Key Takeaways

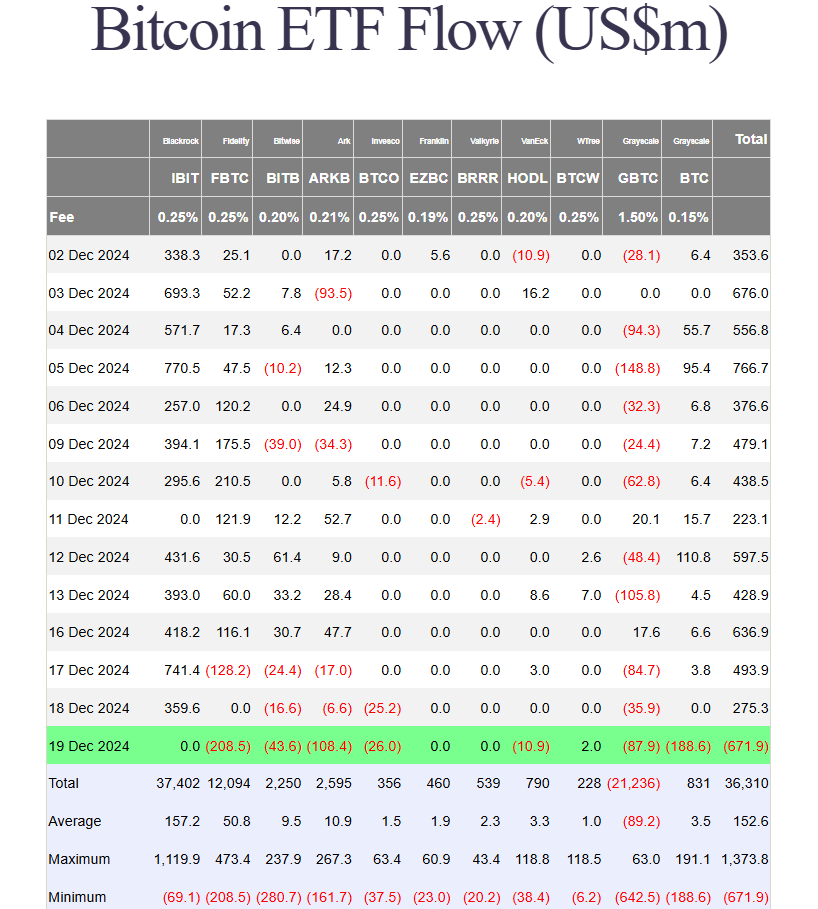

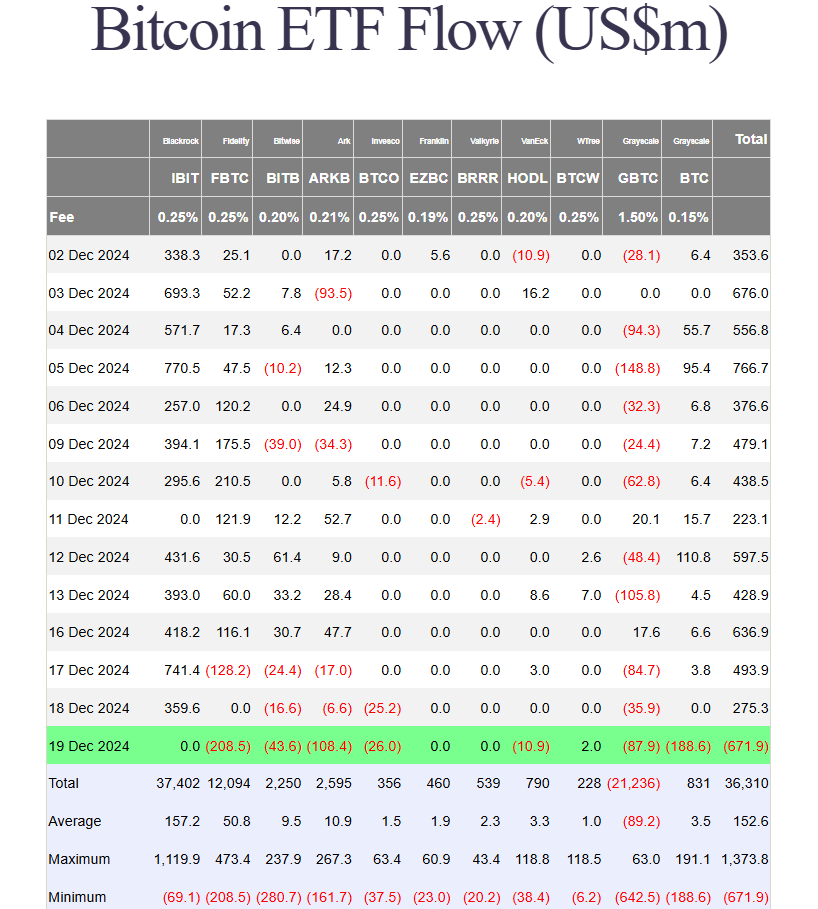

- US Bitcoin ETF experienced historic outflows as investors withdrew $672 million in one day.

- Fidelity’s Bitcoin Fund led the outflows, followed by Grayscale and ARK Invest ETFs.

Share this article

The U.S. spot Bitcoin ETF suffered its largest single-day outflow ever amid a sharp sell-off in the cryptocurrency market following the FOMC meeting. About $672 million exited the fund on Thursday, ending a period of net inflows that began in late November, according to Farside Investors data.

This large-scale withdrawal surpassed the previous record of $564 million set in May. 1, There were withdrawals of nearly $564 million from a group of spot Bitcoin ETFs after Bitcoin fell 10% for a week to $60,000.

Fidelity’s Bitcoin Fund (FBTC) led the exodus with outflows of $208.5 million, while Grayscale’s Bitcoin Mini Trust (BTC) hit its lowest point since launch with net outflows of more than $188 million.

ARK Invest’s Bitcoin ETF (ARKB) and Grayscale’s Bitcoin Trust (GBTC) also saw massive withdrawals, with ARKB losing $108 million and GBTC losing nearly $88 million. Meanwhile, three competing ETFs managed by Bitwise, Invesco and Valkyrie lost a combined $80 million.

BlackRock’s iShares Bitcoin Trust (IBIT), which saw net inflows of $1.9 billion this week and has contributed significantly to the group’s recent strong performance, recorded zero flows for the day.

WisdomTree’s Bitcoin Fund (BTCW) was the only gainer, raising $2 million in new investments.

The price of Bitcoin fell below $96,000 during the market downturn and is currently trading at around $97,000, down 4% in 24 hours, according to CoinGecko data. The sharp decline in all assets led to a $1 billion leveraged liquidation on Thursday, Crypto Briefing reported.

The market turmoil followed the Federal Reserve’s hawkish message following its decision to cut interest rates. The Federal Reserve cut interest rates by 25 basis points on Wednesday but signaled smaller cuts in 2025.

Despite continued price volatility, the Crypto Fear and Greed Index still indicates greed sentiment at 74, down just one point from yesterday.

Share this article