- Whales have amassed $9 million worth of ERC-20 tokens.

- Pepe and LINK showed more positive price trends than UNI.

Significant whale accumulation has been recently seen in Pepe (PEPE), Uniswap (UNI), and Chainlink (LINK). While UNI showed a clear price trend, PEPE and LINK showed similar price movements.

Another thing these assets have in common is that they are all ERC-20 tokens. Sustained accumulation and price trends are considered bullish signals that could impact the Ethereum (ETH) network.

Whales Accumulate Pepe, Chainlink, and Uniswap

According to data from Look on chainWhales engaged in significant accumulation activity on May 4th, acquiring millions of dollars worth of various ERC-20 tokens.

One notable transaction involved the whale withdrawing 322.48 billion Pepe tokens, worth about $2.78 million, from the Binance exchange.

Another whale withdrew 500,000 UNI tokens worth about $3.75 million and 183,799 LINK tokens worth about $2.62 million from the Binance (BNB) exchange.

Pepe and Chainlink see an upward trend.

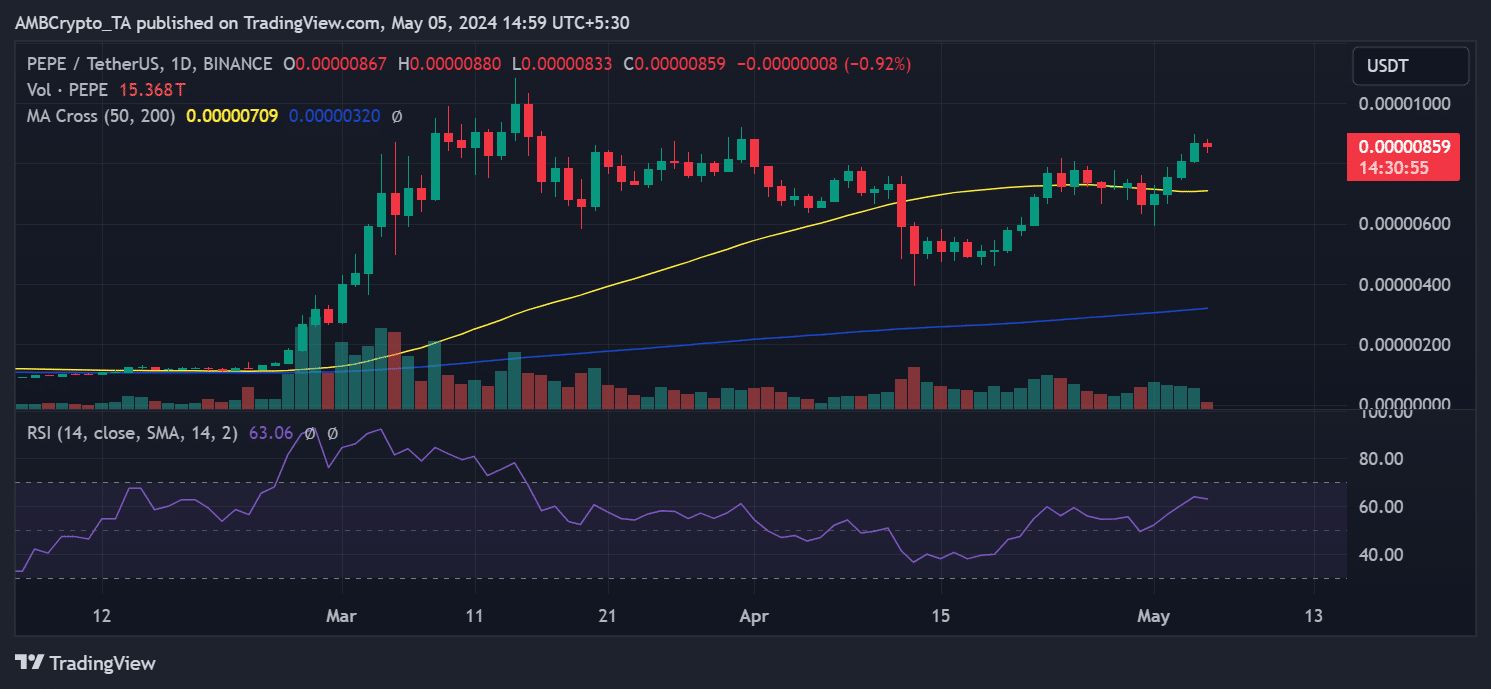

AMBCrypto’s analysis of Pepe’s price movements on the daily charts shows a continuous upward trend from May 1 to 4. On May 4, its value soared by 7.30%.

Notably, the price trend is now above the short-term moving average (yellow line) which has converted into support, indicating a positive price trend.

However, Pepe was seeing his trading value fall by more than 1% at the time of writing.

Source: TradingView

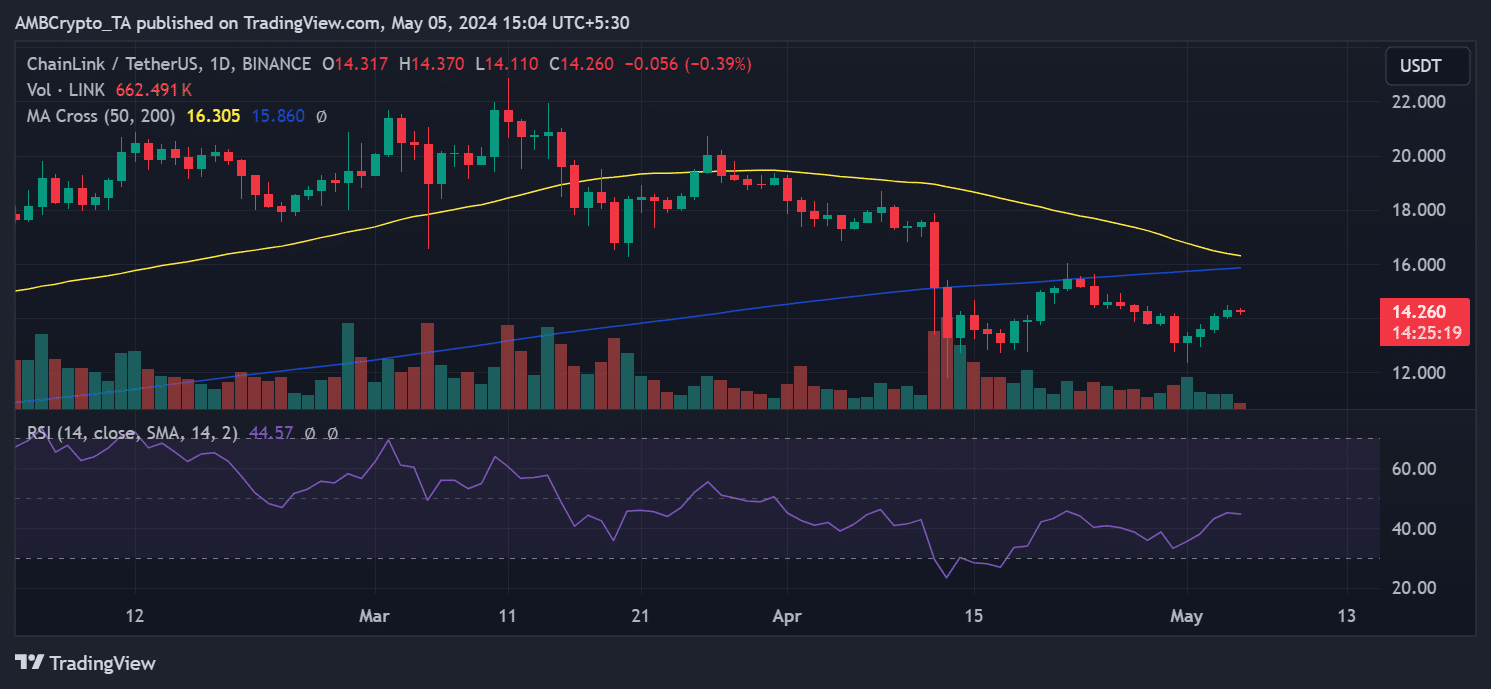

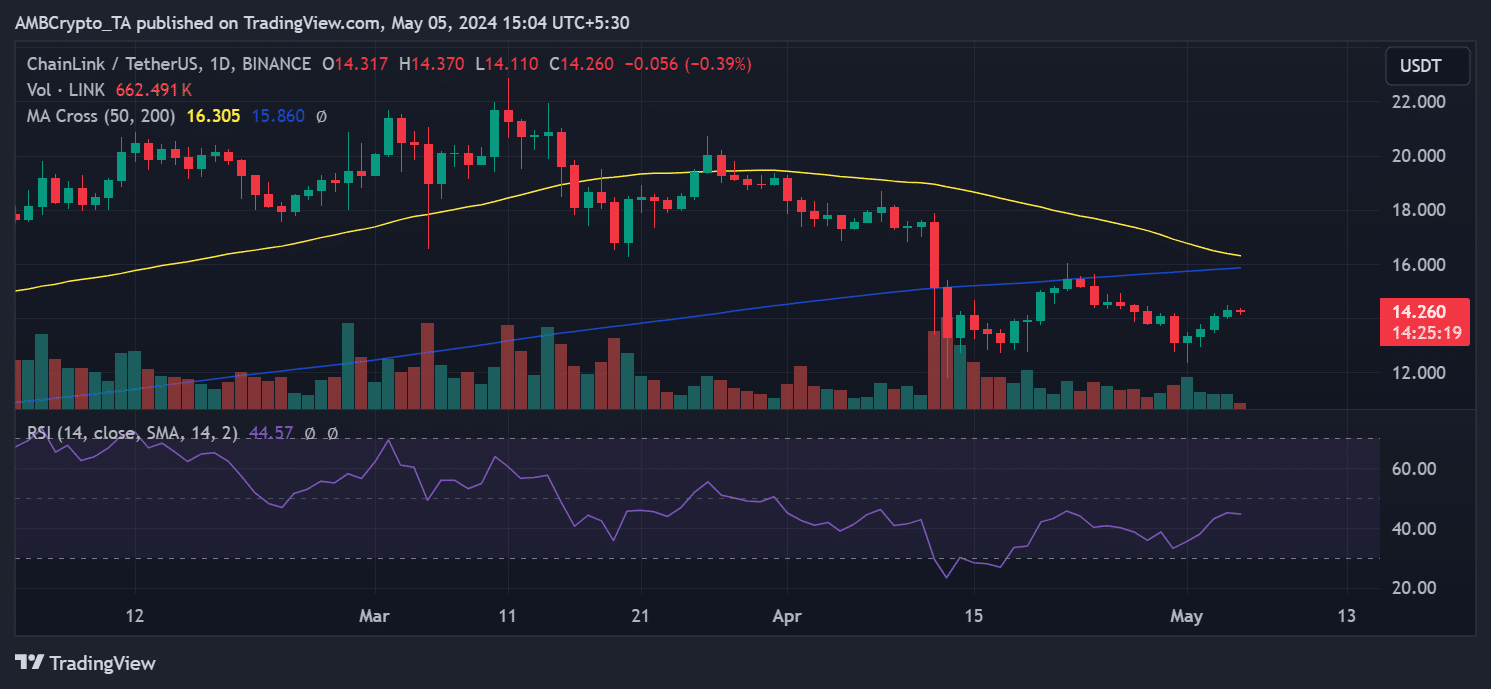

AMBCrypto discovered that Chainlink has also shown a continuous upward trend since May 1st.

The price surged from around $13 to over $14, closing on May 4 at around $14.3, marking a price increase of more than 1%.

Despite the positive movement, Chainlink’s overall trend has been less positive than Pepe’s. Prices were trading below their short-term and long-term averages (yellow and blue lines).

At the time of writing, it is trading at around $14.2, reflecting a decline of less than 1%.

Source: TradingView

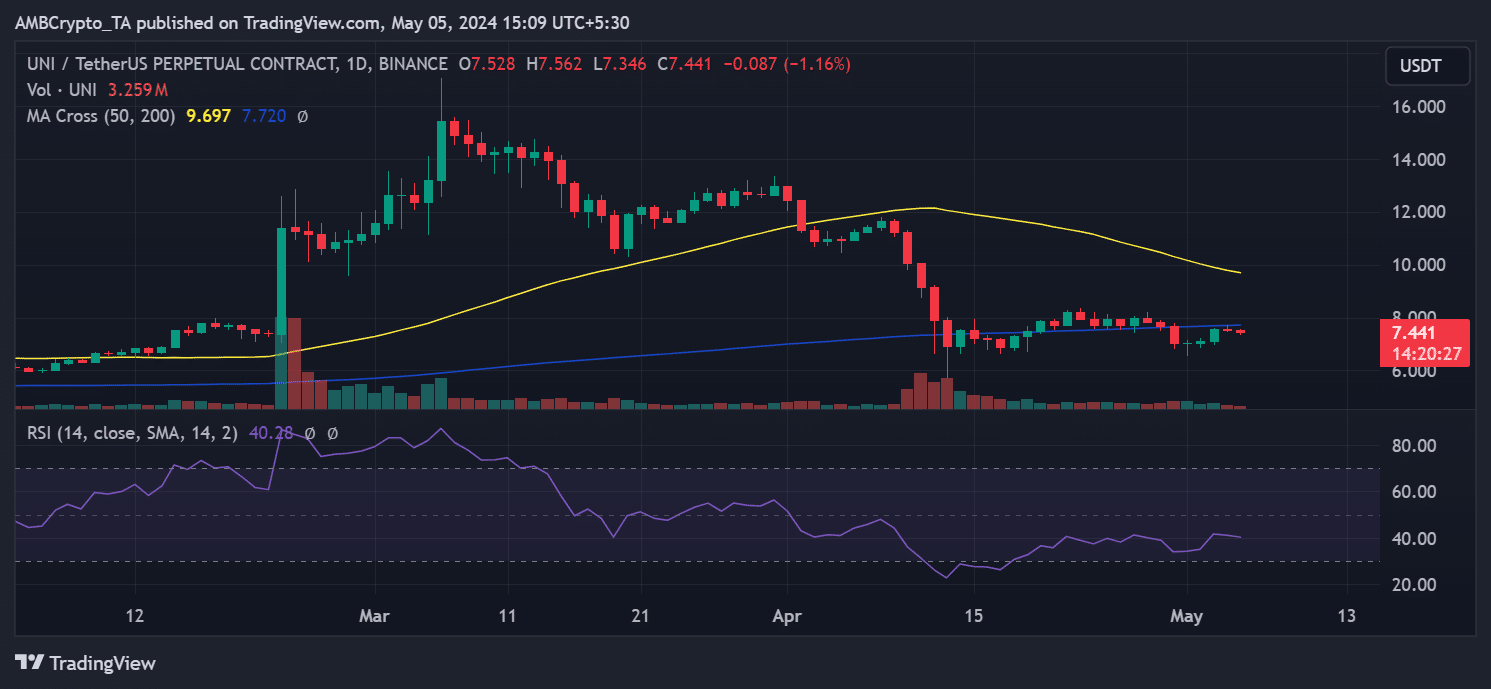

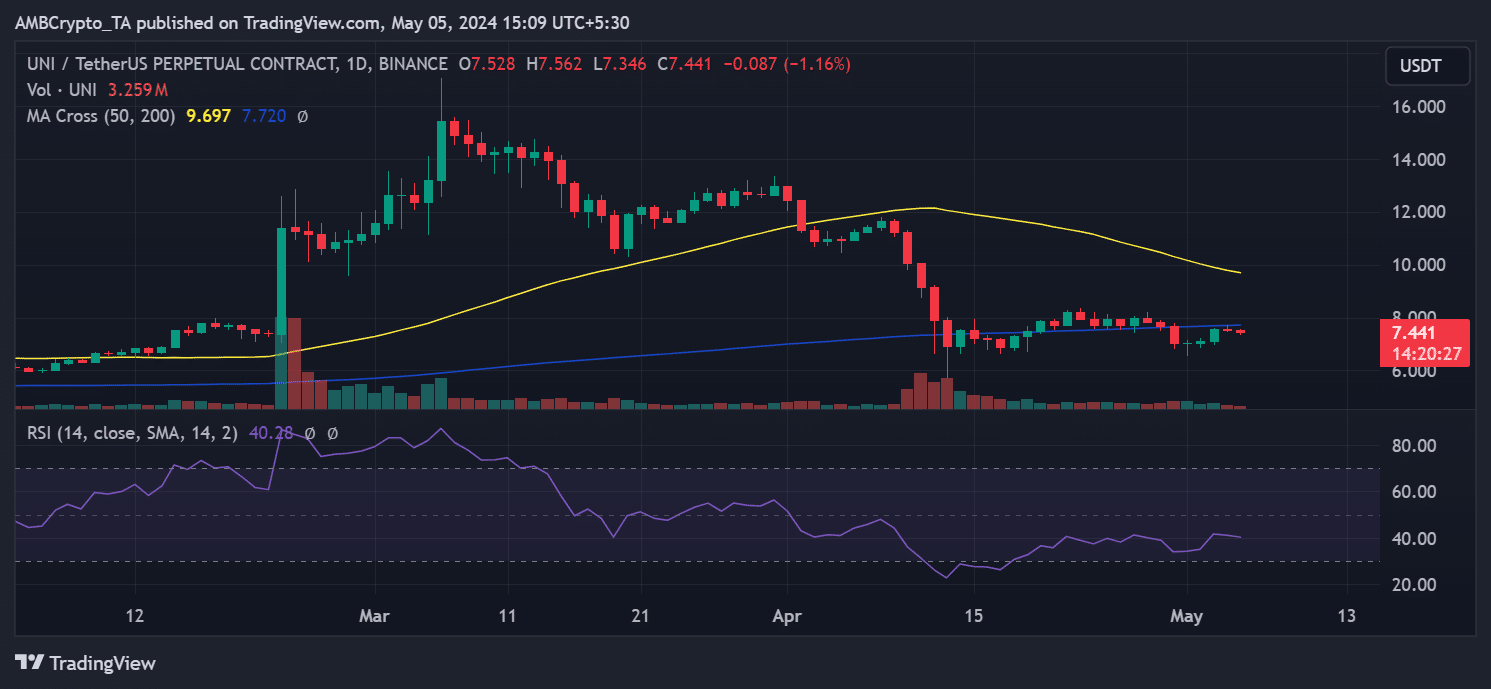

Among the Ethereum standard tokens accumulated by whales, Uniswap had the lowest price/performance ratio.

Prices have increased since May 1, but only on May 4 did the increase exceed 1%, rising 6.66% and trading at around $7.5.

However, despite the rise, the blue and yellow lines acted as resistance levels. It was trading at around $7.4, indicating a loss of more than 1% in value.

Additionally, the relative strength index (RSI) was close to 40, suggesting a bearish trend.

Source: TradingView

Will Ethereum be affected?

The accumulation of Pepe, Chainlink, and Uniswap is a positive sign for these Ethereum-based assets. This essentially implies expectations of further price rises, which are optimistic.

Is your portfolio green? Check out the LINK Profit Calculator

If the price of these tokens ultimately surges, the sale of the accumulated whales could trigger further accumulation by other traders.

This increase in trading volume can have a significant impact on the overall trading volume on the Ethereum network. Moreover, increased transaction volume is likely to impact network fees.