- BONK showed bullish pressure prevailing in lower time frames.

- The recent structural breakdown and sustained buying pressure in recent months could allow the rally to continue.

Bonk (BONK) bulls have been on a strong uptrend this week following news of a proposed BONK token burn. While the 84 billion token burn proposal has yet to be approved, the potential supply reduction has excited bulls, sending the coin up 23% from Monday’s open.

The weighted sentiment was positive, but volumes began to decline. Is this a sign that the price pump is over?

The daily structure is turning bullish

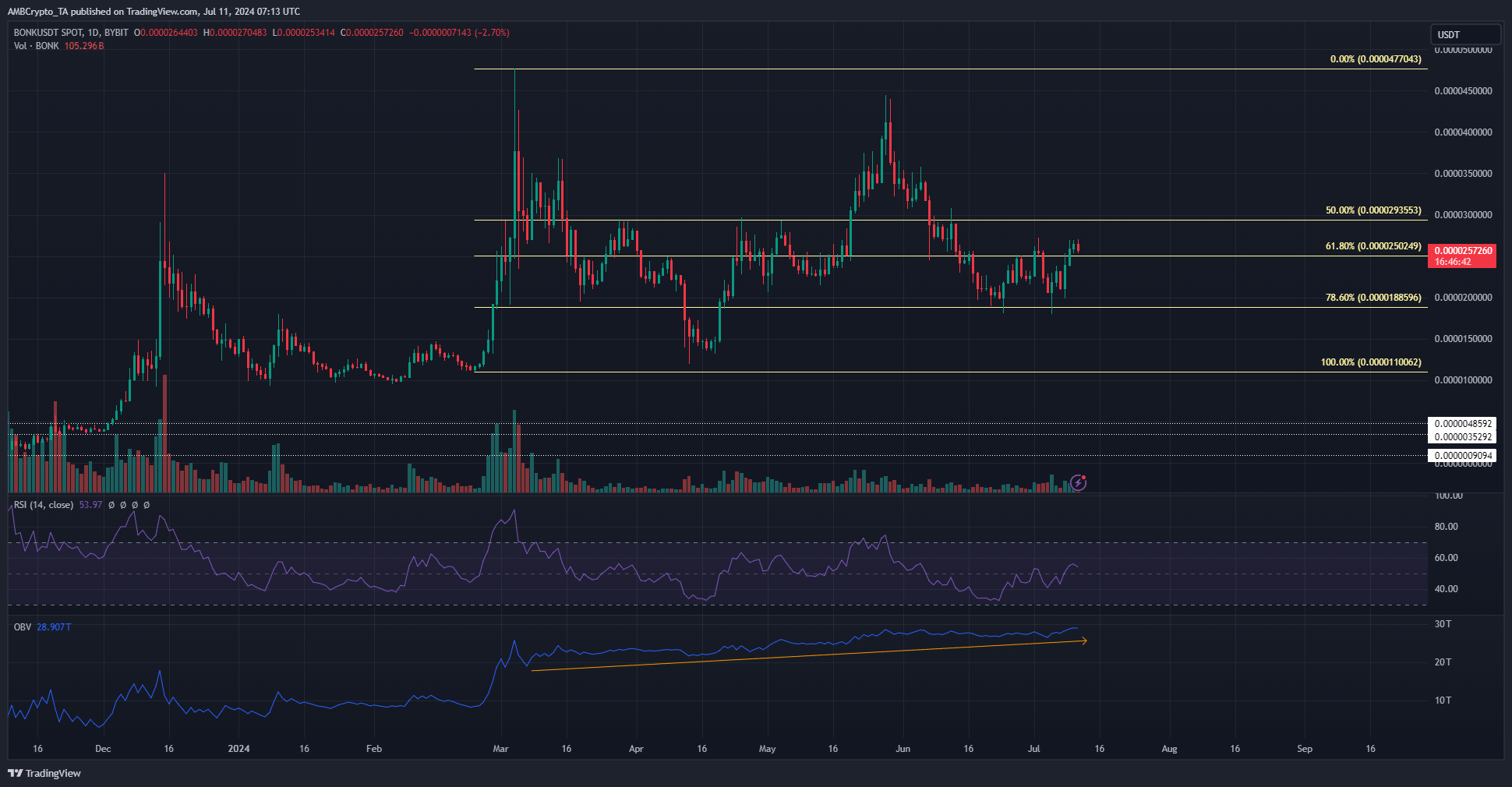

Source: BONK/USDT on TradingView

The daily price chart shows that the most recent low high was set in mid-June at $0.00000256. On July 9, the daily trading session closed above this level, flipping the structure to the bulls.

The 78.6% retracement level has been a strong support level for the past 6 weeks. Bulls will be looking to defend the $0.0000025 and $0.0000023 levels in the coming days.

The RSI has broken above the neutral 50 level, another early sign of a bullish trend reversal. The OBV has been trending up slowly since March, showing that it is not a matter of if but when another explosive rally will occur.

Gift data showed that sentiment was positive.

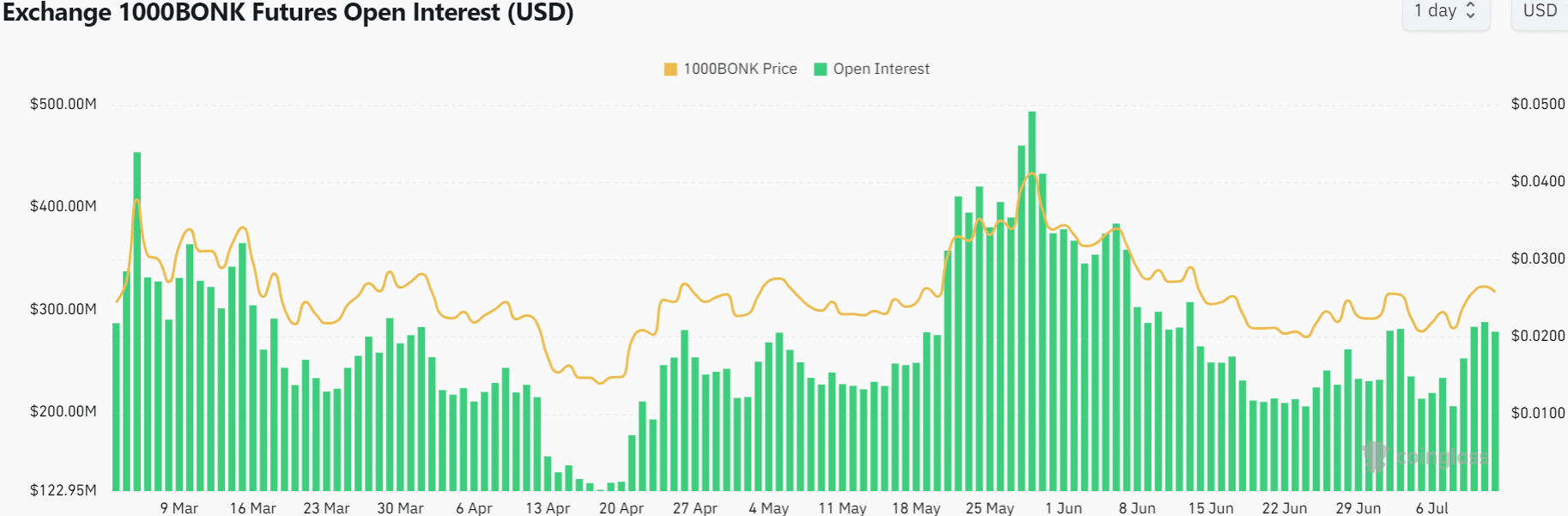

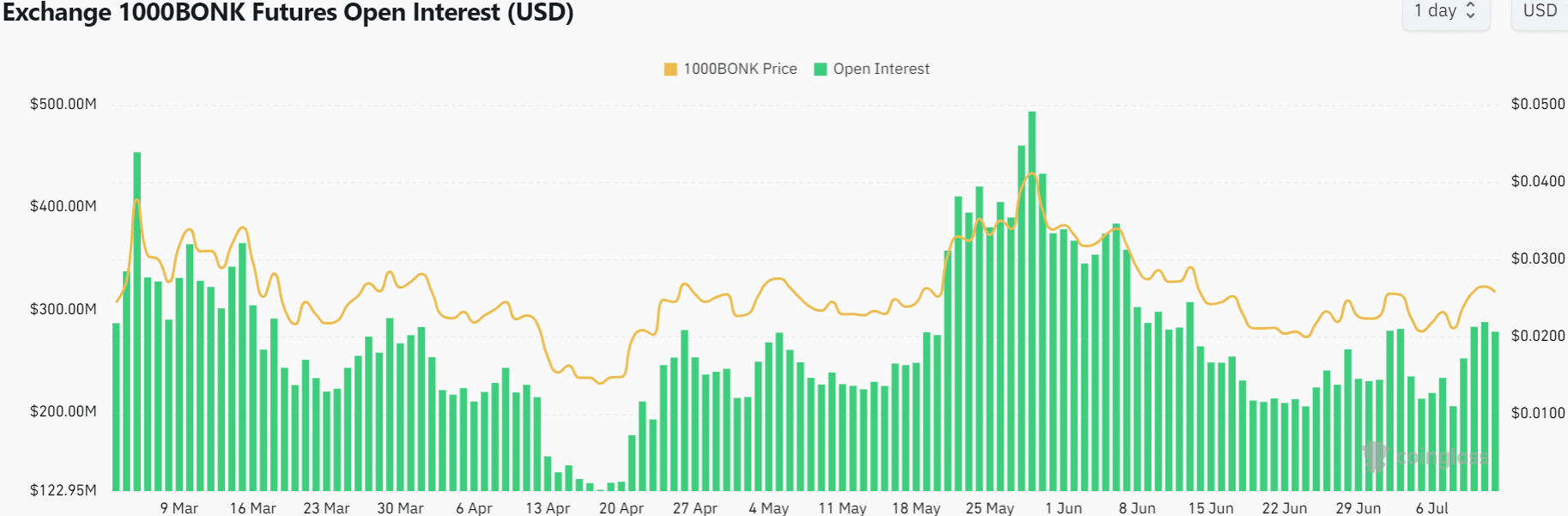

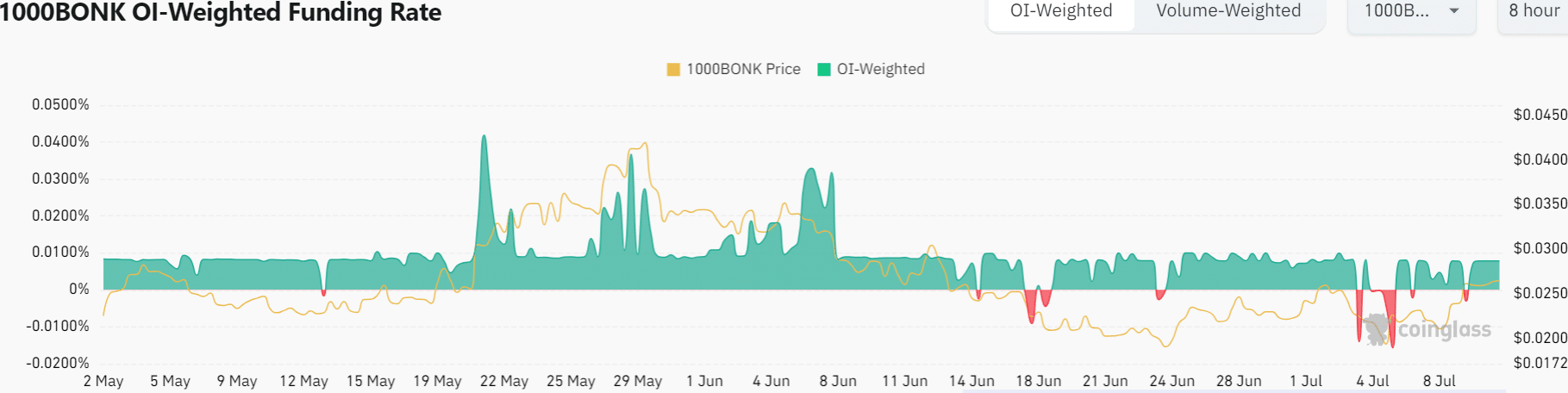

Source: Coinglass

Open Interest increased from $205 million on July 8 to $283.3 million on July 10. With the OI rising rapidly along with the price increase, speculators were willing to take long positions on Memecoin.

The downtrend began in the last 24 hours, but overall short-term sentiment remains bullish.

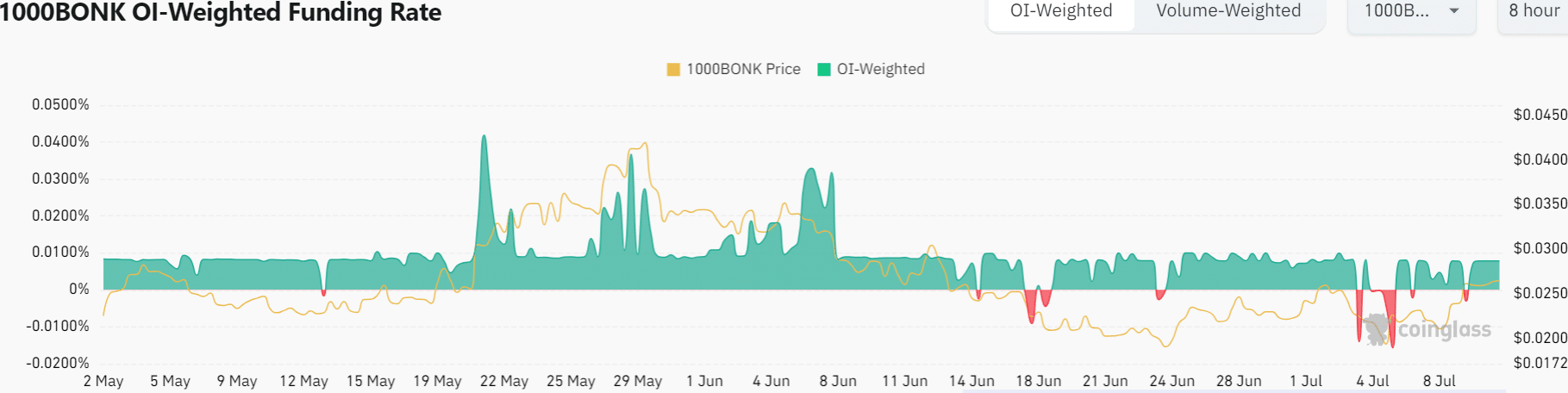

Source: Coinglass

Is your portfolio green? Check out the BONK profit calculator

The funding ratio has risen back into positive territory after falling on July 5 and most recently on July 9.

However, it was not an unusually positive result, suggesting that the market was not overheated.

Disclaimer: The information presented does not constitute financial, investment, trading or any other type of advice and is solely the opinion of the author.