- The total number of addresses with balances on Tron has reached a new high.

- As demand continues, the value of TRX has risen 40% since the beginning of the year.

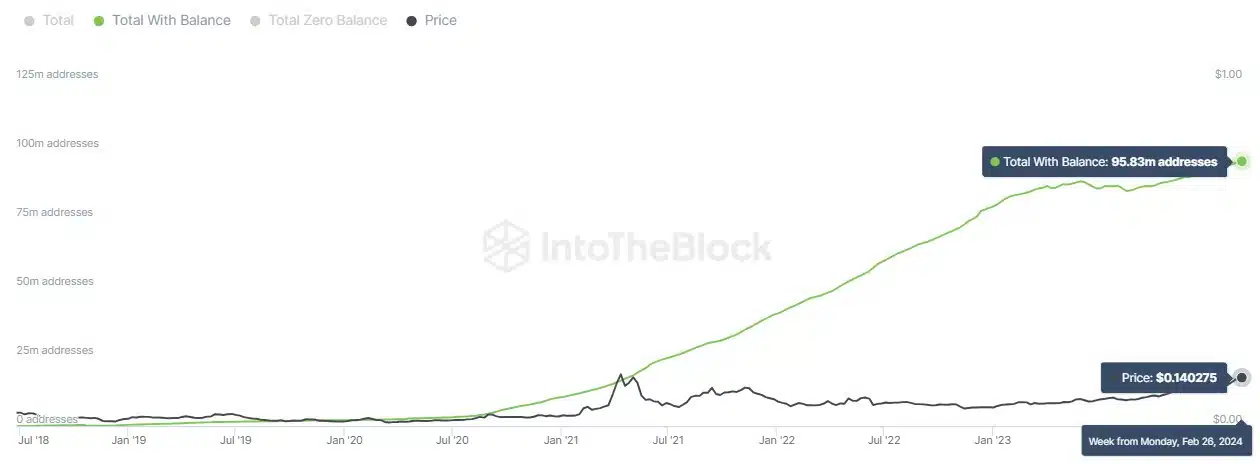

The number of addresses on the public open source blockchain Tron (TRX) has exceeded 95 million. This marks an all-time high in the number of addresses with non-zero balances on the network, according to on-chain analytics platform IntoTheBlock. post to (formerly Twitter).

Source: X

According to the data provider, Tron’s address count significantly surpasses other major layer 1 (L1) blockchains such as Cardano (ADA) and Avalanche (AVAX), which boast 5 million and 7 million addresses respectively.

Years on Tron so far

An evaluation of Tron’s year-to-date (YTD) on-chain activity revealed a surge in new demand on the L1 network since the start of the year.

AMBCrypto observed Tron’s new adoption rate. This measures the daily rate of new addresses making their first transaction among all active addresses on a given day, and found that it has increased by 21% since January 1.

As of February 28, the network’s new adoption rate was 12%, meaning that 240,000 of the 2 million active addresses recorded were new.

Source: IntoTheBlock

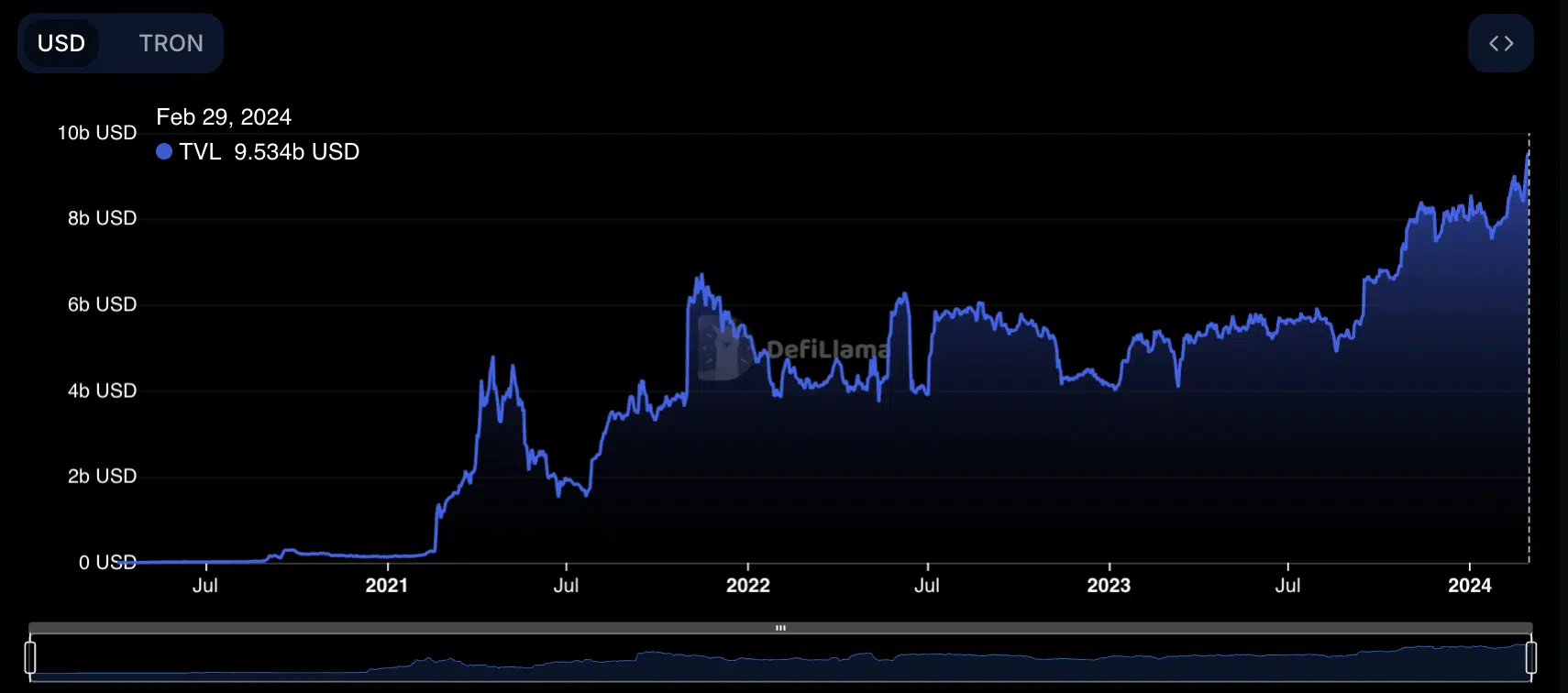

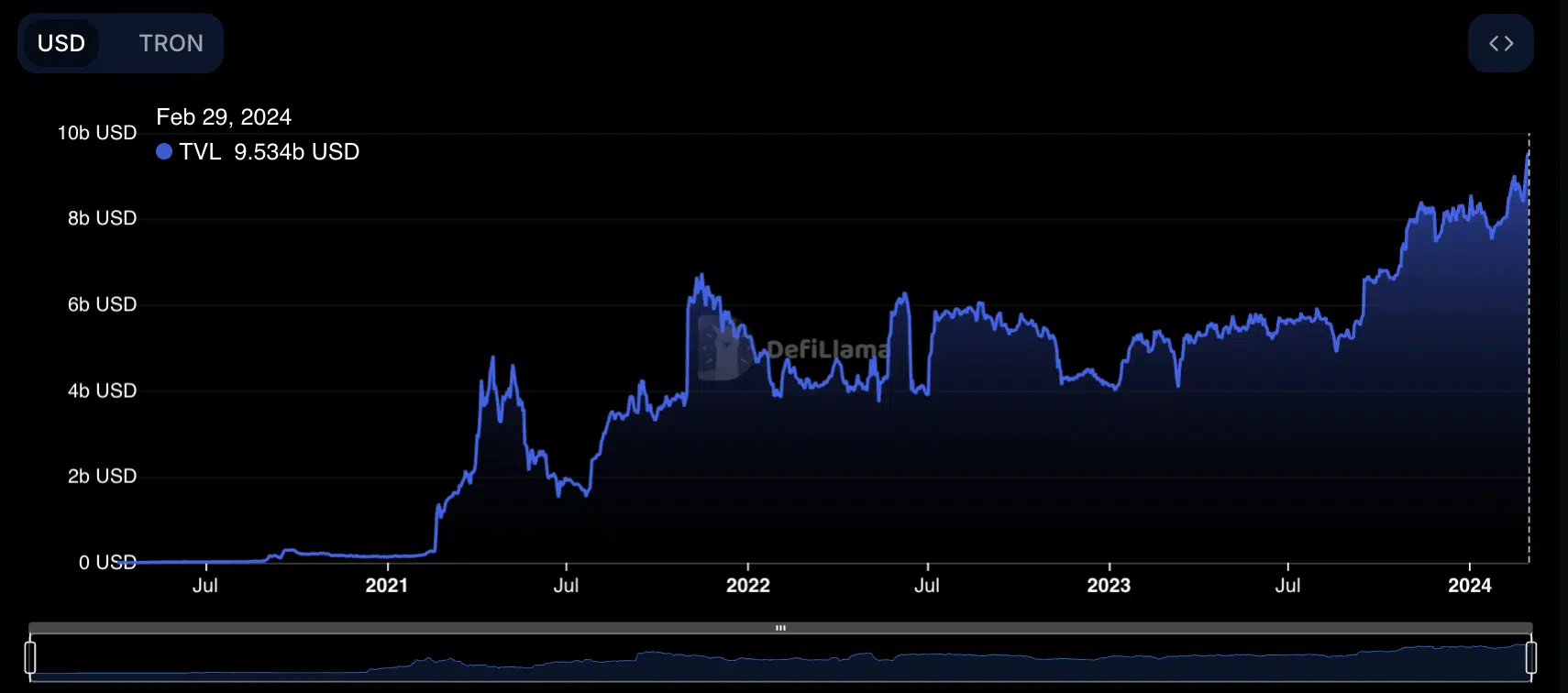

One way the surge in new demand for Tron has been seen since the beginning of the year is through the increase in decentralized finance (DeFi) Total Value Locked (TVL). per data DipilamaAt press time, the network’s TVL was $10 billion, up double digits over the past month.

Since January 1st, Tron’s TVL has surged 27%. AMBCrypto stated that at current values, Tron’s TVL is at an all-time high.

Source: DefiLlama

As expected, high user activity impacted Tron’s network fees and resulting revenue. According to data from token terminalNetwork fees and revenue have both increased by 20% in the last 30 days.

TRX demand rises

At the time of reporting, TRX was said to be trading at $0.14. CoinMarketCap. The value of the coin has increased by 40% YTD.

Looking at the ADL (Acquisition/Distribution Line), continuous demand for altcoins has been confirmed since the beginning of the year, resulting in a corresponding increase in value. At press time, TRX’s ADL was $113.84 billion.

Realistic or not, the market cap of TRX in terms of BTC is:

When an asset’s ADL rises in this way, it means that traders and investors have increased their asset accumulation. This means there are more market participants buying than selling.

Confirming that buying pressure remains high at press time, TRX’s Relative Strength Index (RSI) and Money Flow Index (MFI) are positioned well above their respective center lines.

Source: TradingView