Over the past few months, altcoin prices have fallen by between 30% and 70%, and analysts have ruled out the possibility of an altcoin season. However, BeInCrypto has found that with new information, things may be about to change.

This analysis sheds light on the basis of these ideas while providing insight into potential catalysts.

It’s still early days, but signs are emerging.

Altcoin season is a market phase where cryptocurrencies other than Bitcoin (BTC) outperform the leading coin and steadily surge in value.

One indicator that proves this period is TOTAL2, the total market capitalization of all cryptocurrencies excluding BTC. An increase in this market capitalization lends credence to the potential rise in altcoin prices.

However, the decline suggests that Bitcoin is dominating the market. At the time of writing, the total altcoin market cap was $940.37 billion, up 4.87% over the past 24 hours. The same market cap fell 23.26% between June 6 and July 8.

Read more: What are the best Altcoins to invest in in July 2024?

If the value of the indicator continues to increase, the altcoin season will be getting closer. The last time this happened was between February and March, when the value of TOTAL2 went from $753.83 billion to $1.24 trillion in one month.

Following the recent changes, analysts at X seem to have changed their stance and are favoring the dominance of altcoins. One of them is Michaël van de Poppe, founder of MN Trading.

“Altcoin market caps have reached important upper time-frame support levels and are looking for support here. It’s still early in the week, but if this uptrend continues into the week, signs will start to improve,” van de Poppe told X.

Bitcoin Dominance Retreat Could Open Doors to Altcoins

In addition to the opinions, another factor that determines whether or not altcoins have a chance to shine is Bitcoin’s dominance. For the cycle to be validated, BTC.D must decline.

Using the weekly chart, we can see that BTC.D fell from 62.69% in March 2021 to 40.89% in May of the same year. Looking at history, this was roughly the same period when many altcoins hit all-time highs during the last bull market.

This week, dominance dropped from 55.04% to 54.68%, indicating that some altcoins outperformed BTC.

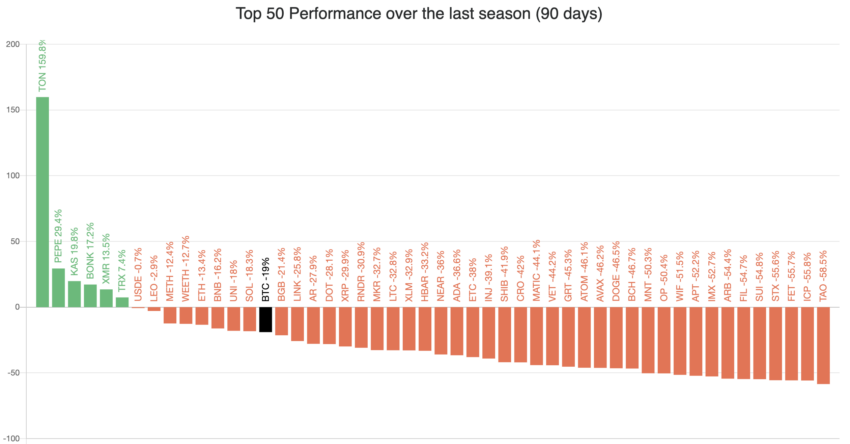

To reflect the performance seen in 2021, at least 75% of the top 50 altcoins would have to outperform Bitcoin.

According to data from Blockchaincenter, only a handful of cryptocurrencies, including meme coins, have done so. Some of them include Toncoin (TON), Pepe (PEPE), Kaspa (KAS), and Bonk (BONK).

As a result, the Altcoin Season Index for the last 90 days remains at 29. However, this is an improvement over the figure of 25 a few days ago.

If the index continues to hit higher values, altcoins are more likely to retest their all-time highs, putting BTC at a disadvantage in the process.

Read more: What is an Altcoin? Alternative Cryptocurrency Guide

Ethereum, Solana’s Role is Important

It is also important to note that Ethereum (ETH) has always been a catalyst for altcoin dominance.

ETH has underperformed BTC over the past few months. However, the imminent approval of a spot Ethereum ETF could see a notable increase in ETH’s value.

If so, other altcoins could join the potential rally as well. For Capo of Crypto, the update on the ETH ETF and the official application for the Solana ETF from VanEck and 21Shares are reasons for the analyst to be bullish on altcoins.

“German government selling pressure is being absorbed. All spot Ethereum ETF applicants have filed updated S-1s. VanEck & 21Shares have officially filed 19b-4s for their spot Solana ETF. I am bullish on altcoins in the coming weeks, especially,” Crypto’s Capo wrote.

Based on the above analysis and market sentiment, altcoins are likely to see a big pump, but traders should keep an eye on it.

The rally could be nullified if selling pressure returns to the market. Also, if Ethereum fails to receive impressive inflows into ETFs, the cryptocurrency could struggle to make a run.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions are subject to change without prior notice. Always conduct your own research and consult with a professional before making any financial decisions. Please be advised that our Terms of Use, Privacy Policy and Disclaimer have been updated.