Analysts are discussing the XRP director (XRPL), and patrons welcome the combat test backbone for the future of payment between borders.

Critics, on the other hand, say that it is a dangerous over -assessment betting on not realized potential.

Was the XRP director in preparation for or overestimated in the global size? Analyzers’ discussion

Ripple CTO DAVID SCHWARTZ, between the XRP leaders, explained why XRPL is in a unique position that can serve as an important infrastructure for global financial systems.

In a detailed thread, Schwartz emphasized that XRPL is flexible and interoperable to smoothly connect assets, markets and participants that cross the border. He said that it comes after 13 years of upgrades, institutional adoption and live network stress tests.

Ripple Executive contrasted XRPL’s open -licensed design (including features with permissions for the regulatory environment) for the closed centralized blockchain.

Based on this, Schwartz claims that open infrastructure provides wider range and adaptability. He also mentioned that it is adopted by a new chain for the use of the low predictable transaction cost (part of the center paid by XRP) and the decision -making final performance consensus mechanism.

Schwartz said, “The encryption tent is growing.

In the face of XRP’s $ 190 billion valuation,

But Ripple’s CTO depicts an inevitable world -class picture, while the difficult numbers tell a more cool story.

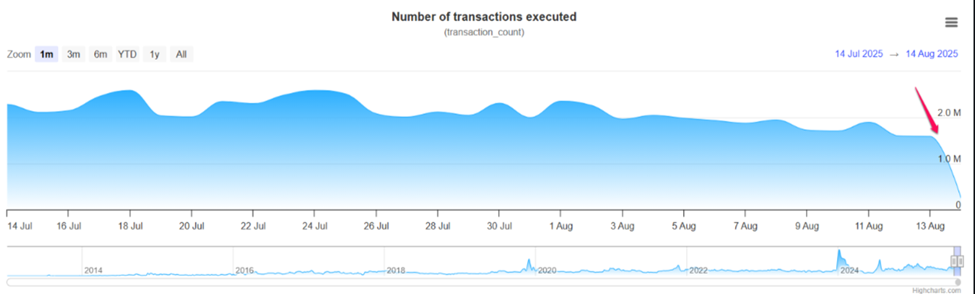

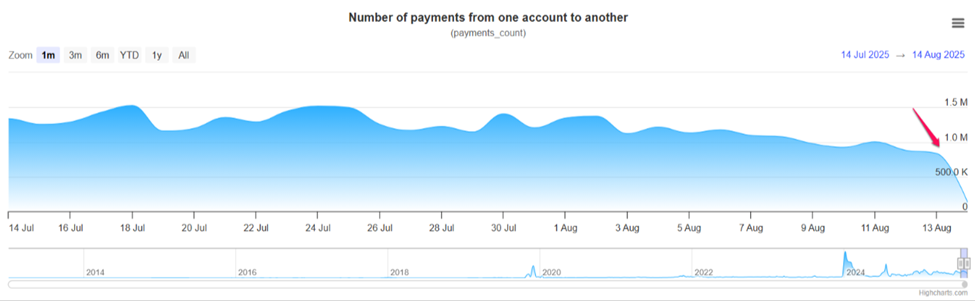

In the last 30 days, the number of transactions in XRPL has decreased from 2.59 million to 1.5 million, down 38%.

Payments on the network were almost 50%reduced from 1.5 million to 835,000. This weakens the expectation that the use of warm chains will increase with the recent surge in XRP.

The data of defillama elsewhere shows the XRPL’s Total Value Locked (tvL). Meanwhile, the app revenue ranges from $ 200 to $ 300 and the app fee is $ 1,367.

This leaves a network of 2,200 times the market cap of 2,200 times higher than most major chains.

Investment analyst Tyler Hill warned that there is a difference between the $ 190 billion market cap and $ 87.7 million TVL signals.

“RSI shows a weak difference → Potential reduction is $ 2.32. The speculation is high, but will the chain growth will be caught before the price is cold?” Hill wrote on X.

Kollyan Trend, an influenzon and market watcher, is called the rate of betting the merchants greatly in the future.

However, I wondered if the current evaluation reflects the actual utility or reflects overtime advertising.

XRP has surged almost 600% since November and is currently trading at $ 3.30. Nevertheless, the gap between the price and the hotint has expanded.

For optimistic investors, XRPL’s long history, payment efficiency and institutional structure justify optimism.

On the other hand, skeptics are looking at the volume of trading and small Defi footsteps that have fallen due to evidence that the promised global size of the network is still a distant goal.

Until adoption follows the valuation, it is balanced whether the XRP director acts as a financial backbone until the amount of speculative exercise comes to or, or if he is trying to face a painful calibration.

Post XRP’s intersection: Global financial backbone or $ 190 billion fantasy? It first appeared in Beincrypto.