- The last Bitcoin halving occurred in April when the block reward dropped from 6.25 Bitcoin to 3.125 Bitcoin.

- Jesse Myers said the price of Bitcoin would need to rise higher for a “supply-demand price” balance to occur.

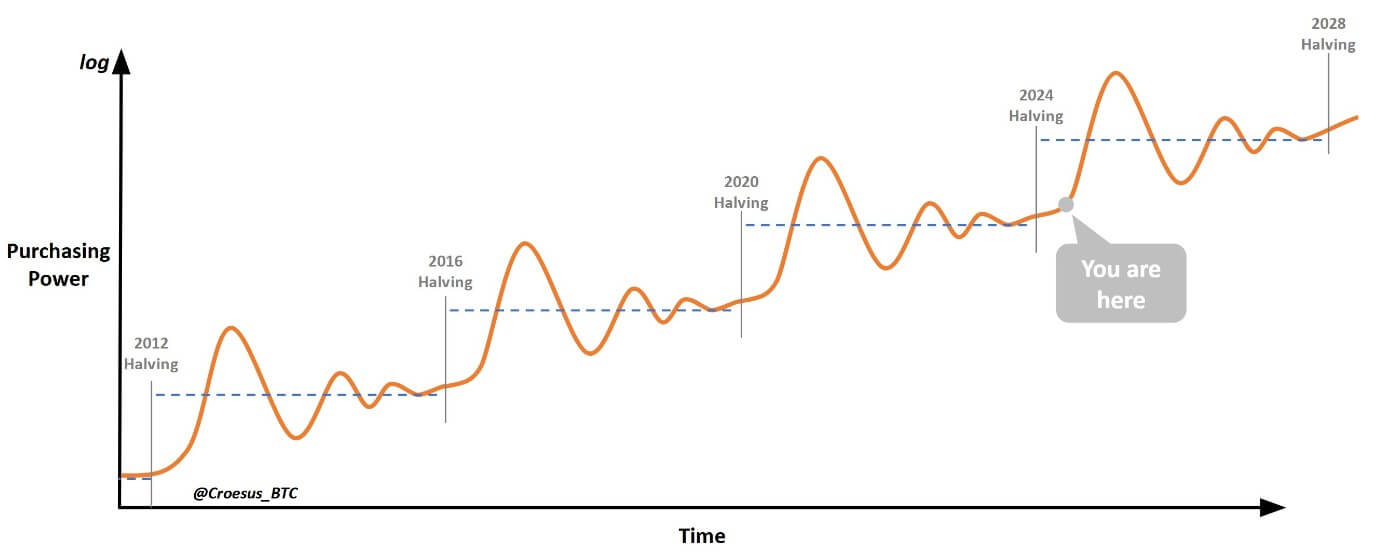

- If that happens, the market will be “flew into the frenzy and bubble” that occurred with the Bitcoin halving events in 2012, 2016, and 2020.

Donald Trump’s re-election to the White House is not the “main story” in the recent rise in Bitcoin prices, the co-founder of Onramp Bitcoin said.

In a post about

The last Bitcoin halving, which takes place every four years, occurred in April when the block reward fell from 6.25 Bitcoin to 3.125 Bitcoin. As a result, each new block becomes more difficult to solve with lower rewards.

A decrease in Bitcoin supply usually means an increase in the price of Bitcoin. The next Bitcoin halving is expected to occur around 2028.

“The supply shock has accumulated,” Myers said. “There is not enough supply to meet demand at current prices,” adding, “We need to restore the supply-demand price balance.”

But the only way Myers believes this will happen is “prices will go up and there will be mania and bubbles, but that’s how it works.”

Bubbles after half-life

Myers provided a chart indicating that the market is currently in the beginning stages of a post-halving bubble. According to his data, Bitcoin price will continue its upward trajectory before reaching new highs and falling to current levels.

“It sounds crazy to say that there’s going to be a reliable, predictable bubble every four years,” Myers said. “But there is no asset in the world where new supply creation is cut in half every four years.”

Post-halving bubbles occurred during the Bitcoin halvings of 2012, 2016, and 2020, Myers said.

The recent rise in Bitcoin price coincided with Trump’s re-election to the White House. Based on his campaign trail ahead of Election Day, Trump was perceived as a cryptocurrency advocate compared to current Vice President Kamala Harris.

Last week, Senator Cynthia Lummis also reaffirmed the United States’ plans to build strategic Bitcoin reserves. If passed, the senator’s Bitcoin bill would propose directing the U.S. Treasury to purchase $1 million over the next five years.