- Indicators suggest that SOL will almost certainly reach $334 at launch.

- The correlation between tokens and ETH showed a negative correlation, but in the case of BTC, there was a strong correlation.

Over the past seven days, the price of Solana (SOL) has struggled to show impressive gains. According to data from CoinMarketCap, the price of SOL was $167.12 at press time.

This was about the same price as May 25th. On a year-to-date (YTD) basis, SOL increased by 52.63%. But it was nothing compared to the token’s performance in 2023.

But despite the recent underwhelming price action, that hasn’t stopped Solana bulls from betting on an incredible rally. For most SOL holders, the price of the cryptocurrency will reach over $500 before the end of this cycle.

SOL requires Bitcoin, not ETH

However, this same set also predicted that Solana would surpass its all-time high of $260 before the end of the first quarter of 2024. However, that did not happen as the closest SOL to this target was $210 in March.

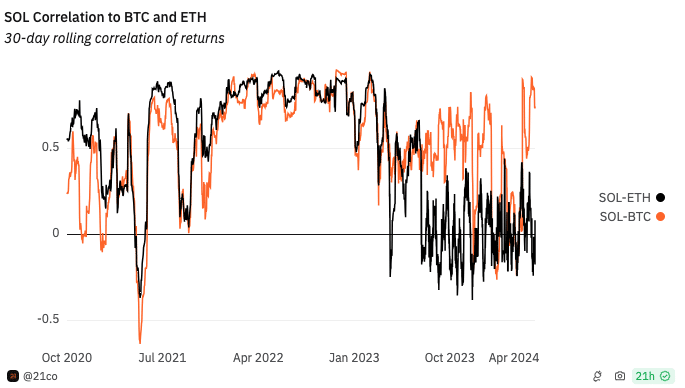

AMBCrypto analyzed Solana’s price prediction from an on-chain perspective. First, we looked at the correlation with Bitcoin (BTC) and Ethereum (ETH).

According to data from Dune Analytics, the correlation between SOL and BTC is 0.83, indicating that prices mostly move in the same direction.

Source: Sand Analysis

For ETH, the figure is 0.10, which represents the difference between the two cryptocurrencies. Therefore, for SOL to reach $500 in the near future, BTC will need to increase beyond its all-time highs.

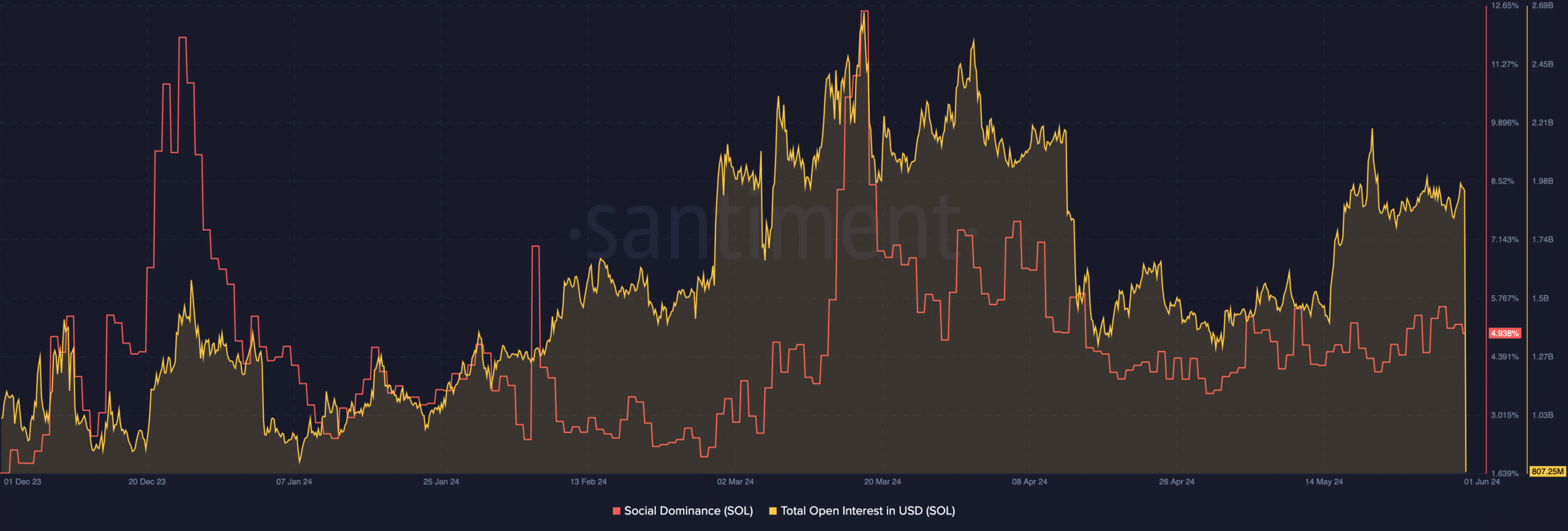

Another indicator that AMBCrypto examined was social dominance. Social dominance refers to the percentage of discussion about a token compared to other cryptocurrencies in the top 100.

Did you come across any good items?

According to Santiment’s data, Solana’s social dominance was 4.938%. Compared to the peak in March, this figure is low.

However, history has shown that low social dominance can be a good buying opportunity. This is because less conversation about the token means that the token has not reached a high level of demand.

Therefore, buying SOL around $161 to $168 could be a good entry point before another rally begins. Further supporting this point was Open Interest (OI).

OI decreases or increases depending on net positioning. A rising indicator means that funds are flowing into contracts related to that token.

On the other hand, a decline means liquidity is leaving the market. At press time, SOL’s open interest had decreased to $807.25 million.

Source: Santiment

Regarding the price, this sharp drop indicates that Solana could sell at the underlying support at $161. However, this does not mean that an increase in public contracts will not occur again.

If SOL’s OI rises past $2 billion as it did a few months ago, the price could rise by 100%. At press time prices, this means the token’s target could be around $334 in a few months.

“There is ample purchasing power,” according to the data.

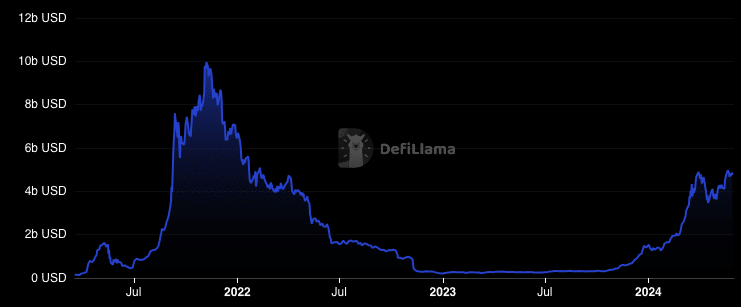

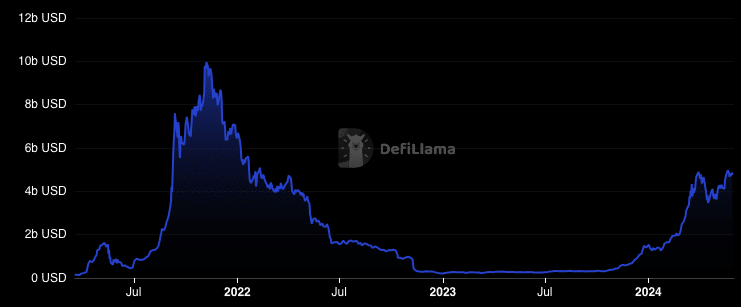

In addition to the above indicators, AMBCrypto also examined Solana’s Total Value Locked (TVL). TVL tracks whether market participants lock or stake assets on the protocol and remove capital.

If the indicator increases, it means that the network is healthy and participants trust that the project can generate good profits. On the other hand, a decrease means that the number of assets withdrawn increases.

According to data from DeFiLlama, Solana’s TVL was $4.8 billion. This is an increase of 20.27% over the last 30 days. However, the outlook was not so rosy for the token as some SOL staked in the past seven days appeared to have been withdrawn.

Source: DeFiLlama

Despite the recent decline, the chain’s TVL could reach $8 billion, especially since network activity is much higher than other projects.

When (when) this happens, the demand for SOL will be incredibly high and the price could reach or exceed the $500 mark. Additionally, Dune data shows that stablecoin circulating supply is increasing on Solana.

Realistic or not, the market cap of SOL in ETH is:

Stablecoins such as USDT, USDC, and the recently added PYUSD have contributed to this increase.

An increase here indicates that addresses on the chain have enough purchasing power to send the value of SOL higher.