- At the time of writing, Aave was outperforming most cryptocurrencies.

- Aave’s funding rates showed a bullish bias.

Aave (AAVE) looks set to outperform other cryptocurrencies going forward, and the AAVE/BTC chart shows this trend.

The AAVE/USDT pair has been steadily rising, forming higher highs and higher lows. The recent weekly candle closed above the true close of the consolidation range that has lasted for over 800 days.

If AAVE price shows a downtrend on the daily chart, the $108 support area will be important.

As long as price remains above this range, the resistance level can become a potential price target.

Source: TradingView

If the price holds above the $150 level, we can target $200 before this cycle ends.

However, it is very likely that Aave will hit the $108 range before reaching the $200 target.

Funding ratio turns green

According to Highblock Capital tools, the funding rate has turned green, indicating that traders are becoming increasingly optimistic about Aave’s price potential.

A positive funding ratio suggests increasing demand for long positions, creating upward momentum as the market anticipates higher prices.

Combined with the current price action of AAVE/USDT, Aave is likely to go higher.

Source: Hyblock Capital

However, if there is a significant downtrend, it would be best to just wait or cut your losses.

Market Performance

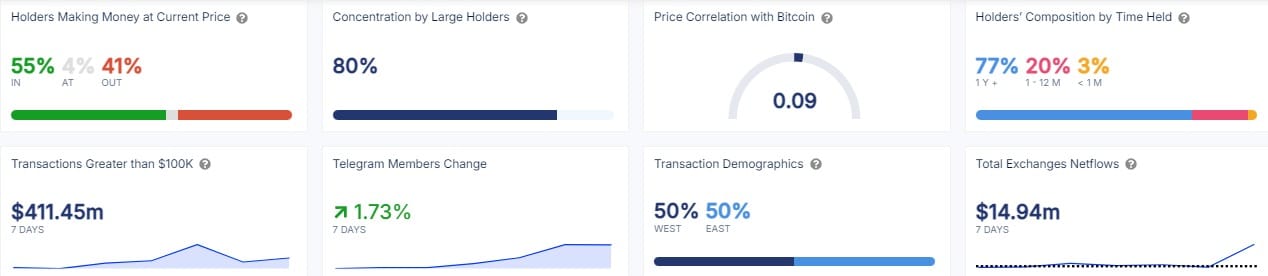

Market performance further supports this bullish outlook, with more than 55% of Aave holders currently generating profits at current price levels.

This is a positive indicator, as these holders are less likely to liquidate their positions. Additionally, 80% of Aave’s supply is concentrated among large holders, adding to the expectation of an uptrend.

Approximately 77% of Aave holders have held their tokens for more than a year.

Source: IntoTheBlock

Additionally, the volume of large transactions exceeding $100,000 exceeded $411 million, and the number of Telegram users increased by 1.73%.

The net trading inflow over the past 7 days has reached $14.94 million, providing further support for a potential price rally.

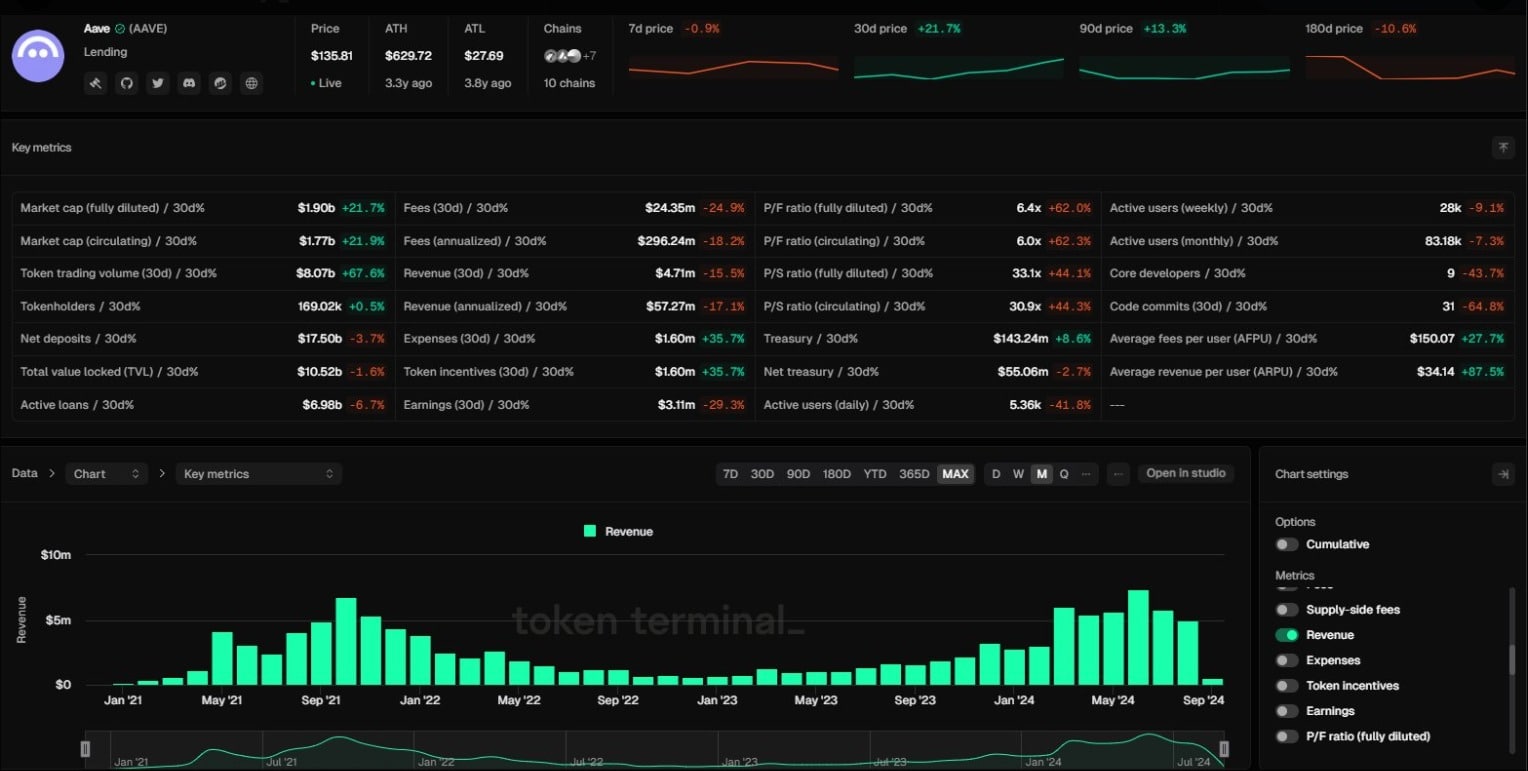

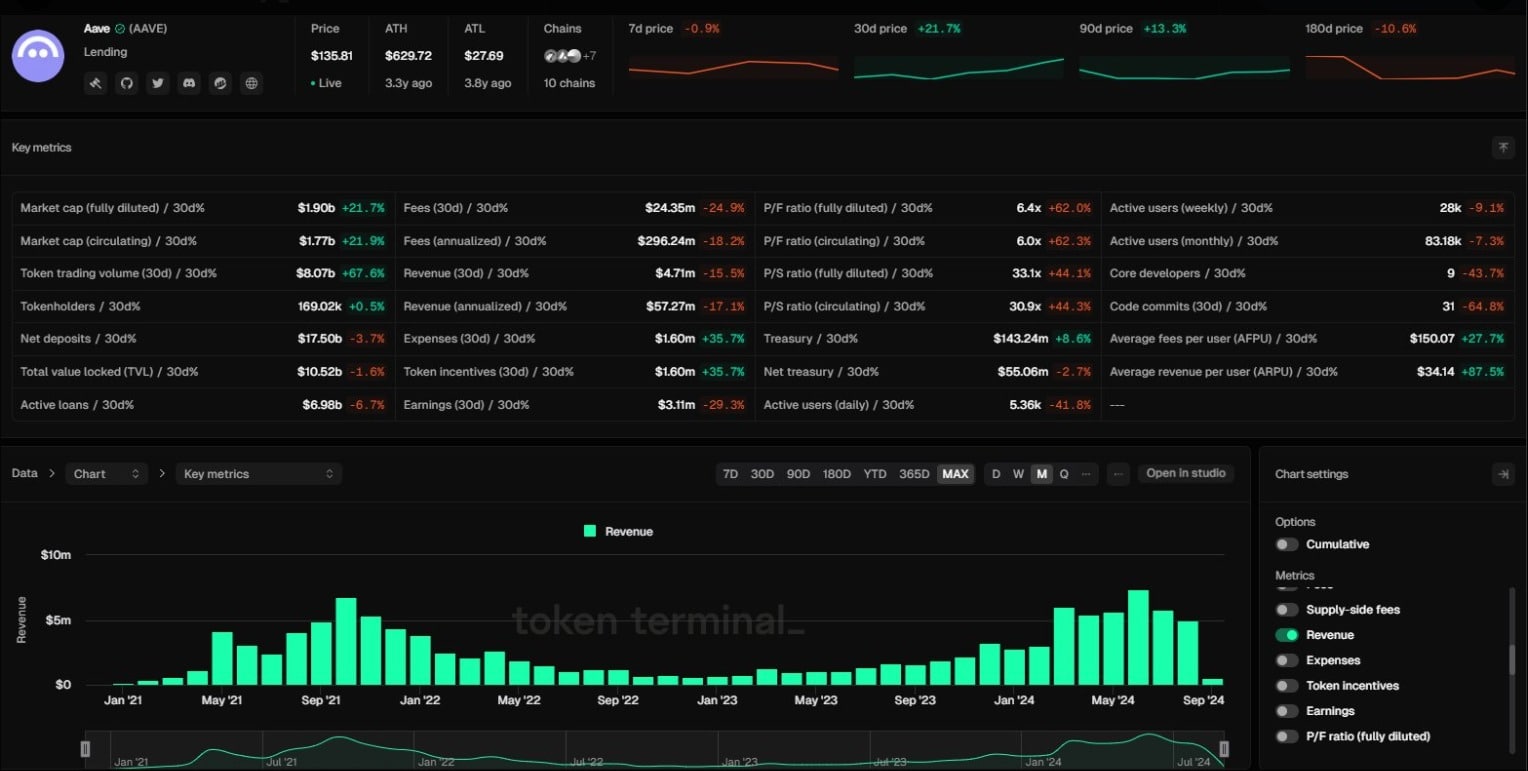

Monthly revenue is increasing

In terms of revenue, Aave has surpassed its previous monthly revenue record. Aave is currently generating $1 million in revenue per week, while AAVE incentives are only $327,000.

The protocol is also one of the few to have surpassed its previous all-time high, generating $7.3 million in July 2024, which is about 9% higher than the October 2021 figure.

Read Aave (AAVE) Price Prediction 2024-2025

This protocol has demonstrated product-market fit (PMF) by increasing market share over similar protocols over the past two years.

Source: Token Terminal

Additionally, a proposal to add a fee conversion to return a portion of the platform’s net excess revenue to token holders was introduced in July 2024, further supporting the token’s strong price performance this year.