Bitcoin price performance in 2024 will be recorded as the best cryptocurrency in history, surpassing $100,000 for the first time. But achieving this milestone opened the door to another conversation. When will the market peak?

As a result, over the past few weeks, there have been several predictions in the cryptocurrency industry about Bitcoin price highs. Recent on-chain observations suggest that the market may not have peaked yet, or even close to it.

Relatively low realized profit rate compared to previous cycle

In a recent Quicktake post on the CryptoQuant platform, an analyst using the pseudonym CryptoOnChain explained how the behavior and movements of whales can help identify top positions in the Bitcoin market. The relevant metric here is the realized profit ratio, which measures the rate at which a group of investors exit the market.

The “Realized Profit Ratio” indicator calculates the ratio of coins sold at a profit to the total traded volume. High values for this metric are a sign that the market is approaching a peak as participants begin to sell assets for profits.

On the other hand, lower realized profit margins mean there are fewer market participants selling the bags for a profit. This often indicates investors’ continued confidence and belief in further price appreciation of the cryptocurrency.

According to CryptoOnChain, the realized return ratio for various groups of Bitcoin whales (holding 10 to 100, 100 to 1,000, and 1,000 to 10,000 BTC) is significantly lower compared to the last cycle. As you can see in the chart below, it appears that the whales have not yet started taking profits.

Source: CryptoQuant

This suggests that Bitcoin whales, influential market players, believe that the leading cryptocurrency has not yet reached the peak of its cycle. As of this writing, the Bitcoin price is just below $102,000, reflecting no significant changes over the past 24 hours.

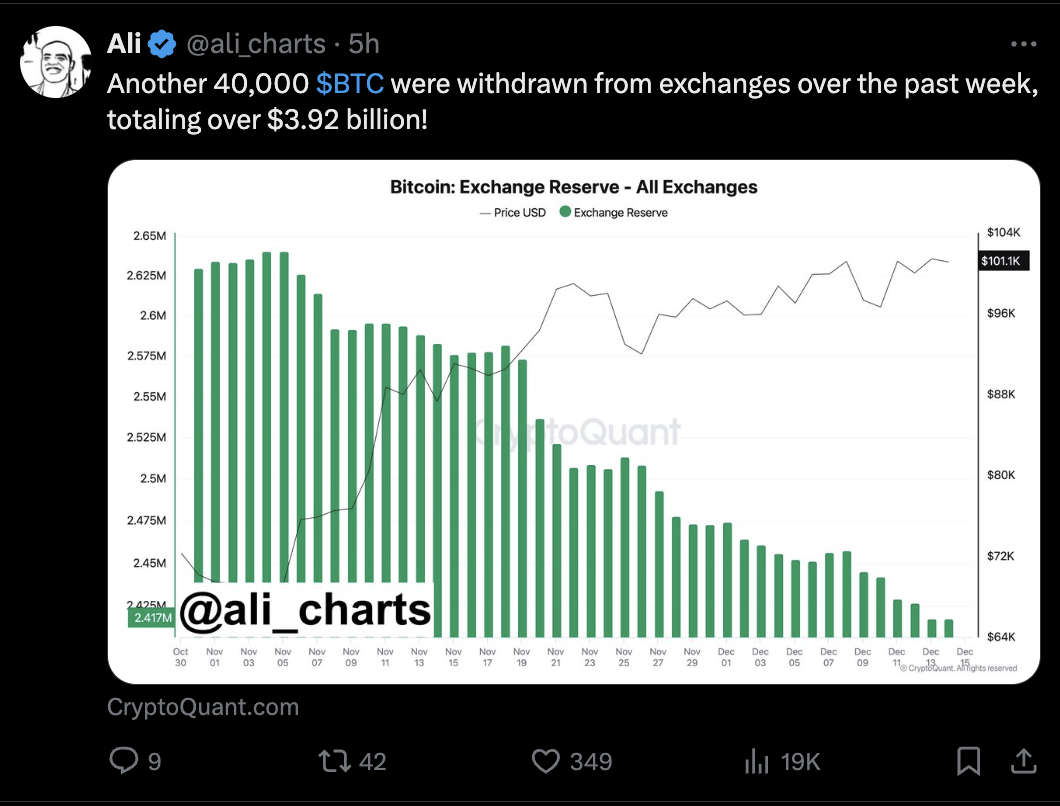

40,000 BTC exits centralized exchange: CryptoQuant

Another data point appears to support the notion that market participants are currently striving for higher profits. Ali Martinez, a prominent cryptocurrency expert, shared on the X platform that a significant amount of Bitcoin has been flowing out of centralized exchanges over the past few days.

Source: Ali_charts/XOver the past week, more than 40,000 BTC (worth approximately $3.92 billion) has been leaked from exchanges. This movement of assets to non-custodial wallets signals growing confidence among investors, with a focus on long-term commitments rather than quick short-term profits.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView