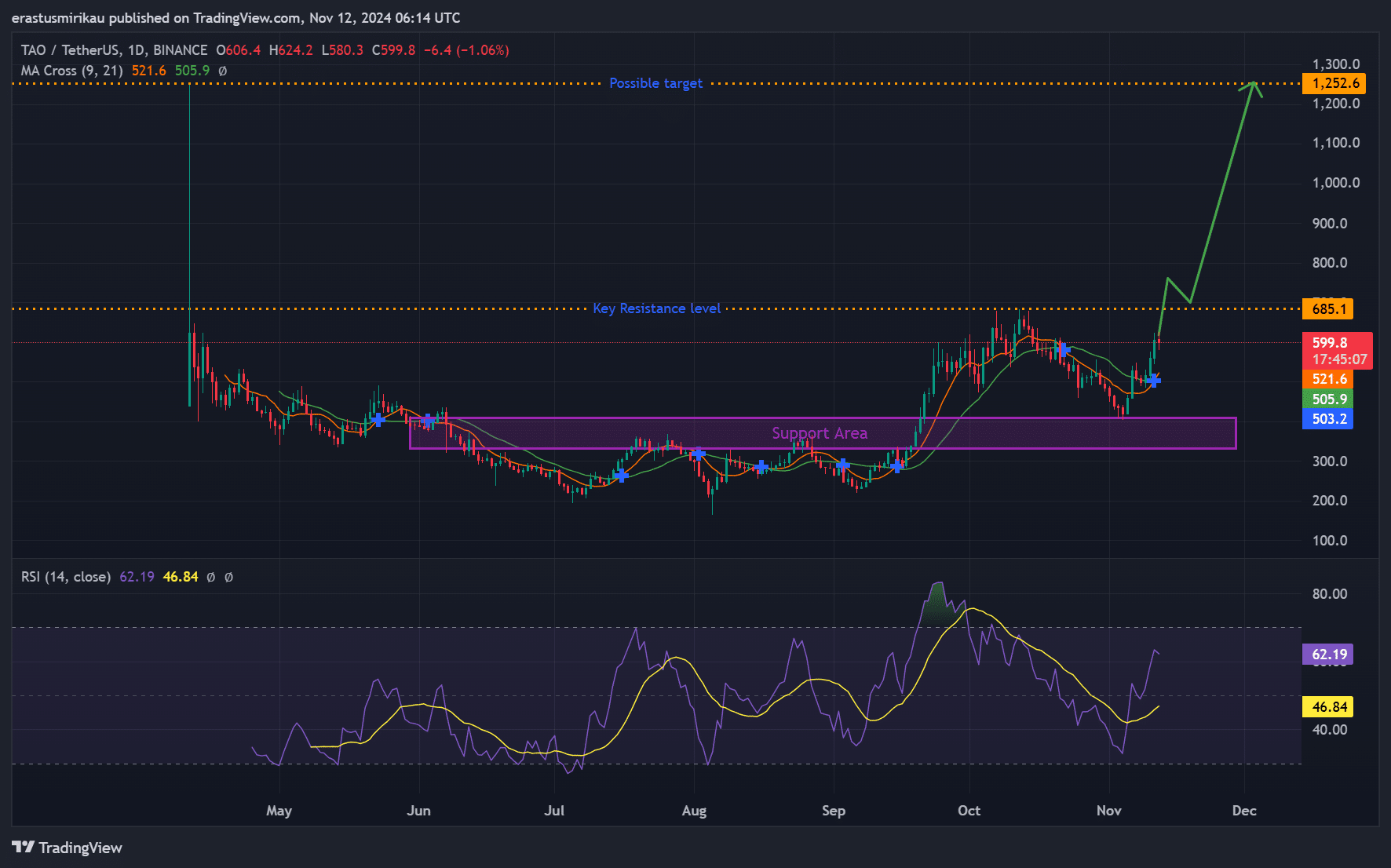

- TAO approaches the important $685 resistance level after a surge in volume and technical strength.

- Market sentiment is supported by rising open interest, rising MA crossover, and low social dominance.

Bit Tensor (TAO) It recently experienced a significant surge in 24-hour trading volume exceeding $500 million, reflecting strong interest and market activity.

A surge in activity signals has fueled interest, with TAO’s trading price rising 8.01% over the past 24 hours to $599.66. As a result, TAO’s market cap has reached $4.43 billion at press time, indicating new momentum as it approaches the key resistance level of $685.

On the back of optimistic sentiment, TAO could prepare for a significant move.

Technical Analysis: Bullish Breakout Signal

TAO’s technical indicators point to a potential breakout. After breaking out of the strong support zone between $400 and $500, the price moved closer to the critical resistance level of $685.

A break above this point would clear the path to the next target of $1,252.6, offering significant potential gains. However, continued buying pressure is essential for this rally to continue.

The relative strength index (RSI) is 62.19, indicating that TAO is approaching overbought territory. This level may encourage some profit-taking once buying pressure eases. However, the upward movement in RSI is still consistent with the bullish outlook.

Additionally, the recent moving average (MA) crossover between the 9-day moving average and the 21-day moving average strengthens the bullish potential. Both averages are trending upward, showing continued momentum and strong buying interest.

Therefore, this MA crossover indicates that TAO’s rally may extend beyond a short-term bounce and that a sustained upward trend is possible.

Source: TradingView

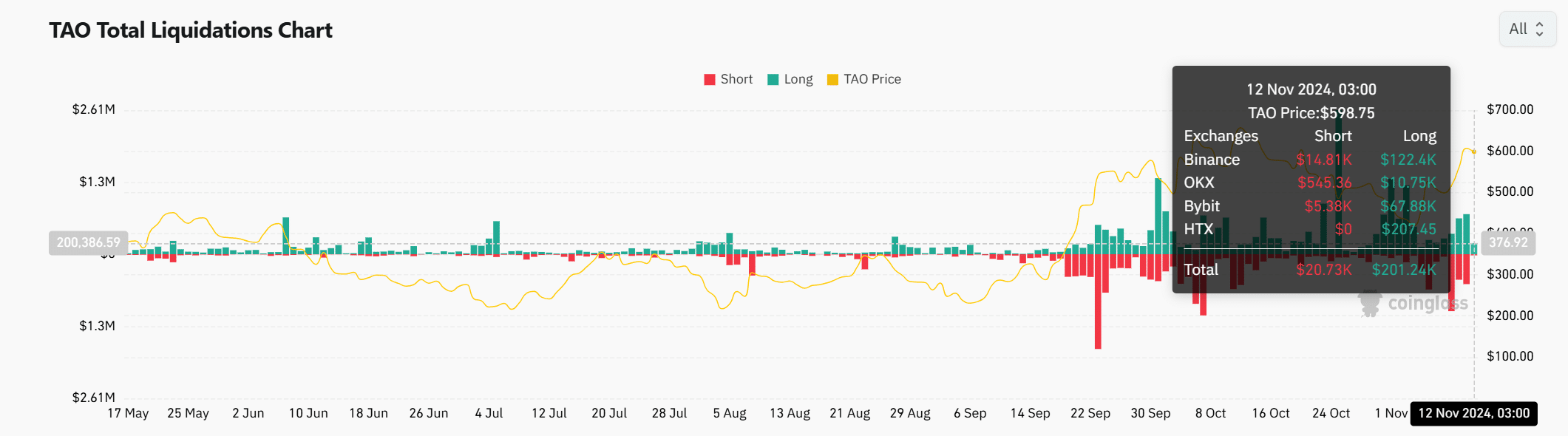

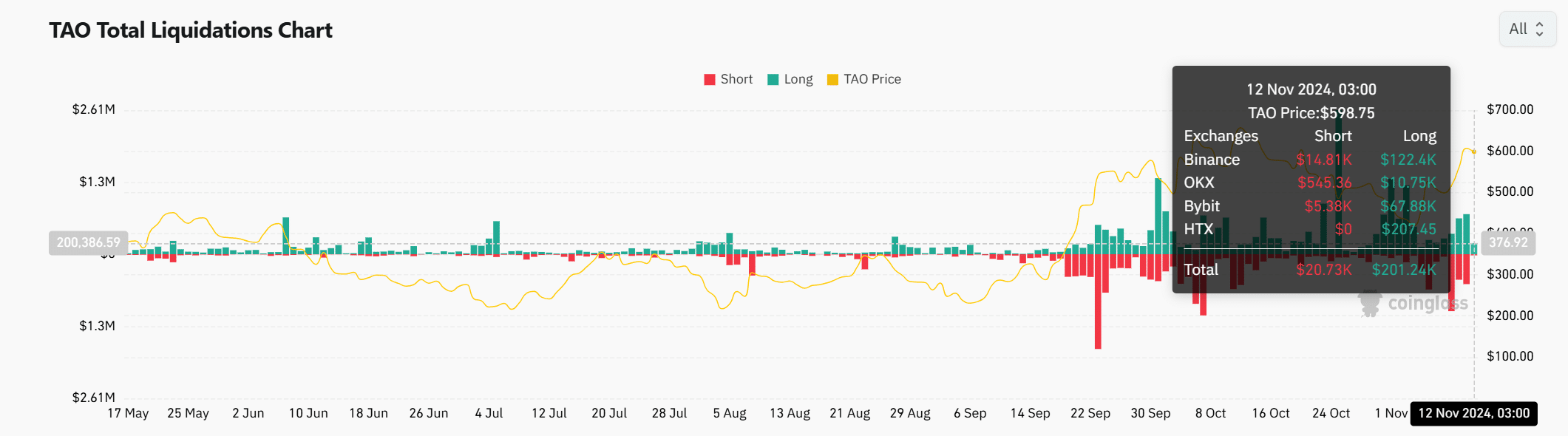

Clearing Data: Bullish Imbalance

The latest liquidation data shows an interesting trend. In other words, long positions exceed $200 million, significantly outpacing sell positions. This indicates that market sentiment is optimistic.

However, this imbalance can increase the risk of serial liquidations if TAO faces rapid downward pressure, amplifying losses and causing volatility.

Source: Coinglass

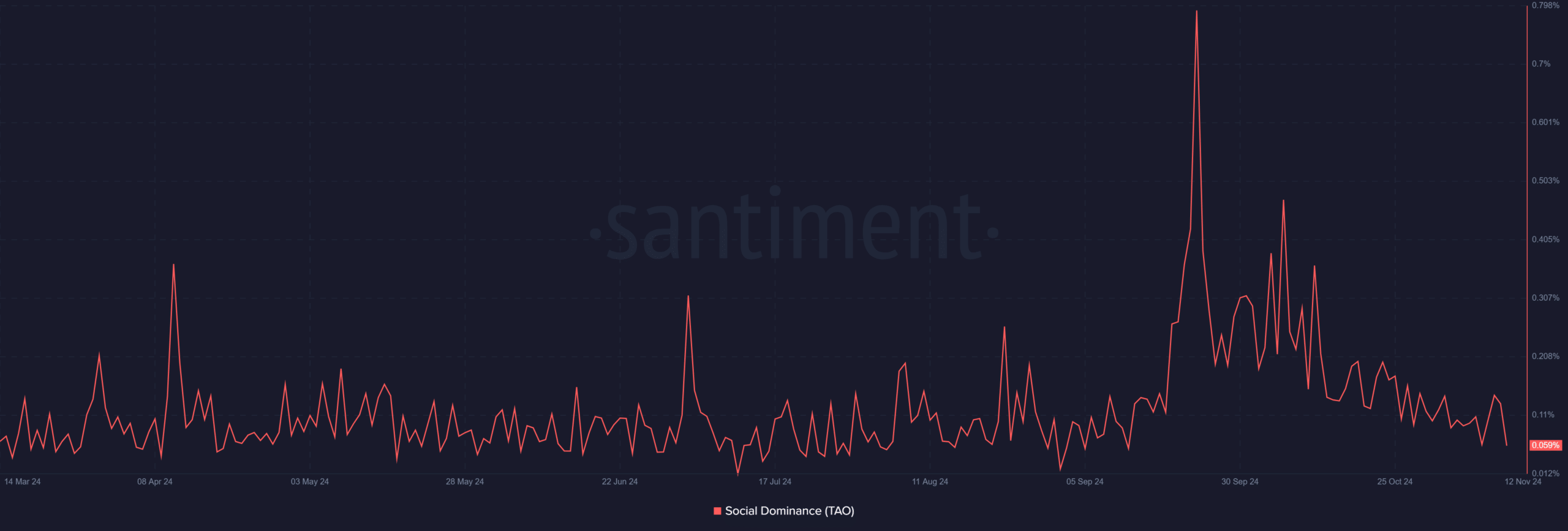

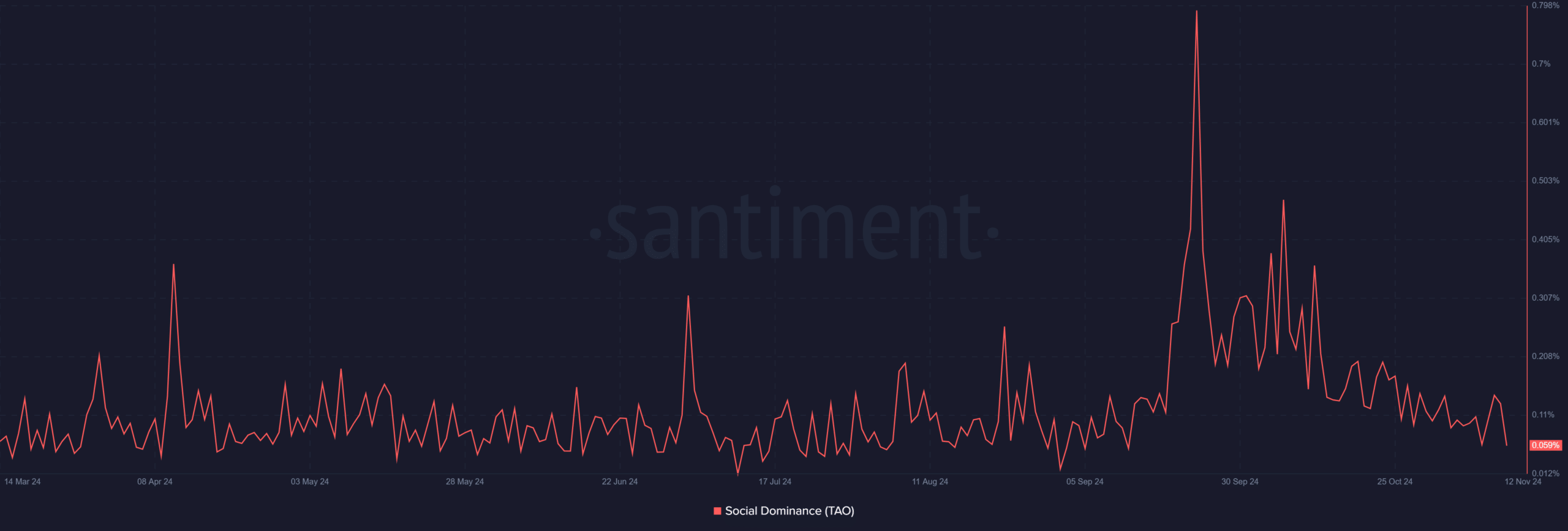

Decline of social dominance in assemblies

Interestingly, social dominance has decreased and currently stands at 0.059%. This suggests that TAO’s recent price gains have been driven by large investors rather than retail hype, potentially providing stability to the upward trend.

As a result, this low social dominance may help reduce speculative volatility.

Source: Santiment

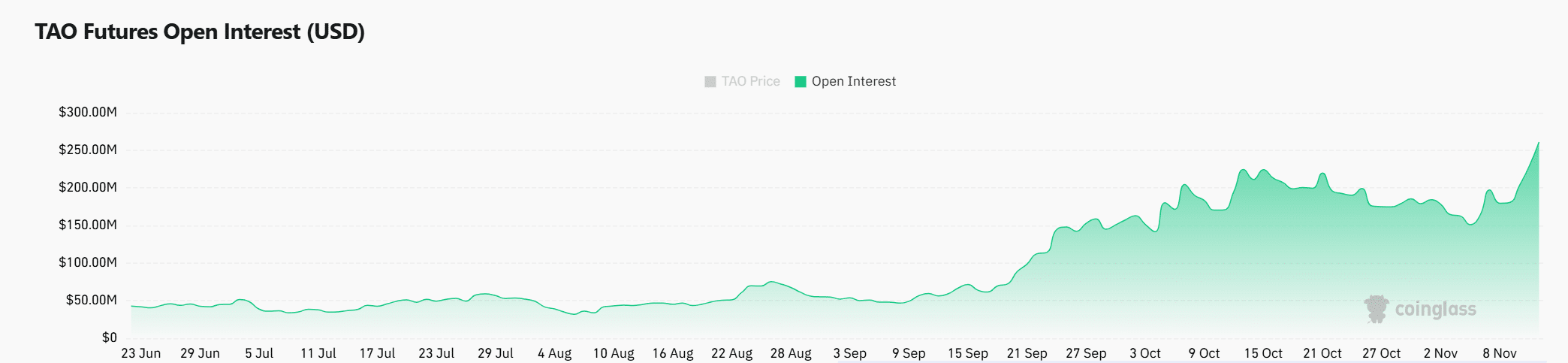

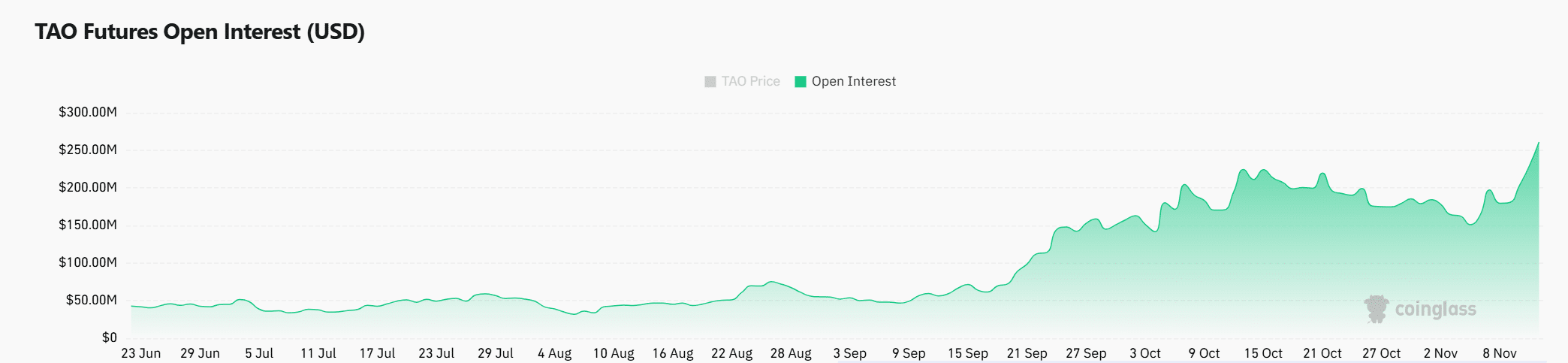

A surge in open interest is a bullish psychological signal.

Open interest increased 12.58% to $251.12 million. This increase in open interest and increased trading volume highlights the strong trust and commitment of investors.

Therefore, this growth means that we expect a further upward move as the market tests the $685 resistance level, adding momentum to TAO’s current rally.

Source: Coinglass

Read Bittensor (TAO) price prediction for 2024-2025

TAO’s technical indicators, rising open interest, and strong volume suggest a possible breakout above $685. However, caution is needed as RSI is approaching overbought territory and social dominance is decreasing.

TAO could reach its ambitious target of $1,252.6, but its upward path could be hampered by loss of momentum or sudden selling pressure.