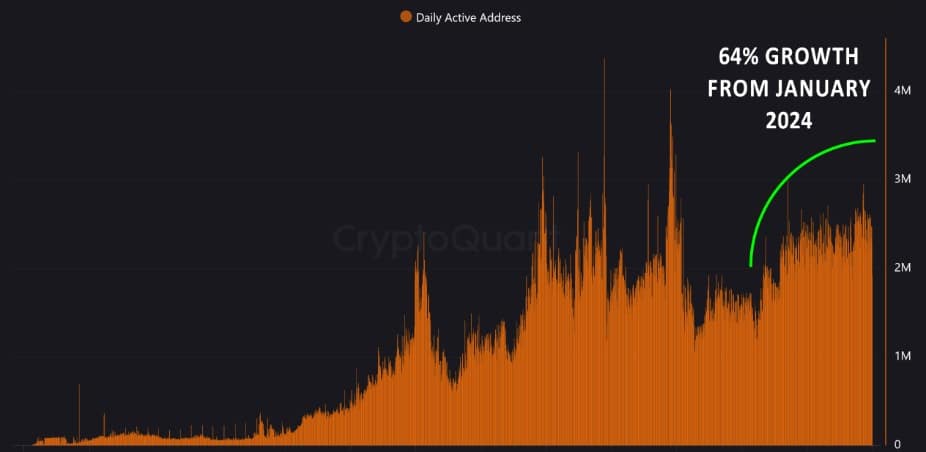

- Active addresses on the TRON network surged 64% in 2024.

- The price of TRX has increased exponentially this year, rising to a new ATH of $0.450.

Throughout the year, TRON (TRX) has recorded explosive gains on the price charts. Since the beginning of the year, TRX has risen 328.75% from a low of $0.105 to an all-time high of $0.450 hit a month ago.

As TRON sees its native token TRX grow in 2024, the altcoin’s blockchain has also grown exponentially. Especially on the active address front.

Active addresses on the TRON network will surge by 64% in 2024

According to CryptoQuant, the network is still showing impressive growth. Despite TRX’s price performance on recent charts.

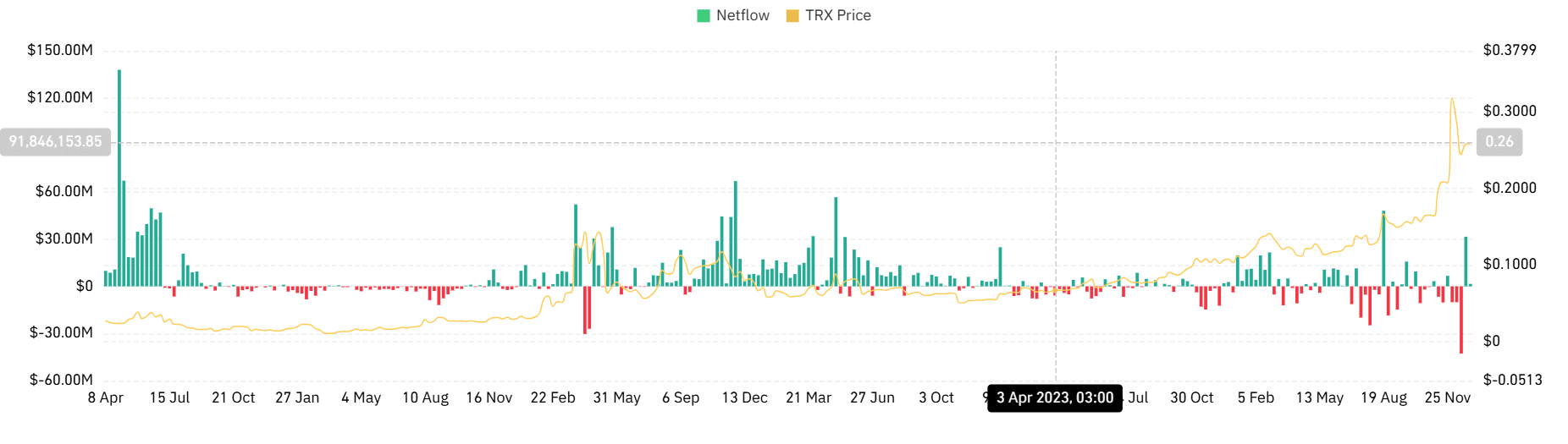

Source: CryptoQuant

In fact, active addresses for altcoins have surged 64% since the beginning of 2024. This strong increase highlights the growing popularity and adoption of blockchain.

Amid this increase in addresses, the TRON blockchain has seen a thriving DeFi and NFT ecosystem that continues to attract users and developers. Likewise, TRON’s scalability and efficiency have made it the preferred blockchain for decentralized applications.

Therefore, as the end of the year approaches, the rapid growth of the TRON network has established it as a top contender in the blockchain space. The increase in activity therefore signals an exciting chapter ahead for blockchain, investors, and all stakeholders.

What impact will this have on TRX?

In general, continued growth in network adoption has a positive impact on token prices. This trend has been present throughout the year, as prices often accompany network growth.

However, in the short term, TRON’s native token, TRX, has struggled to keep pace. After the November rally fueled by the US presidential election, TRX failed to recover higher resistance levels on the charts.

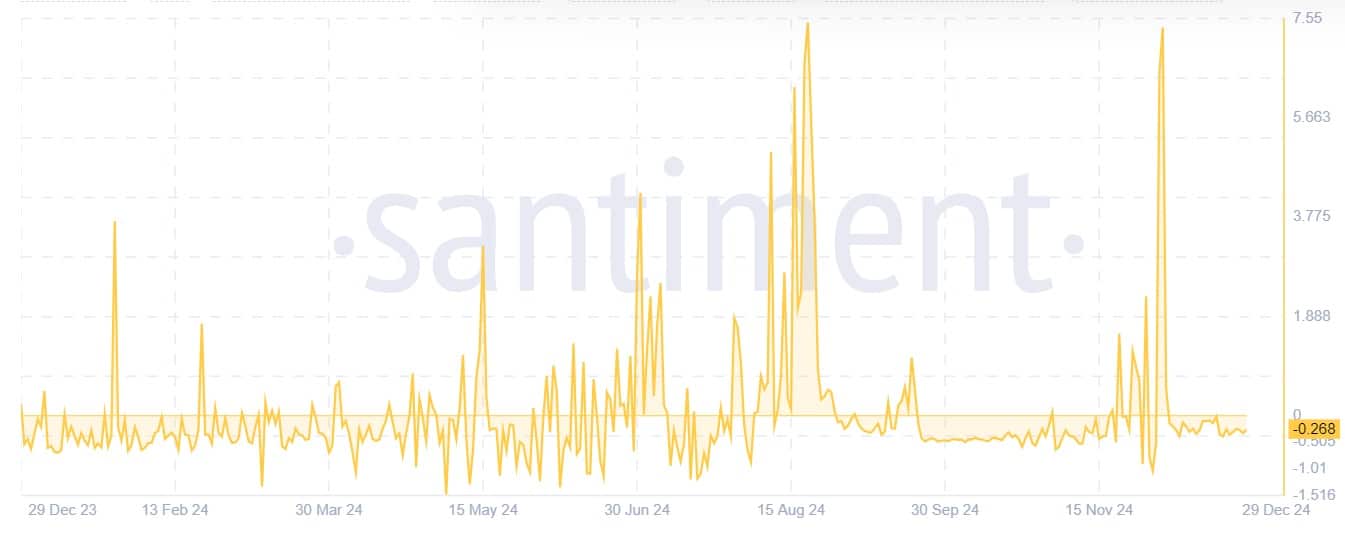

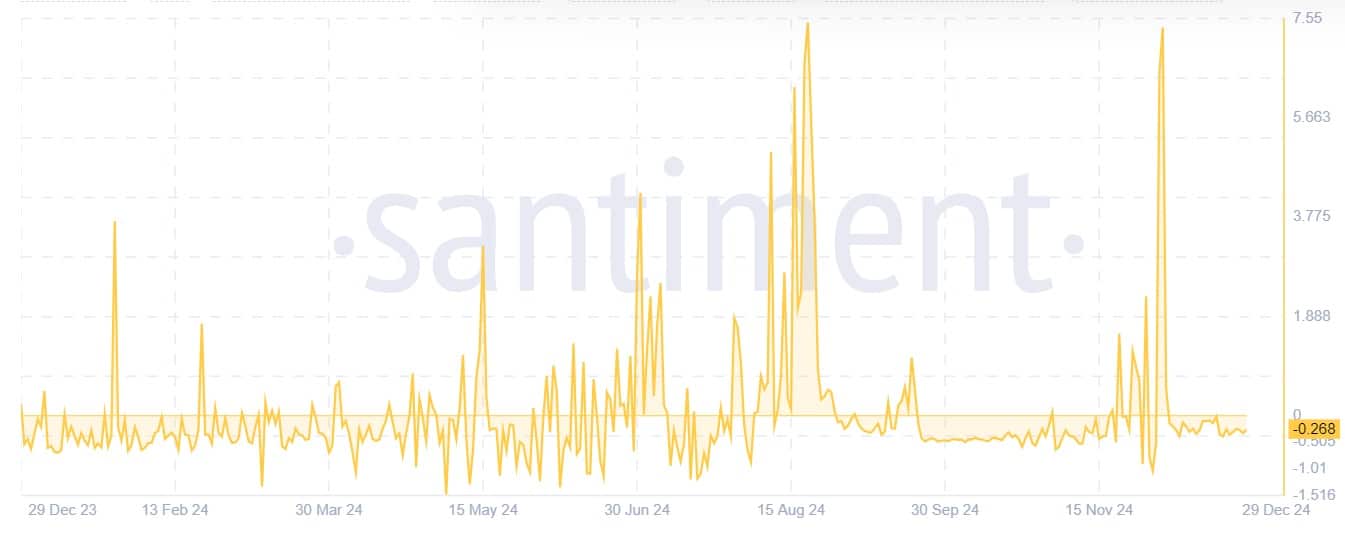

In fact, AMBCrypto’s analysis shows that bearish sentiment has persisted as investors become impatient for a long-term consolidation.

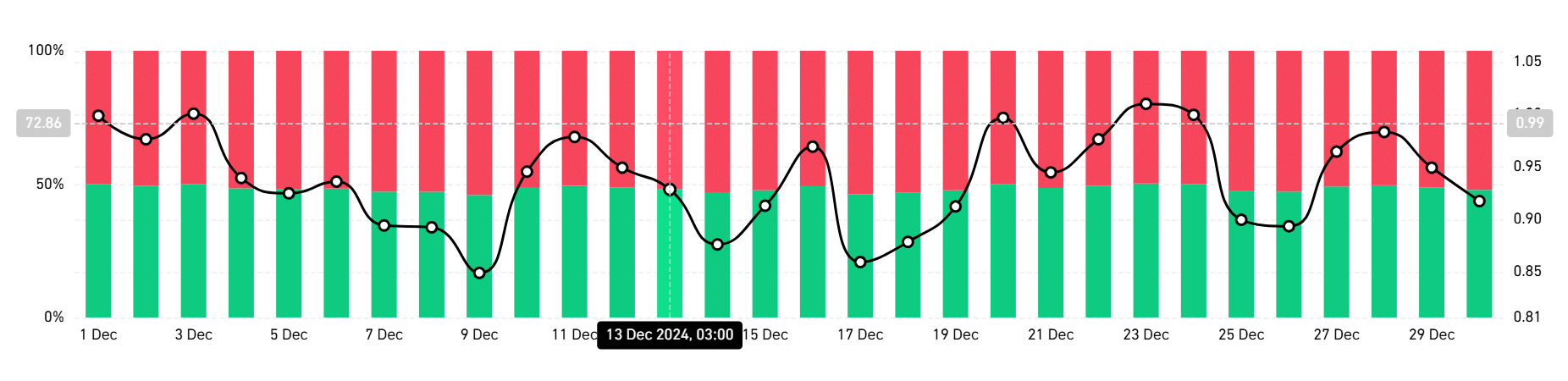

Source: Santiment

This weakness can be seen because the weighted sentiment for TRON has remained negative over the past week.

According to Santiment, sentiment has remained negative since December 3 as altcoin prices began to decline and then consolidated.

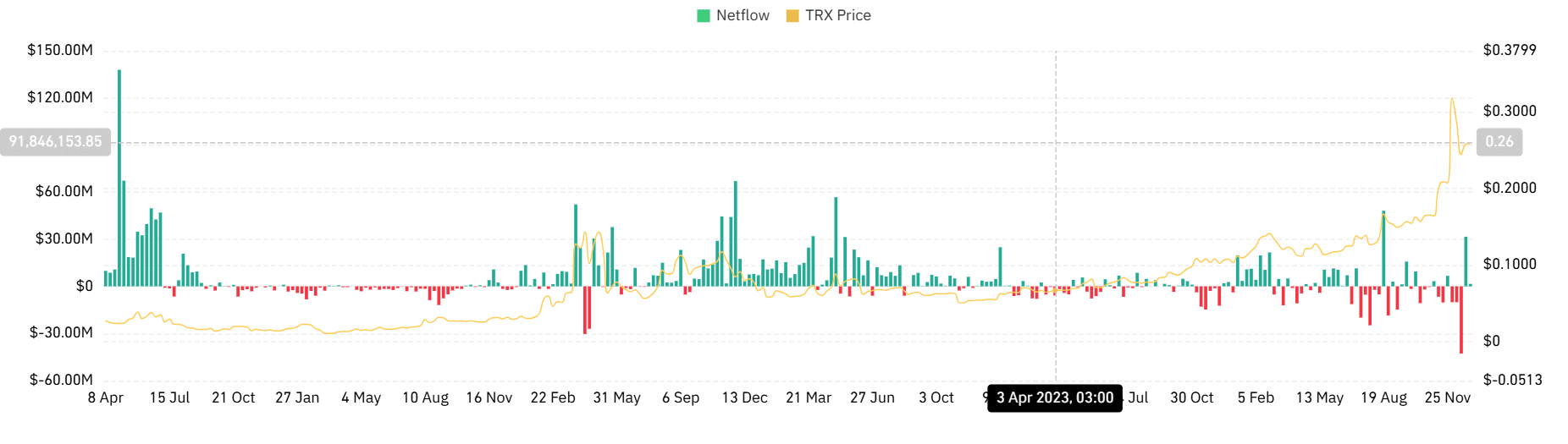

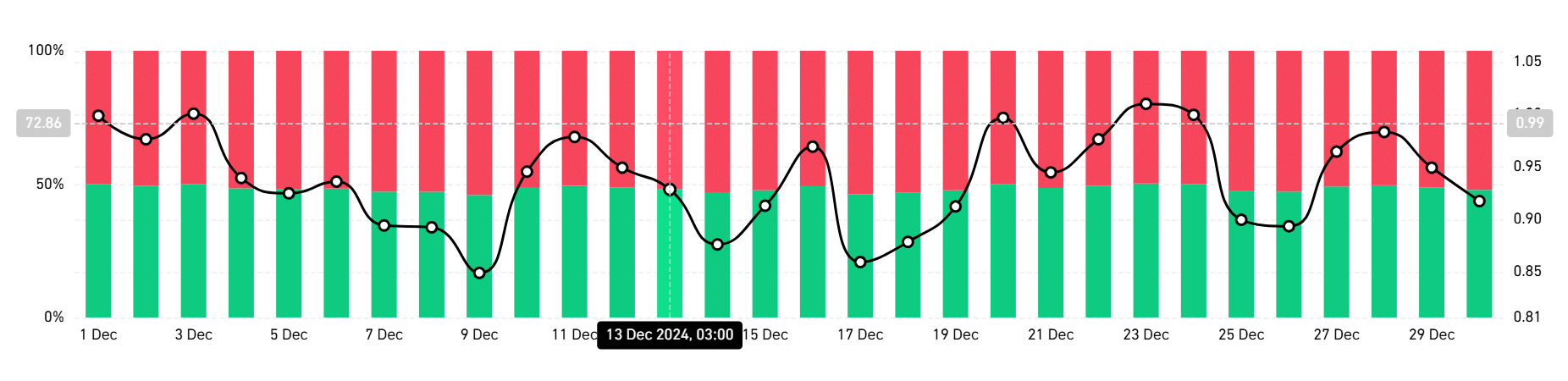

Source: Coinglass

Additionally, on the weekly chart, TRX netflow turned positive for two consecutive months. This is a sign of greater inflows into the exchange. If inflows are greater than outflows, this means the altcoin is facing more selling pressure.

Source: Coinglass

Finally, this weakness appeared to intensify in the near term. According to the long/short ratio, most traders have short positions. With short selling dominating the market, this means most investors are expecting prices to fall.

In conclusion, 2024 has been a fantastic year for the TRON network and its native token TRX. During this period, prices soared to historic highs along with an increase in active addresses. By 2025, all stakeholders hope that TRON and TRX will continue to grow.

However, in the short term, TRX is struggling to record more profits. For the altcoin to recover by 2025, it will need to break out of its consolidation range and reclaim $0.3. However, if market weakness continues to dominate the market, TRX risks falling below $0.2.