- NEAR’s bullish market structure appears to be at odds with disappointing market demand.

- Spot CVD offered hope that bulls could defend $3.85.

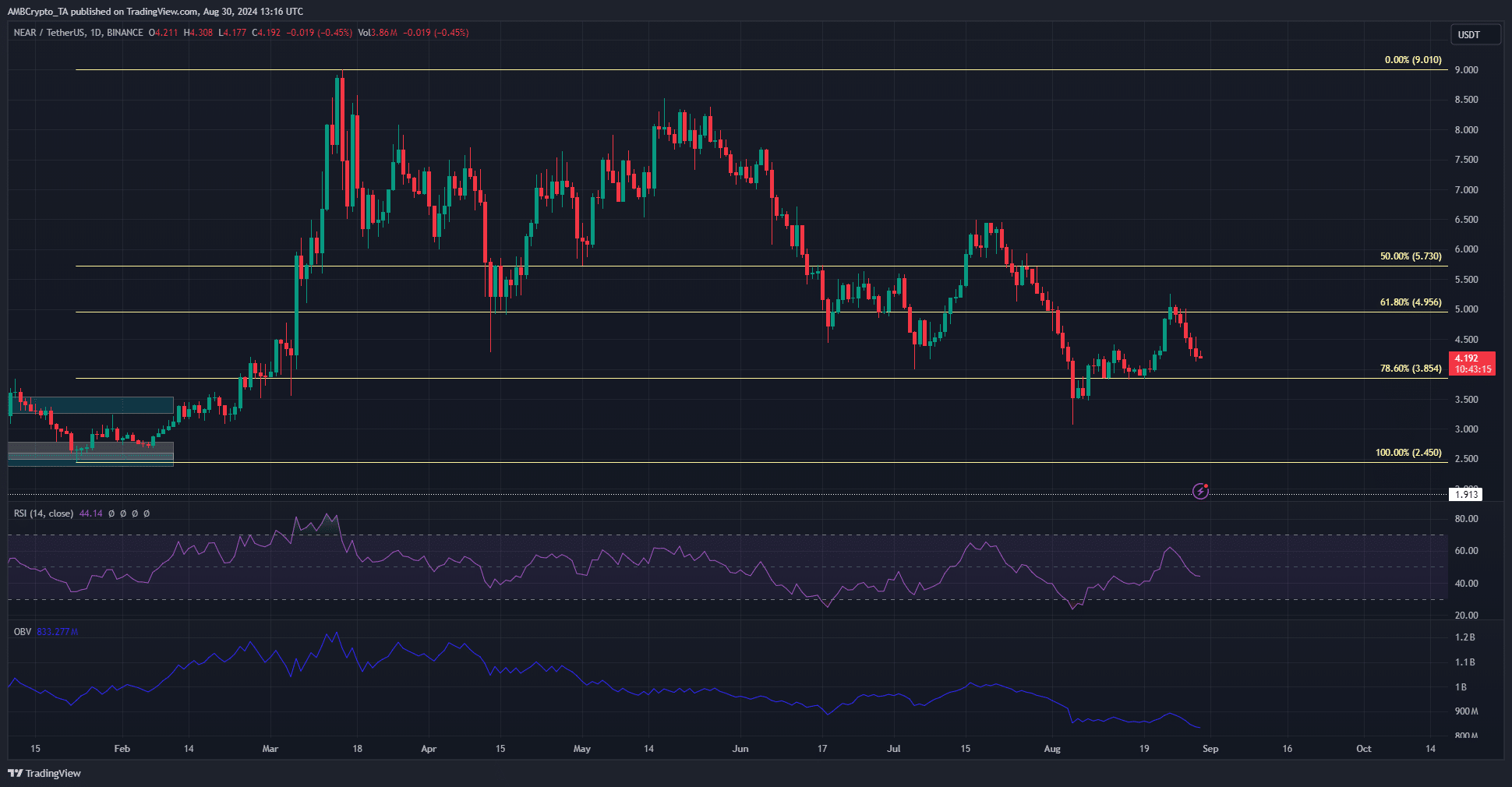

NEAR Protocol (NEAR) is in a downtrend on the higher time frames at the time of writing. On the chart, the bulls have found refuge at the $3.85 level, which is the 78.6% Fibonacci retracement level of the rally from $2.45 to $9 in February and March.

Since then, the market structure has flipped bullish several times. At the time of writing, the structure is bullish, but the outlook for the token is bearish.

$5 rejection and continued downward pressure

Source: NEAR/USDT on TradingView

This bearish outlook is driven by the continued downtrend in OBV. The steady selling flow means that NEAR is trading above the higher timeframes but should hold support at $3.85.

The price bounced from $3.85 last week and the token rose to $5.25. Unfortunately, it failed to turn the level into support in the following days.

After the recent price decline, the daily RSI also fell below the neutral 50 level, indicating a change in momentum. Investors will be expecting a range formation around the $4 zone and a slow rise in OBV, indicating accumulation.

As mentioned above, if things don’t improve, NEAR’s price looks bleak in the long term.

Spot CVD maintains bullish trend despite NEAR price decline

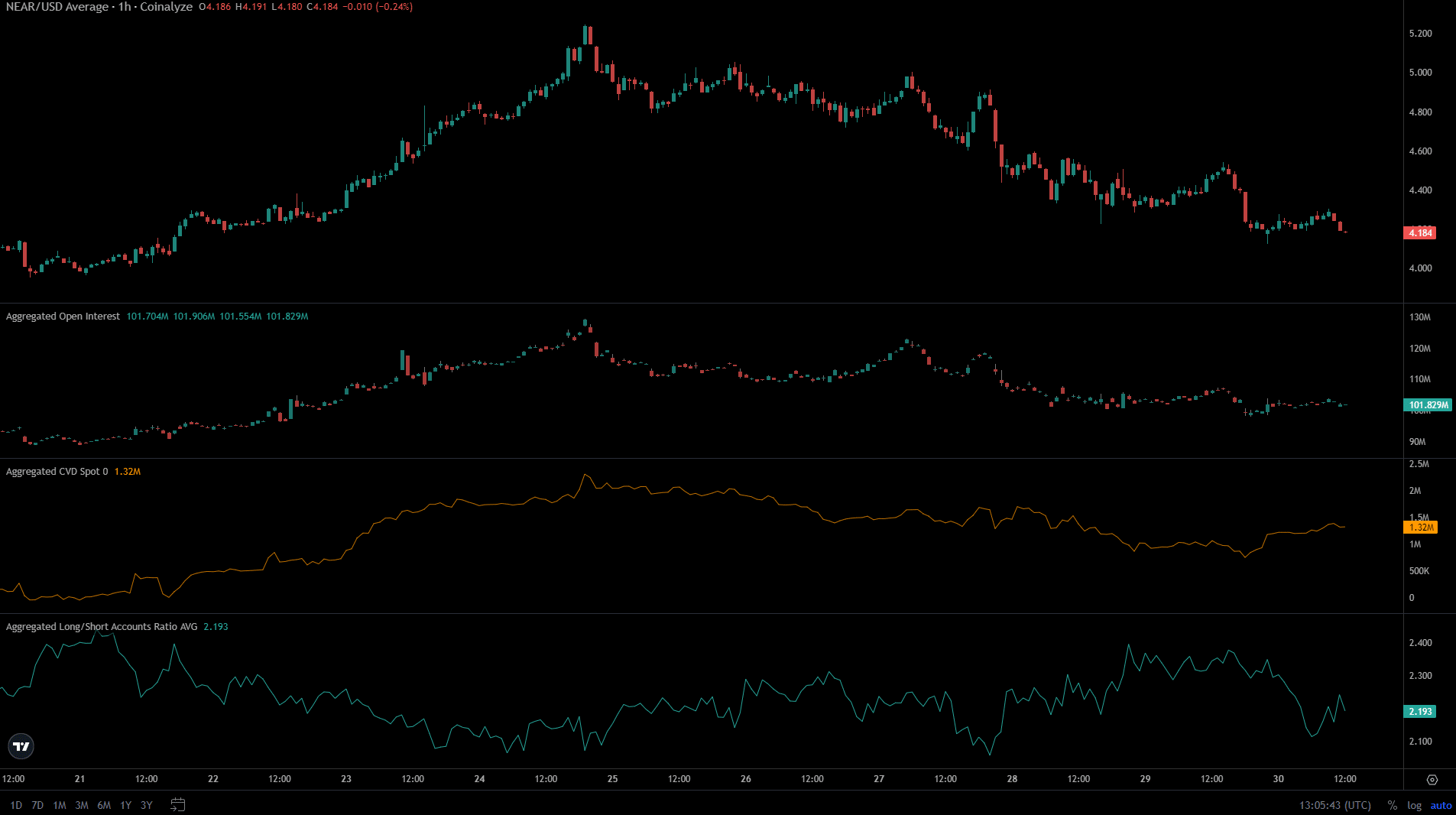

Source: Coinalyze

Over the past few days, the open interest balance of NEAR Protocol has been falling along with the price, indicating bearish sentiment in the futures market.

The long/short account ratio also showed a downward trend over the last 24 hours, but remained at a healthy level of 2.19, suggesting that long positions outnumber short positions.

Realistic or not, NEAR’s market cap in BTC terms is as follows:

Surprisingly, even though the price is struggling in a short-term downtrend, the spot CVD has been rising. This increase in buying pressure could give traders hope that NEAR can once again bounce from the $4 support zone.