- Analysts predict that Litecoin will rally to $105-$110, supported by strong technical indicators and growing market momentum.

- More than 90% of Litecoin holders are making profits, showing positive sentiment and continued interest in cryptocurrencies.

Litecoin (LTC) It has shown promising strength recently, and analysts are predicting a potential surge in price.

Cryptocurrency analyst World Of Charts says stated Litecoin is gearing up for a significant breakout, and if successful, it could see a rally to the $105-$110 range.

The analyst noted:

“$LTC is looking strong here and ready for a breakout. A successful breakout could see a move to $105-$110.”

Source: X

Another analyst, ZAYK Charts, also provided similar insights. predictionIdentifying a descending channel formation on Litecoin’s daily timeframe.

Chart analysis shows that the pattern typically indicates a downtrend, but a break above the upper trendline could potentially lead to an uptrend.

According to ZAYK chart,

“If a breakout happens, the next target will be $100.”

This prediction is consistent with technical analysis principles, namely that prices often move significantly higher after a bear market breakout.

Source: X

Current price movement

At the time of writing, Litecoin was trading at: $65.52It is up 0.28% over the last 24 hours and up 8.59% over the last 7 days.

Litecoin currently has a market cap of $4.88 billion, with a 24-hour volume of $438 million.

With a circulating supply of 75 million LTC, Litecoin is being watched closely by investors for potential upside momentum.

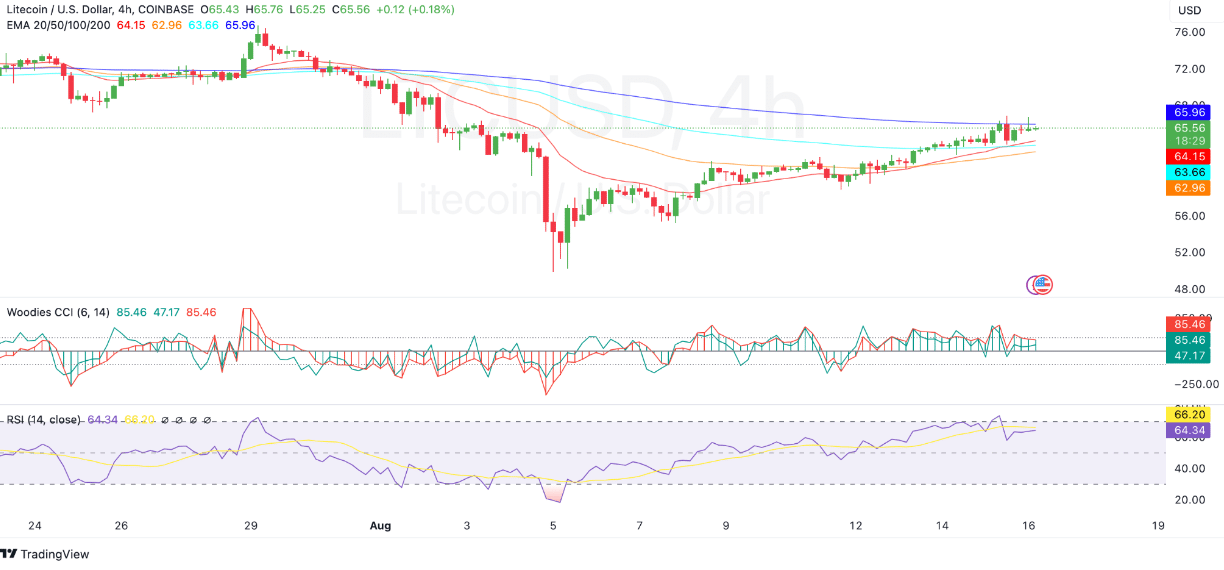

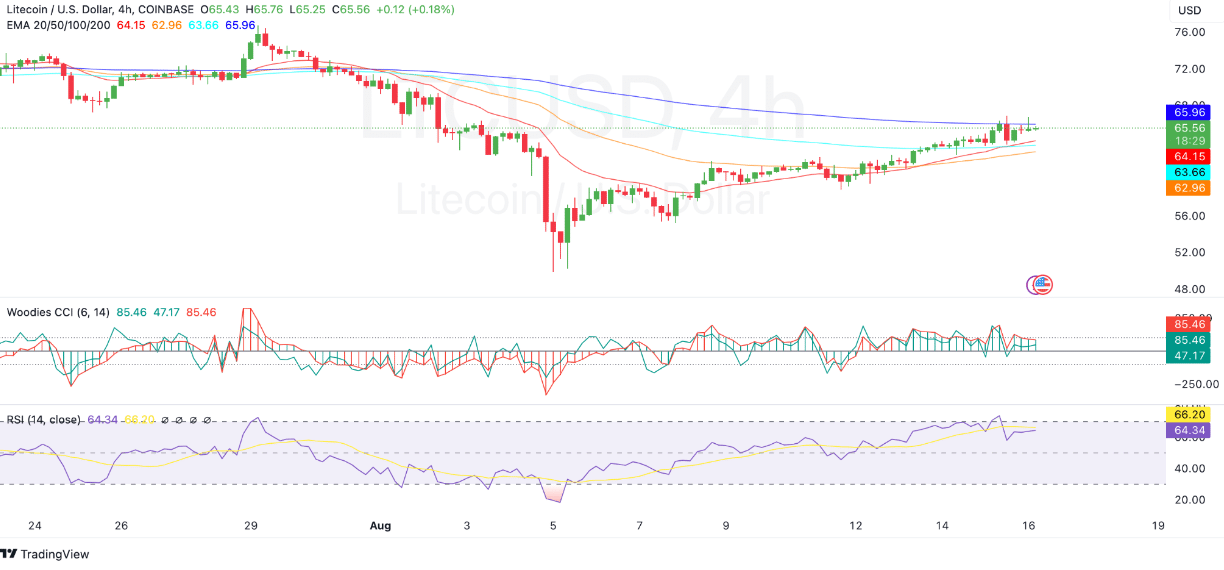

The 4-hour chart shows Litecoin rising steadily, supported by the 20, 50, and 100-period exponential moving averages (EMA).

The price is approaching the resistance level at $65.96, the 200-period EMA, which could challenge further upside.

If Litecoin breaks this level, it could build further bullish momentum and increase the chances of reaching the $100 target predicted by analysts.

Despite the positive outlook, some indicators suggest caution. The Woodies Commodity Channel Index (CCI) is at 87.82, showing that Litecoin is in overbought territory.

This suggested short-term selling pressure and a potential downside if prices fail to break above key resistance levels.

Source: TradingView

Additionally, the Relative Strength Index (RSI) remained at 66.21, indicating healthy bullish momentum but still below the extreme buying overheating zone of 70.

If the RSI rises above 70, Litecoin may face increased selling pressure, which could hinder the uptrend.

Investors are advised to closely monitor these technical signals as they may influence Litecoin’s next move.

Active Addresses and Profitability

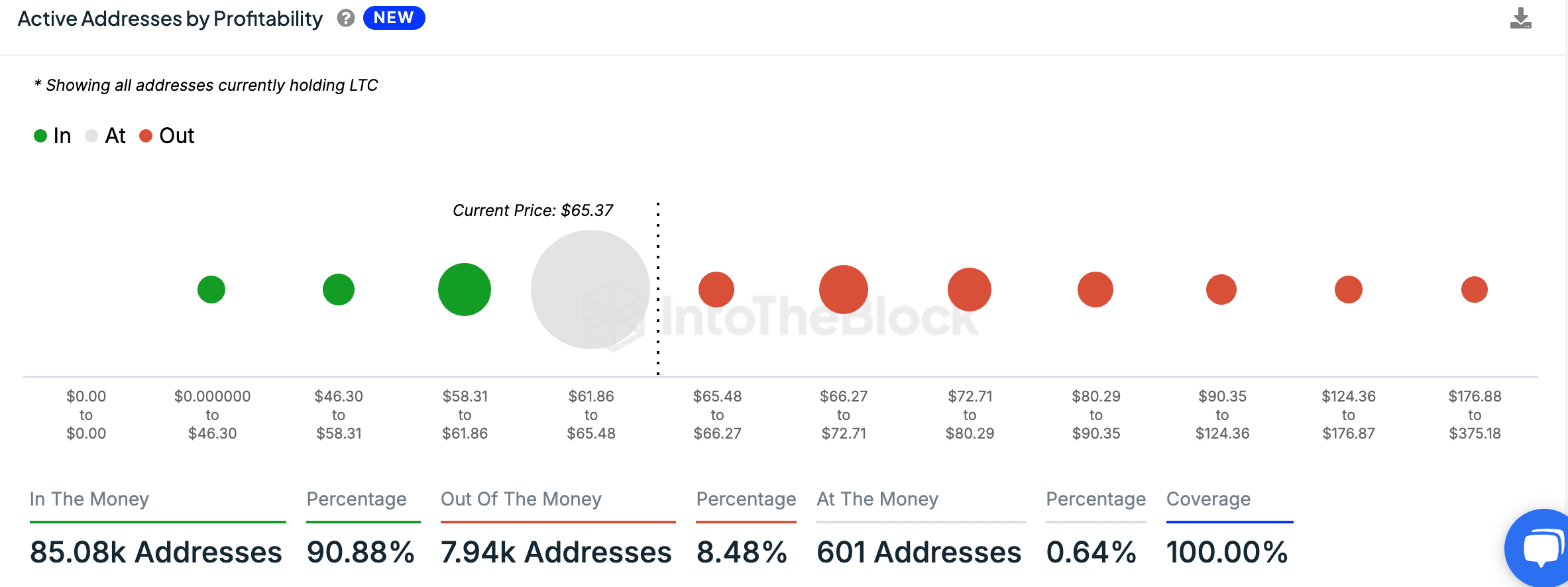

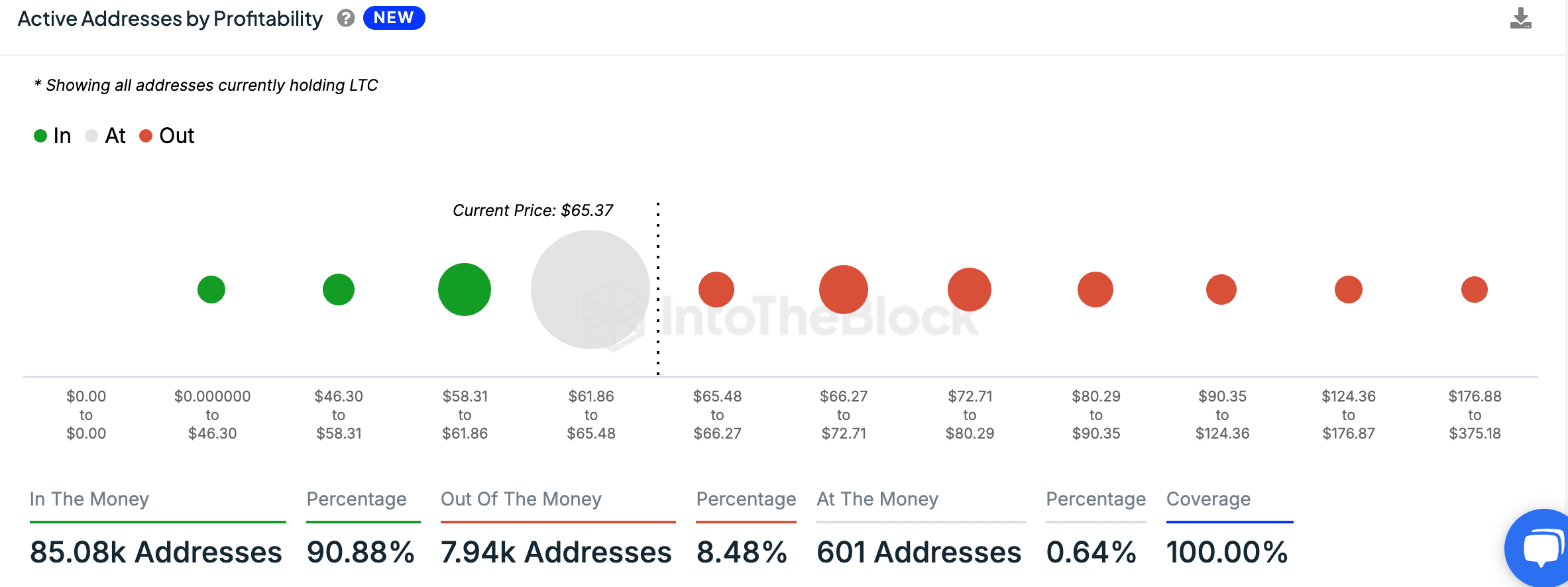

Recent data Into the block Litecoin still appears to be profitable for most holders.

About 90.88% of all LTC addresses, or 85.08k addresses, were “In the Money”, meaning that the LTC was bought at a lower price than the current market price.

Meanwhile, 8.48% of addresses are “Out of the Money” as they held LTC purchased at a price higher than the current value of $65.37.

The minority of 0.64% or 601 addresses are “at the cash price” holding shares purchased near the current price.

Source: IntoTheBlock

This data suggests that the majority of Litecoin holders are seeing profits as of the time of writing, further supporting positive market sentiment.

According to DiplomaLitecoin’s total value locked (TVL) is reported to be $3.41 million, with fees incurred in the last 24 hours reaching $1,342.

Is your portfolio green? Check out our LTC profit calculator

Additionally, there were 435,508 active addresses within the network.

The combination of profitability and activity indicates continued interest in cryptocurrencies and continued engagement from the user base.