TAO, the utility token for decentralized network Bittensor, is one of the biggest gainers in the market today. The altcoin, which was trading at $181.79 on August 5, has surged to $316.93 at the time of writing.

This rally represents a 15.61% increase in 24 hours. However, there are a few other interesting things happening on the network, which we will discuss in this on-chain analysis.

The Power Behind the Surge in Interest

On August 7, BeInCrypto reported that leading crypto asset manager Grayscale had added Bittensor to its new investment trust. This development comes a few weeks after the company created a decentralized AI trust that included other AI-themed tokens.

Since the announcement, traders in the derivatives market have increased their exposure to TAO. According to Santiment, the open interest in the cryptocurrency is around $17 million. As of this writing, that value has nearly doubled.

Open Interest (often referred to as OI) measures the value of open contracts in the market. An increase in OI indicates that traders are adding more liquidity to the contract, while a decrease indicates a decrease in net positions.

Learn more: How to Invest in Artificial Intelligence (AI) Cryptocurrencies?

When analyzed critically, Open Interest (OI) can indicate whether a trend is likely to continue. If both OI and price move in the same direction, the trend is likely to continue. However, if they move in opposite directions, a trend reversal may occur.

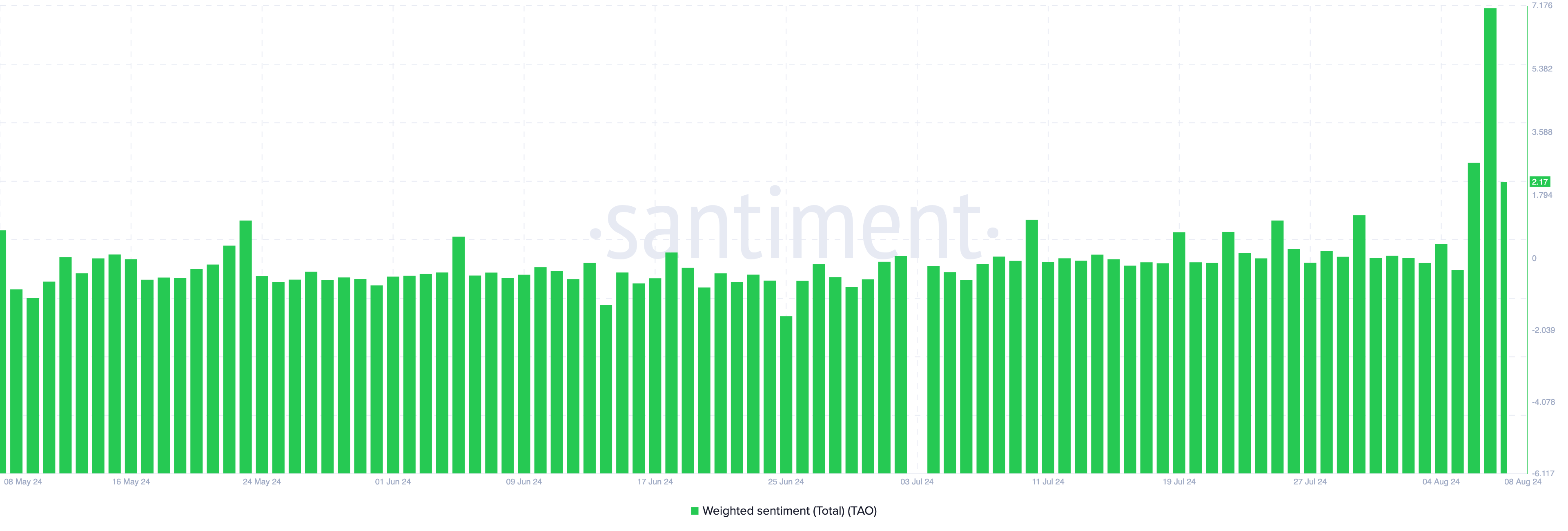

As both the price and OI of TAO increase, the token could reach a higher value in the short term. Also, on-chain data shows that Weighted Sentiment surged on August 7, reflecting a very bullish sentiment towards Bittensor.

This sentiment has declined slightly but is still positive, suggesting that the broader market still has a bullish outlook. If this sentiment continues in a positive range over the next few days, demand for TAO could increase, potentially pushing the price higher.

TAO Price Prediction: Can It Break the $360 Barrier?

Before the recent surge in TAO, the daily chart showed a rounded top forming. The inverted bowl-shaped pattern, often considered a bearish signal, indicates that selling pressure is building. However, the support level of $217.87 prevented a breakdown from occurring.

Meanwhile, the Relative Strength Index (RSI) is at 54.31, indicating solid bullish momentum for the cryptocurrency. RSI is generally a technical indicator that uses speed and price changes to determine momentum.

An increase indicates that buying momentum is dominant, while a decrease suggests that sellers are in control. For TAO, a rising RSI rating can reinforce an uptrend, as can Open Interest.

Read more: 9 Best AI Cryptocurrencies of 2024

According to the analysis, TAO can target overhead resistance at $323.18. If it breaks this level, the price can reach $361.51. However, if the bears overpower the bulls, the cryptocurrency’s value can drop to $272.58.

disclaimer

In accordance with the Trust Project guidelines, this price analysis article is provided for informational purposes only and should not be considered financial or investment advice. BeInCrypto strives to provide accurate and unbiased reporting, but market conditions may change without prior notice. Always do your own research and consult with a professional before making any financial decisions. We inform you that our Terms of Use, Privacy Policy, and Disclaimer have been updated.