Following other altcoins like Bitcoin and Ethereum, Solana is on the rise again after its steep losses in June. Although buyers have yet to reclaim the $155 support level, the expansion over the past few days has added 25% since its crash in early July.

Is SOL ready for $1,000?

With such encouraging gains over the past few days, traders are expecting a big uptrend in the coming days and weeks. Moving to X, one analyst said the coin could easily rise 6x from its spot price and hit $1,000 in the next bull cycle.

In the current situation, it is clear that SOL is already in an uptrend. In the depths of the 2022 downtrend, with the collapse of FTX and Alameda Research, SOL fell to a low of $8. The coin has been on an uptrend for the past few months, especially in the second half of 2023, reaching $210 in March 2023.

However, the cooling over the past three months has not offset the major uptrend. Rather, buyers are still in control, and despite recent losses, SOL is up about 8x since October 2023.

Several factors could push Solana above the $220 mark it hit during the last bullish cycle of 2021. A large part of this rise is due to a surge in adoption and Solana’s emergence as the third most valuable smart contract platform, overtaking Ethereum and the BNB chain.

Solana, the home of meme coins, is emerging as the platform of choice for developers and traders, most of whom point to its high scalability and low transaction fees.

At the same time, some argue that Solana may be more secure than Ethereum’s layer 2 platforms like Base, as there is no need to use off-chain solutions.

Solana, Ethereum Dominance, Spot ETF Hopes

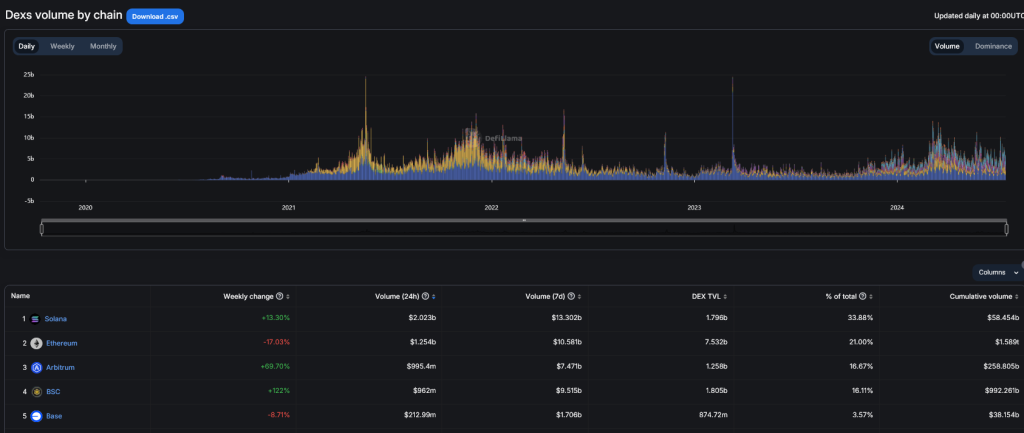

The surge in meme coins has led to increased on-chain activity on Solana, as evidenced by the surge in DEX trading volume.

According to DeFiLlama data, Solana dominates Ethereum in daily and monthly DEX trading volume. On average, these DEXs process over $13 billion per week.

If the meme coin price recovers and surpasses the $65 billion highs recorded over the past few months, CoinMarketCap data suggests Solana will likely solidify its position by extending Ethereum. BOME, WIF, BONK, and other Solana meme coins are among the most active and valuable.

Although the U.S. Securities and Exchange Commission (SEC) previously held that SOLs were unregistered securities, some changes may challenge this preview.

VanEck and 21Shares recently applied to regulators for approval of a spot Solana exchange-traded fund (ETF). The application is still in its early stages, but a final decision is expected before the end of Q1 2025.