- According to XRP indicators, the bullish trend is likely to ease somewhat in the next 1-2 weeks.

- Traders should plan and prepare for two possible scenarios in July.

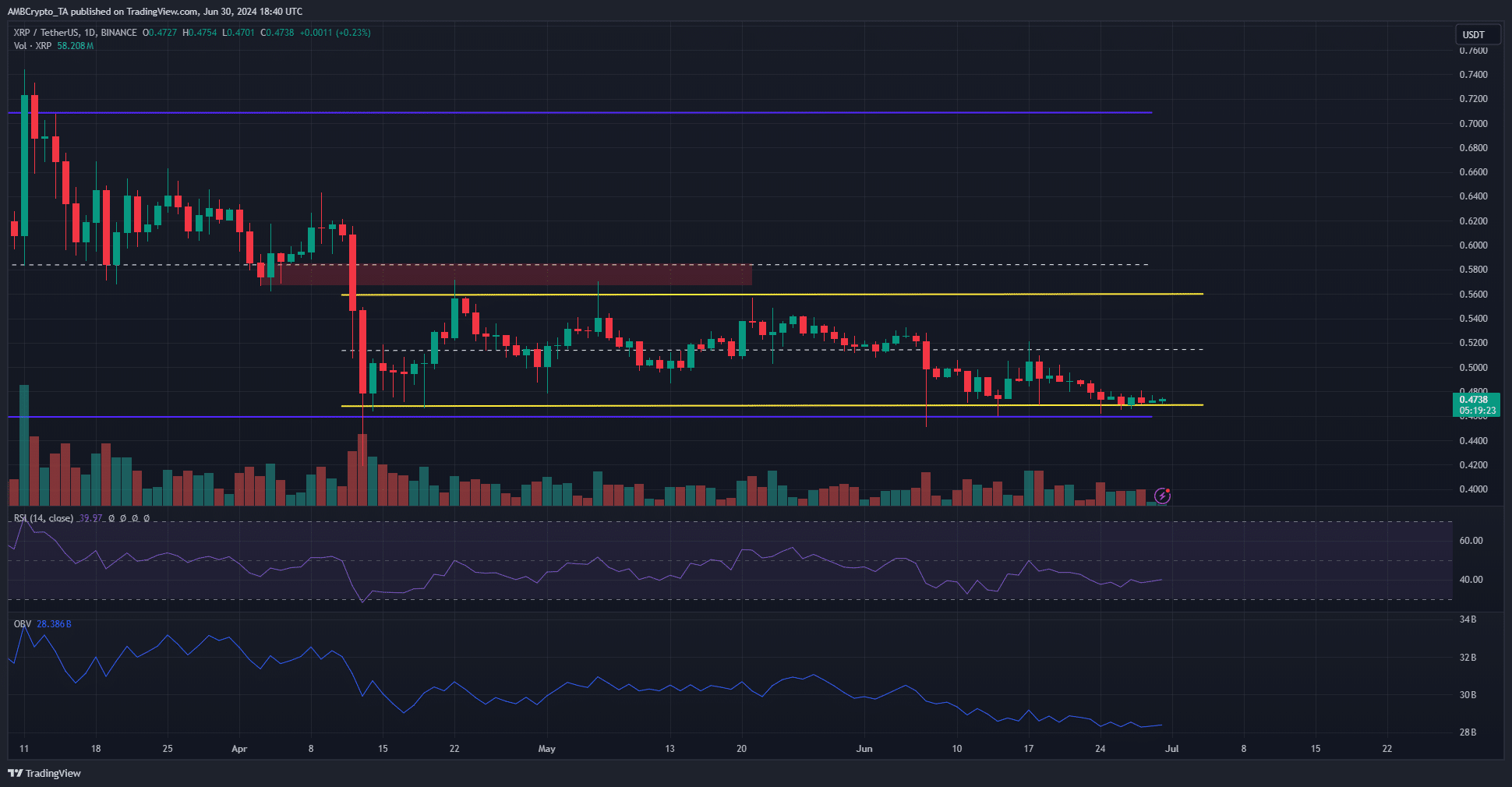

Ripple (XRP) was trading at the low end of a range that dates back to mid-April. A recent AMBCrypto report noted that prices have formed a bullish pattern while consolidating in recent days.

Source: XRP/USDT on TradingView

If the price can break out of this wedge pattern, a 30-40% upside would be more likely. However, in the current situation, momentum and volume indicators highlight bearish pressure.

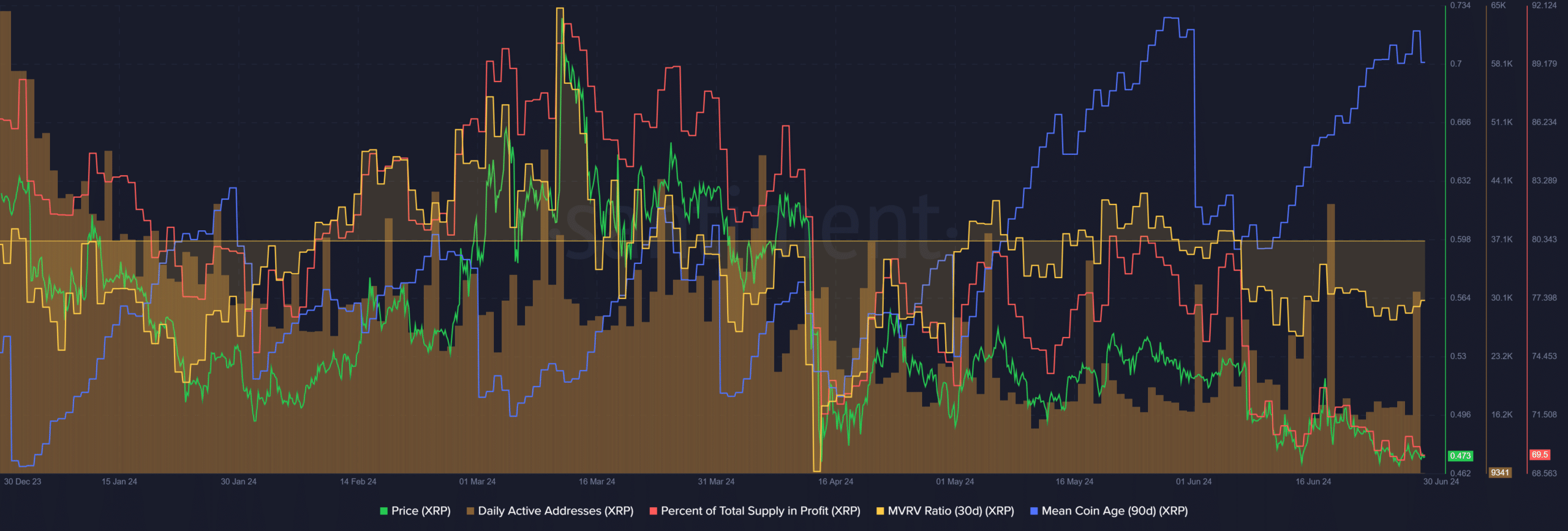

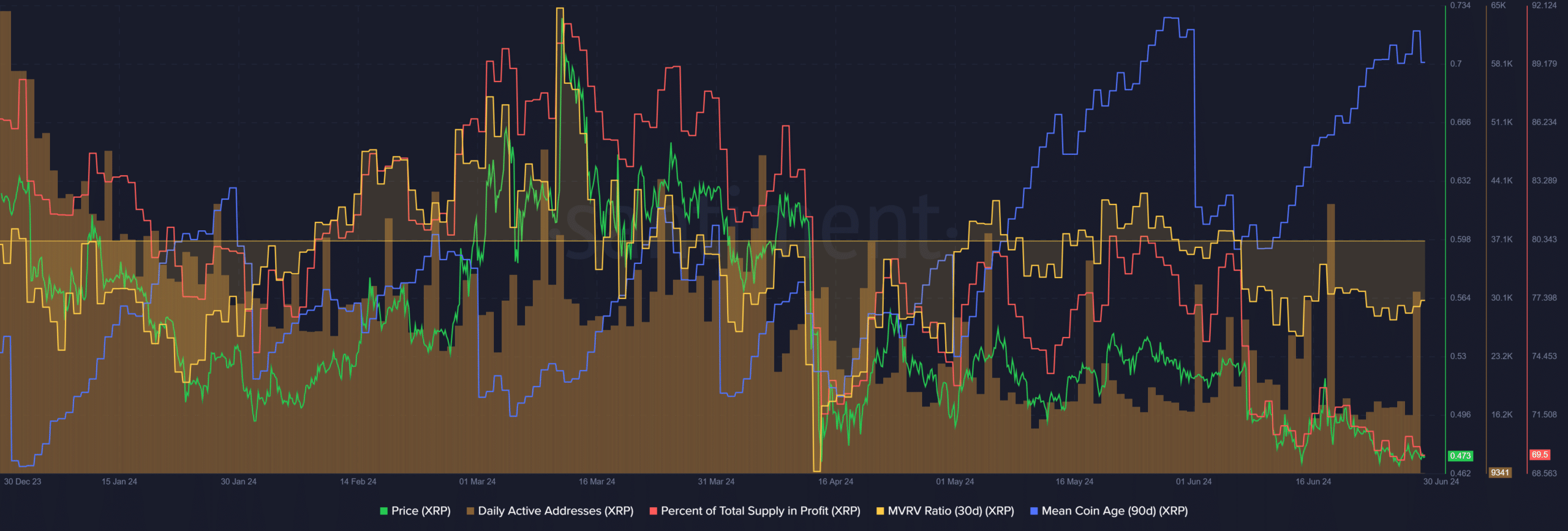

XRP on-chain indicators indicate buying opportunities.

Source: Santiment

Daily active addresses have been trending down slowly since late March. There were significant spikes in activity on certain days, but overall the indicator was trending down. This was a negative sign, indicating a decline in usage and demand.

The supply ratio of profits also fell along with prices in June, which is not surprising. Price movements have pushed the 30-day MVRV into negative territory.

However, since last month, the average monetary age has started to show an upward trend.

Together, the rising average coin age and the falling MVRV have shown signs of accumulation and undervalued assets, which is a buy signal. Should traders take it?

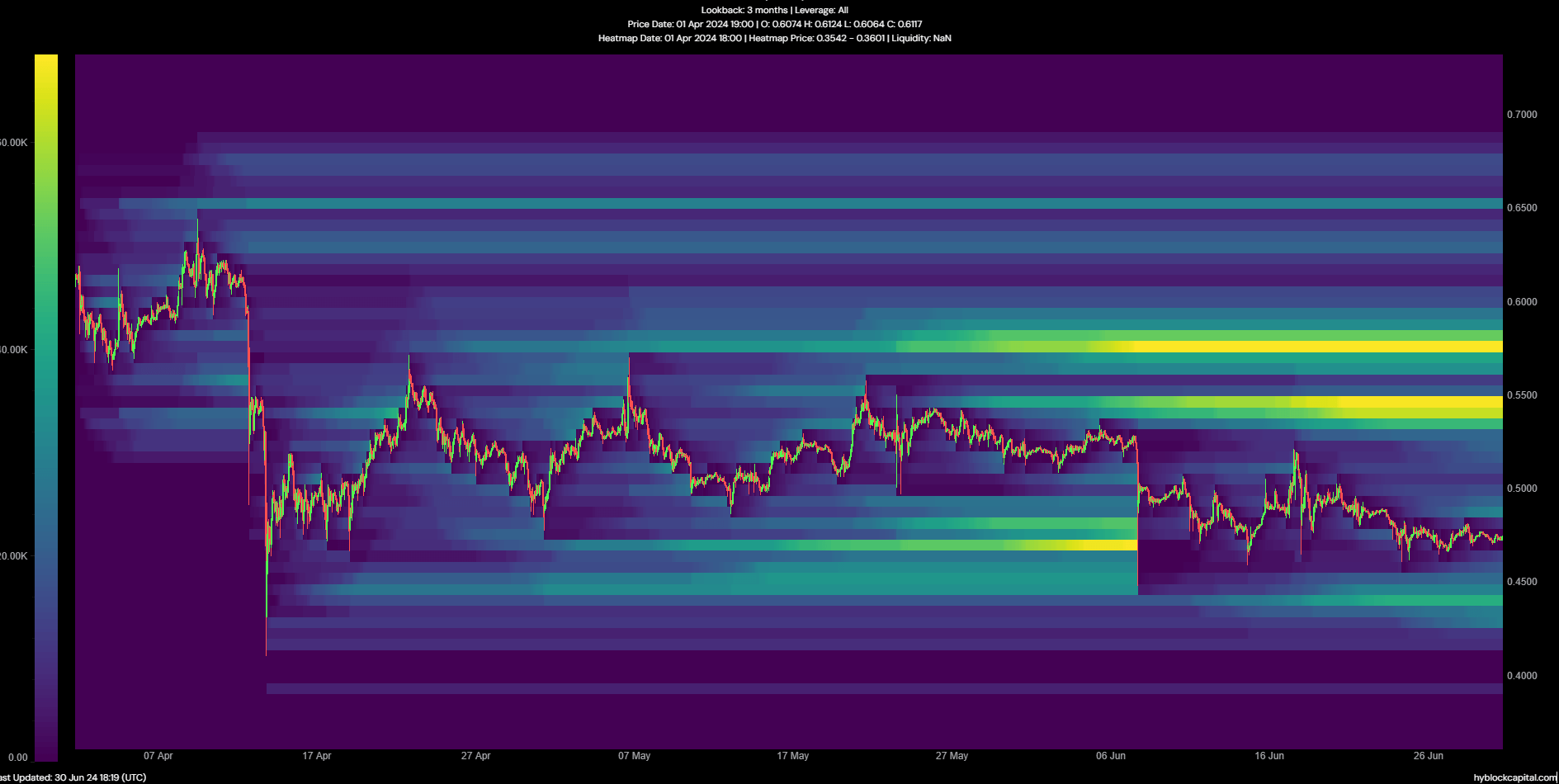

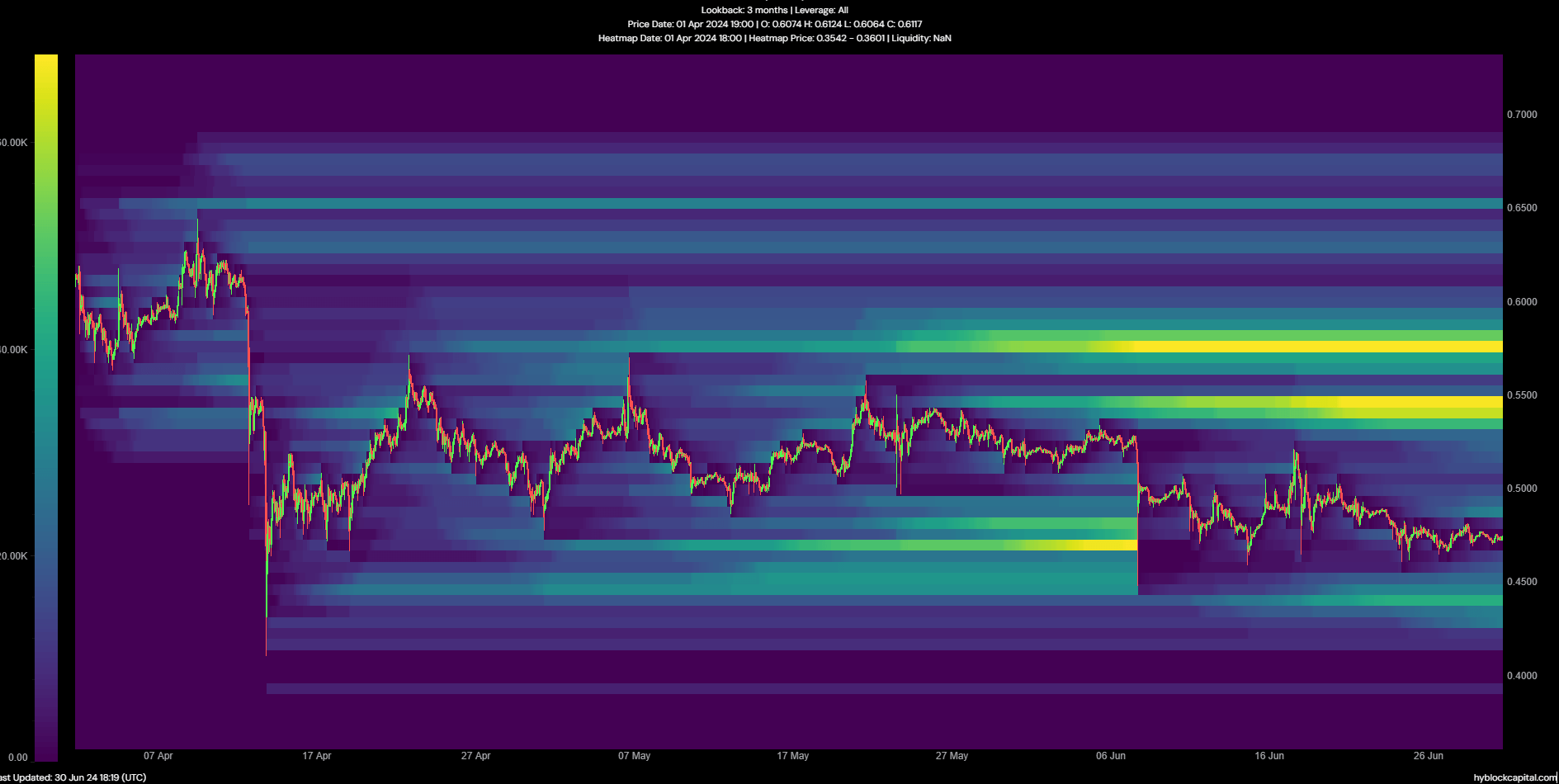

Liquidation data and two scenarios that could unfold here

Source: Hiblock

The liquidation heatmap showed a large concentration of liquidation levels just below the $0.55 level. This magnetic zone is likely to push the price higher towards a short-term liquidation.

However, $0.436 provided another attractive liquidity close to the market price.

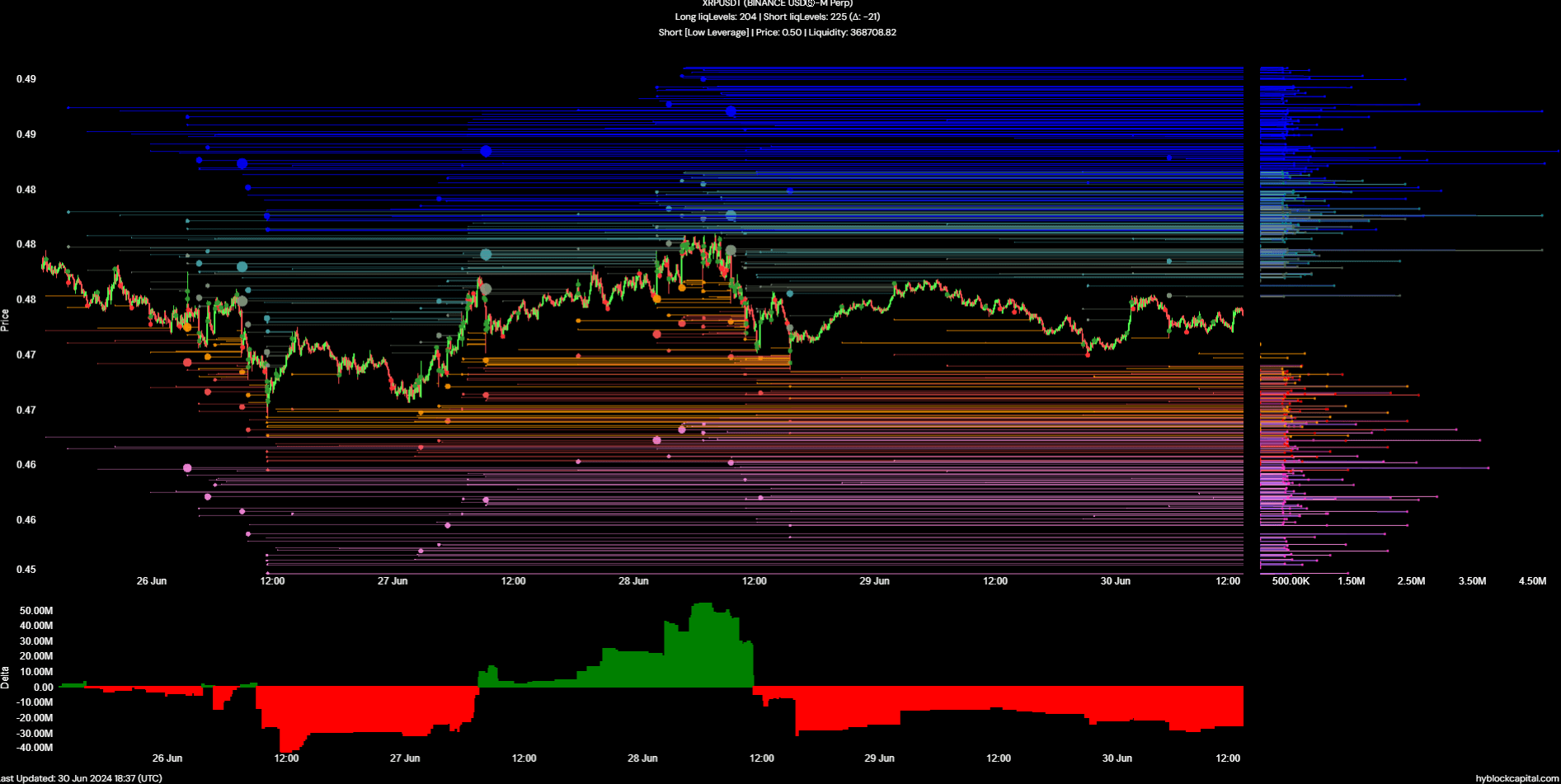

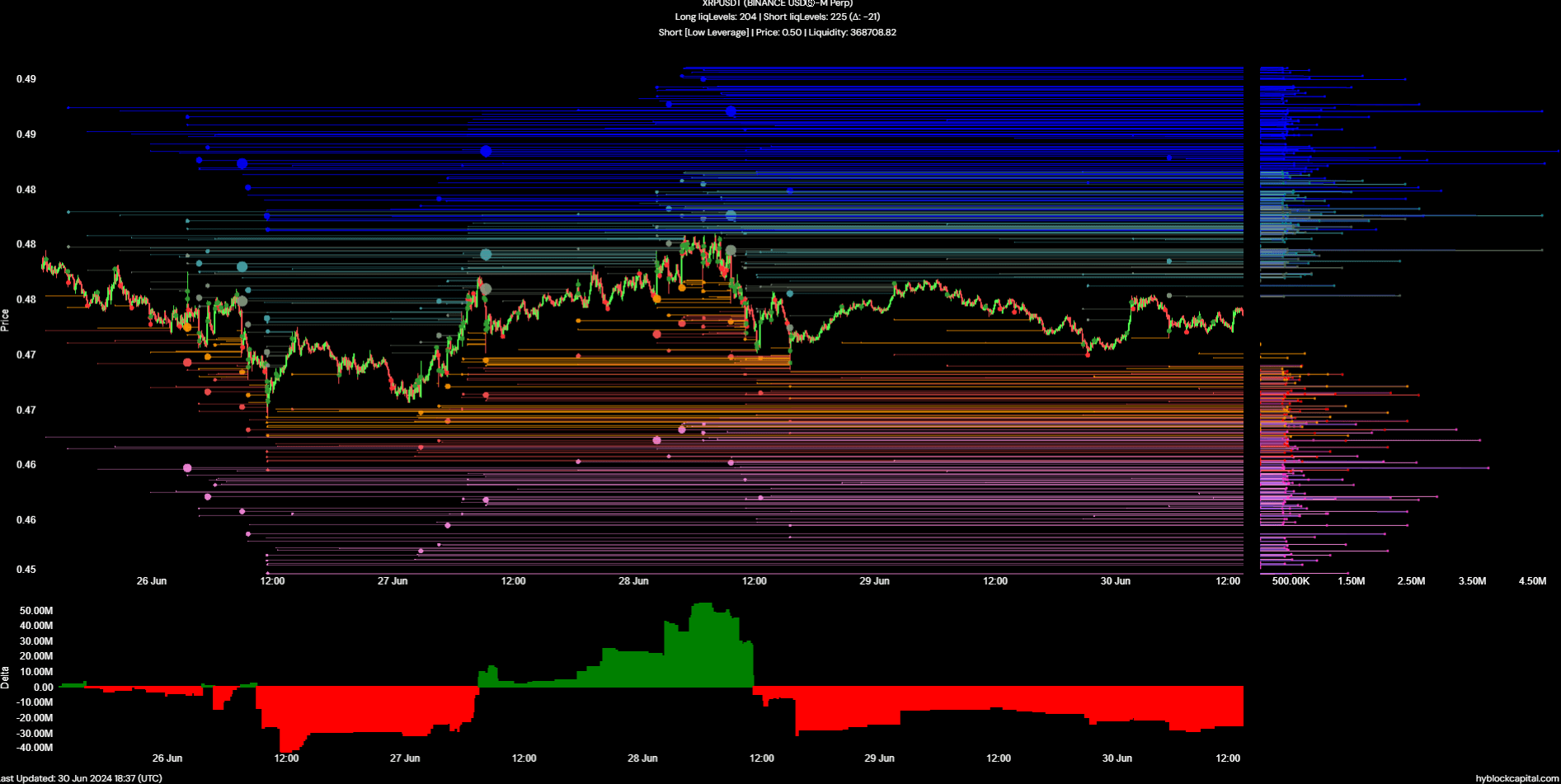

Source: Highblock

The cumulative liquidation level delta was very negative. This means that long-term liquidation levels are much higher than short-term liquidation levels.

Realistic or not, the market cap of XRP in BTC terms is:

In turn, this suggested that a higher rally could begin to pressure these short sellers. The $0.485 level is the key near-term target, almost 2.5% above the price. In one scenario, XRP reversed recent losses and surged to $0.55.

In another scenario, XRP could rise to $0.485-$0.49, be rejected, drop to $0.436, and then start a recovery with the price moving towards the high of the $0.56 range. Traders should be prepared to adapt as the situation arises.