of their portfolios.

Read Ripple (XRP) Price Prediction 2024-2025

However, the race to take the top spot for XRP is heating up. Dogecoin (DOGE) briefly gained attention, but its reign was short-lived. But this does not mean that the throne remains unclaimed. Other competitors are lurking, waiting for their opportunity.

So, while the current situation is favorable for Ripple and it has a reputation as a safer bet during volatile times, securing dominance will not be easy.

To stay ahead, XRP must continue to break down key psychological barriers in any bull market. In the near term, reaching $3 could fuel FOMO and maintain momentum.

However, XRP will need to break much higher levels to cement its place as a top investment in 2025. It must prove that it is here to stay and not just another passing trend.