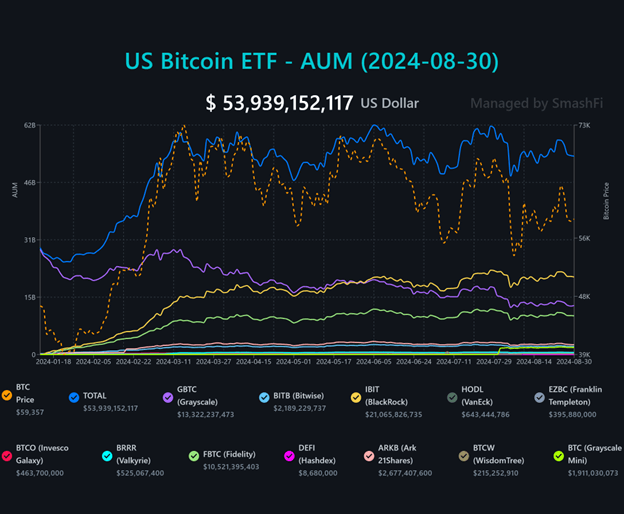

- Bitcoin ETFs attracted $5 billion in net inflows, while Ethereum ETFs saw $500 million in net outflows.

- BlackRock’s IBIT is the leader, recording over $224 million in a single day and currently holds over 350,000 BTC.

- Ethereum ETFs Struggle With Liquidity Issues and Grayscale’s $2.5 Billion Outflow

A look at recent trends in the cryptocurrency exchange-traded fund (ETF) market reveals that the performance of Bitcoin and Ethereum ETFs is quite different.

When comparing Farside Investors’ Bitcoin ETF Flow data with Ethereum ETF Flow data, the Ether spot ETF has underperformed the Bitcoin ETF. Since its launch, the Ether ETF has experienced net outflows of around $500 million, in stark contrast to the $5 billion net inflows the BTC ETF has seen over a similar period since its launch.

Several factors contribute to this imbalance. First, Bitcoin’s “first mover advantage,” higher liquidity, and lack of staking opportunities in Ether ETFs have made Bitcoin more attractive to institutional investors.

Additionally, the Ether ETF performance was further undermined by an unexpected $2.5 billion outflow from Grayscale’s Ethereum Trust (ETHE), far exceeding the bank’s initial estimate of $1 billion. To counter these outflows, Grayscale launched a mini Ether ETF, but it only received $200 million in inflows.

On the other hand, BTC ETFs have shown resilience and solid performance, with US-based BTC ETFs posting impressive gains for the eighth straight day, with net inflows reaching $202 million, led by BlackRock’s iShares Bitcoin Trust (IBIT).

On August 26th alone, IBIT attracted over $224 million in net inflows, solidifying its dominance in the market as its total Bitcoin holdings surpassed 350,000 BTC.

Competitive funds managed by Franklin Templeton and WisdomTree also saw positive inflows, while others, including Fidelity, Bitwise, and VanEck, reported negative inflows. Grayscale’s Bitcoin Trust (GBTC), in particular, has seen a decline in redemptions over the past two weeks, indicating a stabilization in the market.

As investor confidence in Bitcoin ETFs grows, asset managers are increasingly seeking hybrid ETFs that provide exposure to both Bitcoin and Ethereum, reflecting the changing dynamics of the cryptocurrency investment landscape.