Cardano’s price hit a two-year high of $0.78 on March 5, which caused ADA’s weekly gains to exceed Solana’s performance.

Cardano and other altcoins have seen declines over the past week, while Bitcoin’s dominance (BTC.D) has fallen. On-chain analysis examines how the rapid growth of Cardano’s DeFi ecosystem could help the ADA price capture more value in the future.

ADA price surpassed SOL last week.

Bitcoin has dominated most media headlines so far in March 2024. But Bitcoin’s dominance over the past week highlights how investors are starting to diversify their portfolios as BTC prices reach record highs.

According to market data, ultra-capable layer 1 altcoins have been attracting billions of dollars in capital inflows, with ADA now emerging as one of the most popular coins in the current market rally phase.

The price of ADA rose 34% in the past week, rising from $0.61 on February 27 to a high of $0.80 on March 4. The price of Solana (SOL), a competing L1 network, rose only 28% over the same period.

As the cryptocurrency market rally continues for the sixth month in a row, ADA has captured the hearts of larger investors. In 2024, steady demand for DeFi products and services built on the Cardano network could be a significant bullish catalyst.

Cardano defi TVL attracted $98 million in inflows in 2024.

Last week, ADA price surpassed Solana. And thanks to the steady capital inflows recorded in the Cardano defi ecosystem, the gap could widen further in the coming weeks.

Cardano’s defi TVL hit an all-time high of $506 million on March 4. According to DefiLlama data, this represents an impressive increase of $98 million since the beginning of the year.

An increase in TVL is a bullish signal for any layer 1 network. This represents more significant use and adoption of projects built on the network. Cardano’s defi ecosystem could witness another wave of fund inflows, with Ethereum gas rates recently recording a dramatic gas rate spike on March 5th and Solana’s painful network outage on February 5th.

If the scenario continues, increased demand for DeFi services could push the price of ADA above the important resistance level of $1 in the coming weeks.

Prediction: Will Cardano’s price ever reach $1 again?

From an on-chain analytics perspective, ADA has gained investor recognition over SOL at a critical time in the altcoin market rally, which, combined with the surge in Ethereum gas fees, could push Cardano price up another 25% towards its $1 target. .

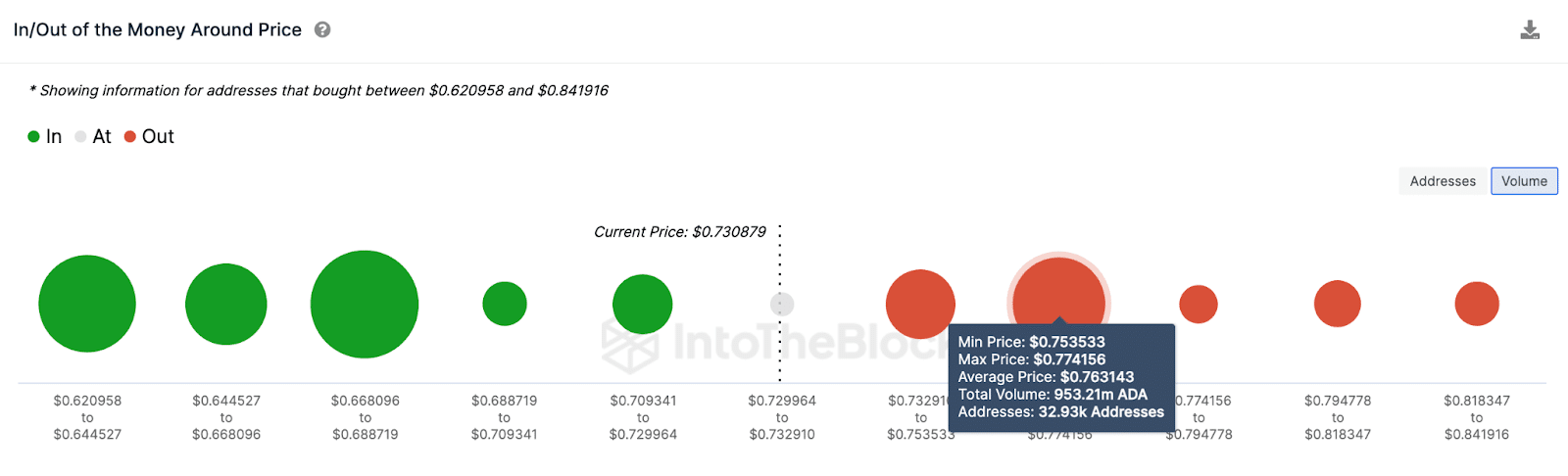

Further corroborating this position, IntoTheBlock’s global fund deposit/withdrawal data shows that over 83% of existing ADA investors are now in a profitable position due to the latest ADA price rises, including:

Profitable holders are often reluctant to sell their coins during market rallies. If the rally continues, ADA will be in prime position for an accelerating rally towards $1.

However, when it comes to near-term price action, ADA faces significant resistance in the $0.77 area.

As you can see in the chart, 32,930 existing holders purchased 953,210 ETH at a minimum price of $0.77. If the bulls can establish a steady support level above $0.78, a sharp rise towards $1 could be on the cards, as expected.

If Cardano sees a significant decline, ADA bulls could regroup and put up a buying wall in the $0.69 area.